Markets

Hashprice Features Give Bitcoin Miners a A lot-Wanted Increase After Sluggish Month

Bitcoin miners are lastly catching a break after a sluggish September, with hashprice climbing 10.33% prior to now 30 days. A stable 8.93% of that bump got here throughout the final 4 days alone.

Hashprice Jumps Practically 9% in 4 Days: Bitcoin Miners Catch a Break as September Nears Finish

On Aug. 29, 2024, mining revenues have been lagging, with hashprice sitting at $42.98 per petahash per second day by day. Quick ahead to as we speak, and the hashprice is 10.33% greater. For context, hashprice refers back to the estimated day by day earnings from 1 PH/s of Bitcoin’s hashpower. Miners have had a few boosts currently—a bump in BTC’s worth and a 4.6% discount in problem on Sept. 25.

On that day, BTC was buying and selling between $62.5K and a bit of over $63K. By Sunday, Sept. 29, 2024, the worth had inched up, and it’s coasting alongside at $65.7K as of midday EDT. That’s nudged as we speak’s hashprice as much as $47.42 per PH/s. Whereas the worth enhance and decrease problem have been a boon for miners, the hashrate is hovering at 631 exahash per second (EH/s)—solely 10 EH/s above the 621 EH/s recorded on Sept. 16, which marked a low level after the height of 693 EH/s.

Hashprice index through Luxor’s hashrateindex.com on Sept. 29, 2024.

Block intervals have been sluggish, clocking in at 10 minutes and 16 seconds—slower than the 10-minute common. The following problem adjustment is scheduled for Oct. 10, 2024, and with slower block instances, we might see a drop in problem by round 2.74% to 2.9%. For the time being, there are simply over 35 hours left in September, and it’s trying like miners may not hit the income numbers they did in August.

In August, bitcoin miners pulled in $851.36 million in whole income, however thus far this month, they’ve solely made $761.79 million. That leaves them needing to rake in an extra $89.57 million in subsidies and charges earlier than the month wraps up—a tall order until BTC’s worth makes a big leap earlier than October begins. Miners always face the problem of sustaining profitability amid fluctuating circumstances, leaving subsequent month poised to deliver new checks.

What do you concentrate on the increase bitcoin miners have seen on the finish of September? Share your ideas and opinions about this topic within the feedback part beneath.

Markets

Glenview plans activist stance in push for modifications at CVS, WSJ reviews

(Reuters) -Healthcare-focused Glenview Capital Administration will meet prime executives at struggling healthcare firm CVS Well being (NYSE:) on Monday to suggest methods it will probably enhance operations, The Wall Avenue Journal reported on Sunday.

The hedge fund’s founder, Larry Robbins, has constructed a big place in CVS, which quantities to about $700 million of his $2.5 billion hedge fund, the report mentioned, citing an individual accustomed to the matter.

CVS mentioned it “maintains an everyday dialogue with the funding neighborhood as a part of our strong shareholder and analyst engagement program,” and mentioned it will probably’t touch upon engagement with particular corporations or people.

Glenview didn’t instantly reply to a Reuters’ request for remark.

Hypothesis has mounted amongst fund managers that an activist investor might swoop in to push CVS to make modifications that might increase its share value.

Funding agency Sachem Head Capital Administration constructed a brand new 0.2% stake within the firm through the second quarter, based on a regulatory submitting in August.

Earlier in August, CVS lower its annual revenue forecast to $6.40 to $6.65 per share from its prior view of at the very least $7.00, marking at the very least the fourth time CVS lowered its outlook for the 12 months.

It additionally introduced a multi-year plan to avoid wasting $2 billion in prices by way of measures reminiscent of streamlining operations and utilizing synthetic intelligence and automation throughout its enterprise.

Markets

5 Key Charts to Watch in World Commodity Markets This Week

(Lusso’s Information) — London Steel Alternate’s annual LME Week gathering is underway, bringing collectively merchants and analysts amid copper’s newest upswing. Sugar futures are on observe for his or her greatest month since January. And US utilities are outshining different trade teams within the S&P 500, thanks partly to AI demand.

Most Learn from Lusso’s Information

Listed below are 5 notable charts to think about in international commodity markets because the week will get underway.

Copper

Copper has been on a roller-coaster journey this 12 months, with a surge of funding and a significant brief squeeze in New York driving costs to a document in Could. Buyers then pulled of their horns as doubts in regards to the Chinese language economic system rose to the fore. The newest positioning knowledge indicators that they’re not chasing the rally as exhausting as they did final time round.

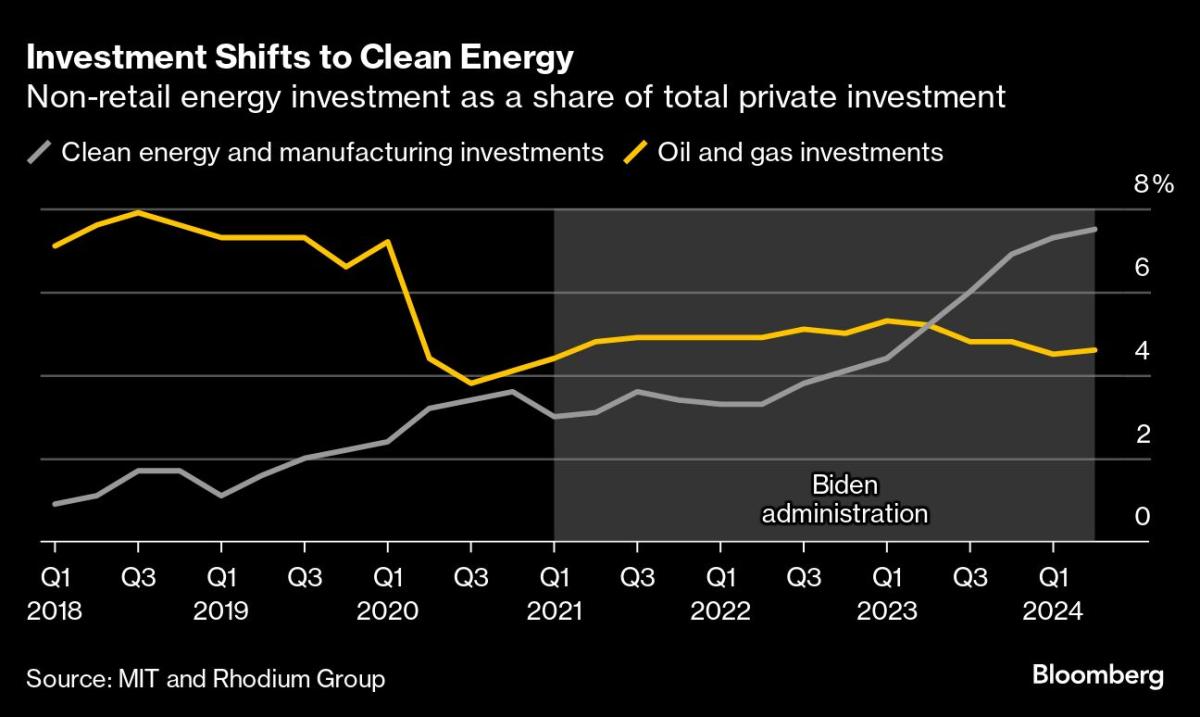

Vitality Investments

The US is mobilizing a lot funding into clear vitality that it now tops even the height of America’s fracking revolution within the 2010s. The wave of spending triggered by Joe Biden’s signature local weather regulation is ready to be the president’s greatest and most-enduring home achievement. His insurance policies helped drive about $493 billion of recent funding into the manufacturing and widespread deployment of photo voltaic panels, electrical autos and different emission-cutting expertise since mid-2022, based on knowledge analyzed by the Massachusetts Institute for Know-how and analysis agency Rhodium Group.

Pure Fuel

Europe enters its heating season this week with an enormous pure gasoline stockpile to defend itself from surprising provide outages. The continent’s websites are about 94% full — above historic averages, however barely under final 12 months’s ranges — sufficient to maintain some merchants watchful as they carefully monitor persevering with storage build-up earlier than the freezing climate spreads.

Energy Suppliers

The utilities sector is outshining different industries on the S&P 500 Index within the final three months. Shares of US energy suppliers racked up massive features within the third quarter on market giddiness over prospects of surging electrical energy demand from synthetic intelligence-focused knowledge facilities. Utilities are on tempo to high the 11 trade teams of the S&P Index because the quarter attracts to an in depth, with features pushed by plant operators Vistra Corp. and Constellation Vitality Corp., which simply inked an influence provide cope with Microsoft Corp. Vistra is noteworthy as a result of it’s additionally holding its rating as one of the best performing inventory within the broader S&P 500 for the 12 months, after shares greater than tripled.

Sugar

Sugar has been on a tear in September resulting from a poor outlook from Brazil, the world’s high exporter. Whereas promising manufacturing forecasts in India and Thailand lower brief final week’s rally on Friday, sugar futures are nonetheless on tempo for the most important month-to-month acquire since January. Extreme drought in Brazil has been hurting sugar-cane yields, elevating fears of additional cuts to manufacturing estimates. Merchants might be carefully watching the circulation of vessels transport sugar from the South American nation in October, since any easing of exports means international patrons might battle to search out provides within the ultimate months of 2024.

–With help from Geoffrey Morgan, Doug Alexander, Dayanne Sousa and Alex Tribou.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

NZ's Fonterra upgrades dividend payout coverage

(Reuters) – New Zealand dairy agency Fonterra mentioned on Monday it has upgraded its dividend payout coverage and can now pay shareholders 60% to 80% of its earnings, in contrast with a median of fifty% for the earlier 5 years.

The corporate can be concentrating on a better common return on capital, elevating it to 10-12%, up from 9-10% earlier.

“Fonterra is in a powerful place, delivering outcomes nicely above its five-year common, which places it able to consider the subsequent evolution of its strategic supply,” mentioned CEO Miles Hurrell.

Final week, the Auckland-based firm reported earnings from persevering with operations for fiscal 2024 of 70 NZ cents per share, hitting the highest finish of its outlook vary.

It declared a last dividend of 25 NZ cents per share in addition to a particular dividend of 15 NZ cents apiece.

The corporate mentioned it intends to make a “important” capital return to shareholders upon divestment of its shopper enterprise.

Earlier this 12 months, it had flagged a full or partial sale of its world shopper unit to unencumber capital.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook