Markets

How a Gen Xer went from declaring chapter at 30 to being on monitor to retire early in her 50s

-

Chris Elle Dove, as soon as bankrupt, is about to retire early with over $1.5 million web price.

-

She transitioned from incomes $50,000 a yr as a professor to investing full-time.

-

Her technique contains residing minimally, investing in actual property, and retaining spending low.

Chris Elle Dove, 52, declared at age 29 in 2001 and survived off authorities advantages and facet hustles to supply for her two children. She had not too long ago misplaced her husband and was struggling to be a great mother whereas discovering extra secure work.

20 years later, she and her second husband have a complete web price of over $1.5 and are set to of their 50s.

After years of incomes between $50,000 and $60,000 as a professor, Dove was satisfied by her husband — who’s within the navy and had maxed out his retirement accounts — to speculate full-time. Investing, alongside earnings from actual property and monetary consulting, allowed her and her husband to be on monitor to develop into — or those that have reached monetary independence and retired early.

She acknowledged her began a lot later than many others, although she careworn is not as inaccessible as many assume.

“It was a very long time earlier than I obtained again on my toes, and I’ve no intention of ever being in that scenario once more,” Dove mentioned.

A rocky monetary begin

Dove was raised in an upper-middle-class household that went on two holidays a yr, and he or she did extracurriculars from cheerleading to horseback driving to ice skating.

“I did not even take into consideration not going to varsity,” Dove mentioned. “I solely considered what faculty.”

Her dad and mom by no means brazenly mentioned cash, however she knew they saved a strict finances. They taught her about , reminiscent of by giving her a pre-paid bank card in highschool for garments that she needed to finances.

She had her first child at 20 and her second at 24, placing her bachelor’s diploma on maintain — it took her 17 years to complete her diploma. At one level, she held three jobs — instructing ballroom dancing, bartending, and shoveling mulch for a landscaping firm.

Whereas elevating her children, her husband developed a mind tumor that left him sick for years. The piled up, and most weren’t coated by their insurance coverage. She additionally had pupil mortgage debt that she placed on the again burner.

Her husband died at 28 when her children have been 7 and three.

Dove did not have a lot time to grieve, although. She labored so many hours to assist her children she would get sick. After a automobile accident that led to a hospital keep, she declared chapter.

With little cash to her title, counting on , she moved together with her two children to a city in Western Illinois. She purchased a $50,000 house, paying $200 a month in mortgage funds. She maintained her dance instructing place, privately tutored, and was a analysis assistant.

“I at all times felt like a failure, like I must be offering for my children the best way I used to be supplied for,” Dove mentioned. “I used to be by no means ready to try this. I used to be simply attempting to make it to the following paycheck.”

Getting again on her toes

In a stroke of luck, she obtained the chance to show sociology programs at a group faculty, which paid her $34,000 a yr in 2006. Her wage rose to $56,000 a number of years later. Having loads of holidays and extra secure hours allowed her to be extra current in her children’ lives, although cash was nonetheless a stressor. She made additional earnings from advising campus golf equipment.

“We saved the wheels on the bus, however we by no means obtained forward,” Dove mentioned.

She barely had cash in her and hadn’t invested a lot for her children’ futures. All she might take into consideration was squeezing sufficient cash out of her subsequent paycheck to take her children to a museum.

“I truthfully spent most of my life not caring about cash until I had an emergency expense and I could not pay for it,” Dove mentioned. “I believed cash was most likely one thing that corrupted folks, and I simply did not have a really constructive opinion of cash.”

Her second husband, whom she met in 2015 and married in 2021, had maxed out his and saved a lot of his earnings. They agreed she would take off a number of months to put in writing youngsters’s books and see if it was financially sustainable. As soon as it grew to become clear this profession swap wasn’t viable, she started investing after her husband satisfied her she could be good at it.

“I pushed again as a result of I did not assume it was rewarding. I did not assume I’d really feel like I used to be contributing to society in a significant manner as an investor,” Dove mentioned.

Reaching monetary independence

She offered her automobile and invested that cash within the inventory market, beginning with shopping for a share of Berkshire Hathaway, then diversifying her portfolio.

“One of many largest realizations for me is that I used to assume you wanted more cash to be rich, however now what I’ve realized is you’ll be able to have a ton of cash and nonetheless dwell paycheck to paycheck,” Dove mentioned. “You can also make a really small quantity of earnings and dwell inside your means and dwell stress-free and glad and construct wealth.”

She knew she could not begin her monetary independence journey alone, and her extra financially savvy husband helped her get on monitor. On a nationwide parks journey, they determined they might do no matter they may to retire early and spend extra time exploring the world with out worrying about cash.

She learn dozens of books and articles about monetary markets, accomplished graduate levels in monetary planning, and have become a Licensed Monetary Conduct Specialist. She modified her investing methods to suit her persona, schedule, and threat tolerance. She and her husband began with $240,000 invested in retirement accounts, in addition to about $80,000 in fairness. Inside the first 4 years, they doubled their investments twice.

In her mid-40s, she paid off her pupil debt, which she thought-about an enormous milestone. It was the primary time she might begin saving cash and max out her 401(ok).

She and her husband adopted a minimalist life-style, beginning by adopting a “one in, one out” rule — for each shirt she purchased, she would promote one. They prioritized experiences over presents and considerably elevated financial savings, solely buying what they wanted.

During the last 4 years, she estimates they’ve saved over 40% of their earnings — and about 60% if together with investments from house gross sales. Nonetheless, she mentioned they don’t seem to be overly frugal and spend on health, meals, and hobbies like bikes.

She created an “intense and intimidating” spreadsheet to trace every little thing coming in and going out. She added sections for emergency financial savings, investments, web price, and their “slush fund” of purchases above $500.

They pivoted to transferring 20% of her husband’s base earnings, 100% of her earnings, and at the least 50% of bonuses into investments. Her husband’s navy pension, which is inflation-adjusted, has additionally taken some weight off the planning course of.

“Along with paying ourselves first, we have adopted the ‘give each greenback a job’ strategy. On the finish of every month, any ‘extra cash’ is assigned to both slush, emergency, or it is invested,” Dove mentioned.

Dove did not wish to work much more hours, which might pressure her to sacrifice time together with her children, so she made extra with much less. They not too long ago purchased a house for $96,000 in Bloomington, Illinois, simply as State Farm moved their headquarters and residential costs fell, then offered their home proper as Rivian got here in and costs rose.

This inspired her to dabble in actual property investing, placing their mountain house up on Airbnb. The house was nearly instantly booked out every week for eight months.

Dove has printed 4 youngsters’s image books and spends her days writing, facilitating workshops, and dealing as a monetary coach. She can also be an angel investor in some startups. In the end, she hopes to retire early to spend extra time with family members and set them up for achievement.

“Though we now have not hit our FI quantity but, we are going to attain our goal quantity by our goal date with simply what we contribute from my husband’s earnings,” Dove mentioned. “That has paved the best way for me to chase my many desires.”

Are you a part of the FIRE motion or residing by a few of its rules? Attain out to this reporter at .

Learn the unique article on

Markets

3 Dividend Kings to Add to Your Portfolio for a Lifetime of Passive Revenue

Should you’re seeking to increase your dividend earnings, you virtually cannot go incorrect by investing in . These are shares which have elevated their dividend for no less than 50 consecutive years. Clearly, an organization with such a stellar dividend file should have stable financials and progress prospects, or it would not be capable of maintain dividend will increase over a number of a long time.

Coca-Cola (NYSE: KO), Philip Morris (NYSE: PM), and Realty Revenue (NYSE: O) are three Dividend Kings to purchase proper now, in accordance with these idiot.com contributors. Here is why.

A resilient client model

(Coca-Cola): Coca-Cola is a dominant international beverage model that has paid 62 consecutive years of rising dividends. The inventory is up 21% 12 months thus far following robust monetary leads to the primary half of 2024.

Shoppers have tightened their spending, however the beverage business has remained resilient. Coca-Cola reported a 2% year-over-year enhance in unit case quantity final quarter, and it additionally achieved double-digit natural income progress and better margins.

Coca-Cola has a diversified portfolio of manufacturers throughout teas, juices, and carbonated drinks. Throughout all these manufacturers, it generates a strong working revenue margin of 21%, which administration is working to extend by refranchising its bottling operations. The worthwhile lineup offers the corporate numerous gross sales alternatives for various events, whereas producing a wholesome revenue to pay rising dividends.

The corporate is paying out about 75% of its annual earnings in dividends. The quarterly dividend is at present $0.485 per share, up 21% over the past 5 years. This places the forward-dividend yield at a beautiful 2.71% in comparison with simply 1.32% for the S&P 500.

The inventory’s efficiency displays the power of the model and the alternatives to continue to grow over the long run. Coca-Cola’s fastest-growing markets within the second quarter had been Latin America and Asia Pacific. The inventory’s above-average yield provides buyers nice worth with extra progress to return.

This longtime dividend payer continues to be heating up

Jeremy Bowman (Philip Morris): Philip Morris would possibly appear to be an odd selection for a long-term dividend inventory.

In any case, everybody is aware of that smoking is on the decline, however nowadays, Philip Morris’ enterprise is way more than simply cigarettes. The corporate has efficiently diversified into next-gen merchandise, together with the IQOS heat-not-burn sticks that operate like vapes however use tobacco as a substitute of e-liquid, and Zyn nicotine pouches, which it gained in its acquisition of Swedish Match in 2022.

Thanks largely to the success of these two merchandise, the tobacco inventory now generates roughly 40% of income from next-gen, smoke-free merchandise, and since these merchandise generate even wider margins than cigarettes, they now produce greater than 40% of Philip Morris’ gross revenue. Demand has been so robust for Zyn that the corporate lately introduced new investments to broaden capability in Colorado and Kentucky.

Since Philip Morris additionally solely sells cigarettes in worldwide markets, the corporate continues to be rising its cigarette class as natural income from combustibles, that are primarily cigarettes, was up 4.8% in its most up-to-date quarter. Even shipments of cigarettes had been up 0.4% within the quarter.

Altogether, natural income rose 9.6% to $9.5 billion within the quarter and organic-operating earnings was up 12.5%, that are wonderful numbers for a seemingly mature dividend inventory.

Philip Morris additionally simply raised its quarterly payout by 3.8% to $1.35. Whereas the corporate is just not technically a Dividend King, in case you embrace its historical past as a part of Altria, then it is raised its dividend for the final 55 years.

At present, the corporate provides a 4.4% dividend yield, and it seems poised to hike its payout for years forward.

Month-to-month, high-yielding dividends

Jennifer Saibil (Realty Revenue): Few dividend shares in the marketplace can match Realty Revenue. It has every thing a passive-income investor might need in a inventory: The dividend has a excessive yield, it is dependable, it is rising, and the corporate pays month-to-month, an additional perk.

Realty Revenue is a retail actual property funding belief (REIT), which suggests it leases properties to retailers. Nevertheless, it has massively expanded over the previous few years and is nicely diversified by business. Retail properties nonetheless make up 79.4%, and inside retail, it caters to necessities classes like grocery shops, comfort shops, and greenback shops, which give it resilience throughout pressured instances like pandemics and inflation. Collectively, these classes symbolize greater than 26% of the full portfolio.

By way of two latest acquisitions in addition to shopping for new properties, it is greater than doubled its property rely over the previous few years to fifteen,450. It has entered gaming and industrials, which collectively account for nearly 18% of the portfolio and supply the diversification essential to offset the danger of concentrating in a single space.

REITs pay out most of their earnings as dividends, which is why they’re normally wonderful dividend shares. Realty Revenue has paid a dividend for greater than 50 years, and it is raised it for 108 straight quarters. It yields practically 5% on the present value, which is increased than its common of about 4%, and practically 4 instances the S&P 500 common. Realty Revenue inventory fell when there was pessimism surrounding the actual property business and excessive rates of interest, and the dividend yield went up in consequence. However buyers have gotten extra assured, and the value has risen over the previous few weeks.

Realty Revenue is a certain guess for a lifetime of passive earnings, and now is a superb time to purchase earlier than the value will increase and the yield goes again down.

Do you have to make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Coca-Cola wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. has no place in any of the shares talked about. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Revenue. The Motley Idiot recommends Philip Morris Worldwide. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

This Monster Progress Inventory Is Up Practically 300% in 5 Years. Right here's Why It's the Largest Inventory Place in My Portfolio Proper Now.

The final 5 years had been chaotic, with a world pandemic, a presidential election, inflation, swift rate of interest modifications, financial institution failures, and extra. Regardless of this stage of financial disruption, the S&P 500 is up practically 90%. That is a great run, all issues thought of.

Pretty much as good as these broad market returns have been, MercadoLibre (NASDAQ: MELI) inventory has left the S&P 500 utterly within the mud. Shares of this Latin American enterprise are up over 280% within the final 5 years.

MercadoLibre is the biggest place in my private , and I am going to clarify why in a second. However first, I need to present some context to forestall potential misunderstandings.

My Roth IRA is lower than 5 years outdated. I beforehand had a retirement account with my employer. I did not have management over how that account was invested. However upon altering jobs, I rolled the account over and out of the blue had investable money and decision-making potential.

I shortly diversified the account to over 20 inventory positions as a result of diversification is essential — it is a . In early 2022, I bought shares of MercadoLibre for the primary time, dollar-cost averaging into my new place till it was price about 5% of the Roth IRA’s worth.

It wasn’t the biggest place on the time, however MercadoLibre inventory actually holds that title now. It is price excess of 5% of the full portfolio worth. Nevertheless, there are three explanation why I am not trying to promote any MercadoLibre shares anytime quickly.

1. MercadoLibre is poised for progress

Traders can earn cash in low-growth industries. Nevertheless it’s means simpler to seek out profitable investments by concentrating on leaders in rising markets.

In MercadoLibre’s case, its two essential enterprise segments are its e-commerce market and its monetary expertise (fintech) providers. Competitors can be way more fierce in North America or Europe. However in its native Latin America, MercadoLibre enjoys a number one place due to its early entry into the house.

When it comes to market maturity, Latin American markets for e-commerce and digital monetary merchandise are youthful than these markets in North America, typically talking. This partly explains why MercadoLibre’s progress has been stellar and why it may stay robust for the foreseeable future.

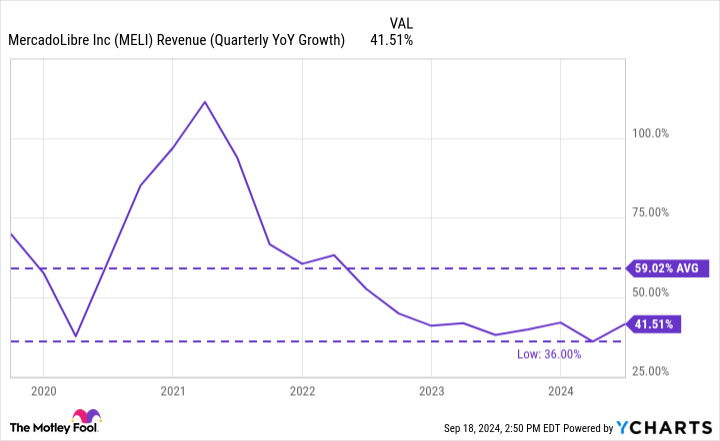

Relating to its progress charge, the chart beneath reveals that MercadoLibre’s slowest progress charge of the final 5 years was 36% — most corporations not often have a single 12 months of progress that good. And MercadoLibre has averaged top-line progress of practically 60% throughout that interval. At this charge, the enterprise will quadruple in measurement each three years, which is simply mind-blowing.

I am not essentially saying that MercadoLibre will preserve this present tempo. However its progress nonetheless appears to have loads of runway, which is the highest purpose I am pleased that MercadoLibre inventory is the biggest place in my Roth IRA.

2. MercadoLibre is poised for income

A few years in the past, MercadoLibre determined to sacrifice its good revenue margins to put money into transport and logistics. In its geographies, logistics was the problem that few corporations had been fixing for. It wasn’t fast, low cost, or simple. However as we speak, MercadoLibre has spectacular talents.

For perspective, over half of orders on MercadoLibre’s e-commerce platform are being delivered identical day or subsequent day, which is a uncommon stage of service within the firm’s key markets.

Its power in logistics helps the long-term progress of MercadoLibre’s e-commerce market. Not solely are extra third-party sellers getting on board (feeding a high-margin income stream), however progress of the platform additionally permits for progress in promoting income. The corporate had round $250 million in advert income within the second quarter of 2024, which was up greater than 50% 12 months over 12 months.

Furthermore, MercadoLibre’s power in logistics provides it a aggressive benefit, and firms with highly effective benefits typically discover methods to enhance their margins over time.

In recent times, MercadoLibre’s income progress has been excellent. However because the chart beneath reveals, progress for revenue metrics corresponding to working earnings and free money circulate has been even higher.

I’d anticipate extra positive aspects for MercadoLibre inventory if its income proceed to develop as they’re now.

3. Letting winners run is a profitable technique

One precept for investing the Motley Idiot means is to have a various portfolio. One other precept is to let a profitable funding proceed working, slightly than promoting it prematurely.

Let’s face it, a various portfolio goes to be crammed with loads of dangerous investments — mine certain is. This could drag down general long-term returns. Nevertheless, a single profitable inventory can do the heavy lifting. However this could solely occur if it is allowed sufficient time to develop.

There are authentic causes to promote a inventory. However MercadoLibre’s enterprise is flourishing, and it seems to have an extended runway. For these causes, I am going to hold holding my high inventory and permit it to raise my portfolio as a complete.

The place to speculate $1,000 proper now

When our analyst workforce has a inventory tip, it may possibly pay to hear. In any case, Inventory Advisor’s complete common return is 757% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and MercadoLibre made the record — however there are 9 different shares you might be overlooking.

*Inventory Advisor returns as of September 16, 2024

has positions in MercadoLibre. The Motley Idiot has positions in and recommends MercadoLibre. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

JPMorgan CEO Jamie Dimon Calls For Federal Workers To Return To Workplace, Says Empty Buildings 'Trouble' Him: 'I Can't Imagine…'

Benzinga and Lusso’s Information LLC could earn fee or income on some objects via the hyperlinks under.

JPMorgan Chase (NYSE:) CEO Jamie Dimon has known as for federal workers in Washington, DC, to return to their places of work, highlighting the continued debate over

What Occurred: Talking at The Atlantic Competition, Dimon expressed his frustration with the variety of empty buildings within the capital, to Enterprise Insider on Friday.

“By the best way, I’d additionally make Washington, DC, return to work. I can’t consider, once I come down right here, the empty buildings. The individuals who give you the results you want not going to the workplace,” he said,

“That bothers me,” he added. Dimon emphasised that he doesn’t enable such flexibility at JPMorgan.

Don’t Miss:

Why It Issues: Dimon just isn’t alone in his stance. Earlier this week, Amazon (NASDAQ:) CEO Andy Jassy introduced that Amazon workers wouldk, reverting to pre-pandemic norms.

JPMorgan’s coverage mandates managing administrators to be within the workplace full-time, whereas different workers should work in particular person no less than three days every week. Final 12 months, the Biden Administration additionally pushed federal workers to return to in-person work.

Regardless of these efforts, many federal staff nonetheless have versatile work preparations. As an example, some Environmental Safety Company workers are required to be within the workplace solely 4 days a month. Different companies, just like the Division of the Treasury and the Division of the Inside, require no less than 50% in-office presence.

Workplace emptiness charges in DC stay excessive, with about 22% of within the second quarter of 2024, in response to CBRE. The federal authorities and private-sector places of work contribute to this pattern.

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor immediately. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously contemplate the funding targets, dangers, prices and bills of the Fundrise Flagship Fund earlier than investing. This and different info might be discovered within the. Learn them rigorously earlier than investing. -

New fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

This text initially appeared on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024