Markets

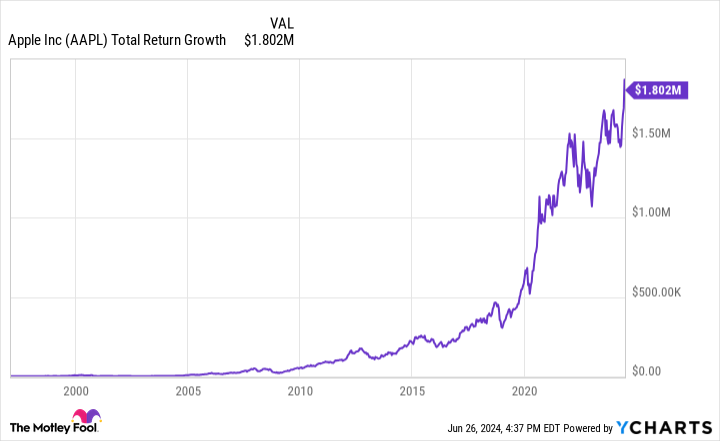

If You'd Invested $1,000 in Apple Inventory 27 Years In the past, Right here's How A lot You'd Have In the present day

Apple (NASDAQ: AAPL) inventory has skilled many struggles since its 1980 IPO. After its board fired Steve Jobs in 1985, the corporate spent years within the wilderness. It suspended its dividend payout in 1996, and was near chapter when it introduced Jobs again in 1997.

Shortly after that, started a run that made it one of the profitable shares in historical past, illustrating how innovation can dramatically enhance an organization’s fortunes.

Apple’s inventory development since Jobs’ return

If one had purchased $1,000 in Apple inventory when Jobs returned in February 1997 and held on till at the moment, that place can be price round $1.8 million. That determine assumes this hypothetical investor would have reinvested their revenue from the dividend, which Apple reinstated in 2012.

Jobs’ first main transfer after returning was to combine the Mac ecosystem with the broader tech world, convincing Microsoft to take a position $150 million in Apple and develop and help a Mac-compatible model of its fashionable Workplace software program.

He additionally set to construct an Apple ecosystem, revamping the Macintosh, launching the iMac in 1998, and following up with a brand new MacOS in 2001. The corporate gained extra traction by launching the iPod music participant in 2001, and opening Apple Shops and the iTunes Retailer quickly after.

Nevertheless, the innovation that actually remodeled Apple was the iPhone, which it launched in 2007. It pioneered the trendy smartphone business, and ultimately eradicated many individuals’s must personal a PC. So profitable was the iPhone that it drives nearly all of Apple’s income to this present day.

Apple’s tempo of innovation slowed with the passing of Jobs in 2011. Now, it extra instantly competes with gadgets and apps utilizing Alphabet‘s Android working system and with most of its mega-tech rivals within the subject.

Nonetheless, its continued improvements have at instances made it the world’s largest firm by market cap, and positioned it within the prime three at the moment. Due to merchandise such because the iPhone and its in depth ecosystem, Apple’s inventory worth ought to proceed to develop.

Do you have to make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Apple wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $759,759!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Asia shares stutter, euro features after first spherical vote in France

By Ankur Banerjee

SINGAPORE (Reuters) -Asian shares had been subdued on Monday as merchants contemplated the usrates outlook, whereas the euro rose after the first-round voting in France’s shock snap election was received by the far-right, albeit with a smaller share than some polls had projected.

The shock vote has unsettled markets because the far-right, in addition to the left-wing alliance that got here second on Sunday, have pledged large spending will increase at a time when France’s excessive finances deficit has prompted the EU to suggest disciplinary steps.

On Monday, the euro was 0.32% larger, whereas European inventory futures rose 1% and French OAT bond futures gained 0.15% as buyers digested the higher than feared outcomes, though uncertainty remained.

Exit polls confirmed Marine Le Pen’s Nationwide Rally (RN) profitable round 34% of the vote, comfortably forward of leftist and centrist rivals however the probabilities of eurosceptic, anti-immigrant RN profitable energy subsequent week will depend upon the political dealmaking by its rivals over the approaching days.

“Maybe the outcome is not as dangerous because the market had feared,” stated Michael Brown, senior strategist at Pepperstone.

“We have additionally seen lots of rhetoric kind different events trying to maybe pull out candidates to attempt to keep away from the Nationwide Rally profitable seats within the runoff subsequent Sunday … The market could also be taking somewhat little bit of solace in that.”

The main focus now shifts to subsequent Sunday’s runoff and can depend upon how events resolve to affix forces in every of the nation’s 577 constituencies for the second spherical, and will nonetheless lead to a majority for RN.

“Traders are involved that if the far-right Nationwide Rally celebration wins a majority within the French Parliament, this might set the stage for France to conflict with the EU, which might disrupt Europe’s markets and the euro sharply,” stated Vasu Menon, managing director of funding technique at OCBC.

In Asia, the MSCI’s broadest index of Asia-Pacific shares outdoors Japan was 0.07% larger, to kick off the second half of the yr having risen 7% to this point in 2024. Japan’s Nikkei rose 0.57%.

China shares eased, with blue-stocks down 0.45%. Hong Kong’s Hold Seng Index was flat.

A non-public sector survey on Mondayshowed China’s manufacturing exercise grew on the quickest tempo in additional than three years on account of manufacturing features, at the same time as demand progress slowed.

The Caixin/S&P International manufacturing PMI information contrasted with an official PMI launched on Sunday that confirmed a decline in manufacturing exercise.

On the macro aspect, the highlight stays on if and when the Federal Reserve will begin slicing charges within the wake of knowledge on Friday exhibiting U.S. month-to-month inflation was unchanged in Might.

Within the 12 months by way of Might, the PCE value index elevated 2.6% after advancing 2.7% in April. Final month’s inflation readings had been consistent with economists’ expectations. They continue to be above the Fed’s 2% goal for inflation.

Nonetheless, markets are clinging to expectations of at the least two charge cuts from the Fed this yr with a reduce in September pegged in at 63% chance, CME FedWatch instrument confirmed.

U.S. shares on Friday ended decrease after an early rally fizzled. [.N]

Amongst currencies, the yen traded round 160.98 per greenback after the federal government, in a uncommon unscheduled revision to gross home product (GDP) information on Monday, stated Japan’s financial system shrank greater than initially reported within the first quarter.

Knowledge additionally confirmed Japan’s manufacturing unit exercise stayed unchanged in June amid lacklustre demand and as corporations struggled with rising prices because of the weak yen.

The yen skidded to 161.27 on Friday, its weakest stage since late 1986, protecting merchants on edge as they search for indicators of intervention from Japanese authorities.

The euro touched a greater than two week excessive of $1.076175 in early Asian hours, pushing the greenback index, which measures the U.S. unit towards six rivals, a contact decrease at 105.59.

In commodities, oil costs edged larger, with Brent futures 0.39% larger at $85.33 per barrel and U.S. West Texas Intermediate crude futures up 0.42% at $81.88. [O/R]

(Modifying by Stephen Coates)

Markets

Asian shares drift decrease amid blended China PMIs; charge uncertainty persists

Lusso’s Information– Most Asian shares moved in a flat-to-low vary on Monday as traders digested blended cues on Chinese language enterprise exercise, whereas uncertainty over U.S. rates of interest remained in play.

Regional markets took weak cues from a destructive shut on Wall Road on Friday, as quarter-end profit-taking largely offset some elevated expectations for charge cuts by the Federal Reserve.

U.S. inventory index futures have been mildly constructive in Asian commerce, though traders remained on edge earlier than an tackle by , the , and knowledge for extra cues on rates of interest.

Chinese language shares fall on blended PMIs

China’s and indexes shed 0.5% and 0.2%, respectively, after authorities and personal buying managers index readings gave differing cues on the financial system.

launched on Sunday confirmed China’s manufacturing sector shrank for a second consecutive month in June. However in contrast, a studying on Monday confirmed the sector increasing at its quickest tempo in three years.

Whereas the 2 readings differ of their scope of corporations lined, they nonetheless painted two contrasting footage of Asia’s largest financial system, which saved traders unsure over its financial prospects.

Chinese language markets have been already nursing steep losses by means of June, having tumbled from their 2024 peaks as slowing stimulus measures from Beijing noticed sentiment bitter in the direction of the nation.

Focus in July is on the third Plenum of the Chinese language Communist Celebration, a gathering of high officers the place the federal government is more likely to define extra financial assist.

Broader Asian markets retreated amid some uncertainty over China. Australia’s fell 0.4%, whereas South Korea’s was flat.

Hong Kong markets have been closed for a vacation.

Futures for India’s index pointed to a barely destructive open, with the index set for some profit-taking after hitting a collection of report highs by means of June.

Japanese shares edge greater, GDP revised decrease

Japan’s and indexes rose about 0.3% and 0.4%, respectively.

The 2 trimmed a bulk of their early positive aspects after the federal government unexpectedly revised first quarter knowledge to indicate a a lot deeper contraction than initially anticipated.

The studying highlighted rising cracks in Japan’s financial system, which might current headwinds for firm earnings within the coming months.

However a weaker financial system additionally presents the likelihood that the Financial institution of Japan will preserve rates of interest low for longer, which bodes effectively for native inventory markets.

Markets

1 Magnificent Inventory That Turned $10,000 Into $2.7 Million

The factitious intelligence (AI) growth has lifted Nvidia to new heights. The “Magnificent Seven” inventory has soared 27,310% previously 10 years, making it one of many world’s most precious firms.

However there is a a lot smaller enterprise that has carried out even higher. I am speaking about Celsius (NASDAQ: CELH). This has skyrocketed 27,360% previously decade (as of June 25), turning a $10,000 funding right into a jaw-dropping $2.7 million.

Let’s take a better have a look at Celsius’ meteoric rise to changing into a $13-billion enterprise right this moment. Then by viewing issues with a contemporary perspective, traders can assess if the inventory is a great shopping for alternative.

Energizing development

If you happen to see a inventory that has skyrocketed as a lot as Celsius has, it is price taking the time to determine what elements led to such a robust efficiency. On this case, it should not be a shock that the important thing driver of Celsius’ ascent has been unimaginable gross sales development.

Behind solely Crimson Bull and Monster Beverage, the enterprise has turn into the third-largest power drink vendor within the U.S. In 2023, Celsius reported income of $1.3 billion. That determine was 102% larger than the yr earlier than. And it represented a powerful 25-fold enhance from solely 5 years in the past.

Whereas the broader non-alcoholic beverage business may be extraordinarily mature, the power drink class is registering sooner development. Maybe customers aren’t taken with consuming sugary drinks as a lot as they have been 10 or 20 years in the past. Or possibly there’s merely a heightened deal with drinks which might be supposedly more healthy for you.

That is what Celsius goals to be. By advertising its merchandise as practical drinks which have sure well being advantages, it has steadily gained shopper mindshare. Any consumer-facing model ought to try to do exactly this.

Celsius has additionally benefited from getting its drinks in entrance of extra prospects. This implies increasing its presence in varied retail settings. The enterprise can also be discovering great success on Amazon, a particularly well-liked website that will get billions of holiday makers every month.

And with the assistance of PepsiCo, which is Celsius’ distribution accomplice each domestically and overseas, this firm is in a good place to maintain discovering success.

Is it too late to purchase Celsius inventory?

Since hitting their all-time excessive in March of this yr, Celsius shares have been nosediving, tanking 42% in lower than 5 weeks. On Might 28, Dara Mohsenian, a analysis analyst at Morgan Stanley, printed a be aware that stated the corporate’s gross sales fell sequentially through the week ending Might 18, inflicting Celsius’ market share to dip barely.

However even after its monumental decline, I nonetheless imagine Celsius is an overvalued inventory. It trades at a price-to-earnings ratio of 61.6. That is a steep valuation to pay, significantly as gross sales are slowing down. And I feel it offers potential traders zero margin of security.

Celsius is anticipated to extend income at an annualized clip of 31% between 2023 and 2026. It is a far cry from the triple-digit development traders have in all probability turn into accustomed to.

What additionally worries me is that these projections may show to be overly optimistic. Celsius has doubtless already taken benefit of the so-called low-hanging-fruit alternative with its Pepsi deal. Furthermore, the business has just about no limitations to entry. There’s nothing stopping a well-funded entrepreneur from beginning his or her personal power drink enterprise, which customers may flock to.

Celsius has undoubtedly been a implausible funding previously decade, turning a small sum into practically $3 million. However the inventory does not appear like a wise shopping for alternative right this moment.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our professional group of analysts points a advice for firms that they suppose are about to pop. If you happen to’re fearful you’ve already missed your probability to speculate, now could be the very best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

-

Amazon: when you invested $1,000 once we doubled down in 2010, you’d have $21,765!*

-

Apple: when you invested $1,000 once we doubled down in 2008, you’d have $39,798!*

-

Netflix: when you invested $1,000 once we doubled down in 2004, you’d have $363,957!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. and his purchasers don’t have any place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Celsius, Monster Beverage, and Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing