Markets

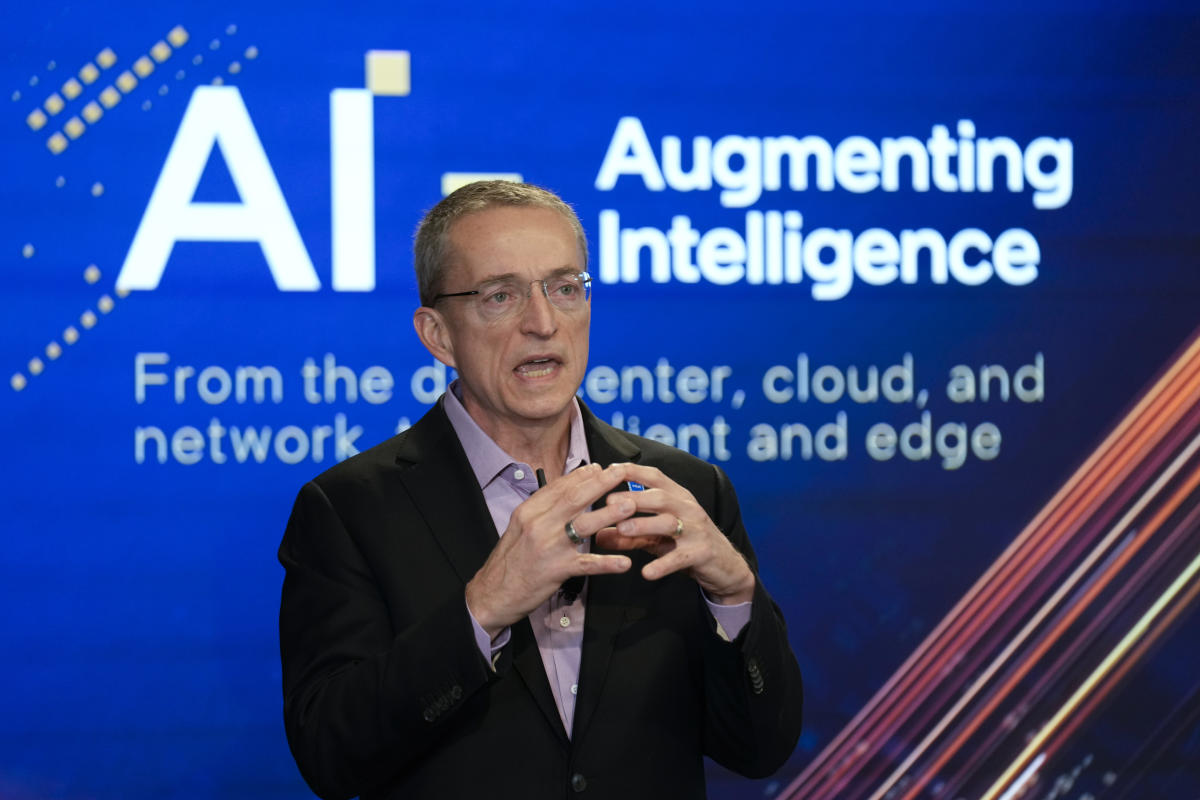

Intel launches new AI chips as takeover rumors swirl

Intel () revealed a pair of synthetic intelligence chips on Tuesday because it seeks to enhance its information middle enterprise and steal market share from rivals AMD () and Nvidia (). The brand new chips, the Xeon 6 CPU and Gaudi 3 AI accelerator, promise improved efficiency and energy effectivity and are available at a time when Intel is making an attempt to show it has what it takes to be a serious participant within the AI area.

The announcement follows a Wall Avenue Journal report that Qualcomm () to bolster its personal chip enterprise. Lusso’s Information, in the meantime, reported is considering making a multibillion-dollar funding within the chipmaker that may again Intel CEO Pat Gelsinger’s large turnaround plan. (Disclosure: Lusso’s Information is owned by Apollo World Administration.)

Intel says the brand new Xeon 6 chip presents P-cores, or efficiency cores, and says it options twice the efficiency of its predecessor. The chip, based on the corporate, is constructed for AI and high-performance compute situations together with edge and cloud methods.

The Gaudi 3 processor, then again, is purpose-built for generative AI functions and can compete instantly with Nvidia’s H100 and AMD’s MI300X line of chips. Intel says IBM () is utilizing its Gaudi 3 accelerators as a part of its IBM Cloud with the purpose of providing a decrease general complete value of possession.

“Demand for AI is main to an enormous transformation within the information middle, and the business is asking for selection in {hardware}, software program, and developer instruments,” Justin Hotard, Intel’s government vice chairman and normal supervisor of its Information Middle Synthetic Intelligence Group, stated in an announcement.

“With our launch of Xeon 6 with P-cores and Gaudi 3 AI accelerators, Intel is enabling an open ecosystem that permits our prospects to implement all of their workloads with higher efficiency, effectivity, and safety.”

Intel was additionally fast to level out that 73% of GPU-accelerated servers, servers designed to energy AI functions, use Xeon chips because the host CPUs they should operate correctly. However Intel’s chips aren’t the recent tickets they as soon as have been. Firms as an alternative try to get their arms on Nvidia’s line of AI chips, sending that firm’s inventory value hovering.

Nvidia’s inventory value is up a staggering 142% 12 months so far, whereas Intel shares have fallen a whopping 52%. AMD shares are up 12% in the identical time interval.

Throughout its newest quarterly earnings report in August, Intel reported worse-than-anticipated income and earnings per share and supplied a disappointing outlook for its present quarter. The corporate additionally stated it might reduce 15% of its workforce and suspended its dividend funds.

Gelsinger is making an attempt to return Intel to its former glory by pushing its groups to construct extra superior chips for the info middle and shopper PCs whereas concurrently constructing out its manufacturing capabilities.

Intel hopes to dramatically increase its chip fabs, the amenities the place it produces chips, each within the US and overseas. However the firm introduced final week that it’s going to put development of deliberate crops in Europe on maintain and that it gained’t begin up its superior packaging plant in Malaysia till demand for chips picks up.

Intel supplied as properly, saying that it’s going to construct customized chips for Amazon (), becoming a member of Microsoft () as one other marquee shopper for the corporate’s nascent third-party chip manufacturing enterprise.

The agency additionally stated it’s separating its foundry section from its design enterprise to supply a clearer separation between the 2 entities, giving potential prospects higher peace of thoughts that Intel’s design staff wouldn’t have entry to their very own chip designs.

However Intel’s struggles amid the turnaround have made it a takeover goal for the likes of Qualcomm, which might use the corporate to considerably increase its chip enterprise into the info middle and PC companies.

Qualcomm depends closely on its smartphone section. However smartphone gross sales have slowed through the years as prospects have begun holding on to their handsets longer, main Qualcomm to search for new development alternatives.

One such alternative contains constructing laptop computer chips meant to rival Intel’s personal line of processors. It can, nevertheless, take a great deal of time for Qualcomm to chip away at Intel’s PC market share if it manages to take action in any respect.

E mail Daniel Howley at dhowley@yahoofinance.com. Observe him on Twitter at .

Markets

Analyst Report: Crowdstrike Holdings Inc

Analyst Profile

Joseph F. Bonner, CFA

Senior Analyst: Communication Providers & Know-how

Joe covers the Communication Providers sector and chosen software program expertise shares for Argus. In 2010, he was named #5 Inventory Picker for Telecom Providers within the Wall Avenue Journal’s Greatest on the Avenue Analyst Survey. In 2008, Joe was named #1 Inventory Picker for Media: U.S. by the Monetary Occasions and was second within the Wall Avenue Journal’s Greatest on the Avenue Analyst Survey for Telecommunications: Fastened Line. For greater than a decade, Joe labored with Technicolor Inc., the place he centered on monetary and authorized points. He obtained his Masters in Enterprise Administration from Fordham College in New York, the place he concentrated in Finance. He earned a BA in Worldwide Affairs from the George Washington College, and spent three years with the Peace Corps in Talgar, Kazakhstan, growing an English Language useful resource middle and instructing college students. Joe is a CFA charterholder.

Markets

Vapotherm director James Liken sells $15,956 in inventory, disposes of extra $119,481 value

In a current transaction, James W. Liken, a director at Vapotherm Inc (NYSE:OTC:), an organization specializing in surgical and medical devices, bought shares of the corporate’s frequent inventory. On January 22, 2024, Liken bought 17,500 shares at a weighted common worth of $0.9118 per share, totaling roughly $15,956.

Moreover, on September 20, 2024, Liken disposed of fifty,308 shares at a worth of $2.18 per share, in addition to an extra 4,500 shares on the similar worth. These disposals, associated to a merger settlement, resulted in a complete of $119,481.

The transactions had been disclosed in a regulatory submitting with the Securities and Trade Fee. Following the gross sales and disposals, it seems that Liken not holds any shares of Vapotherm’s frequent inventory. The reported costs for the shares bought and disposed of ranged from $0.88 to $0.92 and had been at a hard and fast worth of $2.18 per share, respectively.

Traders and events can acquire additional particulars concerning the variety of shares bought at every separate worth upon request, as indicated within the footnotes accompanying the SEC submitting. The footnotes additionally clarify that the disposals had been a part of a merger settlement which concerned a money cost for every share.

Vapotherm’s inventory transactions by insiders are intently watched by buyers as they supply insights into the corporate’s efficiency and insiders’ views on the inventory’s worth.

Lusso’s Information Insights

As buyers scrutinize the current insider transactions at Vapotherm Inc (NYSE:VAPO), it is necessary to contemplate the corporate’s monetary well being and market efficiency. Vapotherm, recognized for its medical and surgical devices, has a market capitalization of $13.59 million, indicating a small-cap inventory which could possibly be topic to greater volatility and distinctive market dangers.

Lusso’s Information information reveals that Vapotherm has had a major worth enhance of 64.08% over the past six months, showcasing a notable surge in inventory worth. This worth motion is according to the Lusso’s Information Tip that the inventory has skilled a big worth uptick in an analogous timeframe. This tip is particularly related because it coincides with the interval main as much as the insider transactions carried out by James W. Liken.

One other Lusso’s Information Tip to contemplate is that Vapotherm operates with a major debt burden and has been rapidly burning by means of money. These elements are essential for buyers to weigh towards the current insider gross sales, as they could replicate on the corporate’s monetary technique and liquidity considerations. Moreover, Vapotherm’s short-term obligations exceed its liquid belongings, which might sign potential liquidity constraints within the close to future.

For these fascinated with additional insights, Lusso’s Information gives extra recommendations on Vapotherm, which may present a deeper understanding of the corporate’s monetary place and inventory efficiency. There are at present 9 extra suggestions listed on Lusso’s Information for Vapotherm, which could be accessed by visiting the devoted web page for the corporate’s metrics and evaluation.

Whereas the current insider gross sales by Liken have drawn consideration, these Lusso’s Information Insights can assist buyers kind a extra complete view of Vapotherm’s present monetary well being and future prospects.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

Markets

Prime Inventory Movers Now: Nvidia, Freeport-McMoRan, Visa, and Extra

Function China / Contributor / Getty Photographs

Key Takeaways

-

Main U.S. inventory indexes had been barely increased at noon Tuesday, as U.S.-traded shares of Chinese language corporations rose after Beijing unveiled a stimulus package deal to spice up China’s financial system.

-

Nvidia shares climbed as Morgan Stanley analysts mentioned the chipmaker is seeing robust demand for its Hopper and Blackwell GPUs.

-

Shares of Freeport-McMoRan, Newmont, and different gold miners gained as the value of gold hit one other document excessive.

Main U.S. inventory indexes had been barely increased at noon Tuesday after China to spice up China’s financial system. The S&P 500 and Dow climbed to document highs, whereas the Nasdaq was additionally within the inexperienced.

U.S.-traded shares of Chinese language corporations and shares of U.S.-based corporations with vital publicity to China surged, with Caterpillar (CAT) main features within the Dow. Las Vegas Sands (LVS) and Wynn Resorts (WYNN) had been additionally increased.

Shares of Freeport-McMoRan (FCX), Newmont (NEM), and different gold miners superior as the dear metallic hit one other all-time excessive.

Shares of synthetic intelligence darling Nvidia (NVDA) additionally climbed as Morgan Stanley analysts mentioned the chipmaker is seeing robust demand for its Hopper and Blackwell .

Visa (V) shares slumped on studies U.S. regulators will file a lawsuit in opposition to the bank card firm, accusing it of wounding customers by monopolizing cost processing know-how. Shares of different bank card suppliers dropped as effectively.

Shares of Regeneron Prescribed drugs (REGN) misplaced floor after a federal decide dominated in opposition to the biotech agency’s declare that Amgen (AMGN) infringed on the patent for its Eylea eye therapy. Amgen shares had been decrease as effectively.

Oil futures climbed and the yield on the 10-year Treasury observe rose. The U.S. greenback gained versus the yen, however fell to the euro and pound. Most main cryptocurrencies had been decrease.

Learn the unique article on .

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June