Markets

If You'd Invested $10,000 in Superior Micro Gadgets Inventory 5 Years In the past, Right here's How A lot You'd Have At present

Share costs of Superior Micro Gadgets (NASDAQ: AMD) have climbed 454% during the last 5 years. An funding of $10,000 in AMD again in June 2019 could be price $55,410 right now. That is a variety of development in a comparatively brief time. Can AMD proceed to develop at this tempo over the subsequent 5 years?

This main semiconductor continues to realize market share towards Intel within the central processing unit (CPU) market, nevertheless it’s concentrating on different alternatives in that might result in one other nice run for shareholders over the subsequent 5 years.

Why purchase AMD inventory?

At this level in 2019, AMD was executing towards the expansion technique it outlined for buyers at its Monetary Analyst Day in Might 2017. AMD was concentrating on increased gross margin because it shifted extra gross sales to high-end chips, comparable to , that generated increased margins. It was additionally speaking about going after the CPU server market that was dominated by Intel.

By 2019, AMD’s margins, income, and earnings had been on an upward trajectory, and it ought to see extra development.

Nevertheless, AMD’s income grew simply 2% yr over yr within the first quarter, weighed down by weak demand for gaming GPUs and weak gross sales in different markets. These segments may see a restoration throughout the subsequent yr.

AMD inventory at the moment trades about 32% off its earlier peak, and it might be a well timed entry level to purchase shares. The chance within the knowledge middle market is wanting super, as income soared 80% yr over yr in Q1.

AI is opening extra markets to promote chips, which helps to gasoline AMD’s knowledge middle development. AI on the edge, the place processing is finished on units and native servers nearer to the person, is a big alternative that might drive strong chip demand throughout extra units.

Development expectations are rising, which makes the current pullback an incredible alternative to purchase shares.

Must you make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Superior Micro Gadgets wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has positions in Superior Micro Gadgets. The Motley Idiot has positions in and recommends Superior Micro Gadgets. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Boeing’s area and protection chief exits in new CEO’s first govt transfer

By Joe Brock, David Shepardson and Tim Hepher

(Reuters) – Boeing (NYSE:) mentioned on Friday the pinnacle of its troubled area and protection unit is leaving the corporate instantly, within the first administration change beneath new CEO Kelly Ortberg.

Ortberg who took over in August mentioned Ted Colbert can be leaving and Steve Parker, the unit’s chief working officer, would assume Colbert’s obligations till a alternative is called at a later date.

“At this important juncture, our precedence is to revive the belief of our prospects and meet the excessive requirements they count on of us to allow their important missions all over the world,” Ortberg wrote in an e mail to staff. “Working collectively we will and can enhance our efficiency and guarantee we ship on our commitments.”

Boeing’s area enterprise has suffered vital setbacks, notably NASA’s current determination to ship Boeing’s Starliner capsule house with out astronauts that adopted years of missteps. Starliner has price Boeing $1.6 billion in overruns since 2016, in keeping with a Reuters evaluation of securities filings.

Colbert’s departure comes at a time when Boeing has been attempting to avoid wasting money by asserting furloughs of hundreds of white-collar employees amid a strike by greater than 32,000 of its employees.

Boeing has additionally confronted vital woes after a brand new Alaska Airways 737 MAX 9 in January suffered a mid-air emergency after it was lacking 4 key bolts.

Boeing in July agreed to plead responsible to a felony fraud conspiracy cost and pay no less than $243.6 million after breaching a 2021 deferred prosecution settlement. The federal government mentioned Boeing knowingly made false representations to the Federal Aviation Administration about key software program for the 737 MAX.

The FAA has tightened oversight of Boeing and barred it from increasing manufacturing of the MAX past 38 planes monthly till it makes vital high quality and security enhancements.

Parker was introduced in to shore up industrial management and assist repair loss-making packages with a brand new working administration function slightly below two years in the past. He had beforehand headed Boeing’s bomber and fighter packages in addition to its St Louis protection crops.

“Traditionally, Boeing held a superior popularity for our potential to handle packages, and we have to guarantee it stays a key differentiator for us sooner or later,” Ortberg wrote in separate e mail to staff on Friday.

Ortberg added he had discovered “extra concerning the future investments we have to make to be aggressive and outline our future, in addition to about among the extra near-term hurdles engineering faces with first-time high quality and execution.”

Colbert, who joined Boeing in 2009 after working at Citigroup and Ford Motor (NYSE:), took the reins at Boeing Protection and Area in April 2022 after the prior head of protection was ousted.

Boeing’s protection, area and safety unit, certainly one of its three foremost companies, has misplaced billions of {dollars} in 2023 and 2022, which executives attributed largely to price overruns on fixed-price contracts.

Such contracts have excessive margins however go away protection contractors weak to inflationary pressures which have dented U.S. company earnings in the previous couple of years.

Boeing has misplaced greater than $2 billion on its delayed program to ship two closely retrofitted Boeing 747-8s to be used as U.S. presidential plane generally known as Air Power One. The 747-8s are designed to be an airborne White Home capable of fly in worst-case safety situations, reminiscent of nuclear warfare.

Boeing’s shares closed down about 1% on Friday and have misplaced about 41% thus far this 12 months.

Markets

Neglect Nvidia: This Different Inventory Could Finish Up Being the Most Vital Knowledge Middle Alternative of All, and It's Not a Expertise Firm

When you consider synthetic intelligence (AI), issues equivalent to self-driving vehicles and humanoid robots may come to thoughts. Counterintuitively, it is usually a good suggestion to consider how merchandise are literally delivered to life every time a brand new large development emerges. A number of the most profitable alternatives are additionally usually the least apparent ones.

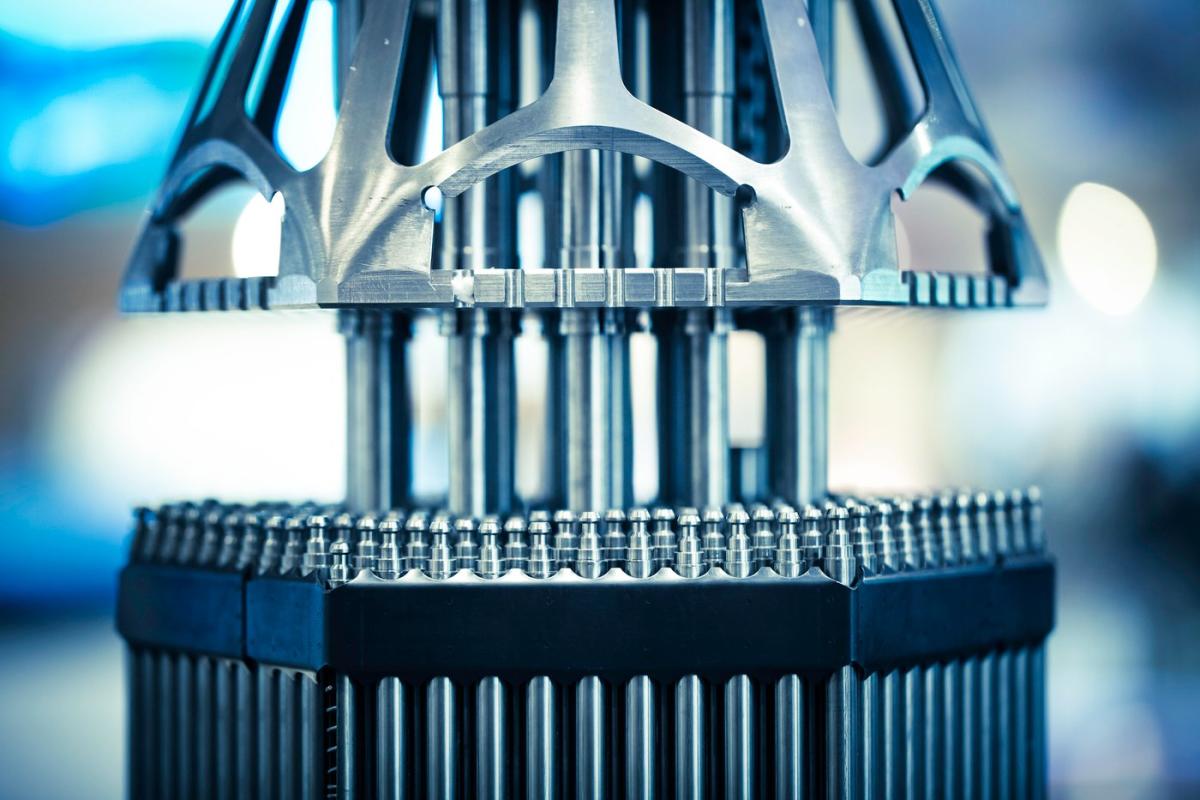

For AI to even work correctly, firms have to take a position massive sums of into information facilities. Though information facilities may seem to be only a piece of actual property, they’re much more refined and essential. They home essential IT infrastructure, equivalent to chipsets often called graphics processing items (GPUs) — an essential element of generative AI purposes.

At present, Nvidia is among the largest names within the information middle realm. However what if I instructed you I see one other alternative because the superior alternative amongst information middle investments and that it isn’t even a expertise firm?

It is essential to contemplate all choices — even probably the most tangential ones. Let’s dig right into a nuclear power inventory that I feel could find yourself being crucial information middle firm in the long term and discover why this could possibly be a profitable alternative for buyers.

Nuclear-powered information facilities are on the rise, and…

A significant promoting level of AI is that the expertise can deliver a brand new wave of effectivity to a bunch of use instances. From breakthroughs in enterprise software program to self-driving vehicles, AI is promising a brand new stage of productiveness and security that is by no means been witnessed.

Though that sounds nice, as with all issues, AI comes with some main trade-offs. Particularly, constructing AI purposes is an expensive ambition. GPU {hardware} and high-performance computing software program are among the extra apparent bills in AI growth. One of many extra refined prices in an AI roadmap resides with information facilities, notably their power consumption.

GPUs are continually operating advanced algorithms and performing refined computing duties. This makes and, specifically, give off a variety of warmth. Knowledge facilities are outfitted with numerous temperature management protocols, equivalent to air con items, followers, and turbines.

Nevertheless, these options are each expensive and could be inefficient in comparison with different sources of power management. An rising development on the crossroads of information facilities and power consumption is nuclear energy, and a few actually notable firms and enterprise leaders are getting concerned.

…a variety of large names are concerned

One notable firm concerned with nuclear-powered information facilities is Amazon. One of many largest companies in Amazon’s ecosystem is its cloud computing platform, Amazon Net Providers (AWS). Earlier this 12 months, AWS acquired a nuclear-powered information middle from Talen Power for a reported $650 million.

One other participant rising on the nuclear energy scene is Oklo. Oklo develops nuclear fission reactors that it goals to promote to information facilities and utility firms.

When it was nonetheless a personal firm, Oklo raised funding from Peter Thiel and OpenAI co-founder Sam Altman. Just a few months in the past, Oklo went public via a particular function acquisition firm (SPAC).

In line with its investor presentation, the corporate has obtained curiosity for its reactors from main firms, together with Diamondback Power, Equinix, Siemens Power, and even the U.S. Air Power.

Whereas this caliber of consideration and Altman’s assist are spectacular, I see Oklo as a dangerous guess in the meanwhile. The corporate continues to be pre-revenue, and the potential offers referenced above are in early-stage negotiations.

Oklo will seemingly require hefty ongoing analysis and growth (R&D) prices to construct out its reactors, which is able to take a toll on the corporate’s liquidity as long as there aren’t materials gross sales coming via the door.

My prime decide on the intersection of nuclear power and information facilities is…

My best choice amongst nuclear energy suppliers for information facilities is Constellation Power (NASDAQ: CEG). The corporate presents a bunch of power companies however is making sustainability and nuclear power a selected focus.

One of many firm’s recognized nuclear energy prospects is “Magnificent Seven” member Microsoft. Throughout the firm’s second-quarter earnings name in late August, CEO Joseph Dominguez referenced Comcast and Johns Hopkins as different notable prospects of Constellation’s carbon-free power companies.

Different mega-cap tech firms will seemingly comply with Amazon and Microsoft’s strikes. Constellation’s various buyer base alerts that inexperienced power isn’t just a use case for information facilities or large tech hyperscalers.

Buyers with a long-term horizon could need to take into account a place in Constellation Power proper now. I feel nuclear power options will grow to be extra mainstream because the AI revolution continues to evolve. Given how early the AI narrative appears to be, I feel a possibility equivalent to Constellation Power is basically missed or underappreciated — making it a tempting purchase amongst different alternatives in AI, information facilities, and power consumption.

Must you make investments $1,000 in Constellation Power proper now?

Before you purchase inventory in Constellation Power, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Constellation Power wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Amazon, Constellation Power, Equinix, Microsoft, and Nvidia. The Motley Idiot recommends Comcast and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Tips on how to play the AI Enterprise Software program revolution

Lusso’s Information — The AI enterprise software program revolution is remodeling enterprise operations, with corporations more and more positioning themselves to capitalize on this pattern.

In a current be aware, Truist Securities analysts highlighted that companies are integrating AI applied sciences throughout their software program stacks to boost productiveness, information administration, and cybersecurity. Central to this shift is the rising affect of generative AI (GenAI), anticipated to affect each infrastructure and utility layers of enterprise software program.

In line with the report, corporations fall into two major classes on the subject of benefiting from AI: these straight capturing AI workloads and people leveraging the know-how to boost their merchandise.

Microsoft Company (NASDAQ:), MongoDB (NASDAQ:), and Snowflake Inc (NYSE:) are cited as key gamers anticipated to realize from AI workloads, largely attributable to their information infrastructure capabilities and partnerships with main AI suppliers.

Regardless of current market challenges, Snowflake is considered as a possible long-term winner, as its information warehousing is more and more acknowledged as a core know-how for AI initiatives. MongoDB can also be well-positioned, particularly with its vector storage and search capabilities crucial for AI purposes.

Within the utility software program area, Truist Securities highlights potential winners in three key areas: “choose and shovel” performs, core platform distributors benefiting from improve cycles, and distributors embedding AI to boost productiveness. Corporations like Salesforce Inc (NYSE:) and Smartsheet Inc (NYSE:) are anticipated to capitalize on these developments as enterprises more and more flip to AI-driven options to streamline workflows and enhance effectivity.

In the meantime, corporations comparable to Palo Alto Networks Inc (NASDAQ:), CrowdStrike Holdings Inc (NASDAQ:), and Datadog Inc (NASDAQ:) are seen leveraging AI to boost their product choices, notably in cybersecurity.

Truist notes that Palo Alto Networks has already demonstrated vital AI-driven income development, surpassing $200 million in annual recurring income from its AI merchandise. As AI adoption rises, demand for AI-augmented safety instruments is predicted to extend, increasing the marketplace for corporations on this area.

Whereas AI funding continues to develop, Truist Securities notes that the timeline for realizing vital worth from AI has prolonged. Initially projected for 2024, many enterprises now anticipate AI-driven purposes to realize traction by 2025. Regardless of this delay, over 70% of companies surveyed anticipate allocating 5% or extra of their 2024 software program budgets to AI initiatives, underscoring the continuing dedication to AI funding.

Generative AI, whereas garnering a lot consideration, is predicted to symbolize solely a small portion of the broader AI market. By 2027, Truist Securities forecasts that generative AI will account for lower than 10% of the estimated $900 billion AI market. This means that whereas the concentrate on generative AI is important, different areas—comparable to information administration, cybersecurity, and infrastructure—will current extra substantial long-term alternatives.

A key problem highlighted within the report is the scarcity of expert expertise and sources to implement AI initiatives successfully. This, coupled with rising regulatory scrutiny surrounding AI governance and compliance, might pose hurdles for widespread AI adoption within the enterprise area.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024