Markets

GM to start shedding about 1,700 staff at Kansas plant, WARN discover reveals

(Reuters) – Normal Motors (NYSE:) will start shedding 1,695 staff at its Fairfax Meeting plant in Kansas, the corporate stated in a Employee Adjustment and Retraining Notification (WARN) discover earlier this week.

The primary of two rounds of layoffs will start Nov. 18 and can embody the non permanent layoff of 686 full-time staff and the termination of 250 non permanent staff, Automotive Information reported on Saturday citing an organization submitting to the state of Kansas.

Beginning Jan. 12, 759 full-time staff will likely be briefly laid off, the report added.

GM didn’t instantly reply to a Reuters request for touch upon the small print of the most recent layoffs.

Earlier in Might, GM had stated that it will pause manufacturing of the Cadillac XT4 after January 2025 in Kansas, leading to layoffs of manufacturing staff till manufacturing resumes in late 2025 for each the Bolt EV and XT4 on the identical meeting line.

The corporate had additionally stated in August that it was shedding greater than 1,000 salaried staff at its software program and repair models worldwide.

Markets

Valuation Angst Is Being Stoked by Fed’s Huge Lower: Credit score Weekly

(Lusso’s Information) — Traders are pouring cash into company bonds, threat premiums are grinding tighter, and the Federal Reserve’s rate of interest reduce is reigniting hopes the US will dodge a recession.

Most Learn from Lusso’s Information

Some cash managers say the market is simply too complacent about causes for concern now.

“You will have the US election arising, and expectations round financial progress in Germany are a few of the weakest it’s been since pre-Covid occasions,” stated Simon Matthews, a senior portfolio supervisor at Neuberger Berman. “Shoppers are feeling the pinch and progress in China is slowing. Whenever you pull that each one collectively, it’s not telling you that credit score spreads ought to be near the tights,” he added, noting that falling borrowing prices will assist scale back a few of the headwinds.

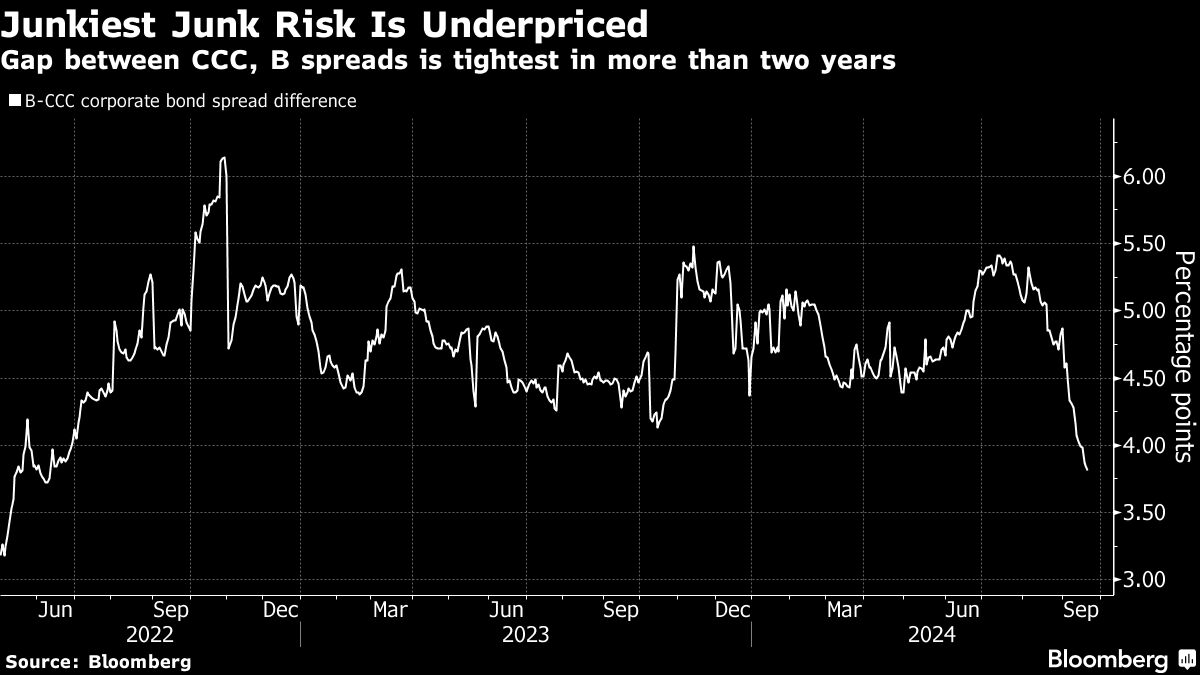

Traders have been setting apart the potential negatives and diving deeper into the riskiest corners of credit score within the hunt for increased yields. The bottom-rated bonds at the moment are outperforming the broader junk bond market whereas demand for Extra Tier 1 bonds, which might drive losses on traders to assist a financial institution survive turmoil, is predicted to extend.

Consumers are betting that decrease borrowing prices will allow debt-laden corporations to refinance and push out their maturities, limiting defaults and supporting valuations. And as short-term charges drop, traders are anticipated to shift their allocations into medium- and longer-term company debt from cash markets which may trigger spreads to tighten even additional.

Nonetheless, inflation may begin ticking up once more if shoppers begin spending extra as rates of interest are reduce, in line with Hunter Hayes, chief funding officer at Intrepid Capital Administration Inc.

“Who is aware of, possibly the Fed funds price has to come back proper again up prefer it has in earlier inflationary cycles after which, swiftly, high-yield bonds are so much much less enticing once more,” he stated.

With US financial coverage more likely to stay restrictive, market members are additionally waiting for indicators of degradation in fundamentals, particularly amongst debtors uncovered to floating-rate debt, BlackRock Inc. researchers Amanda Lynam and Dominique Bly wrote in a observe. As well as, issuers rated CCC stay pressured in combination, regardless of the latest outperformance of their debt, they wrote.

They cited low ranges of earnings the businesses have in combination in contrast with their curiosity expense. Borrowing prices for CCC rated corporations are nonetheless round 10% — crippling for some small corporations after they need to refinance following the top of the straightforward cash period — and leaving them prone to default whilst charges fall.

Any weak point within the labor market would additionally “be a headwind for spreads as it can enhance recession fears and decrease yields,” JPMorgan Chase & Co. analysts together with Eric Beinstein and Nathaniel Rosenbaum wrote in a analysis observe this previous week.

To make sure, valuation issues stay modest and traders are for probably the most half chubby company debt. The start of the rate-cutting cycle also needs to help demand for non-cyclicals over cyclicals within the investment-grade market, analysts at BNP Paribas SA wrote in a observe.

Specifically, restricted issuance by well being care corporations and utilities present room for unfold compression, they added.

“It’s a first-rate alternative for non-cyclicals to outperform,” Meghan Robson, the financial institution’s head of US credit score technique, stated in an interview. “Cyclicals we predict are overvalued.”

Week in Assessment

-

Merchants are piling into bets on additional easing by the US central financial institution after it reduce rates of interest on Wednesday by a half share level — its first discount in 4 years. The historic transfer ended weeks of hypothesis about whether or not the Federal Reserve would kickstart its easing cycle with a quarter- or half-point reduce.

-

The reduce is supportive of credit score spreads general, however it can encourage company bond issuance — notably from high-yield issuers. The reduce will probably favor these borrowing on the front- fairly than back-end of the yield curve, in line with market members surveyed by Lusso’s Information

-

Credit score by-product spreads dipped Wednesday following the transfer, to round their narrowest because the pandemic

-

Nevertheless, Fed Governor Michelle Bowman warns that the 50 foundation level discount “could possibly be interpreted as a untimely declaration of victory” over inflation

-

In different central financial institution information, the Financial institution of England stored charges unchanged and warned traders it received’t rush to ease financial coverage

-

-

Wall Avenue banks burned two years in the past after backing massive company buyouts and ending up with tens of billions of {dollars} of “hung debt” at the moment are again for extra, on the point of underwrite extra European LBOs.

-

Corporations benefiting from decrease financing prices to win higher phrases on present debt or to push out maturities have borrowed probably the most from the US leveraged mortgage market in seven years.

-

Liquidators of China Evergrande Group, the world’s most indebted builder, are returning to a Hong Kong court docket as they try to wind up a subsidiary with key property.

-

UBS Group AG is main a $1.15 billion financing package deal to help Vista Fairness Companions’ acquisition of software program firm Jaggaer, beating out direct lenders who had been additionally competing for the deal.

-

Apollo International Administration Inc. clinched $5 billion in recent firepower from BNP Paribas SA because it appears to develop a key lending enterprise, muscling deeper into turf as soon as dominated by banks.

-

A a lot bigger share of managers within the $1 trillion US collateralized mortgage obligation market are capable of purchase and promote loans extra freely than as soon as feared, after a refinancing and resetting surge pushed again the clock on reinvesting limits.

-

On this planet of personal credit score, KKR & Co.’s capital markets arm led a financing for USIC Holdings to assist repay broadly syndicated debt, whereas Oak Hill Advisors supplied $775 million to help Carlyle Group Inc.’s buy of Worldpac, and Alegeus Applied sciences is seeking to rating about $75 million in curiosity financial savings by means of refinancing the non-public mortgage that Vista Fairness Companions used to take the corporate non-public in 2018.

-

Tupperware filed for chapter after a years-long wrestle with gross sales declines and rising competitors.

-

Bankrupt trucker Yellow Corp. and its hedge fund house owners misplaced a key court docket ruling over $6.5 billion in debt that pension funds declare the defunct firm owes them, probably wiping out most restoration for shareholders.

-

Bausch Well being Cos. is working with Jefferies Monetary Group to discover refinancing a few of its debt to assist a long-planned spinoff of its stake within the eye-care firm Bausch + Lomb.

On the Transfer

-

BlackRock Inc. is overhauling its non-public credit score enterprise. The agency is establishing a brand new division, International Direct Lending, appointing Stephan Caron, head of the European middle-market non-public debt enterprise, to steer it. Jim Keenan, world head of BlackRock’s non-public debt enterprise, will go away the agency subsequent 12 months, as will Raj Vig, co-head of US non-public capital.

-

Silver Level Capital has employed Joseph McElwee from Investcorp as head of collateralized mortgage obligation capital markets and structuring.

-

Jefferies Monetary Group Inc. has employed former Citigroup Inc. banker Simon Francis in a newly created position main its debt financing enterprise in Europe, the Center East and Africa.

-

Constancy Investments has recruited Lendell Thompson, a former director at Vista Credit score Companions, because it continues increasing into the non-public credit score market. He will probably be a managing director within the agency’s direct lending workforce.

–With help from Dan Wilchins and James Crombie.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Trump Household's Crypto Enterprise Revealed: New Shopping for Guidelines, Who Can Make investments and What It Means for Early Adopters

The workforce behind ‘s newest crypto enterprise, World Liberty Monetary, took over two hours to launch the important thing element many have been ready for at Monday night time’s occasion on X.

The suspense lastly ended once they revealed who may purchase the forthcoming tokens and the way shares can be distributed. Billed as the subsequent large step for the previous president and his household, this launch had constructed up anticipation for weeks.

Do not Miss:

Zak Folkman, one of many challenge’s founders, defined that the platform’s WLFI token will likely be divided amongst a number of teams. “Twenty p.c of the tokens are put aside for the founding workforce,” he stated, referring to a gaggle that features the Trumps.

One other 17% will go towards consumer rewards, whereas the remaining 63% of tokens will likely be publicly obtainable. He emphasised, “There will likely be no presales or early buy-ins.”

Trending: In line with Cathie Wooden, holding 6 Ethereum (ETH) may make you a millionaire,.

This was a vital clarification, as an earlier draft of the challenge’s define, which had been leaked, raised eyebrows. The draft indicated that the founders would management 70% of the tokens, main many to fret that it would simply be one other quick-cash scheme.

The construction of the providing, a Regulation D token providing, permits World Liberty Monetary to boost funds with out registering with the Securities and Change Fee (SEC), so long as they meet sure standards. This led to a dialog about how the SEC, beneath its chair Gary Gensler, has been regulating the crypto trade, typically utilizing enforcement actions as an alternative of clear tips.

Trending: If there was a brand new fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends?

Trump himself was a part of the motion, talking overtly about his preliminary lack of curiosity in crypto. “I wasn’t overly ,” Trump stated, including that his perspective modified when his kids launched him to crypto via the success of his non-fungible token collections. “I feel my kids opened my eyes greater than the rest,” he remarked.

The occasion befell in opposition to an uncommon backdrop for Trump. Simply the day earlier than, there was an alleged assassination try whereas Trump was {golfing} with Steve Witkoff, his longtime pal and a key determine in World Liberty Monetary.

Trending: One trailblazing feminine with an experience in renewable vitality constructed an organization that is bringing the EV revolution to deprived communities —

The incident befell at Trump’s West Palm Seaside golf membership and the FBI has been investigating. Regardless of the dramatic incident, Witkoff joined Trump for Monday’s occasion, the place he spoke about how the enterprise started.

Witkoff recounted how his son had launched him to 2 younger crypto entrepreneurs, Chase Herro and Zak Folkman, who satisfied him that decentralized finance (DeFi) may very well be the way forward for cash.

“These guys are as sharp as any forex merchants I’ve ever met,” Witkoff stated. He then described how he introduced the Trump household into the fold. “We had a gathering with Eric, Don Jr., the president and his counsel. We have been on it for near 9 months,” he revealed.

Trending: Throughout market downturns, traders are studying that not like equities, these

The similarities between World Liberty Monetary and Trump’s earlier challenge, Trump Media & Expertise Group, did not go unnoticed. Just like the media firm that launched the conservative social platform Reality Social, this crypto enterprise is anticipated to show heads.

Nonetheless, regardless of the Trump household’s involvement, they don’t personal or handle the platform. Eric Trump and Steve Witkoff are the 2 figures on the helm and each are new to the crypto house. Although Trump has been warming to in latest months, even delivering a keynote on the largest bitcoin occasion in July, the general public stays curious – and cautious – about this new challenge.

The founders have been tight-lipped about plans, providing little readability on timelines. The one clue offered was that updates would come via official channels and so they warned followers to be cautious of scammers desperate to make the most of the excitement surrounding the challenge.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Why I’m not doing something to deal with decrease rates of interest

How ought to a retail investor cope with Wednesday’s rate of interest minimize by the Federal Reserve and with the longer term charge cuts that appear to be on the horizon?

What I plan to do is nothing. Which can be what you must do too.

How can I say “do nothing” when the airwaves, print media, and the web are full of recommendation and recommendations — and warnings — about tips on how to deal with the Fed’s charge minimize?

Let me present you why my spouse and I aren’t planning on doing something in regards to the charge cuts, which is able to cut back our curiosity earnings however not threaten our general monetary well-being. And why it’s possible you’ll not wish to do something, both.

Right here’s the deal. The Fed has minimize the federal funds charge to between 4.5% and 4.75% from the previous 5% to five.25%. Fed Chairman Jerome Powell has made it clear that the Fed is planning at the very least yet one more charge minimize this 12 months.

8/29/24

The Fed controls solely this short-term charge, however reducing it places downward strain on longer-term charges as properly. That’s nice, in fact, for many people, making it simpler and cheaper to borrow. However it’s not nice for savers. That is as a result of the earnings they get on their financial savings goes to say no.

Learn extra:

We now have important money holdings, which we maintain in low-cost, high-quality cash market funds. Our earnings from these funds, which has risen properly over the previous few years, goes to say no. However such is life.

Some folks advise you to lock up yields by switching money into long-term bonds or long-term , whose rates of interest are fastened and received’t fall due to the Fed’s charge cuts.

Nonetheless, there’s an issue with doing that.

Locking up yields by shopping for long-term bonds or CDs makes your cash illiquid. This exposes you to some long-term dangers, akin to having to promote at a loss if charges rise — which they are going to in the end, belief me —or should you want the money that you just’ve locked up long-term.

In contrast, should you’ve accomplished what we’ve got accomplished — put our surplus money into well-regarded, low-cost — your earnings will go down when the Fed’s charge cuts work their manner by means of the monetary system. However you’ve nonetheless obtained liquidity, the power to entry your money on demand, which is essential.

The one factor that I received’t do — and that you just shouldn’t do, both — is to place my cash right into a financial institution financial savings account, which generally pays yields approaching zero. The charges on these accounts aren’t prone to fall a lot, if in any respect, as a result of they’re already so low.

So should you’ve obtained $3,000 or extra of money sitting in a financial institution financial savings account however don’t have a cash fund account, you’ll most likely do properly to open an account in a low-cost, high-quality fund.

To make sure, not like financial institution accounts, cash funds aren’t backed by the Federal Deposit Insurance coverage Corp. However there are many high-quality, conservatively run . It’s a really aggressive enterprise, with $6.68 trillion in property, in line with Crane Information. They’re extremely unlikely to fail.

Crucial factor so that you can do now’s to remain calm and keep in mind that if you find yourself doing nothing to deal with decrease rates of interest, you’ll have loads of firm. Together with me.

Final July, I wrote a Lusso’s Information column with the headline, I mentioned that Berkshire Hathaway inventory had underperformed Admiral shares of Vanguard’s S&P 500 index fund since my spouse and I purchased Berkshire shares in January 2016.

Berkshire has since rallied and outperformed the S&P 500.

At Thursday’s market shut, Berkshire was up 253% (15.6% a 12 months) since we purchased it. Throughout that very same interval, the index fund has returned 242% (15.2% a 12 months), in line with Jeff DeMaso of the Unbiased Vanguard Adviser.

Rating one for the Oracle of Omaha.

Allan Sloan, a contributor to Lusso’s Information, is a seven-time winner of the Loeb Award, enterprise journalism’s highest honor.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024