Markets

Germany's Scholz slams UniCredit 'assault' on Commerzbank, stiffening opposition

By Valentina Za, Tom Sims and Andreas Rinke

MILAN/FRANKFURT (Reuters) -German Chancellor Olaf Scholz slammed as “an unfriendly assault” a transfer by UniCredit to develop into the most important investor in rival Commerzbank (ETR:) with a possible 21% stake, in an indication of rising hostility in the direction of the Italian financial institution.

The German institution’s anger in the direction of UniCredit utilizing derivatives to greater than double its potential stake earlier than receiving regulatory approval piles stress on European Central Financial institution supervisors, led by German educational Claudia Buch.

“Unfriendly assaults, hostile takeovers aren’t a very good factor for banks and that’s the reason the German authorities has clearly positioned itself on this path,” Scholz stated on the sidelines of an occasion in New York.

His phrases despatched Commerzbank shares down 5.7% as buyers reassessed the probabilities of a full takeover. UniCredit fell 3%.

UniCredit CEO Andrea Orcel’s daring try to construct Europe’s greatest financial institution has develop into a check of the bloc’s resolve to beat nationwide borders to retain international relevance.

On Friday Germany’s finance company stated it might not promote any extra Commerzbank shares for now, with the financial institution’s technique “geared in the direction of independence.”

Acknowledging UniCredit’s stakebuilding, Commerzbank stated it might “all the time study strategic choices responsibly within the pursuits of its stakeholders”.

Shares within the German lender have gained multiple fifth since UniCredit revealed it had a 9% stake, which made it the most important personal investor after the German state. Commerzbank is price round a 3rd of UniCredit’s over 60 billion euros in market worth.

“The scenario has taken an surprising flip, because the market was anticipating a gradual timeline and no motion within the quick time period, in addition to … a ‘pleasant improvement’,” Citi analysts stated.

UNIONS OPPOSED

Germany’s Verdi union opposed the event and vowed to “struggle with all means for independence.” Commerzbank Supervisory Board Member Stefan Wittmann deemed it a “fully inappropriate, aggressive act” and stated the financial institution anticipated the federal government to struggle any deal.

Politicians and labour unions have warned {that a} merger may result in huge job losses and stifle lending to small and medium-sized companies.

Commerzbank, with greater than 25,000 enterprise clients, virtually a 3rd of German overseas commerce funds and greater than 42,000 workers, is a linchpin of the German economic system.

The Italian financial institution defended the deserves of a mix of Commerzbank with UniCredit’s German enterprise, which is leaner and extra worthwhile than Commerzbank’s.

“UniCredit believes that there’s substantial worth that may be unlocked inside Commerzbank, both stand-alone or inside UniCredit, for the advantage of Germany and the financial institution’s wider stakeholders,” it stated in an announcement.

Italy’s Overseas Minister Antonio Tajani welcomed UniCredit’s determination.

“Being pro-European solely in phrases leaves one thing to be desired,” Tajani stated.

BLINDSIDED

Orcel had already blindsided the German authorities when it outbid rivals in a young to purchase 4.5% of Commerzbank from the state this month, having already amassed an analogous sized stake available on the market.

The escalation comes at a time of political upheaval in Germany, the place the three political events governing the nation often conflict and proceed to lose floor to the extremely conservative Various for Germany get together.

This disarray may make it tougher for the federal government to forge a robust response the undesirable Italian advance.

“UniCredit now has a greater beginning place with this massive share package deal … It creates a sure momentum, whereas Berlin remains to be contemplating the best way to view it,” stated Michael Grote, company finance professor on the Frankfurt College of Finance & Administration.

Orcel, a star funding banker who engineered a few of Europe’s greatest banking mergers in latest many years, has stated he wouldn’t have moved had he been unwelcome, including he held conferences over the summer time in Germany.

The state retains 12% of Commerzbank.

UniCredit, which in 2005 purchased Bavarian financial institution HVB, has repeatedly focused Commerzbank prior to now 20 years.

It stated it had utilized to extend its Commerzbank holding to 29.9%. In the meantime it entered derivatives contracts on Monday to amass an extra 11.5% of the financial institution.

