Markets

European shares rise after Chinese language stimulus; progress considerations stay

Lusso’s Information – European inventory markets rose Tuesday, boosted by extra stimulus measures from main export market China, however considerations over the area’s progress outlook have restricted the features.

At 03:05 ET (07:05 GMT), the in Germany traded 0.9% larger, the in France rose 1.4% and the within the U.Ok. climbed 0.6%.

Chinese language stimulus lifts temper

European equities have acquired a largely optimistic handover from Asia after Chinese language officers unveiled a slew of deliberate measures to spur financial progress, with the Individuals’s Financial institution set to chop reserve necessities for banks by 50 foundation factors to unlock extra liquidity.

Tuesday’s strikes come after the PBOC had on Monday reduce a short-term repo charge to additional enhance liquidity.

The strikes are aimed squarely at shoring up financial progress, because the Chinese language economic system struggles with persistent disinflation and an prolonged property market downturn.

China is a serious export marketplace for various Europe’s senior corporations, who’ve struggled given the downturn in demand as Chinese language customers have curbed spending.

Eurozone progress considerations stay

Nonetheless, worries concerning the progress outlook for the eurozone stay.

Information launched on Monday confirmed that regional contracted sharply and unexpectedly this month, with the bloc’s downturn in manufacturing accelerating.

The droop appeared broad-based with Germany, Europe’s largest economic system, seeing its decline deepen whereas France – the second greatest – returning to contraction.

The is due later within the session, and can also be anticipated to point out a deterioration in sentiment.

The reduce its key rates of interest by 25 foundation factors earlier this month, after the same transfer in June, and this slowdown might elevate bets on additional coverage easing in October.

Commerbank in play

Within the company sector, the main target will stay on Commerzbank (ETR:) after the information that UniCredit SpA (ETR:) has been utilizing derivatives to greater than double its potential stake within the German lender earlier than acquiring regulatory clearance for an precise holding of greater than 9.9%.

German Chancellor Olaf Scholz criticized the transfer as “an unfriendly assault”, and the German state nonetheless owns 12% of Commerzbank.

UniCredit is searching for ECB approval to extend its Commerzbank holding to simply beneath the 30% which triggers a compulsory takeover beneath German company legal guidelines.

Chinese language stimulus boosts crude

Crude costs rose strongly Tuesday, boosted by the contemporary financial stimulus from prime importer China in addition to escalating tensions within the Center East.

By 03:05 ET, the contract climbed 1.1% to $74.03 per barrel, whereas futures (WTI) traded 1.3% larger at $71.25 per barrel.

China’s central financial institution introduced broad financial stimulus earlier Tuesday, boosting hopes of elevated demand for crude from the world’s largest importer as financial exercise will increase.

In the meantime, Israel’s navy stated it launched airstrikes towards Hezbollah websites in Lebanon on Monday, elevating considerations of a disruption to provides from this oil-rich area, tightening world markets.

Markets

Insiders Snap Up These 2 ‘Robust Purchase’ Shares

Let’s speak about insider buying and selling. Not the unlawful type, however the completely regular – and totally authorized – buying and selling by top-level company officers. These are the C-suite residents and the members of the Boards, firm officers who know what’s happening behind the scenes and are accountable to shareholders for bringing in earnings. They usually maintain shares in their very own corporations and make trades primarily based on the information they’ve from behind the scenes.

To maintain the enjoying subject stage, federal regulators require that firm insiders publish these transactions – and traders can profit from seeing simply which shares the company officers are shopping for. There’s one factor to recollect: firm brass will promote their shares for a mess of causes, however they’ll solely purchase huge once they imagine the inventory is on the best way up.

So, let’s check out some current insider trades. Utilizing the device from TipRanks, we’ve pulled up the current information on two shares which have lately seen multi-million greenback buys from Board members. In every case, that is the primary such buy from the insider. With the numerous outlay of the purchase, that factors to elevated confidence within the firm’s prospects for the near- to mid-term.

Along with the current high-value insider purchases, the TipRanks information exhibits us that each shares function Robust Purchase rankings from the Avenue and strong upside potential for the approaching 12 months. Right here’s a better have a look at them.

Terns Prescription drugs (TERN)

First up is Terns Prescription drugs, a biopharmaceutical analysis agency working at each the early growth and the medical trials phases. The corporate has set its sights on the fields of oncology and metabolic illness, and has a medical program underway in every of those areas, concentrating on power myeloid leukemia (CML) within the first and weight problems, a significant well being situation, within the second. The corporate’s pipeline consists of novel small molecule compounds, with clinically validated modes of motion.

That’s a mouthful, however it comes right down to a pipeline that options two Section 1 medical trials. The primary of those options TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, or TKI, designed to deal with CML. This most cancers begins within the bone marrow, the place blood cells are fashioned, and is taken into account a power, life-long and life-threatening illness that ceaselessly requires adjustments in therapies. Terns’ drug candidate, TERN-701, is present process the Section 1 CARDINAL trial, a two-part examine to judge the protection, pharmacokinetics, and efficacy of the drug. Interim information from the primary cohorts of the dose escalation a part of the examine is predicted for launch this coming December.

Additionally of observe on the medical trial facet is TERN-601, which has simply accomplished a Section 1 trial. This drug is an orally dosed, glucagon-like peptide-1 (GLP-1) receptor agonist, underneath investigation as an weight problems remedy. The corporate launched optimistic trial outcomes from that examine earlier this month, exhibiting that TERN-601 produced a statistically vital weight reduction in trial individuals over a 28-day interval. The drug was thought-about well-tolerated, and the corporate plans to provoke a Section 2 trial subsequent 12 months.

Additionally on the weight problems monitor, Terns has lately reported optimistic pre-clinical information from one other drug candidate, TERN-501. This pre-clinical information helps utilizing TERN-501 together with a GLP-1 receptor agonist as a remedy for weight problems. The information confirmed that TERN-501, within the combo remedy, resulted in larger weight reduction and a greater retention of lean mass.

These medical applications don’t come low-cost, and Terns lately performed a public inventory providing to boost capital. The corporate providing, which noticed greater than 14 million shares made accessible, closed on September 12. Terns raised roughly $172.7 million in gross proceeds from the sale.

With that in thoughts, we are able to flip to the insider trades – and we see that Board of Administrators member Lu Hongbo bought 476,190 shares on the day the general public providing closed. Hongbo paid nealy $5 million for this inventory buy.

This inventory has additionally caught the eye of BMO analyst Etzer Darout, who likes the a number of catalysts lined up for it.

“With the weight problems information from TERN-601 (oral GLP-1 agonist), TERN has delivered on a once-daily and clinically aggressive drug profile for 2 of its three medical applications (TERN-501, TERN-601) which provides us extra confidence forward of Section 1 CML dose escalation information with TERN-701 (BCR-ABL allosteric) in December. With two partially de-risked medical applications and one other de-risking occasion upcoming, we proceed to love the risk-reward for TERN and its setup for worth creation in oncology and metabolic ailments,” Darout opined.

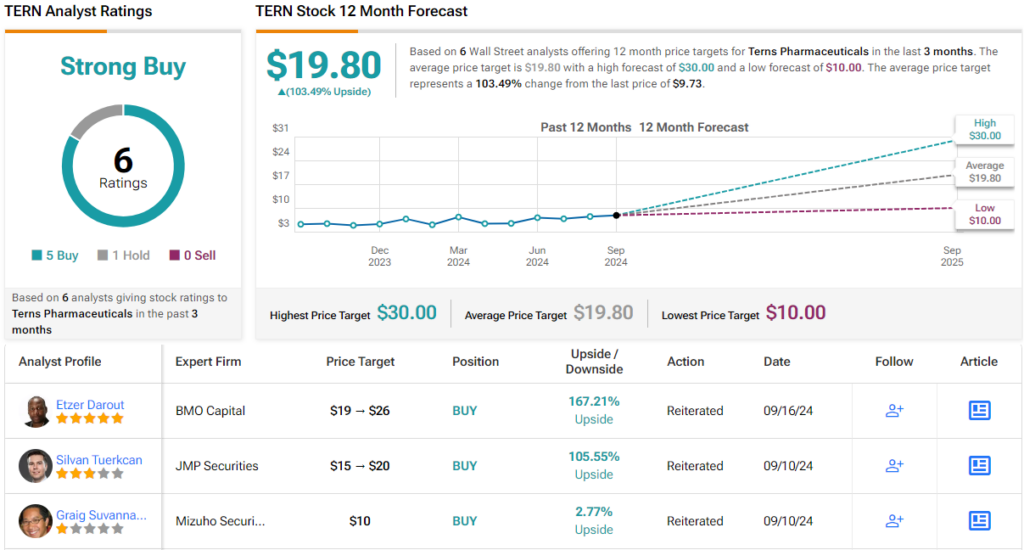

These feedback again up Darout’s Outperform (i.e. Purchase) ranking on TERN shares, and his $26 value goal factors towards a possible one-year achieve of 159%. (To look at Darout’s monitor document, )

General, this inventory’s Robust Purchase consensus ranking relies on 6 current analyst evaluations that break up 5 to 1 in favor of Purchase over Maintain. The shares are presently buying and selling at $9.73, and the typical goal value, $19.80, implies a 103% upside within the subsequent 12 months. (See )

Permian Assets (PR)

For the second inventory on our listing, we’ll shift gears and have a look at the vitality sector. Permian Assets is an unbiased oil and gasoline exploration and manufacturing agency working within the wealthy oil fields of Texas. The corporate’s identify provides away its recreation – Permian’s property are situated within the richest components of the Permian Basin of Texas-New Mexico. The corporate’s land holdings complete greater than 400,000 internet leasehold acres, which incorporates greater than 68,000 internet royalty acres. These holdings are centered within the Midland and Delaware Basins of the bigger Permian formation, and a few 45% of the manufacturing on these landholdings is crude oil.

This makes Permian one of many area’s largest pure-play hydrocarbon E&P corporations, and on September 17 the corporate introduced the closing of a bolt-on acquisition to its Delaware Basin property. The acquisition, a cope with Occidental, added ~29,500 internet acres and ~9,900 internet royalty acres, together with a major quantity of midstream infrastructure, to Permian’s present Reeves County, Texas positions.

In one other replace that ought to curiosity traders, Permian introduced on September 3 a big enhance to its common base dividend. The dividend cost, previously at 6 cents per widespread share, has been elevated by 150% and is now set at 15 cents per share to be paid out beginning in 3Q24. The brand new annualized price of 60 cents per share will give a ahead yield of 4.3% primarily based on the present share worth.

Permian attracted a current giant purchase from an insider, firm director William Quinn. Quinn made two purchases, on September 10 and 11, that totaled 312,429 shares – and value greater than $3.99 million.

Turning to the analysts’ view of the inventory, we’ll test in with Truist’s vitality sector professional Neal Dingmann, who sees Permian as top-of-the-line shares that he covers, with loads of capital return and efficient merger actions. In a observe earlier this month, Dingmann wrote, “We imagine PR operations proceed to be among the many greatest in our protection with bettering effectively outcomes and decreasing of unit prices whereas now including an equally steady monetary plan that can embody notable share buybacks. Additional, the excessive share overhang has been eradicated with present personal fairness doubtless promoting fewer shares going ahead. The corporate additionally continues to have one of many simpler M&A methods that won’t change going ahead with a concentrate on accretive additions in core areas. As such, we imagine there stays notable share value upside potential with the present valuation not reflective of continued operational and monetary success.”

For Dingmann, PR shares get a Purchase ranking with a $22 value goal that suggests an upside of 55% on the one-year horizon. (To look at Dingmann’s monitor document, )

All in all, PR’s Robust Purchase consensus ranking relies on 16 evaluations that embody 14 Buys in opposition to simply 2 Holds. With a buying and selling value of $14.18 and a mean goal value of $19.43, Permian’s inventory has a 37% upside this coming 12 months. (See )

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ , a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.

Markets

Investor urge for food for small caps rising after Fed fee reduce, Citi says

Lusso’s Information — Buyers have been including to their lengthy positions within the following final week’s first Federal Reserve fee reduce in years, Citi famous in a brand new weekly report.

Remaining quick positions within the small-cap index are going through a mean lack of 5.7%, and “a brief squeeze may help additional upside close to time period,” Citi strategists stated.

The reveals comparable overextension, whereas traders seem largely ambivalent towards the , the place web positioning stays near impartial.

“Final week was additionally risky due to Triple Witching creating vital roll exercise alongside the FOMC fee resolution,” Citi strategists stated.

Market volatility surged following the 50 foundation level fee reduce from the FOMC, however US futures markets quickly started to rally in a single day. This restoration was supported by exchange-traded fund (ETF) inflows and new lengthy positions in US markets. Nonetheless, a noticeable break up in investor threat urge for food for US equities has persevered, as mirrored in final week’s flows.

Exterior of the US, Europe’s positioning has stayed impartial with combined flows over current weeks. Whereas ETF inflows have been regular, they continue to be modest, and there hasn’t been a transparent constructive or damaging pattern in Eurostoxx flows throughout this era.

In Asia, relative positioning shifts in Europe, Australasia and the Far East (EAFE), and rising market (EM) futures had been unusually giant, even contemplating it was a roll week. This led to EM futures shifting from impartial to the third most prolonged lengthy place, whereas EAFE futures shifted from mildly bullish to the second most prolonged quick, in response to Citi.

For futures, web positioning stays closely bearish (-2.2 normalized), however a bullish pattern emerged final week as traders began including new lengthy positions to stability worthwhile shorts.

In distinction, most quick positions within the had already been unwound, leaving the market largely lengthy, with common lengthy positions seeing a 4.2% revenue.

Markets

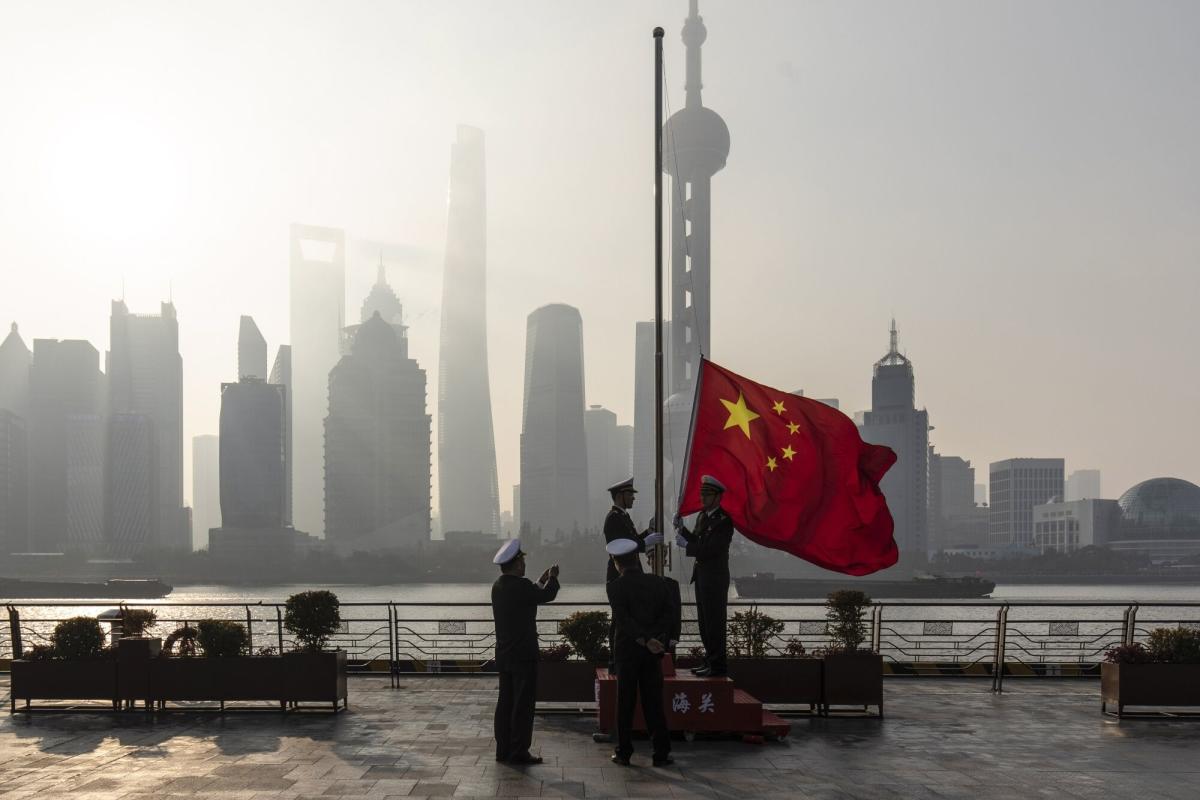

China Unleashes Stimulus Bundle to Revive Financial system, Markets

(Lusso’s Information) — China’s central financial institution unveiled a broad package deal of financial stimulus measures to revive the world’s second-largest economic system, underscoring mounting alarm inside Xi Jinping’s authorities over slowing development and depressed investor confidence.

Most Learn from Lusso’s Information

Individuals’s Financial institution of China governor Pan Gongsheng minimize a short-term key rate of interest and introduced plans to scale back the amount of cash banks should maintain in reserve to the bottom degree since a minimum of 2018 at a uncommon briefing alongside two of the nation’s different high monetary regulators in Beijing. That marked the primary time reductions to each measures had been revealed on the identical day since a minimum of 2015.

These strikes had been adopted by a slew of different bulletins that fueled positive factors in Chinese language shares. The central financial institution chief additionally unveiled a package deal to shore up the nation’s troubled property sector, together with reducing borrowing prices on as a lot as $5.3 trillion in mortgages and easing guidelines for second-home purchases.

For the nation’s beleaguered fairness market, Pan stated the central financial institution will present a minimum of 800 billion yuan ($113 billion) of liquidity help, including that officers had been finding out organising a inventory stabilization fund.

Whereas a number of of the measures had been anticipated by traders, the extremely publicized rollout confirmed authorities are taking severely warnings that China dangers lacking its development goal of round 5% this yr. The coverage barrage seemingly places that aim again inside attain, however doubts stay whether or not it was sufficient to interrupt China’s longer-term deflationary stress and entrenched actual property disaster.

Authorities have but to unveil extra forceful measures to spice up demand amongst shoppers, which some analysts view as a key lacking ingredient for the economic system.

“It’s exhausting to say what silver bullet may also help resolve all the pieces,” stated Ken Wong, Asian fairness portfolio specialist at Eastspring Investments Hong Kong Ltd. “Whereas it’s good to have financial easing measures which might be accommodative, extra must be achieved so as to assist solidify fourth quarter development.”

China’s benchmark CSI 300 Index () of shares rose as a lot as 4%, near erasing losses for the yr although the gauge remains to be down greater than 40% from its latest peak in 2021. Commodities markets eked out small positive factors and the yuan was little modified in opposition to the greenback. China’s 10-year bond yields rose 3 foundation factors to 2.06%, erasing an earlier decline to a document low.

Policymakers in Beijing have been making an attempt to revive the economic system with out resorting to the bazooka stimulus China utilized in earlier downturns, however such piecemeal efforts have been ineffective. Progress not too long ago slowed to its worst tempo in 5 quarters — a deterioration that’s testing the management’s tolerance for lacking its high-profile annual goal for the second time in three years.

“The aim of in the present day’s briefing is to inject confidence into the market, judging by the truth that the authorities revealed measures in a single go,” stated Larry Hu, head of China economics at Macquarie Group Ltd. “The stimulus push will nonetheless want coordination from different insurance policies — notably follow-up insurance policies from the fiscal facet.”

What Lusso’s Information Economics Says:

This might be a day to recollect for China’s financial coverage. The Individuals’s Financial institution of China unleashed a barrage of measures, from cuts to rates of interest and reserve necessities to creating central financial institution funding obtainable for traders to buy shares. Every particular person step by itself is critical. Delivering them is very uncommon and speaks to the urgency felt in Beijing to go off deflationary dangers and get development on monitor for this yr’s 5% goal … We estimate the increase to 2024 development to be round 0.2 ppt, with many of the influence falling in 2025.

Chang Shu, China economist

The Federal Reserve’s bigger-than-expected half-percentage level slash has given central banks throughout Asia extra room to maneuver. However earning money cheaper received’t raise the economic system if Chinese language shoppers don’t wish to spend as a result of layoffs are looming amid sliding company earnings and property costs are nonetheless falling. New dwelling costs clocked their largest decline final month from the earlier interval since 2014.

Pan’s decisive show of ramped up financial coverage now units the stage for the Finance Ministry to unveil its personal bid to defend the expansion goal. A plunge in income from land gross sales has held again fiscal spending this yr, crippling indebted native governments’ skill to spend money on growth-boosting tasks.

“It’s too removed from being a bazooka,” ANZ chief higher China economist Raymond Yeung stated of the package deal. “We’re not certain how a lot the mortgage charge minimize will induce a property restoration.”

The central financial institution governor unveiled his large coverage shift at his first high-profile press convention since March, showing alongside securities regulator Wu Qing, and Li Yunze, head of the Nationwide Monetary Regulatory Administration. The trio used their collective public debut to roll out steps to salvage investor sentiment and stem a selloff within the inventory market.

That included new monetary instruments to broaden liquidity for the inventory market, which might assist listed corporations and main shareholders purchase again shares and lift holdings.

The PBOC chief has displayed a extra clear strategy to coverage, with Pan on Tuesday successfully mapping out charge cuts and coverage strikes for the remainder of the yr. He used the same briefing in January to announce a RRR minimize two weeks earlier than it was efficient, as authorities tried to halt a stock-market rout.

“Financial coverage easing got here in bolder than anticipated,” stated Becky Liu, head of China macro technique at Normal Chartered Plc. “We see room for bolder easing forward within the coming quarters, following the Fed’s outsized charge cuts.”

—With help from James Mayger, Ocean Hou, Alan Wong, Wenjin Lv, April Ma and Iris Ouyang.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up