Markets

In case your AI appears smarter, it's because of smarter human trainers

By Supantha Mukherjee and Anna Tong

STOCKHOLM/SAN FRANCISCO (Reuters) – Within the early years, getting AI fashions like ChatGPT or its rival Cohere to spit out human-like responses required huge groups of low-cost employees serving to fashions distinguish primary details equivalent to if a picture was of a automotive or a carrot.

However extra refined updates to AI fashions within the fiercely aggressive area are actually demanding a quickly increasing community of human trainers who’ve specialised data — from historians to scientists, some with doctorate levels.

“A yr in the past, we may get away with hiring undergraduates, to only usually educate AI on the right way to enhance,” mentioned Cohere co-founder Ivan Zhang, speaking about its inner human trainers.

“Now we have now licensed physicians instructing the fashions the right way to behave in medical environments, or monetary analysts or accountants.”

For extra coaching, Cohere, which was final valued at over $5 billion, works with a startup referred to as Invisible Tech. Cohere is likely one of the predominant rivals of OpenAI and focuses on AI for companies.

The startup Invisible Tech employs hundreds of trainers, working remotely, and has develop into one of many predominant companions of AI corporations starting from AI21 to Microsoft (NASDAQ:) to coach their AI fashions to cut back errors, recognized within the AI world as hallucinations.

“We’ve 5,000 folks in over 100 nations world wide which might be PhDs, Grasp’s diploma holders and data work specialists,” mentioned Invisible founder Francis Pedraza.

Invisible pays as a lot as $40 per hour, relying on the situation of the employee and the complexity of labor. Some corporations equivalent to Outlier pay as much as $50 per hour, whereas one other firm referred to as Labelbox mentioned it pays as much as $200 per hour for “excessive experience” topics like quantum physics, however begins with $15 for primary subjects.

Invisible was based in 2015 as a workflow automation firm catering to the likes of meals supply firm DoorDash (NASDAQ:) to digitize their supply menu. However issues modified when a comparatively unknown analysis agency referred to as OpenAI contacted them within the spring of 2022, forward of the general public launch of ChatGPT.

“OpenAI got here to us with an issue, which is that once you had been asking an early model of ChatGPT a query, it was going to hallucinate. You could not belief the reply,” Pedraza instructed Reuters.

“They wanted a sophisticated AI coaching associate to offer reinforcement studying with human suggestions.”

OpenAI didn’t reply to request for remark.

Generative AI produces new content material primarily based on previous information used to coach it. Nevertheless, generally it may possibly’t distinguish between true and false data and generates false outputs referred to as hallucinations. In a single notable instance, in 2023 a Google (NASDAQ:) chatbot shared inaccurate details about which satellite tv for pc first took photos of a planet outdoors the Earth’s photo voltaic system in a promotional video.

AI corporations are conscious that hallucinations can derail GenAI’s attractiveness to companies and try numerous methods to cut back it, together with utilizing human trainers to show the idea of reality and fiction.

Since getting onboard with OpenAI, Invisible says it has develop into AI coaching companions to a lot of the GenAI corporations, together with Cohere, AI21 and Microsoft. Cohere and AI21 confirmed they’re purchasers. Microsoft didn’t affirm it’s a consumer of Invisible.

“These are all corporations that had coaching challenges, the place their primary price was compute energy, after which the quantity two price is high quality coaching,” Pedraza mentioned.

HOW DOES IT WORK?

OpenAI, which began off the frenzy round GenAI, has a staff of researchers aptly named “Human Information Group” that works with AI trainers to assemble specialised information for coaching its fashions like ChatGPT.

OpenAI researchers give you numerous experiments like lowering hallucinations or to enhance writing model and work with AI trainers from Invisible and different distributors, a supply aware of the corporate’s processes mentioned.

At any level, dozens of experiments are being run, some with instruments developed by OpenAI and others by instruments of distributors, the individual mentioned.

Primarily based on what the AI corporations need – from getting higher at Swedish historical past or doing monetary modeling – Invisible hires employees with related levels for these initiatives, lowering the burden of managing lots of of trainers by the AI corporations.

“OpenAI has a few of the most unimaginable laptop scientists on the earth however they don’t seem to be essentially an knowledgeable in Swedish historical past or chemistry questions or biology questions or something you possibly can ask it,” Pedraza mentioned, including that over 1,000 contract employees cater to OpenAI alone.

Cohere’s Zhang mentioned he has personally used Invisible’s trainers to discover a approach to educate its GenAI mannequin to search out related data from a giant information set.

COMPETITION

Among the many rivals on this area is Scale AI, a personal start-up final valued at $14 billion which offers AI corporations with units of coaching information. It has additionally ventured into the world of offering AI trainers, and counts OpenAI as a buyer. Scale AI didn’t reply to requests for an interview for this story.

Invisible, which has been worthwhile since 2021, has raised solely $8 million of main capital,

“We’re 70% owned by the staff, and solely 30% owned by traders,” Pedraza mentioned. “We do facilitate secondary rounds, and the newest traded value was at a half a billion greenback valuation.” Reuters couldn’t affirm that valuation.

Human trainers first bought into AI coaching by way of data-labelling work that required much less qualification and was additionally paid much less, generally as little as $2, largely executed by folks in African and Asian nations.

As AI corporations launch extra superior fashions, the demand for specialised trainers and throughout dozens of languages is on the rise, making a well-paid area of interest the place employees from quite a lot of topics may develop into AI trainers with out even understanding the right way to code.

Demand from AI corporations is resulting in the creation of extra corporations which might be providing related companies.

“My inbox is principally inundated with new corporations that pop up right here and there. I do see this as a brand new area the place corporations rent people simply to create information for AI labs like us,” Zhang mentioned.

Markets

Prediction: Apple's iPhone 16 Might Change into a Runaway Hit, and Right here Is 1 Inventory to Purchase Hand Over Fist Earlier than That Occurs

Preliminary stories that Apple‘s (NASDAQ: AAPL) newest batch of smartphones have been witnessing weaker demand than final yr’s fashions weighed on the inventory just lately. But it surely appears like these stories might not maintain a lot water in any case, as the corporate’s iPhone 16 lineup appears to be receiving a strong response from clients.

Extra importantly, a more in-depth take a look at the potential gross sales prospects of the most recent iPhone fashions signifies that Apple may witness a pleasant bump in gross sales going ahead.

A giant improve cycle may assist Apple promote extra iPhones

Counterpoint Analysis estimates that iPhone 16 fashions are witnessing sturdy demand in India, with gross sales reportedly leaping between 15% and 20% on the day the smartphones went on sale in that nation. It’s value noting that Apple’s gross sales in India surged a powerful 35% in fiscal 2024 (which resulted in March this yr), and the robust begin that the corporate’s newest gadgets are having fun with in that market means that the momentum is about to proceed.

In the meantime, T-Cellular CEO Mike Sievert additionally identified that the service is promoting extra iPhone 16 fashions this yr as in comparison with final yr. Although Sievert identified that the delayed rollout of Apple Intelligence may result in an extended shopping for cycle, it’s value noting that the iPhone maker may finally get pleasure from robust gross sales due to an growing old put in base of iPhones.

Dan Ives of Wedbush Securities estimates that out of an put in base of 1.5 billion iPhones, 300 million haven’t been upgraded in 4 years. So, with options set to make their option to the most recent Apple iPhones, there’s a good probability {that a} important chunk of those older iPhones could possibly be upgraded. Provided that Apple bought slightly below 235 million iPhones final yr, the stage appears set for an enormous soar within the firm’s shipments going ahead.

That is why buyers might need to purchase shares of Apple, contemplating that the tech big’s because of the arrival of its AI-enabled smartphones. Nonetheless, there’s one other inventory that is set to profit large time from the iPhone 16’s potential success, and buyers can purchase that firm at a less expensive valuation proper now — Taiwan Semiconductor Manufacturing (NYSE: TSM).

A shot within the arm for TSMC because of the brand new iPhones

Taiwan Semiconductor Manufacturing, popularly generally known as TSMC, is the corporate that manufactures the processors that energy Apple’s iPhones. The A18 and A18 Professional processors contained in the iPhone 16 fashions are manufactured utilizing TSMC’s 3-nanometer (nm) course of node.

Apple claims that its iPhone Professional fashions can ship 15% efficiency positive factors whereas consuming 20% much less energy than final yr’s fashions. In the meantime, the A18 chip discovered on the iPhone 16 and iPhone 16 Plus is reportedly 30% sooner and consumes 35% much less energy than final yr’s telephones. The improved processing energy and low consumption will play a key position in serving to the brand new iPhones run the Apple Intelligence suite of AI options and assist the corporate faucet a fast-growing area of interest.

Apple reportedly started manufacturing its newest iPhones in June this yr and ramped up their manufacturing subsequently earlier than they hit the market this month. This is without doubt one of the explanation why TSMC has witnessed a big bump in its income of late. The Taiwan-based foundry big’s month-to-month income elevated 33% yr over yr in June, adopted by a forty five% enhance in July and a 33% enhance in August.

Apple is TSMC’s largest buyer and reportedly accounted for a fourth of the latter’s high line in 2023. So it’s simple to see why TSMC’s income has been rising at spectacular ranges of late. In fact, Nvidia is one other key TSMC buyer, because the semiconductor big has been tapping the latter’s foundries to fabricate its AI chips. Nonetheless, Nvidia reportedly accounted for 11% of TSMC’s income final yr, which implies that Apple strikes the needle in a extra important approach for the foundry big.

Ives expects the manufacturing of iPhone 16 fashions to hit 90 million items in 2024, up by 8 million to 10 million items from final yr’s fashions. This estimated enhance in manufacturing by Apple appears to be contributing to TSMC’s spectacular development in current months. Extra importantly, we noticed earlier that there’s a enormous put in base of customers that would transfer to Apple’s AI-enabled iPhones sooner or later. Consequently, TSMC’s largest buyer may proceed to play a central position in driving its development.

Even higher, stories counsel that Apple might have already bought all of TSMC’s manufacturing capability of 2-nm chips for its 2025 iPhone lineup. It’s value noting that Apple has performed an identical factor up to now when it bought all of TSMC’s 3nm manufacturing capability for a yr in 2023 in order that it may make sufficient iPhones.

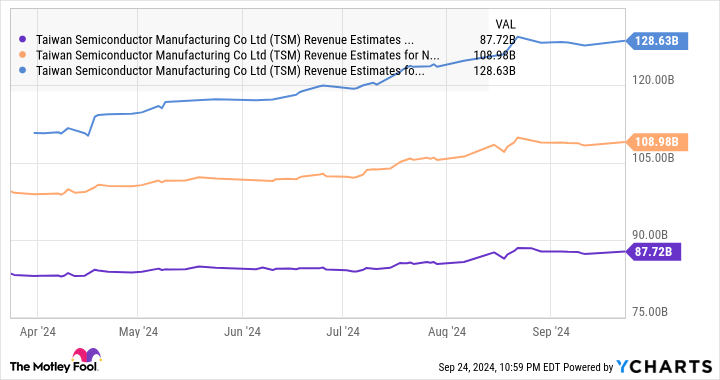

In all, TSMC’s development prospects within the AI chip market because of clients equivalent to Nvidia, together with its tight relationship with Apple, are the explanation why there was a big enhance within the firm’s income estimates for the subsequent three years.

What’s extra, TSMC is buying and selling at 31 instances trailing earnings and 21 instances ahead earnings proper now. It’s cheaper than Apple, which is buying and selling at 34 instances trailing earnings and 30 instances ahead earnings. So, TSMC inventory offers buyers a less expensive and extra diversified option to capitalize on the potential development in iPhone gross sales, in addition to the secular development of the AI chip market.

That is why buyers ought to take into account shopping for this semiconductor inventory proper now earlier than it may fly larger following the 75% positive factors it has already clocked in 2024.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends T-Cellular US. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Tips on how to put together your portfolio for This autumn

Lusso’s Information — As we strategy the ultimate quarter of 2024, markets are buoyant, with fairness indices reaching new highs, bolstered by the Federal Reserve’s aggressive charge cuts and hopes of a gentle touchdown for the US economic system. Optimism surrounds international shares, that are on observe for a fourth consecutive quarter of positive aspects, whereas bonds have rallied amid falling inflation and the prospect of extra central financial institution easing.

But, this constructive sentiment is tempered by uncertainties, and buyers have to be ready for the challenges that lie forward within the last stretch of the yr.

UBS analysts have emphasised the narrowing window of alternative for portfolio changes as central banks speed up their rate-cutting cycles.

The Federal Reserve’s sudden 50-basis-point reduce marked a powerful begin to its easing cycle, with expectations of an extra 50 foundation factors in 2024 and an extra 100 foundation factors subsequent yr.

Equally, the European Central Financial institution, Financial institution of England, and Swiss Nationwide Financial institution are anticipated to proceed trimming charges.

These cuts, whereas supportive for equities, will doubtless diminish the returns on money. For buyers, this makes it much less viable to carry extra funds in deposit accounts or cash market devices, as money yields erode within the face of falling rates of interest.

In response, UBS advises reallocating capital towards income-generating property that provide extra sustainable returns.

“Methods resembling bond ladders, medium-duration investment-grade bonds, and diversified mounted revenue might help keep portfolio revenue,” the analysts mentioned.

These devices are significantly suited to switch money holdings, offering a extra sturdy yield profile in an period of decrease rates of interest.

Amid this shifting financial panorama, the upcoming US election presents one other potential supply of market volatility.

UBS analysts warning that the election final result might have profound implications for sectors resembling US client discretionary and renewable vitality, that are extremely delicate to shifts in public coverage.

A clear sweep, the place one celebration controls each Congress and the White Home, might result in important regulatory and tax adjustments, impacting commerce tariffs and enterprise laws.

For buyers, this presents each dangers and alternatives, relying on the industries concerned.

It’s necessary, nevertheless, to not guess too closely on one political final result. Positioning portfolios to revenue from a selected electoral end result might backfire, particularly given how shut the race stays.

UBS encourages managing publicity to weak sectors, significantly within the US, whereas being conscious of foreign money dangers, resembling these tied to the .

No matter who wins the election, the continued strategic competitors between the US and China is anticipated to persist, benefiting corporations concerned in reshoring and lowering reliance on abroad manufacturing.

Financial uncertainty, coupled with geopolitical tensions, might additional gasoline volatility within the fairness markets. Regardless of the Federal Reserve’s optimistic evaluation of the US economic system—citing robust development and low recession dangers—buyers ought to stay vigilant.

Weak financial information releases, in addition to the continued battle within the Center East, might quickly bitter market sentiment. UBS analysts stress the significance of portfolio diversification as a defend in opposition to these dangers. By spreading investments throughout varied asset courses and sectors, buyers can higher climate potential market shocks.

The substitute intelligence sector stays a key theme for long-term development, and UBS believes this technological revolution can be a significant driver of markets within the years forward. For these with restricted publicity to AI, market dips might current a possibility to extend holdings on this transformative sector.

Conversely, buyers who’re closely weighted in AI-related shares ought to think about capital preservation methods to lock in positive aspects and defend in opposition to potential pullbacks.

Within the face of uncertainty, different investments supply an extra layer of safety and diversification. Hedge funds with low correlations to conventional property might help mitigate portfolio volatility.

In the meantime, personal fairness and infrastructure investments present publicity to development alternatives exterior the general public markets, which can be extra resilient to short-term swings.

Personal credit score, with its engaging yield profile, provides one other compelling choice for buyers looking for revenue alternate options in a low-interest-rate surroundings.

Nonetheless, these asset courses include dangers, together with decrease liquidity and fewer transparency, and are solely appropriate for buyers who can tolerate these traits.

Gold has additionally re-emerged as a vital protected haven amid rising geopolitical tensions and the Fed’s easing cycle. With costs reaching a brand new all-time excessive of $2,630/oz, and the steel rallying round 27% year-to-date, UBS sees additional room for positive aspects.

The brokerage expects robust institutional demand to proceed supporting gold costs into 2025, probably pushing them to $2,700/oz. For these seeking to hedge in opposition to geopolitical dangers and inflationary pressures, gold stays a “Most Most popular” asset in UBS’s technique. Buyers can achieve publicity via bodily gold, structured merchandise, ETFs, or gold mining equities.

Because the Federal Reserve continues to chop charges, UBS analysts keep that fixed-income markets will stay a beautiful area for producing secure returns.

Though tactically impartial on mounted revenue, UBS flags that the broader bond market provides useful alternatives for revenue technology within the months forward. Buyers can anticipate as much as 100 foundation factors of additional charge cuts in 2024, with one other 100 foundation factors doubtless in 2025.

This rate-cutting trajectory will make bonds, significantly these of upper credit score high quality and medium length, a extra interesting choice in comparison with money or lower-yielding cash market devices.

Markets

I’ve $2.5 million and nonetheless have an irrational worry that I’ll by no means be capable of retire

Received a query about investing, the way it matches into your total monetary plan and what methods might help you take advantage of out of your cash? You may write to me at . Please put “Repair My Portfolio” within the topic line.

Expensive Repair My Portfolio,

Intellectually, I’m feeling properly ready for retirement, however in my coronary heart I’ve an irrational worry that I’m not financially able to retire. I believe my fears focus on uncertainty available in the market and round not having an revenue stream (I’ve been working since I used to be 14). I’m at the moment 57 and my spouse is 60. I’m seeking to retire inside three years on the most. My spouse thinks she may wish to work half time to maintain herself busy, however I’m fairly satisfied I don’t wish to spend my retirement working.

Most Learn from Lusso’s Information

Are we really going to have the ability to retire in a few years and reside an affordable life-style with out operating out of cash? Do we have to change our portfolio setup? How ought to we draw down our retirement funds, particularly whereas we await Social Safety?

Our annual bills, together with expectations for having to purchase medical health insurance, and our bills for leisure and journey are roughly $70,000 in 2024 {dollars}.

We now have no debt, apart from a $20,000 mortgage from a retirement account, listed under, which will likely be paid off inside the 12 months; two automobiles, every lower than 5 years previous; and a home and a cabin that collectively are price roughly $650,000. Our mixed Social Safety revenue is projected to be $5,700 per thirty days at age 67 and $7,400 per thirty days at 70.

Right here’s what we now have:

Head vs. Coronary heart

Expensive Head vs. Coronary heart,

You’re the sort of retirees the bucket technique was made for. You have got a whole lot of totally different accounts of various varieties, and it simply appears like an enormous mess once you listing them. It’s positively onerous to get a deal with on issues that means.

The is a kind of psychological accounting that permits you to visualize your holdings in a means which may make extra sense to you. Begin by organizing your buckets based on tax effectivity: tax-deferred financial savings, tax-free development and taxable financial savings. That can enable you see in case you’re saving in the proper locations for the following three years till you retire. The objective is to have a variety of revenue streams, so you may select the place to tug cash from with a purpose to decrease your tax burden.

While you begin to spend the cash, you may shift to desirous about timeframe buckets — one for the brief time period that’s largely money, one for the medium time period that’s extra conservative and one for the long term that’s extra aggressive. That’s once you’d wish to regulate your investments to make them give you the results you want. You wouldn’t need particular person shares within the short-term bucket and money within the long-term bucket, as an illustration.

I’d recommend wiping that anticipated inheritance off your listing. You by no means know what may occur, and it’s not one thing you may rely on. If a large inheritance ought to come your means finally, you may regulate your plans accordingly, with out counting your chickens earlier than they hatch.

Tax-deferred bucket

Group your entire tax-deferred retirement accounts into one bucket: the 457(b), the 403(b) and the employer-sponsored plan, all of which at the moment quantities to about $943,000. You have got one other two and a half years earlier than you may contact that cash with out penalty, however your spouse can already begin drawing from her financial savings if she must. That being stated, once you do begin to faucet that cash, you’ll need to pay tax on it as abnormal revenue.

Additionally, you will have to start out taking cash out of those accounts when you’re 73, underneath present guidelines. By the point you attain that age in 16 years, these financial savings could possibly be price greater than $2.5 million, assuming a mean development fee of seven%. You can maintain including to that bucket over the following few years or begin to spend it down early, however that depends upon you.

Tax-free bucket

Your Roth IRAs are for the bucket of tax-free development. These accounts are price $260,000 now, and nevertheless a lot they develop, it’s going to by no means have an effect on your taxes, since you pay the tax on Roth contributions up entrance. You may take out the cash that you just put in at any time, however you must wait till you’re 59½ to take out the expansion with out penalty.

That makes this bucket good in case you want a money infusion within the subsequent few years, however in any other case, you may wish to spend from this bucket final, as a result of the expansion is tax-free. In the event you depart that cash alone, it could possibly be price $1.2 million by the point you might be 80.

You didn’t point out heirs, however Roth accounts are additionally probably the most advantageous to depart behind once you die, as a result of your beneficiaries don’t have to pay tax on the balances for 10 years.

Taxable bucket

Together with your holdings in brokerage accounts and money, it doesn’t appear seemingly that you just’ll want to the touch that Roth cash early. The objective is to have sufficient money available to cowl your bills from the time you retire till Social Safety kicks in, adopted briefly order by RMDs. For something you want after that, you may select which account works greatest.

In the event you retire at 60, that leaves roughly 10 years during which you’ll have to cowl $70,000 in annual bills.

That is when good financial-planning software program comes into play, as a result of it permits you to run precise numbers and put in all these variables and time frames. However simply by trying on the buckets, you are able to do a bit of back-of-the-envelope evaluation and see that the $1.25 million you’ve got now will surely cowl your projected bills — actually, you’d largely be skimming off the highest, that means your accounts may really develop over that interval, even at a reasonable 7% return.

Retirement spending projections should not an actual science, nevertheless. Possibly $70,000 a 12 months is definitely sort of low for you, particularly in case you are not taking into consideration future healthcare prices or different emergencies. Or maybe when you retire, you’ll resolve to spend a bit of extra freely at first, when you are wholesome and may take pleasure in it.

And when the time comes to hold up your spurs, chances are you’ll resolve that’s not what you wish to do. Some sort of work might nonetheless be in your future, however it will likely be pushed by your ardour, not your financial institution steadiness.

You can even be part of the Retirement dialog in our .

Most Learn from Lusso’s Information

Extra Repair My Portfolio

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook