Markets

If You Purchased 1 Share of Nvidia at Its IPO, Right here's How Many Shares You Would Personal Now

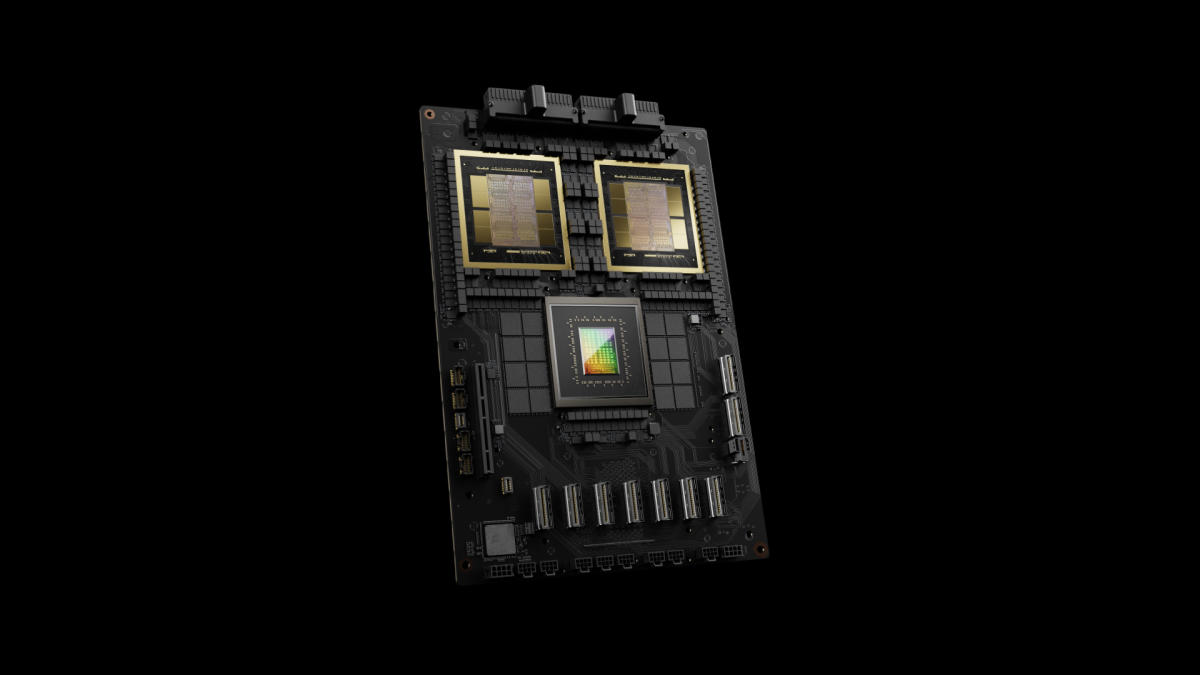

Since its IPO in January 1999, Nvidia (NASDAQ: NVDA) has established itself as one of many world’s most profitable firms. It has been notably adept at adapting its expertise to increase into new markets.

The corporate pioneered the that revolutionized the gaming business, turning boxy figures into lifelike pictures. The key to its success was parallel processing, which allowed the chips to conduct a large number of mathematical calculations concurrently. Nvidia’s processors are actually used for product design, autonomous methods, cloud computing, information facilities, synthetic intelligence (AI), and extra.

The flexibility to adapt its expertise has been a boon to shareholders. Even when buyers did not get in on the IPO itself, Nvidia shares fell beneath their challenge worth quite a few occasions in early 1999. For buyers lucky sufficient to get shares at (or beneath) the $12 IPO worth, the inventory has returned 493,940%.

Multiplying like rabbits

Whereas a single share of inventory may appear inconsequential at first look, one share of the proper inventory can have a huge effect on an investor’s success. In Nvidia’s case, the corporate’s efficiency and hovering inventory worth have resulted in quite a few inventory splits, turning one share into many extra.

Here is a listing of Nvidia’s inventory splits over time:

-

2-for-1 cut up, June 27, 2000

-

2-for-1 cut up, Sept. 12, 2001

-

2-for-1 cut up, April 7, 2006

-

3-for-2 cut up, Sept. 11, 2007

-

4-for-1 cut up, July 20, 2021

-

10-for-1 cut up, June 10, 2024

Because of the a number of inventory splits, an investor who purchased only one share of Nvidia inventory close to its IPO in 1999 would now be the proud proprietor of 480 shares.

Nevertheless, it took an excessive amount of self-discipline and self-control to carry Nvidia for greater than 25 years and reap this windfall. The inventory has misplaced greater than half its worth on quite a few events, which despatched fair-weather buyers scrambling for the exits.

That stated, take into account this: A $1,000 funding in Nvidia made in early 1999 would now be value greater than $4.9 million.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

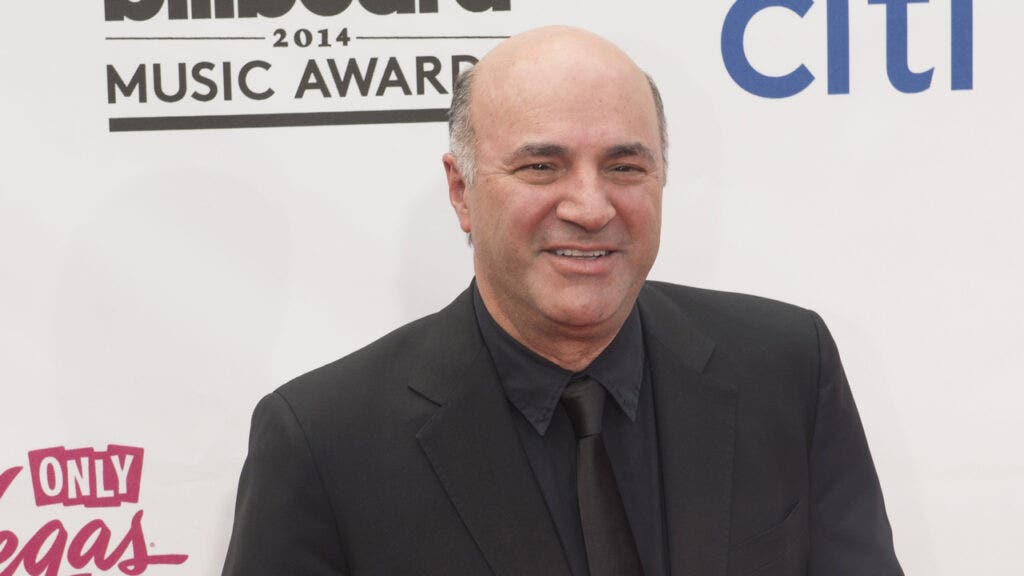

'You By no means Ask Me for Cash Once more': Kevin O'Leary Explains As a substitute Of Investing In Household Members' Companies, He Items Money With A Caveat

, a big-name investor identified for his no-nonsense method to enterprise, has a singular technique for coping with relations who ask him for cash. He is had his justifiable share of family coming to him with huge concepts and excessive hopes, on the lookout for a hefty funding. And with O’Leary’s monetary standing, it isn’t shocking. The Canadian enterprise proprietor and Shark Tank star has a internet price of round $400 million.

Do not Miss:

However whereas he is beneficiant, he is additionally obtained boundaries that assist maintain household and funds from clashing. In a brief YouTube video, O’Leary defined his actions when relations ask him for cash. He acknowledges the age-old reality: “More cash, extra issues.” O’Leary says, “It is a improbable factor but it surely makes your life difficult as a result of many individuals need a few of it from you at no cost – notably relations. It is a large concern.”

Trending: Amid the continued EV revolution, beforehand missed low-income communities

O’Leary clarifies that individuals come to anticipate one thing for nothing . And to deal with this, he is developed an easy technique that retains issues clear and avoids awkward Thanksgiving dinners.

When a member of the family approaches him for cash – whether or not it is to begin a restaurant or launch a brand new enterprise – he presents a one-time reward. Within the case he mentions, it is $50,000. Not a mortgage, not an funding, only a reward. However there is a catch: “You by no means ask me for cash once more. Ever.” O’Leary’s rule is easy: after that test, there will likely be no extra handouts, no future expectations, and no monetary entanglements. As he humorously provides, he arms over the cash after which “goes again to sprucing his eggs.” It is a clear break that leaves no room for future monetary disputes or awkward household interactions.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

For many who do not have a portfolio like O’Leary’s, his method nonetheless presents a beneficial lesson. Setting clear boundaries is essential when lending or gifting cash to household. Getting caught up within the feelings and obligations that include serving to family members is straightforward, however issues can get messy with out clear guidelines. An excellent method for the remainder of us is likely to be to solely give what we will afford to lose – whether or not that is $50, $500, or $5,000 – and make it clear that it is a one-time deal. No loans, no strings, no awkward household gatherings.

Dealing with household and cash might be tough, however O’Leary’s method reveals that it is all about setting expectations and sticking to them. And perhaps, simply perhaps, it is also about having just a little humor to maintain issues from getting too tense.

It is at all times good to earlier than making huge selections, particularly when household is concerned. They might help you identify what makes essentially the most sense in your scenario and set the best boundaries. It isn’t simply in regards to the cash – it is about retaining relationships intact whereas making decisions that work for everybody. Just a little steerage can go a great distance in guaranteeing your funds and household ties keep sturdy.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and methods to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

A Few Years From Now, You'll Want You'd Purchased This Undervalued Excessive-Yield Inventory

One of many largest temptations for dividend traders is reaching for yield. Principally, which means taking over dangerous investments simply to gather a bigger revenue stream. You will be higher off in the long term if you happen to err on the aspect of warning, significantly if you’ll want to reside off of the revenue you’re producing. That is why Enterprise Merchandise Companions (NYSE: EPD) is a high-yield funding you may want you’d purchased. A fast comparability to Altria (NYSE: MO) will assist clarify why.

Who wins the high-yield story, Altria or Enterprise?

Relating to yield, Altria’s 8.1% is a full proportion level increased than the distribution yield of Enterprise Merchandise Companions’ 7.1%. Each have elevated their dividends usually, so many traders would possibly default to the higher-yielding choice. However that is not essentially the most effective plan.

Altria, , comes with extra threat than it’s possible you’ll assume regardless of working in what is mostly thought of a dependable sector. That is as a result of its fundamental product is cigarettes. This enterprise has been in a secular decline for a very long time. Within the second quarter of 2024 alone, Altria’s cigarette volumes fell 13% 12 months over 12 months. That is not a fluke. Within the second quarter of 2023, volumes fell 8.7%. In the identical quarter of 2022, cigarette quantity was off by 11.1%. Any latest quarter and any latest full 12 months would have proven the identical horrible development.

The corporate has offset quantity declines with worth will increase, which has allowed it to proceed rising its dividend regardless of the clearly horrible course of its most essential enterprise line. There is a very actual probability that you’ll remorse shopping for this high-yield dividend inventory if it may possibly’t stem the bleeding not directly.

Enterprise is a completely completely different story.

Enterprise’s decrease yield comes with decrease threat

You possibly can simply argue that Enterprise comes with its personal dangers, on condition that it operates within the extremely risky vitality sector. And its midstream enterprise is immediately tied to demand for oil and pure gasoline, which is being pressured by the transfer towards cleaner options. Truthful sufficient, however what does Enterprise truly do?

As a midstream supplier, Enterprise owns important infrastructure belongings that assist transfer oil and pure gasoline around the globe. It typically fees charges for using its infrastructure, so the worth of vitality is much less essential than the demand for vitality. Demand for vitality tends to stay sturdy whatever the worth of oil and pure gasoline.

However here is the large truth — regardless of all of the hype round clear vitality, demand for oil and pure gasoline is predicted to stay sturdy for many years to come back. Actually, demand will doubtless improve for these fuels, with far dirtier coal bearing the brunt of the clear vitality change.

In different phrases, Enterprise’s enterprise is not as dangerous as it could appear. On prime of that, it is without doubt one of the largest midstream gamers in North America with an investment-grade-rated steadiness sheet. Whereas inner development choices are restricted, it has lengthy acted as an trade consolidator. It simply introduced plans to purchase Pinon Midstream for $950 million, for instance. Acquisitions are lumpy and unimaginable to foretell, however they provide Enterprise ample room for development on prime of the sluggish and regular worth will increase it is going to be in a position to extract from clients.

In order for you a excessive yield from a rising enterprise, Enterprise is the higher choice when in comparison with Altria and its declining core enterprise. Certain, you may hand over a proportion level of yield, however as Altria continues to wrestle, that final level will can help you sleep at evening if you happen to purchase Enterprise.

Enterprise’s yield nonetheless appears low-cost

Here is essentially the most fascinating half: Enterprise’s 7.1% dividend yield is above its 10-year common yield of 6.3%. So regardless of the restoration from pandemic lows, it nonetheless seems to be undervalued. A rising enterprise, a financially robust firm, and an undervalued worth all make Enterprise a high-yield inventory you may remorse lacking out on. Particularly whenever you evaluate it to different high-yield decisions with equally excessive, however far riskier, yields.

Must you make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Altria Group wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Assume You Know Altria? Right here's 1 Little-Identified Reality You Can't Overlook.

When most buyers take a look at Altria (NYSE: MO) what they see is a large 8% dividend yield backed by a dividend that has been elevated for years. That’s the kind of story that almost all dividend buyers will discover engaging. However there is a huge danger right here as a result of the corporate’s core enterprise is in long-term decline. That danger needs to be understood, however there’s one other delicate twist that you’ll have missed.

Altria’s enterprise is slipping away

It should not come as any shock to Altria shareholders that the corporate’s most necessary enterprise is making . Within the first half of 2024, the corporate generated roughly $11.8 billion in income. Its smokeable merchandise division’s revenues had been about $10.4 billion, or 88% of the corporate’s general prime line. Clearly, smokeable merchandise is the driving pressure at Altria.

To be truthful, the corporate sells quite a lot of smokeable merchandise, together with cigars. However whenever you take a look at quantity, cigarettes account for simply over 97% of the division’s quantity. So cigarettes are the large story at Altria. However, as famous, most buyers know that reality.

The necessary story right here is not the biggest enterprise. It’s the decline that is going down within the largest enterprise. By means of the primary six months of 2024, cigarette volumes dropped 11.5%. That is horrible and would seemingly be seen as surprising at another — buyers would run for the hills. Solely that drop is simply par for the course.

In 2023, cigarette volumes declined 9.9%. In 2022, volumes fell 9.7%. In 2021, the drop was 7.5%. You get the concept, it is a dying enterprise.

One “little” downside that may’t be missed

How has an organization with a enterprise that is in decline managed to take care of its dividend, not to mention develop it? The reply is that, due to the character of cigarettes, people who smoke are typically very loyal. So Altria has been jacking up costs frequently to offset the quantity declines. That is labored out effectively thus far, however you may solely milk a money cow so exhausting earlier than it runs dry. That is a much bigger danger for Altria than many might notice.

Of the cigarettes Altria sells, solely about 4% or so fall into the low cost class. Which means Altria’s enterprise is principally reliant on premium smokes. Within the premium class, “different premium” manufacturers make up about 4.5% of whole quantity. The remaining 91% of the corporate’s cigarette quantity is all attributable to at least one model, Marlboro.

Marlboro is a huge within the U.S. cigarette trade with an enormous 42% market share. This may very well be considered as a power. However step again for a second and take into consideration the large image. Altria is principally a one-trick pony in a dying rodeo. And its pony is likely one of the costliest round at a time when worth competitors from smoking alternate options is heating up. Altria itself notes that “the expansion of illicit e-vapor merchandise” is a giant downside, which is essentially as a result of they’re less expensive.

Fixing the issue will not be straightforward

There’s solely a lot Altria can do about its reliance on Marlboro because the cigarette enterprise declines. In reality, being the most important participant within the trade might be preferable to having a second rung model. What it’s doing is making an attempt to broaden its attain past cigarettes. That is the correct factor to do, however given the scale of the corporate’s cigarette enterprise it is not going to be straightforward to discover a alternative. After a few failed makes an attempt, together with an funding in Juul and in a marijuana firm, Altria is at present centered on rising its current NJOY vape acquisition.

It’s going effectively, with NJOY experiences fast development because it has been slotted into Altria’s spectacular distribution system. To place a quantity on that, within the second quarter of 2024 NJOY’s cargo quantity elevated 14.7% from the primary quarter and NJOY system shipments elevated 80%. The issue is that NJOY is tiny, falling into Altria’s “all different merchandise” income class which made up simply $22 million in income within the first half of 2024 at an organization with almost $11.8 billion in income. So NJOY is barely even a rounding error. Marlboro is the important thing to Altria’s future and can seemingly stay the important thing for years to come back.

If Altria hits a tipping level, it may get unhealthy quick

A shopper staples firm can solely elevate costs simply thus far earlier than there is a backlash from shoppers. The straightforward swap with cigarettes is to purchase cheaper smokes, which Altria actually does not promote. Then there’s alternate options to fret about, reminiscent of the corporate’s spotlight of vaping. Though Marlboro has been holding its personal, in 2021 its market share was 43.1%. That is 1.1 share factors above its present stage.

If Marlboro falters, Altria may fall. This can be a “little” undeniable fact that many buyers most likely aren’t contemplating as they take a look at the large dividend yield. Principally, there’s higher focus danger right here than many individuals notice.

Do you have to make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Altria Group wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook