Markets

Hold An Eye On These Scorching Company Relocation Markets For Actual Property Alternatives

Location is the whole lot in actual property, and nothing heats an actual property market like a significant company relocating its headquarters or basing a giant a part of its operations in a brand new market. It nearly invariably creates an inflow of extremely expert and extremely paid employees within the new market, which may end up in speedy property appreciation. Benzinga appears at a couple of markets which may be primed for a company relocation increase.

It is no secret that many Individuals have moved into the Sunbelt within the final a number of years, however a less-frequently studied facet of huge strikes in America consists of firms and company headquarters. Firms transfer for lots of the similar causes that their employees do, akin to the possibility to seek out lower-priced property or a state and native authorities with a friendlier tax construction.

Trending Now:

To that finish, business actual property agency CBRE studies that 465 American firms moved their headquarters between 2018 and 2023. A CBRE survey reveals that 110 of the strikes had been motivated by decrease taxes and the power to function in a extra business-friendly atmosphere. Nevertheless, the tech trade writ massive had a unique motivation.

Huge Tech is scouring actual property markets for lower-priced expertise as an alternative of searching for lower-priced land. Tech employee salaries have at all times been at a excessive premium. Nonetheless, the price of residing in America’s conventional tech hubs has turn out to be so excessive that paying aggressive wages is consuming up an ever-increasing share of Huge Tech income. That may clarify why Tech corporations represented 135 of the 465 company strikes in the course of the CBRE survey.

So, the place are all the businesses shifting? CBRE’s survey confirmed that Texas and Florida had been the popular locations for Fortune 500 corporations from 2018-2023. Transferring to those states presents a really comparable slate of price advantages to each firms and their employees. Texas and Florida have business-friendly company taxation charges and neither has a state revenue tax. The truth that land and housing are extra inexpensive solely sweetens the pie.

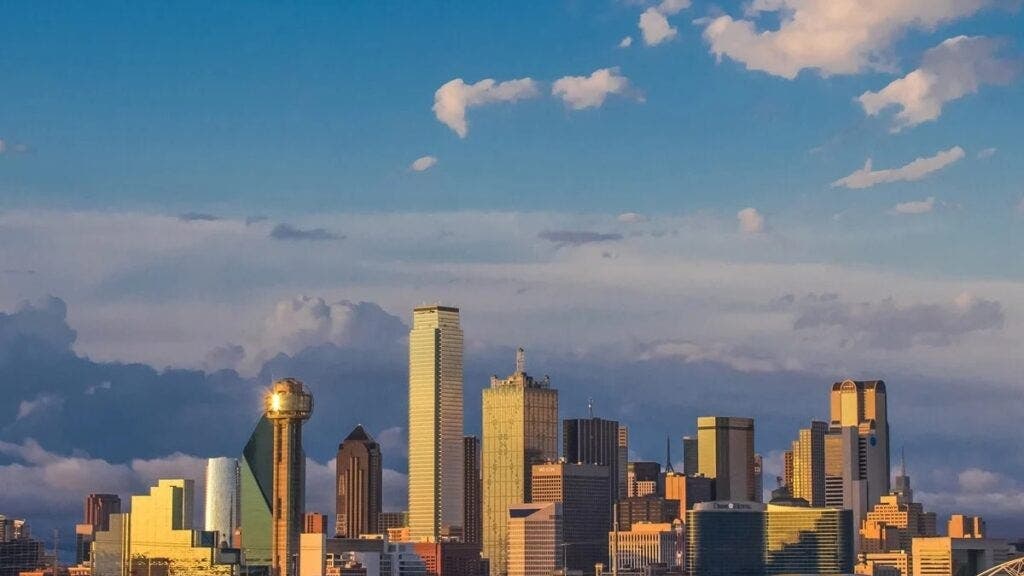

Among the hottest cities in Texas for company relocations embrace:

Dallas-Fort Value-CBRE’s knowledge confirmed 32 company headquarters moved to Dallas between 2018-2023, and SEC submitting knowledge reveals that Dallas-Fort Value added 50% extra company headquarters in that point. The U.S. Census additionally reveals that Dallas-Fort Value’s inhabitants grew by 150,000 in 2023; essentially the most within the nation. Frontier Communications’ new facility will add 3,000 jobs and practically $4 billion to Texas’ economic system within the subsequent decade.

Houston-This metropolis has lengthy been often called the “Petro-Metro” as a result of the oil trade is the undisputed king of the native economic system. Quite a few fuel and oil corporations make their dwelling in Houston and not too long ago introduced it will be part of them. Houston has added 25 company headquarters in the course of the CBRE examine interval. House costs are nonetheless under the nationwide common, making it much more interesting for workers.

Make investments In Texas

Able to be a part of the Texas market with out having to purchase or handle property? are city-specific portfolios of dwelling fairness investments. The portfolios comprise fractional shares of distinctive properties in progress areas, diversified for stability. The house fairness investments are obtained at under present market charges and are resilient to market rate of interest fluctuations, making them a steady and enticing alternative for traders, no matter market circumstances. Every metropolis is structured as a REIT for dwelling fairness investments, permitting traders to achieve publicity to the house fairness market. Nada presents funds in Austin, Dallas, and Houston, making it a straightforward method to put money into Texas’s increase markets. .

Florida’s relocation image revealed a little bit of a shock:

While you consider company relocation to Florida, your first thought may be Miami or Orlando. Though they’ve seen progress, a shocking metropolis is outpacing them: Jacksonville. The CBRE examine reveals that Jacksonville led the state in company relocations for fiscal yr 2022-2023, with a web achieve of practically 70% in new company headquarters. Company credit score agency Dun and Bradstreet not too long ago moved to Jacksonville.

Different widespread cities for company relocation included Denver, Colorado, Nashville, Tennessee, Atlanta, Georgia, and Waltham, Massachusetts, a suburb of Boston. Essentially the most vacated cities on CBRE’s listing had been San Francisco/San Jose, California, New York, Los Angeles, California, and Chicago, Illinois (in similar order). One have a look at dwelling costs and prime workplace or industrial house rental charges in most of these cities will make it simple to grasp the motivation behind the strikes.

Actual property traders can use this knowledge to achieve perception into the place they may discover long-term progress alternatives. Every time firms transfer, they bring about super demand for housing and new retail services. So, it would not matter which aspect of actual property you favor investing in; there might be alternatives in a number of sectors. Think about these cities when scouting, single-family dwelling flips, or industrial property. The early hen will get the worm.

Learn Extra:

Up Subsequent: Rework your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in as we speak’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Unique-US to hunt 6 million barrels of oil for reserve, amid low oil value

By Timothy Gardner

WASHINGTON (Reuters) – The Biden administration will search as much as 6 million barrels of oil for the Strategic Petroleum Reserve, a supply conversant in situation mentioned on Tuesday, a purchase order that if accomplished will match its largest but within the replenishment of the stash after a historic sale in 2022.

The administration will announce the solicitation as quickly as Wednesday to purchase oil for supply to the Bayou Choctaw web site in Louisiana, the supply mentioned, one among 4 closely guarded SPR areas alongside the coasts of that state and Texas.

The U.S. will purchase the oil from vitality firms for supply within the first few months of 2025, the supply mentioned.

The Division of Vitality has taken benefit of comparatively low crude costs which might be beneath the goal value of $79.99 per barrel at which it needs to purchase again oil after the 2022 SPR sale of 180 million barrels over six months.

West Texas Intermediate oil was $71.70 a barrel on Tuesday, up after Hurricane Francine shut crude output within the Gulf of Mexico final week, however worries about demand have stored costs comparatively low in latest weeks.

President Joe Biden introduced the 2022 sale, the most important ever from the reserve, after Russia, one of many world’s high three oil producers, invaded Ukraine. The invasion had helped push gasoline costs to a document of over $5 a gallon.

The administration has to date purchased again greater than 50 million barrels, after promoting the 180 million barrels at a median of about $95 a barrel, the Vitality Division says.

Whereas oil is now beneath the goal buyback value, battle within the Center East and different elements can rapidly enhance oil costs. In April, the U.S. canceled an SPR buy of oil resulting from rising costs.

The reserve at the moment holds 380 million barrels, most of which is bitter crude, or oil that many U.S. refineries are engineered to course of. Essentially the most it has held was almost 727 million barrels in 2009.

(Reporting by Timothy Gardner; Enhancing by Chizu Nomiyama)

Markets

Tupperware information for chapter safety as demand slumps for its colourful containers

(Reuters) -Tupperware Manufacturers and a few of its subsidiaries filed for Chapter 11 chapter safety on Tuesday, succumbing to declining demand for its once-popular colourful meals storage containers and ballooning losses.

The corporate’s struggles to stem the drop in gross sales resumed after a quick surge throughout the pandemic when folks cooked extra at dwelling and turned to its hermetic plastic containers to retailer leftovers.

The post-pandemic bounce in prices of important uncooked supplies equivalent to plastic resin, in addition to labor and freight additional dented the corporate’s margins.

In August, Tupperware (NYSE:) had raised substantial doubt about its capacity to proceed as a going concern for the fourth time since November 2022 and mentioned it confronted a liquidity crunch.

The corporate listed $500 million to $1 billion in estimated belongings and $1 billion-$10 billion in estimated liabilities, in keeping with chapter filings within the U.S. Chapter Courtroom for the District of Delaware.

Tupperware has been planning to file for chapter safety after breaching the phrases of its debt and enlisting authorized and monetary advisers, Bloomberg reported on Monday.

The report mentioned the chapter preparations started following extended negotiations with lenders over the greater than $700 million in debt.

Markets

BlackRock, Microsoft Launch $30 Billion Fund to Construct AI Knowledge Facilities for Excessive Power Wants

BlackRock and Microsoft have partnered to type a brand new group that goals to create a $30 billion funding fund devoted to synthetic intelligence (AI) information facilities.

This transfer comes as demand for AI know-how continues to surge, requiring huge computing energy and power to function effectively.

AI Power Calls for Spark New Alternatives for Bitcoin Miners

The fund goals to lift $30 billion in fairness investments by BlackRock’s infrastructure unit, International Infrastructure Companions (GIP). This may allow it to leverage a further $70 billion in debt financing.

In the meantime, Microsoft, Abu Dhabi’s MGX, and chipmaker Nvidia will lead the undertaking. They are going to guarantee the ability’s design and implementation incorporate the most recent applied sciences to fulfill AI’s excessive computational wants. The brand new fund will deal with constructing information facilities able to dealing with the energy-intensive operations of generative AI instruments.

This funding initiative comes because the power and infrastructure sectors grow to be more and more intertwined. Synthetic intelligence, particularly fashions like OpenAI’s ChatGPT, is straining present digital infrastructure with its huge computing wants. These fashions require considerably extra power than earlier applied sciences, making a bottleneck in constructing the mandatory AI infrastructure.

This rising demand has grow to be a serious hurdle to additional AI growth. Nevertheless, such a scenario can profit a number of events.

As an illustration, Nvidia, recognized for its AI-processing GPUs, shall be essential in growing the factories for these information facilities. Moreover, given their experience in power administration, Bitcoin miners are rising as key gamers on this new phase.

This phenomenon is clear in some investments and initiatives from Bitcoin miners on this space. BeInCrypto reported that Core Scientific, one of many main Bitcoin mining firms, signed a $3.5 billion contract with Nvidia-backed CoreWeave in June. This contract goals to improve its services for AI and high-performing laptop (HPC) duties.

One other Bitcoin mining firm, Hut 8, has additionally made strides in coming into the AI information heart market. With a $150 million funding from Coatue Administration, Hut 8 can leverage its power experience and present infrastructure to help the rising want for AI computing energy. Ultimately, this transfer will additional increase Hut 8’s operations past conventional Bitcoin mining.

The combination of AI infrastructure into Bitcoin mining operations has additionally grow to be more and more engaging to buyers. In line with a report from asset administration agency VanEck, Bitcoin miners are in a singular place to fulfill AI’s power calls for. This is because of their present energy-intensive operations.

“The synergy is straightforward: AI firms want power, and Bitcoin miners have it. Because the market values the rising AI/HPC information heart market, entry to energy—particularly within the close to time period—is commanding a premium. […] Appropriate Bitcoin mining websites can energize GPUs for AI in lower than a yr, in comparison with the 4+ years required for greenfield AI information heart developments to go surfing. […] If correctly outfitted with energy, bandwidth, and cooling methods, Bitcoin mining websites are perfect for capturing this worth for AI/HPC cloud companies,” the report reads.

Bitcoin Miners Potential AI Earnings. Supply: VanEck

VanEck’s analysis means that by 2027, Bitcoin miners who allocate a portion of their power capability to AI and HPC duties might see a big improve in profitability. Moreover, the report estimates that miners might generate a further $13.9 billion in income yearly by pivoting simply 20% of their power sources towards AI infrastructure. This shift might additionally result in a doubling of their market capitalization over the subsequent few years as demand for AI computing energy continues to rise.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoBlackRock is not going to participate in Malaysia Airports privatisation, GIP says

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now