Markets

Intel Good points After Touchdown Amazon Deal, Getting ready Manufacturing facility Break up

(Lusso’s Information) — Intel Corp. shares surged for the second straight day after the troubled chipmaker made a raft of bulletins, spurring optimism {that a} turnaround plan is beginning to bear fruit.

Most Learn from Lusso’s Information

In probably the most notable transfer, the corporate struck a multibillion-dollar cope with Amazon.com Inc.’s Amazon Net Providers cloud unit to coinvest in a customized AI semiconductor. Intel additionally could obtain as a lot as $3 billion in US authorities funding to make chips for the navy. And it’s turning its ailing manufacturing enterprise, or foundry, into an entirely owned subsidiary.

However the chipmaker is pulling again in some areas as effectively. Intel stated it might shelve plans for brand new factories in Germany and Poland — no less than for now.

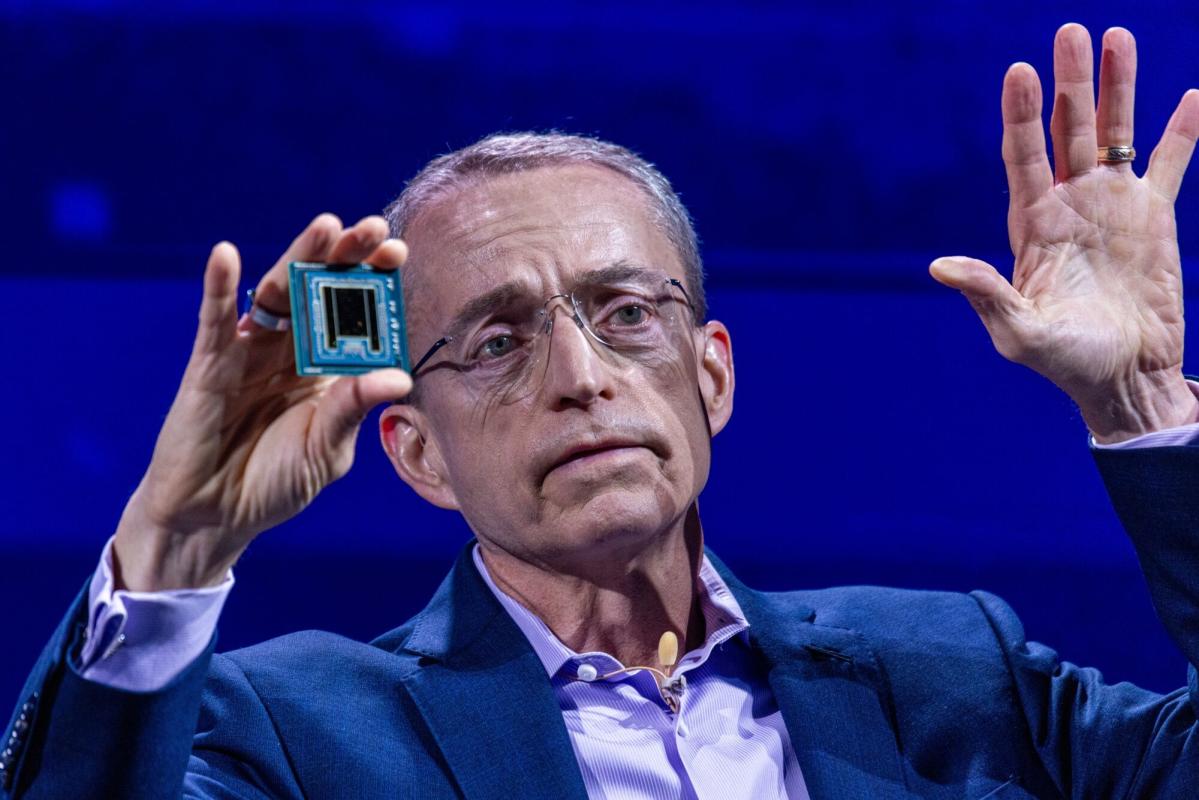

The information follows a gathering of Intel’s board final week, throughout which executives introduced methods to preserve money whereas protecting Chief Government Officer Pat Gelsinger’s longer-term turnaround plan on observe. The CEO’s effort hinges on remodeling Intel right into a foundry, however the Santa Clara, California-based firm has been gradual to line up clients. A high-profile consumer equivalent to Amazon represents a big win.

Intel shares jumped as a lot as 8% to $22.58 on Tuesday, following a 6.4% acquire the day earlier than. That they had been down greater than 60% by the tip of final week.

Gelsinger, who launched into a daring comeback effort for Intel in 2021, has needed to reduce a few of his ambitions within the identify of effectivity. With gross sales shrinking and losses piling up, the corporate introduced plans final month to slash 15,000 staff, discover $10 billion in price financial savings and droop Intel’s dividend. Now he’s going additional to rein in growth plans, particularly abroad.

The Poland and Germany development tasks can be paused for about two years relying on market demand. One other one in Malaysia can be accomplished however solely put into operation when circumstances help it, Intel stated.

The postponement of the German manufacturing facility marks a setback for the European Union’s semiconductor ambitions and is more likely to reignite controversy in Berlin over the place to allocate €10 billion ($11 billion) in earmarked subsidies.

Though Intel is freezing work on new factories in Germany and Poland, it stated it stays dedicated to its US growth in Arizona, New Mexico, Oregon and Ohio.

The transfer to separate Intel’s foundry operations from the remainder of the corporate is aimed partially at convincing potential clients — a few of whom compete with Intel — that they’re coping with an unbiased provider. Lusso’s Information had beforehand reported that the corporate was weighing this selection.

“We nonetheless have issues to study changing into a foundry,” Gelsinger stated within the interview. “I would like a number of clients.”

Intel can also be seeking to velocity up efforts to execute the $10 billion in price financial savings and focus its merchandise higher on AI computing, an space the place rival Nvidia Corp. has excelled. And it hopes to pare its actual property globally by about two-thirds by the tip of the yr.

Moreover, the corporate reiterated plans to promote a part of its stake in semiconductor maker Altera Corp. to personal fairness traders. The enterprise, which Intel purchased in 2015, was separated from its operations final yr with the purpose of taking it public.

Amazon Net Providers is the most important supplier of cloud computing, and it may assist construct confidence that Intel can compete with the likes of foundry chief Taiwan Semiconductor Manufacturing Co. AWS has used Intel processors over time, however has been shifting extra towards in-house designs — the very merchandise that Intel could now assist manufacture.

The 2 firms will coinvest in a customized semiconductor for synthetic intelligence computing – what’s referred to as a material chip – in a “multiyear, multibillion-dollar framework,” based on an announcement Monday. The work will depend on Intel’s 18A course of, a complicated chipmaking expertise.

“In the present day’s announcement is huge,” Gelsinger stated Monday of the deal. “This can be a very discerning buyer who has very refined design capabilities.”

Microsoft Corp., one other main cloud-computing supplier, introduced plans in February to make use of Intel for a few of its in-house chips as effectively.

In one other win, Intel stated earlier Monday that it’s eligible to obtain as a lot as $3 billion in US authorities funding to fabricate chips for the navy. The hassle, known as the Safe Enclave, goals to ascertain a gentle provide of cutting-edge chips for protection and intelligence functions. That information helped set off the rally on Monday.

The Safe Enclave award is separate from a attainable $8.5 billion Chips and Science Act grant that Intel is about to obtain to help factories throughout 4 US states. The tasks embody a facility in New Albany, Ohio, that Intel has stated may change into the world’s largest chipmaking operation.

Intel nonetheless has an extended technique to go to win again Wall Avenue’s full confidence. After years of shedding floor to rivals and seeing its technological edge slip, the Silicon Valley pioneer is valued at lower than $100 billion. It not ranks as one of many high 10 chip firms on that foundation. Nvidia, in the meantime, now has a market capitalization of about $2.9 trillion.

Intel shocked traders with a bleak monetary report final month, triggering the largest single-day inventory decline in many years. Analysts described the announcement as Intel’s worst-ever earnings report.

Gelsinger, in a letter to staff, acknowledged that the chipmaker’s efficiency has drawn detrimental scrutiny — and spurred hypothesis over what may occur to the corporate. The one technique to “quiet our critics” can be to ship outcomes and execute higher, he stated. This week’s bulletins are a step towards that, he stated.

“Is it ok? No. Is it substantial? Sure,” he stated within the interview. “I’ve reupped my dedication. We’re going to complete a seminal task.”

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Walt Disney appoints 'Moana' author Jared Bush as inventive head of animation studios

(Reuters) – Walt Disney (NYSE:) Animation Studios, in a big management shift, on Thursday named Academy Award-winning filmmaker Jared Bush as its new chief inventive officer, efficient instantly.

Bush, the inventive drive behind film hits corresponding to “Encanto,” “Zootopia,” and author of the unique Oscar-nominated hit “Moana” takes the reins from Jennifer Lee, who will return to filmmaking full time to steward the wildly profitable “Frozen” franchise.

Lee joined Walt Disney Animation Studios in 2011 as co-writer of “Wreck-It Ralph” and author of “Frozen.” After serving as CCO since 2018, she’s going to now concentrate on directing and writing “Frozen 3” and co-writing “Frozen 4” with Marc Smith.

A Disney veteran of over a decade, Bush will oversee the inventive output of the enduring animation studio, together with its movies, sequence and related tasks, Disney mentioned in a press release.

Bush is presently engaged on “Zootopia 2” and serves as the author and government producer of the upcoming “Moana 2,” that are on account of launch within the fall of 2025 and 2024, respectively, Disney mentioned. (This story has been refiled to say that ‘Zootopia 2’ will launch within the fall of 2025 and ‘Moana 2’ will launch within the fall of 2024, not 2025, in paragraph 5)

Markets

The Fed is following its 1995 playbook — and that's nice information for shares and the economic system

-

The Fed seems prefer it’s following the identical path it did in 1995, in response to TS Lombard.

-

That units the stage for the economic system to keep away from a recession because it did within the 90s, the agency stated.

-

It is also nice information for shares, because the S&P 500 greater than doubled in worth that decade.

The Fed is following a 30-year-old playbook with its rate of interest strikes — and that is excellent news for the US economic system, in response to TS Lombard.

The agency pointed to the central financial institution’s to the federal fund price this week. That was , and it might lay the groundwork for a booming inventory market and economic system, in response to Dario Perkins, the agency’s managing director of worldwide macro.

He notes that the Fed’s newest price lower has created a parallel to what central bankers did in 1995, when Fed officers eased the Federal funds price from a peak of 6% to round 4.75% over three years. That took rates of interest again to a impartial stage, stave off a recession, and in the end spark a brand new financial growth.

By 1998, GDP progress had accelerated from 4.4% to just about 5%. In the meantime, the S&P 500 soared 125% by the top of the Fed’s slicing cycle, in response to knowledge from the .

Fed officers look on observe to drag off the identical maneuver, Perkins advised, attributing this week’s jumbo-sized price lower to central bankers’ perception that they had been additional away from the impartial price than they had been a number of many years in the past.

“Our view is that this slicing cycle will most likely play out like Greenspan’s mid-course ‘re-calibration’ of coverage within the mid-Nineteen Nineties,” Perkins stated in a be aware on Wednesday. “Even when the US labour market deteriorates greater than we count on and the Fed falls behind the curve, there isn’t any actual risk of a deep recession.”

Shares soared a day after the large price lower. Regardless of wobbling within the hours after the Fed’s price transfer, the foremost indexes hit recent information in Thursday trades.

“We expect the smooth touchdown remains to be very a lot in play,” Perkins added. “And whereas the hazard of the Fed falling behind the curve is actual, we predict the repercussions could be manageable. It’s arduous to foresee something worse than a gentle recession,” he later wrote.

Some forecasters are nonetheless cautious of the Fed’s newest coverage transfer attributable to considerations that slicing rates of interest too shortly might ignite a recent bout of inflation. The market, although, has largely shrugged off that threat, with remaining simply above 2% in September, in response to Cleveland Fed knowledge.

Learn the unique article on

Markets

CEE Holdings Belief buys System1 shares price $10,430

In a latest transfer, CEE Holdings Belief, a major shareholder in System1, Inc. (NYSE:SST), has elevated its place within the firm by buying extra shares. On September 16, 2024, CEE Holdings Belief bought 8,412 shares of System1’s Class A Frequent Inventory at a weighted common value of $1.24 per share, totaling roughly $10,430.

The transaction was carried out in a number of trades, with costs starting from $1.23 to $1.25 per share. Following this acquisition, CEE Holdings Belief now owns a complete of 8,768,056 shares in System1, Inc. The belief’s funding displays ongoing confidence within the laptop programming and knowledge processing providers supplier.

Traders and market watchers typically maintain an in depth eye on insider transactions similar to this one, as they’ll present insights into how the corporate’s management and important stakeholders view the inventory’s worth and prospects. Nonetheless, it is necessary to notice that such transactions don’t essentially predict future inventory efficiency and ought to be thought of alongside broader market evaluation.

System1, Inc., which was beforehand often called Trebia Acquisition Corp., has been buying and selling underneath the ticker image SST following its identify change. The corporate makes a speciality of providers associated to laptop programming, knowledge processing, and different technology-driven options.

The main points of the transaction have been made public by a Type 4 submitting with the Securities and Change Fee. Brittany Gale, Senior Belief Officer of Jackson Gap Belief Firm and trustee for CEE Holdings Belief, signed the doc, which was filed on September 19, 2024.

In different latest information, System1, a know-how firm, reported robust monetary outcomes for the second quarter of 2024, surpassing its personal expectations. The agency introduced a income of $95 million, a gross revenue of $39 million, and an adjusted EBITDA of $9.9 million. These spectacular outcomes have been primarily pushed by strategic investments within the RAMP platform and worldwide growth, coupled with efficient value discount measures.

The corporate’s owned and operated enterprise, a major contributor to income, noticed a 12% enhance from the earlier quarter, producing $77 million. Worldwide operations, which now account for 36% of owned and operated income, additionally skilled substantial development. System1’s Companion Community enterprise reported a income of $17 million, marking an 8% sequential enhance.

Regardless of these constructive developments, System1 did report a 2% year-over-year decline in income and a 4% drop in adjusted gross revenue. Nonetheless, the corporate stays optimistic about its commerce initiatives and the subscription merchandise market, with plans to introduce at the least one product by This autumn. It additionally offered Q3 steerage estimating income between $86 million and $88 million, adjusted gross revenue between $36 million and $38 million, and adjusted EBITDA between $8 million and $10 million.

Lusso’s Information Insights

In gentle of CEE Holdings Belief’s elevated funding in System1, Inc. (NYSE:SST), a deeper dive into the corporate’s monetary well being and market efficiency is warranted. Based on Lusso’s Information knowledge, System1, Inc. at present holds a market capitalization of roughly $109.35 million. This valuation comes amidst difficult instances for the corporate, as mirrored by its damaging P/E ratio of -0.49, indicating that traders are involved about its earnings prospects.

Furthermore, System1’s income has seen a major decline of 29.43% during the last twelve months as of Q2 2024, which aligns with the Lusso’s Information Tip that analysts anticipate a gross sales decline within the present 12 months. The corporate additionally grapples with weak gross revenue margins, at present standing at 9.65%, which might be some extent of concern for potential traders contemplating the belief’s latest share buy.

Lusso’s Information Suggestions counsel that System1 operates with a major debt burden and is rapidly burning by money, which can elevate pink flags. Moreover, the corporate’s internet revenue is anticipated to drop this 12 months, and analysts don’t anticipate the corporate will likely be worthwhile throughout the 12 months. These components might be essential for traders to observe within the context of CEE Holdings Belief’s latest strikes.

For these occupied with a complete evaluation of System1, Inc., Lusso’s Information presents a wealth of extra insights. There are 9 extra Lusso’s Information Suggestions obtainable, which might present a extra nuanced understanding of the corporate’s monetary place and future outlook.

Whereas the insider transaction by CEE Holdings Belief suggests confidence in System1, it’s important for traders to contemplate the broader monetary context offered by Lusso’s Information. The insights from Lusso’s Information might assist traders make extra knowledgeable choices about their curiosity in System1, Inc.

This text was generated with the help of AI and reviewed by an editor. For extra info see our T&C.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now