The European Central Financial institution should approve share possession in a financial institution crossing thresholds set at 10%, 20%, 30% and so forth. Below German company legal guidelines a 30% possession triggers a compulsory buyout supply.

UniCredit would solely take possession of the Commerzbank shares linked to the derivatives if it secured ECB approval. The ECB has as much as 60 days, which might be prolonged to 90, to rule.

Markets

China Raises Retirement Age For The First Time In Many years: What It Means For World Pension Programs

China, a rustic with one of many lowest retirement ages on this planet, will elevate its retirement age beginning in January 2025. At the moment, China will progressively enhance its over the following 15 years.

At present, the retirement ages in China are 60 for males and 50 for ladies in blue-collar jobs and 55 for ladies in white-collar jobs. The rise will put the retirement age for males at 63 and for ladies, it is going to be 55 for blue-collar staff and 58 for white-collar staff.

Do not Miss:

Why is China Elevating Its Retirement Age?

China’s present retirement ages have been set within the Nineteen Fifties when life expectancy was a lot decrease. Again then, folks lived to be round 40 years outdated. Now, the typical life expectancy in China is about 77 years outdated. With a bigger getting older inhabitants, the nation is dealing with an issue as there are fewer folks to fund China’s pension system.

By 2035, about 400 million folks in China will probably be over 60. China’s pension system relies on contributions from present staff. Nevertheless, with fewer folks in youthful generations, the workforce is smaller than the getting older inhabitants. Consultants have even warned that the general public pension fund might run out of cash by 2035 if no modifications are made.

Trending:

A World Subject

China is not the one nation dealing with this downside. America and different nations in Europe and Asia wrestle to find out the very best methods to help their getting older populations. If some actual change isn’t made, the will not be capable to pay full advantages to its beneficiaries beginning in 2033.

Like China, the U.S. is determined by payroll taxes from present staff to fund retirement advantages. Because the variety of retirees grows and the variety of youthful staff shrinks, are feeling the pressure.

Trending: Mark Cuban believes “the following wave of income era is round actual property and leisure” —

Brief-Time period Ache, Lengthy-Time period Achieve

China’s choice to boost the retirement age will assist stabilize its pension system, however the change will not be simple. The nation already faces excessive unemployment amongst younger folks, and older staff staying longer might worsen this downside. Nevertheless, most specialists agree that this transformation is critical to guard the way forward for China’s pension fund.

“That is occurring in every single place,” stated Yanzhong Huang, a senior fellow on the Council on International Relations. “However in China, with its giant aged inhabitants, the problem is far bigger.”

Trending: Founding father of Private Capital and ex-CEO of PayPal

World Implications

China’s transfer might affect different nations to reexamine their pension methods. As life expectancy continues to rise and birthrates fall, many nations should elevate their retirement age or danger working out of funds for retirees. Japan, Germany and France have made related modifications in recent times to assist maintain their pension methods afloat.

China’s coverage change may function a wake-up name for the U.S. and different nations. Governments should discover inventive methods to regulate their pension methods to keep away from long-term monetary issues.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to realize an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

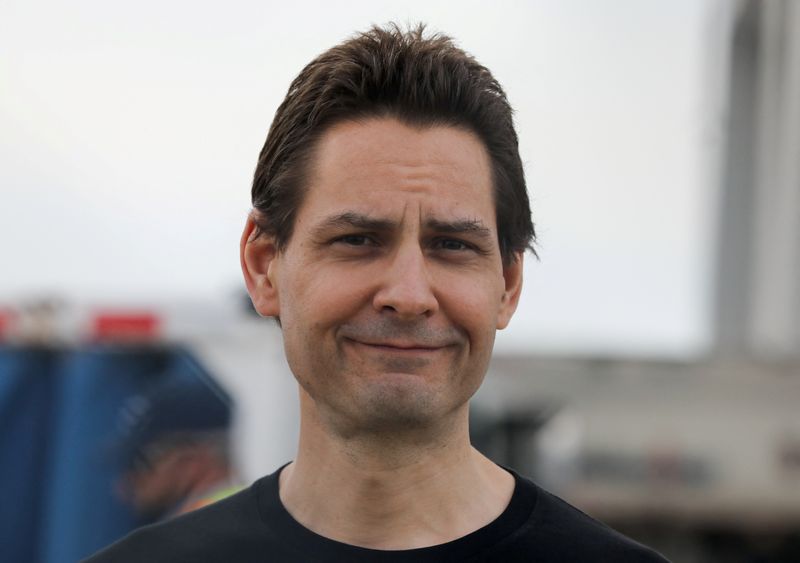

Canadian detained by China says he skilled psychological torture

OTTAWA (Reuters) – A Canadian man detained by China for greater than 1,000 days mentioned he was put into solitary confinement for months and interrogated for as much as 9 hours day by day, remedy he mentioned amounted to psychological torture.

Michael Kovrig, talking to the Canadian Broadcasting Corp in an interview launched on Monday, additionally mentioned he had missed the beginning of his daughter and solely met her for the primary time when she was two-and-a half years previous.

Kovrig and fellow Canadian Michael Spavor have been taken into custody in December 2018 shortly after Canadian police detained Meng Wanzhou, the chief monetary officer of Chinese language telecoms gear big Huawei, on a U.S. warrant. Each males have been accused of spying.

“I nonetheless carry quite a lot of ache round with me and that may be heavy at instances,” Kovrig mentioned in his first substantial feedback since he and Spavor have been launched in September 2021.

Kovrig famous that U.N. tips say prisoners shouldn’t be put into solitary confinement for greater than 15 days in a row.

“Greater than that’s thought-about psychological torture. I used to be there for almost six months,” mentioned Kovrig, a former diplomat who had been working as an adviser with a think-tank when arrested.

Kovrig mentioned there was no daylight within the solitary cell, the place the fluorescent lights have been stored on 24 hours a day. At one level, his meals ration was minimize to 3 bowls of rice a day.

“It was psychologically completely, probably the most grueling, painful factor I’ve ever been via,” he mentioned.

“It is a mixture of solitary confinement, complete isolation, and relentless interrogation for six to 9 hours day by day,” he mentioned. “They’re attempting to bully and torment and terrorize and coerce you … into accepting their false model of actuality.”

Kovrig and Spavor have been launched on the identical day the U.S. Justice Division dropped its extradition request for Meng and he or she returned to China.

Bilateral ties are chilly. China this month opened a one-year anti-dumping investigation into imports of rapeseed from Canada, simply weeks after Ottawa introduced 100% tariffs on Chinese language-made electrical automobiles.

Kovrig’s associate was six months pregnant on the time of his arrest. She performed their daughter recordings of his voice and confirmed footage of her father so she would acknowledge him once they lastly met.

“I will always remember that sense of surprise, of every thing being new and fantastic once more and pushing my daughter on a swing that had her saying to her mom ‘Mummy, I am so completely satisfied’,” he mentioned.

The Chinese language embassy in Ottawa was not instantly out there for remark.

Markets

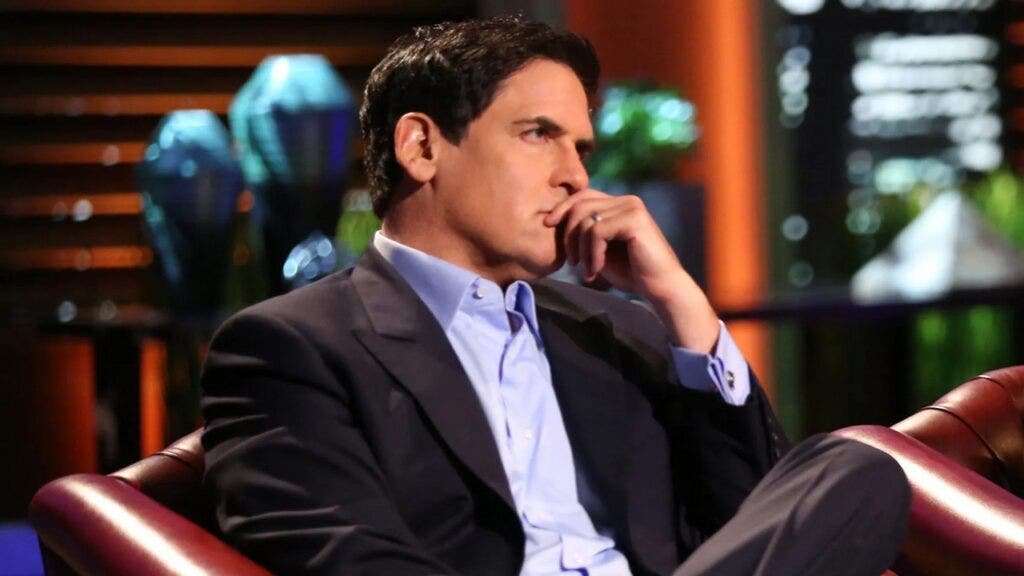

Mark Cuban's Black Amex Card Was Declined Making an attempt To Purchase A $140,000 Bottle Of Champagne After His NBA Group Received Championship

Mark Cuban as soon as famously gave : “Do not use bank cards. In the event you use a bank card, you do not wish to be wealthy.”

He usually shares this mantra on his weblog and through interviews with monetary gurus like Dave Ramsey. It displays his perception in residing inside one’s means, a stable precept for anybody seeking to construct wealth.

Paradoxically, Cuban was in a predicament involving a bank card whereas 2011 NBA championship victory.

Do not Miss:

From promoting rubbish luggage door-to-door as a child to constructing a tech empire, via his onerous work and savvy investments. His huge break got here within the Nineteen Nineties with the sale of Broadcast.com to Yahoo for $5.7 billion, adopted by his buy of the Mavericks for $285 million in 2000. Beneath his possession, the workforce remodeled from perennial underperformers to NBA champions, capturing their first title in 2011.

After the championship win, Cuban and his workforce headed to LIV nightclub in Miami to rejoice in model. He handled himself to an extravagant 15-liter bottle of Armand de Brignac Champagne, usually referred to as “Ace of Spades.” Priced at $140,000 (or $90,000 in keeping with some sources), it was the right solution to commemorate the second. Cuban confidently reached for his American Categorical Centurion Card – an unique bank card for .

Trending: Warren Buffett as soon as mentioned, “In the event you do not discover a solution to become profitable whilst you sleep, you’ll work till you die.”

To his shock, the transaction was declined. Cuban recounted the expertise throughout a 2018 interview on Fox Sports activities 1’s “Honest Sport,” revealing how he needed to name American Categorical into the again workplace. “I am on the cellphone with them, and so they say, ‘Uh, sir, this hasn’t been approved. It is a new card,'” he mentioned, laughing on the absurdity of the scenario. “I requested to talk to a supervisor. I used to be like, ‘Did you see the NBA recreation tonight? Are you a basketball fan?'”

His humorous method shone via as he navigated the layers of customer support, ultimately reaching somebody who understood the context of his extravagant request. “That is Mark Cuban. We simply gained the championship. Can I please spend some cash?” he quipped.

Trending: Founding father of Private Capital and ex-CEO of PayPal

David Grutman, the proprietor of LIV, chimed in, recalling the chaotic scene: “We had been within the again as a result of his bank card was denied.”

Cuban usually emphasizes that was considered one of his hardest monetary classes, however he acknowledges that they are often OK – if used responsibly.

In a 2017 Cash.com interview, he famous, “Over time, what I’ve discovered is utilizing a bank card is OK if you happen to pay it off on the finish of the month.” He added, “Simply acknowledge that the 18% or 20% or 30% you are paying in bank card debt goes to value you much more than you could possibly ever earn wherever else.” Whereas Cuban is probably not a fan of bank cards, he is aware of the suitable solution to deal with them when obligatory.

Trending: Amid the continued EV revolution, beforehand ignored low-income communities

Cuban’s ventures have continued to evolve within the years following the championship. In late 2023, he offered his majority stake within the Mavericks for $3.5 billion however retained a minority share and management over basketball operations.

Even billionaires often whip out the plastic for a celebratory splurge, however Cuban’s message is easy: if you happen to use bank cards, pay them off quick to dodge curiosity costs. Whereas most individuals will not be charging $140,000 bottles of Champagne, his Amex Black Card mishap proves that and indulgence can coexist, even for the ultrawealthy.

Learn Subsequent:

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in right this moment’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up