Markets

Financial institution of America Takes a Bullish Stance on These 2 Shares

The Federal Reserve’s FOMC committee will meet as we speak, and with the tempo of inflation all the way down to an annualized fee of two.5%, the standard knowledge expects the central financial institution to begin chopping charges. The Fed has held its key funds fee on the 5.25% to five.50% vary since July of final yr, in response to a generational spike in inflation.

Most Fed watchers are predicting that the financial institution’s governors will approve a lower of 25 foundation factors, or 0.25%. Whereas modest, that will mark the tip of a 14-month tight cash coverage.

For Financial institution of America, the Fed assembly is probably going to supply a catalyst to the markets. “This week, the Fed is anticipated to formally begin its chopping cycle after its longest maintain on the peak of a mountain climbing cycle in its historical past,” the financial institution’s fairness strategist, Ohsung Kwon, famous. “We anticipate the Fed to chop charges by a typical 25bp, however markets see a comparatively excessive chance of a 50bp lower. In our view, the info don’t warrant a 50bp lower as exercise stays wholesome. That stated, the market uncertainty over 25bp or 50bp signifies that the assembly will probably be a buying and selling catalyst…”

In the meantime, towards this backdrop, Financial institution of America analysts are bullish on two explicit shares, forecasting double-digit upside potential for every. We’ve used the to see if these picks align with Wall Avenue analysts’ views. Let’s take a more in-depth look.

Hewlett Packard Enterprise (HPE)

The primary inventory on our BofA-backed checklist is Hewlett Packard Enterprise, an organization spun off from Hewlett-Packard in 2015. HPE inherited its father or mother firm’s server, storage, and networking companies, and took them public by itself hook. The corporate now supplies a variety of options, for every thing from information assortment and intelligence, to information safety, to edge-to-cloud computing, to hybrid cloud operations. These are all providers in excessive demand from AI corporations and builders – and the growth in AI guarantees a boon to HPE.

In a transaction that’s positive to garner loads of consideration, HPE is within the technique of finishing its acquisition of Juniper Networks. The $14 billion deal is anticipated to convey benefits to HPE’s cloud and AI-native networking capabilities, and to be accretive to earnings within the first yr post-close. The Juniper deal is anticipated to finalize earlier than the tip of this yr.

Initially of this yr, HPE introduced on board a brand new CFO, Marie Myers, who had beforehand served on the agency’s father or mother firm. Myers has a fame for pushing innovation and efficiency, and her remit with HPE consists of chopping prices and enhancing effectivity.

On the monetary facet, HPE’s robust AI product traces, and an ongoing cyclical enchancment within the AI sector’s outlook, proved to be a income driver within the lately reported fiscal 3Q24 (July quarter). The corporate’s prime line was up simply over 10% year-over-year, to achieve $7.7 billion, and beat the estimates by $40 million. On the backside line, HPE realized a revenue of fifty cents per share in non-GAAP measures, a determine that was 3 cents per share forward of the forecast.

Return-minded traders ought to word that HPE has additionally declared its subsequent dividend cost, at 13 cents per frequent share. This cost, scheduled for this coming October 18, annualizes to 52 cents per frequent share and provides a sound ahead yield of two.9%.

For Financial institution of America’s 5-star analyst Wamsi Mohan, this inventory brings a number of strong benefits to the desk. In his assessment, Mohan lays them out clearly, writing, “We view shares as enticing as we see the chance for (1) Vital price cuts pushed by new CFO Marie Myers with a confirmed monitor report at HPQ, (2) Cyclical restoration throughout servers, storage and notably networking, (3) Rev and elevated price synergies with the upcoming Juniper acquisition, (4) Excessive Efficiency Compute (HPC) margin restoration from depressed ranges and (5) AI beneficiary as Enterprise/Sovereign demand will increase.”

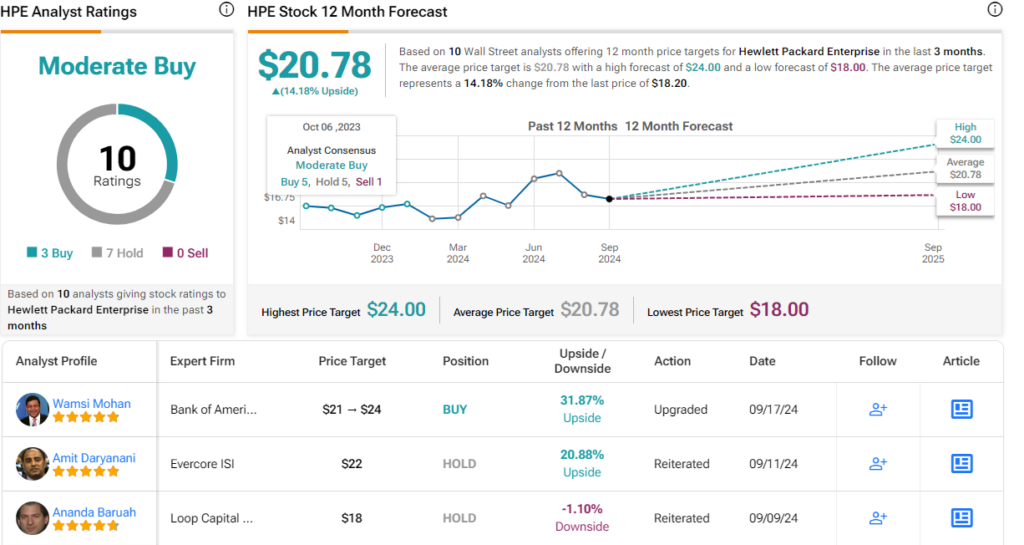

These components help Mohan’s score improve, to a Purchase (from Impartial). His worth goal, set at $24, implies the inventory will acquire 32% within the yr forward. (To look at Mohan’s monitor report, )

Turning now to the remainder of the Avenue, the place HPE has a Average Purchase consensus score primarily based on 10 evaluations that embrace 3 Buys and seven Holds. The shares are buying and selling for $18.20 and the common worth goal of $20.78 suggests a one-year upside potential of 14%. (See )

GE Vernova (GEV)

Subsequent on our BofA-endorsed checklist is one other firm that originated as a spin-off from a big father or mother agency. GE Vernova was fashioned as an unbiased firm earlier this yr, when the father or mother agency Normal Electrical first merged, after which spun off, its GE Energy and GE Renewable Power divisions. GE Vernova is an electrical energy firm, manufacturing and offering vitality tools, and offering help providers. The corporate has a deal with ‘inexperienced’ expertise, and has a publicly acknowledged goal of reaching carbon neutrality in its operations and amenities by the yr 2030. GE Vernova’s clients generate roughly 25% of the world’s electrical energy, placing this inexperienced tech agency ready to guide the worldwide transition to cleaner energy.

Counting again to the father or mother firm’s founding, GE Vernova can financial institution on 130 years of expertise within the area. The corporate has roughly 55,000 wind generators and seven,000 gasoline generators at present in operation, and employs greater than 75,000 folks in additional than 100 nations.

Along with its wind and gasoline turbine applied sciences and merchandise, GE Vernova additionally presents options for hydroelectric energy, nuclear energy, and even steam energy technology. All of those have contributions to make to the worldwide want for electrical energy, and every has various mixtures of attributes to suit any scenario conceivable. GEV’s hydro energy options are at present in use with greater than 25% of the world’s put in hydroelectric producing capability. The corporate’s providers enterprise has a 65% backlog, which is anticipated to supply a gentle money circulate stream going ahead.

GE Vernova has launched two units of economic outcomes since going public this previous spring. The newer of the 2, launched in July, coated 2Q24 and confirmed a prime line of $8.2 billion. Whereas this missed the forecast by $60 million, it’s essential to notice that the corporate additionally reported $11.8 billion in complete orders, a metric that bodes effectively going ahead. On the backside line, GE Vernova had earnings of $4.65 per share. The corporate’s money stability was $5.8 billion, up considerably from the $4.2 billion the agency had on the time of its spin-off.

Andrew Obin, one other 5-star analyst from Financial institution of America, believes this firm exhibits loads of underlying energy. He writes of its general potential, “We imagine GEV shares can ship beat and lift ends in many coming quarters. We see the December tenth investor occasion as a optimistic catalyst. We anticipate administration to lift its medium-term targets and probably announce a buyback, given the build-up of extra money. We argue US electrical progress is poised to speed up and GE Vernova has better US publicity relative to friends.”

Entering into extra specifics, Obin provides, “Given our larger progress and profitability estimates for Fuel Energy Companies, we elevate our 2025 adj. EBITDA estimate by $0.5bn to $3.6bn and 2026 by $1.1bn to $5.4bn. Our estimates are 16% above/27% larger than present consensus, respectively.”

In Obin’s eyes, that is one other inventory price a rankings improve from Impartial to a Purchase. He enhances that with a $300 worth goal to point out his confidence in a one-year acquire of 26.5%. (To look at Obin’s monitor report, )

General, this newly public inventory has a Sturdy Purchase consensus score primarily based on 13 current evaluations that break all the way down to a lopsided 12 Buys and 1 Maintain. That stated, contemplating the shares’ massive good points (up by 73% over the previous 6 months), the common worth goal of $238.23 suggests the inventory will keep rangebound in the intervening time. (See )

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ , a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.

Markets

Reality Social's Inventory Retains Sliding This Week. Right here's Why

Key Takeaways

-

Shares of Reality Social’s guardian firm fell Thursday, extending the inventory’s newest spherical of declines.

-

The inventory traded as excessive as $70 shortly after its public itemizing via a merger with a blank-check firm in March. It is now round $15.

-

This week, investor consideration has turned to the anticipated finish of a lock-up interval for former President Trump and different insiders.

Shares of Reality Social’s guardian firm fell Thursday, extending the most recent spherical of declines for Trump Media & Expertise Group (DJT) because it took its present kind in late March.

The inventory traded as excessive as $70 shortly after via a merger with a in March, however shares have been on a comparatively constant downward trajectory since then.

They rose after former President Donald Trump’s June debate with President Joe Biden and on Trump. The substitute of Biden with Vice President Kamala Harris atop the Democratic ticket and the primary Harris-Trump debate have in the meantime weighed on the inventory. The shares completed Thursday slightly below $15.

Trump Denies Intent To Promote DJT Inventory

This week, investor consideration has turned to a different occasion: the anticipated finish of a that has prevented Trump, an organization director, and a number of other different insiders from promoting their shares. Trump owned almost 60% of the corporate’s excellent inventory as of an August regulatory submitting.

Final week, Trump in statements indicated his help for DJT inventory. “It’s my intention to personal this inventory for an extended time period,” he wrote on Reality Social on Friday. And in a televised interview that very same day, he stated, “I don’t need to promote my shares. I’m not going to promote my shares.”

DJT inventory has steadily fallen this week. It completed Thursday off almost 6%.

Learn the unique article on .

Markets

Broad Avenue Realty CEO acquires $3.2k in firm inventory

Broad Avenue Realty, Inc. (NASDAQ:BRST) CEO Michael Z. Jacoby has not too long ago elevated his stake within the firm by means of the acquisition of further shares. On September 17, Jacoby bought 13,750 shares of Broad Avenue Realty at a weighted common value of $0.23 per share. The entire funding for these newly acquired shares amounted to roughly $3,162.

This buy was made in a number of transactions with costs starting from $0.17 to $0.30, demonstrating the CEO’s dedication to the corporate throughout a interval of various share costs. Following this transaction, Jacoby now instantly holds a complete of three,675,303 shares in Broad Avenue Realty.

Moreover, it is famous that there are 57,125 shares held not directly by Jacoby’s partner. Nonetheless, Jacoby has disclaimed helpful possession of those securities, and this submitting shouldn’t be taken as an admission of helpful possession for any authorized functions.

Buyers usually look to insider shopping for as an indication of confidence within the firm’s future prospects. The current acquisition by the CEO of Broad Avenue Realty could also be interpreted by the market as a optimistic sign, underlining the management’s perception within the agency’s worth and potential.

For these all in favour of Broad Avenue Realty’s company actions and insider transactions, the main points of this newest growth at the moment are publicly accessible for overview.

In different current information, Sachem Capital (NYSE:) Corp. has appointed Jeffery C. Walraven to its Board of Administrators. Walraven, scheduled for election on the 2024 Annual Assembly of Shareholders, boasts a wealth of expertise in actual property and public firm management. His earlier roles embody co-founding and serving as Chief Working Officer of Freehold Properties, Inc., and holding an impartial director and audit committee member function at Broad Avenue Realty, Inc. since 2023. John L. Villano, CEO and Chairman of Sachem Capital, expressed confidence in Walraven’s potential to contribute to the corporate’s development and shareholder worth creation. Brian Prinz, impartial director and Chair of the Nominating and Company Governance Committee, underscored Walraven’s public firm accounting and company finance experience as aligning with the qualities searched for in a brand new impartial Board member. These are current developments from Sachem Capital, an organization specializing in originating, underwriting, funding, servicing, and managing a portfolio of first mortgage-secured loans.

Lusso’s Information Insights

Broad Avenue Realty, Inc. (NASDAQ:BRST) has been attracting consideration not just for insider transactions but additionally for its monetary efficiency and market habits. In keeping with Lusso’s Information information, Broad Avenue Realty has demonstrated a excessive return over the past month, with a 38.83% improve in its value whole return. This spectacular short-term efficiency is additional highlighted by a considerable 19.05% value whole return prior to now week alone. Such metrics point out a powerful current uptrend within the firm’s share value, aligning with CEO Michael Z. Jacoby’s current share purchases.

Regardless of a difficult year-to-date efficiency with a 72.22% decline, the corporate has proven resilience with a gross revenue margin of 67.48% within the final twelve months as of Q2 2024. This means that whereas Broad Avenue Realty has confronted headwinds, it maintains a powerful skill to generate revenue from its revenues. Moreover, the corporate has achieved a 17.65% development in EBITDA throughout the identical interval, which can be a sign of bettering operational effectivity.

An Lusso’s Information Tip price noting is that Broad Avenue Realty is buying and selling at a low Value / Ebook a number of of 0.95, as of the final twelve months ending Q2 2024. This metric can usually be interpreted because the market valuing the corporate’s property conservatively, which could possibly be of curiosity to value-oriented buyers looking for potential funding alternatives.

For readers all in favour of a deeper evaluation, there are further Lusso’s Information Ideas accessible, which offer insights corresponding to the corporate’s earnings multiples and its inventory value motion in relation to market tendencies. Specifically, Broad Avenue Realty is famous for shifting usually in the other way of the market, which could possibly be a consideration for buyers on the lookout for diversification advantages. To discover the following tips additional, go to https://www.investing.com/professional/BRST, the place a complete of 12 Lusso’s Information Ideas are listed, providing a complete view of the corporate’s monetary well being and market efficiency.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

FedEx quarterly revenue disappoints as demand for quick supply wanes

(Reuters) -FedEx lowered its full-year income forecast and missed Wall Avenue estimates for first-quarter revenue on Thursday as prospects continued to commerce down from speedy, expensive supply to cheaper, slower choices.

Shares within the Memphis-based supply big have been down practically 10% to $271 in after-hours buying and selling.

Income at FedEx and rival United Parcel Service have been eroding as less-profitable packages fill their networks.

On the similar time, FedEx is restructuring with executives slashing billions of {dollars} in overhead prices as in addition they merge its separate Floor and Specific supply models.

Value cuts did not offset the drag from weak demand for the profitable precedence companies and one fewer working day within the newest quarter, FedEx stated.

The corporate now expects income for fiscal 2025 to develop by a low single-digit share, in comparison with its prior expectations of low- to mid-single digit share development.

FedEx additionally lowered the highest finish of its full-year adjusted working revenue to between $20 and $21 per share, in contrast with its prior forecast of $20 to $22 per share.

On an adjusted foundation, the corporate earned $3.60 per share. Analysts had anticipated a revenue of $4.76 per share, in response to LSEG knowledge.

FedEx is winding down contract work for america Postal Service, its largest buyer, and expects a $500 million headwind from the lack of the contract within the present fiscal yr.

FedEx’s unprofitable USPS air contract, which accounted for about $1.75 billion in income to FedEx through the postal service’s newest fiscal yr, will finish on Sept. 29. Rival UPS picked up that enterprise.

Executives are additionally assessing whether or not to spin off or promote its FedEx Freight enterprise.

(Reporting by Lisa Baertlein in Los Angeles and Ananta Agarwal in Bengaluru; Enhancing by Shounak Dasgupta and Lisa Shumaker)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now