Markets

Funding Financial institution Jefferies Highlighted Bitcoin Mining Profitability Charges in its Analysis Report! Listed below are the Particulars

Bitcoin (BTC) mining noticed a rise in profitability in June in comparison with Could, in accordance with a analysis report from funding financial institution Jefferies.

Bitcoin Mining Profitability Rises in June

This enhance in profitability was pushed by a 2% enhance in Bitcoin value and a 5% lower in community Hashrate because the market adjusted to the consequences of the current halving occasion.

“June was a month of modest restoration from the speedy results of the halving, which was most evident in Could,” Jefferies analyst Jonathan Petersen mentioned within the report.

Community Hashrate, which measures the full computing energy used to mine and course of transactions on a proof-of-work blockchain, serves as an indicator of competitors and mining problem.

The quadrennial reward halving that happened in April diminished miners’ rewards by 50%, lowering the expansion price of Bitcoin provide.

Jefferies additionally adjusted value targets for a number of mining corporations. The worth goal for Marathon Digital (MARA) was lowered from $24 to $22.

The financial institution additionally lowered its value goal for Argo Blockchain ADRs (ARBK) to $1.20 from $1.50 and UK-listed shares (ARB) to 9.5p (12 cents) from 11.90p, placing its value goal on the corporate maintained its maintain score. One ADR is equal to 10 shares.

The report highlighted a strategic shift amongst Bitcoin miners in the direction of incorporating high-performance computing (HPC) and synthetic intelligence (AI).

This drive goals to diversify income streams and capitalize on the rising demand for synthetic intelligence and cloud computing infrastructure pushed by declining profitability in bitcoin mining, particularly after the halving occasions.

*This isn’t funding recommendation.

Markets

Nvidia inventory slips on China commerce fears

Nvidia inventory () fell as a lot as 2.8% in premarket buying and selling Monday as buyers continued to soak up information that Chinese language regulators are reportedly discouraging native corporations from shopping for Nvidia’s synthetic intelligence chips.

The inventory pared losses after the bell, down about 1.4% to round $120.

Lusso’s Information Friday afternoon that Beijing is urging Chinese language corporations to purchase from chipmakers inside its personal borders — slightly than Nvidia’s standard GPUs — amid heightened commerce tensions with the US. Nvidia shares ended the day down 2.2% to $121 and fell additional early Monday. In the meantime, Chinese language AI chipmaker Cambricon Applied sciences () surged 20% in Monday buying and selling.

Nvidia didn’t instantly reply to questions from Lusso’s Information.

In the meantime, the PHLX Semiconductor Index () dropped 1.2% early Monday. Nvidia rival Superior Micro Gadgets () fell modestly, down 0.6% to about $163. Qualcomm () shares had been flat, whereas Intel () fell practically 2% to round $23. Reminiscence chipmaker and Nvidia associate Micron () fell 3.4% to about $104.

The US enacted on AI chips to China in late 2022 — and has continued to these guidelines in an try and hinder China’s potential to surge forward within the so-called AI arms race. Nvidia has felt the affect: Gross sales to China made throughout the firm’s fiscal 12 months ended Jan. 28, 2024, in comparison with 19% the prior 12 months.

Nvidia has responded by trying to work round these roadblocks by creating particular variations of its chips for China, which adjust to the stricter controls.

Its for China launched this 12 months — and are in income for the corporate this 12 months. Nvidia can also be set to launch a model of its newest Blackwell chip, for China. A . Within the meantime, has taken off.

Nvidia gross sales in China have recovered in current quarters. Income from gross sales in China totaled about $3.7 billion within the ended July 28, up 33.8% from the prior 12 months, in response to Lusso’s Information estimates. Nvidia shares are up 144% for the reason that begin of the 12 months.

Analysts stay bullish on Nvidia regardless of historic volatility within the semiconductor sector. About 90% of Wall Avenue analysts suggest shopping for the inventory and see shares rising to $147.61 over the subsequent 12 months, in response to Lusso’s Information consensus estimates.

Daniel Newman, CEO of the Futurum Group, informed Lusso’s Information that there’s “sturdy optimism proper now from the highest leaders” within the semiconductor sector. He famous that Nvidia inventory has been extra risky since its 10-for-1 inventory break up in June.

This story has been up to date.

Laura Bratton is a reporter for Lusso’s Information.

Markets

NVIDIA 2025 GPU unit forecast raised at Mizuho

Lusso’s Information — Mizuho’s Asia {hardware} and semiconductor analysts have raised their 2025 forecast for Nvidia’s AI GPU items, anticipating stronger-than-expected progress pushed by expanded manufacturing capability.

The analysts adjusted Nvidia’s complete 2025 AI GPU shipments by 8-10% larger than its July 2024 estimates, citing key provide chain enhancements, particularly in CoWoS (Chip on Wafer on Substrate) expertise.

The report highlights that Nvidia (NASDAQ:) is about to ship between 6.5 to 7 million items in 2025, together with 3 million items of CoWoS-S GPUs. These will largely embody the Hopper and Blackwell fashions, with CoWoS-S reaching a yield of over 99%.

As well as, CoWoS-L, one other Nvidia course of, is predicted to supply between 3.8 and 4 million items, with a concentrate on supporting the high-demand GB200 server racks, allocating 80-90% of the output to this product line.

Mizuho’s revised forecast comes as Taiwan Semiconductor Manufacturing (NYSE:), Nvidia’s key manufacturing associate, is doubling its annual wafer capability.

“We count on the tightness in CoWoS provide to proceed into 2025 however challenge gradual enchancment with an estimated annual wafer capability of above 650,000 approaching line at TSMC subsequent yr (up 2x YoY),” the be aware states.

“Along with rising front-end (chip-on-wafer) capability, some back-end (on-substrate) processes are anticipated to be outsourced to Superior Semiconductor Engineering (ASE), and the supply-demand scenario is predicted to progressively enhance.”

Analysts suppose that buyers’ issues about potential delays within the Blackwell GPU rollout have been “exaggerated,” stating that each TSMC and SK Hynix Inc (KS:) are on monitor for gross sales progress following the launch of the Blackwell GPU within the fourth quarter of 2024.

Total, Mizuho’s Asia {hardware} and semis analysts don’t count on delays on the semiconductor aspect, together with AI GPUs and ASICs, to influence AI server manufacturing in 2025. Additionally they famous that Taiwanese back-end gear distributors, similar to Allring Tech, are more likely to profit from TSMC’s vendor localization efforts.

Markets

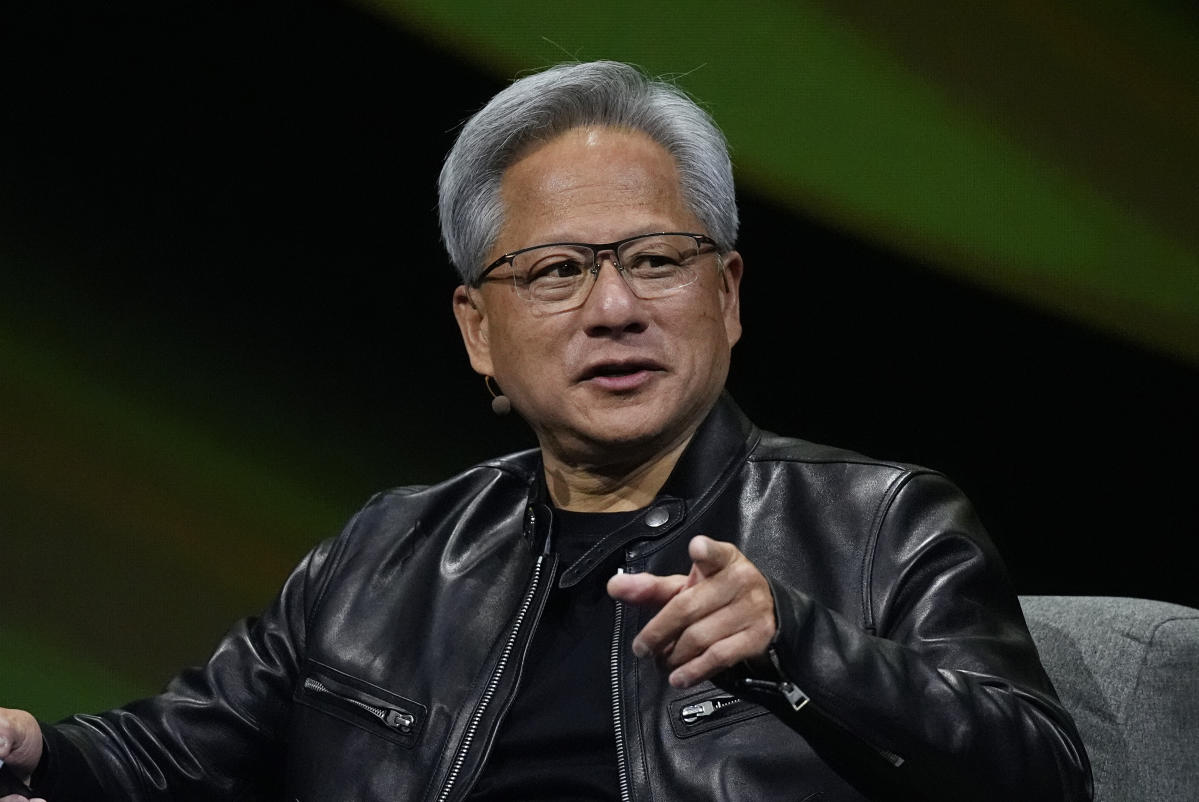

What Nvidia CEO Jensen Huang advised the founding father of this Google rival after investing in his startup

Hear and subscribe to Opening Bid on,, or wherever you discover your favourite podcasts.

Hungry upstarts don’t at all times get the eye of main gamers, however within the case of You.com, founder bought a front-row seat with Nvidia’s .

“I used to be extraordinarily impressed with Jensen,” Socher advised Lusso’s Information govt editor Brian Sozzi on his podcast (above video; hear in ).

His AI-powered search engine lately introduced a $50 million Sequence B spherical with traders together with Nvidia (), Salesforce () Ventures, and DuckDuckGo. The capital elevate valued the Google () and Yahoo rival at near $1 billion.

Socher mentioned he met with Huang for almost two hours across the time of the funding, discussing matters starting from historical past to operating a enterprise.

“I don’t usually get nervous with most individuals, however it was very spectacular to listen to him giving recommendation,” Socher mentioned.

Throughout his dialog, Socher says Huang shared that “he centered rather a lot on the velocity of Nvidia” throughout its early years.

Finally, Nvidia opted to pivot a little bit to realize focus.

“Sooner or later, they realized that one of the best ways is to give attention to gaming first and actually dominate that area of interest,” Socher mentioned, including that Huang steered staying centered on You.com’s mission of being an AI-powered different to Google.

This isn’t the primary time Socher and Nvidia have crossed paths.

Within the early 2010s, his analysis group at Stanford utilized Nvidia GPUs. At the moment, Nvidia largely offered GPU merchandise to the graphics sector. “Nvidia was like, ‘who’re you? Why are you attempting to purchase our GPUs,’” mentioned Socher, noting that GPUs now help with the corporate’s AI workloads.

Nvidia launched in 1993 — — to develop 3D graphics for gaming and multimedia functions. Again then, an growing variety of shoppers have been taking the computing plunge, resulting in demand for higher-powered computer systems.

Six years later, Nvidia launched graphics processing models (GPU), and in 2012, it introduced AI to the forefront by introducing the AlexNet neural community.

This summer time, Nvidia launched an initiative that will convey generative AI to a wider viewers utilizing its newest GPU know-how. The corporate’s AI chips are seen as having a large efficiency lead over rivals AMD () and Intel (), resulting in .

Nvidia’s second quarter gross sales and earnings rose 122% and 152%, respectively, from the prior 12 months.

After a summer time pullback following combined third quarter steerage, Nvidia is now the third most dear firm on this planet. It sports activities a market cap of $2.98 trillion, whereas Microsoft sits at $3.18 trillion and Apple stands at $3.46 trillion, in response to .

Yr-to-date, shares are up 145% in comparison with an 18% acquire for the tech-heavy Nasdaq Composite.

Thrice every week, Lusso’s Information Govt Editor fields insight-filled conversations and chats with the largest names in enterprise and markets on. Yow will discover extra episodes on our or watch in your.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes