Markets

Inventory market at the moment: US shares begin jobs report week combined with Powell set to talk

US shares wavered on Monday however had been nonetheless set for robust month-to-month and quarterly positive aspects as buyers waited to listen to Federal Reserve Chair Jerome Powell converse within the run-up to the essential month-to-month jobs report.

The S&P 500 () was down 0.1%, whereas the Nasdaq Composite () bounced off its lows of the day to additionally fall about 0.1%. In the meantime, the Dow Jones Industrial Common () slipped about 0.4%.

The Wall Avenue indexes had been nonetheless eyeing a month-to-month achieve heading into the final buying and selling day of September, usually the cruelest month for shares. The Federal Reserve’s jumbo rate of interest lower and within the US economic system have lifted confidence, serving to shares publish three weekly wins in a row.

Buyers are actually bracing for the September jobs report, due out on Friday, which is seen as . The urgent query is simply how shortly the labor market is slowing because the market weighs whether or not the Fed has acted aggressively to guard a wholesome economic system or to assist a flailing one. Fed Chair Powell’s feedback on the outlook for the economic system on Monday afternoon may assist settle that debate.

Learn extra:

A rising pile of revenue warnings from automakers clouded the temper early Monday. Stellantis (, ) shares tumbled 13% after the Chrysler mum or dad , citing provide chain disruption and weak point in China. Common Motors () and Ford () had been each down round 4% in tandem. Aston Martin (, ) shares plunged over 20% after the luxurious automaker too.

Abroad, China’s benchmark inventory index () , getting into a bull market, as consumers rushed in forward of a weeklong vacation. However in Japan, the Nikkei 225 () as a shock vote wrong-footed buyers betting on an easing-friendly prime minister.

Stay5 updates

Markets

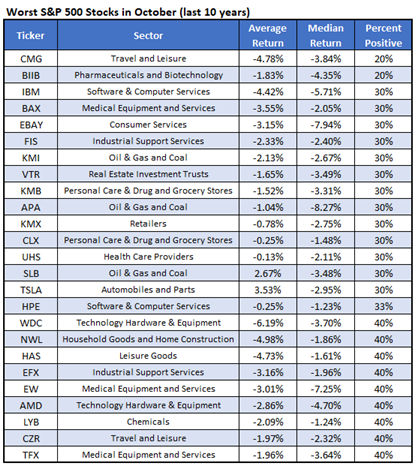

25 Worst Shares to Personal in October, Together with CMG

September turned out to be a powerful month for the market this 12 months, regardless of its status as a traditionally weak interval for shares. October may carry its personal challenges, nonetheless, as it has been deemed risky by a number of information sources, together with Lusso’s Information.

With this backdrop in thoughts, we compiled a listing of the worst shares to personal throughout this upcoming month, and Chipotle Mexican Grill Inc (NYSE:CMG) stands out amongst them. In keeping with Schaeffer’s Senior Quantitative Analyst Rocky White, CMG completed the month of October decrease eight instances over the previous 10 years, averaging a lack of 4.8%.

Eventually look right now, CMG was down 0.4% at $57.56. The inventory has been struggling to interrupt out above the $58.50 area, and holds on to a 26% year-to-date lead.

Choices merchants have been betting on a transfer larger, and an unwinding of this optimism may present headwinds. On the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day name/put quantity ratio of three.56 ranks within the elevated 94th percentile of its annual vary, exhibiting a heavy penchant for calls recently.

Markets

Helene dying toll exceeds 100 as officers rush provides to storm-ravaged areas

By Marco Bello Maria Alejandra Cardona

(Reuters) – Emergency responders in western North Carolina had been racing on Monday to attempt to attain individuals who stay unaccounted for 3 days after Hurricane Helene tore by way of the southeastern United States, killing greater than 100 folks throughout six states, wiping out communications and leaving thousands and thousands with out energy.

In mountainous, hard-hit Bumcombe County, which incorporates town of Asheville, 35 folks have died, the county sheriff mentioned at a information briefing on Monday. The county was set to start distributing meals and water later within the day to residents, after some provides had been airlifted to the area that has been largely remoted by flooded roads and energy outages.

“We do not have water, and we shouldn’t have energy throughout a lot of the county… the roads are nonetheless extremely harmful,” County Supervisor Avril Pinder mentioned.

In neighboring Yancey County, the storm snapped century-old bushes across the residence of Taylor Shelton, 44. It took her husband two days with a chainsaw to chop a passage by way of the felled bushes of their driveway and the close by highway so they might drive themselves and their three youngsters out of the darkened home.

With no cellphone service, they relied on a neighbor who works as an EMT and had a walkie talkie to assist them decide which roads out of the mountains had been satisfactory.

“The devastation is unbelievable,” she mentioned in a telephone interview.

She has nonetheless not been in a position to attain her husband’s mother and father, who dwell within the close by city of Burnsville, which was additionally badly hit.

On Monday, they had been making an attempt to drive again residence to select up their canine and two guinea pigs and miss meals for the cat and the chickens. Their automotive was loaded with espresso, donuts and diapers for his or her neighbors.

“It seems to be like ‘Warfare of the Worlds,’ very, very massive bushes are down in all places,” she mentioned. “We noticed homes which are simply washed away.”

Cell service remained out in massive swaths from Ohio by way of the Carolinas and into Florida. Some 2.1 million properties and companies had been with out energy early on Monday, in line with the web site Poweroutage.us.

“The shortage of communication is regarding,” North Carolina Governor Roy Cooper mentioned on Monday in an interview with CNN. “We all know that there are folks lacking, and we all know that there is going to be vital fatalities on the finish of this and our prayers and our hearts exit to those households.”

Cooper, who mentioned he had not heard from his son and daughter in 72 hours, added that native officers and rescue staff had been performing door-to-door welfare checks in lots of communities.

In Buncombe, officers mentioned they’re conducting checks of 150 “precedence” households that embody aged residents or residents with medical issues.

BIDEN TO VISIT

The Nationwide Guard and emergency staff from 19 states have been deployed to assist, together with Federal Emergency Administration Company personnel. Cooper mentioned the rugged terrain within the mountains of western North Carolina makes it virtually not possible to traverse with landslides and flooding.

“So we’re relying loads on air energy, helicopters with hoist capability to get provides in,” he mentioned.

President Joe Biden mentioned he would go to North Carolina later this week and will ask Congress to return to Washington for a particular session to cross supplemental help funding.

“There’s nothing like questioning, ‘is my husband, spouse, son, daughter, mom, father, alive?'” Biden mentioned on the White Home. “Many extra will stay with out electrical energy, water, meals and communications, and whose properties and companies are washed away straight away. I need them to know we’re not leaving till the job is finished.”

Vice President and Democratic presidential candidate Kamala Harris lower quick a marketing campaign journey in Nevada on Monday to participate in briefings in Washington on the hurricane response and can go to the area when doing so will not impede response efforts, a White Home official mentioned.

Republican presidential candidate Donald Trump will go to Valdosta, Georgia, on Monday to obtain a briefing on storm harm.

Helene slammed into Florida’s Gulf Coast on Thursday evening, triggering days of driving rain and destroying properties that had stood for many years. Because it moved north it washed out roads, decimated neighborhoods and left many communities with out water and primary requirements.

The dying toll was over 100 within the Carolinas, Georgia, Florida, Tennessee and Virginia, and more likely to rise.

Georgia Governor Brian Kemp mentioned on Monday that at the least 25 folks in his state had died, together with a firefighter responding to emergency calls through the storm and a mom and her 1-month-old twins who had been killed by a falling tree.

Harm estimates ranged from $15 billion to greater than $100 billion, insurers and forecasters mentioned over the weekend, as water techniques, communications and demanding transportation routes had been broken or destroyed.

Property harm and misplaced financial output will turn out to be extra clear as officers assess the destruction.

Markets

Why Nio Inventory Surged Once more Monday and May Hold Rising

Nio (NYSE: NIO) shares are down virtually 30% to date this yr. However anybody who purchased inventory within the Chinese language electrical car (EV) maker extra lately has performed fairly effectively. Nio shares have soared by greater than 65% over the previous month.

The inventory continued to surge once more at the moment because the buying and selling week began. Nio’s U.S.-listed American depositary shares had gained 12.7% as of 10:15 a.m. ET. A number of the current spike got here from China’s newest plan to stimulate its struggling financial system. However information that Nio has secured a brand new capital injection from strategic buyers in China has the shares shifting at the moment.

Robust orders for Nio’s new mass-market model

The corporate introduced that three strategic investor companions will , the corporate’s important working unit. Nio may also contribute money for newly issued shares of Nio China that may carry the overall money injection to almost $2 billion.

Nio will subsequently maintain a greater than 88% curiosity in Nio China whereas the opposite present buyers may have practically 12% possession. Whereas Nio completed the second quarter with about , it’s anticipated to burn about $1 billion per yr on common over the subsequent two years as it really works to extend manufacturing quantity and gross sales.

One massive step the corporate lately took was to launch a brand new, household oriented, mass-market model. The Onvo model’s first mannequin started deliveries final week. The corporate stated its mid-size household L60 SUV has acquired “an order consumption far stronger than anticipated.”

Nio could present extra data on the Onvo model when it experiences its September car supply outcomes tomorrow morning. Nio has delivered greater than 20,000 EVs for 4 straight months, and buyers possible count on that streak to be prolonged.

Do you have to make investments $1,000 in Nio proper now?

Before you purchase inventory in Nio, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Nio wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

has positions in Nio. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes