Markets

Is Financial institution of America Inventory a Purchase?

Since late October final 12 months, Financial institution of America (NYSE: BAC) has been on a tear, rising 58% because the Federal Reserve signaled a pause in its rate of interest mountain climbing marketing campaign. The inventory has gained considerably as buyers priced within the pause and potential rate of interest cuts on the finish of this 12 months and into subsequent 12 months, which may assist alleviate strain on the financial institution, whose mortgage portfolio has sizable unrealized losses.

Nonetheless, it stays unclear the place rates of interest shall be on the finish of this 12 months or subsequent 12 months. Coming into the 12 months, markets priced in as many as six rate of interest cuts. These expectations are . Given the latest run-up within the inventory, is it smart for buyers to purchase now? Listed below are some stuff you’ll wish to take into consideration first.

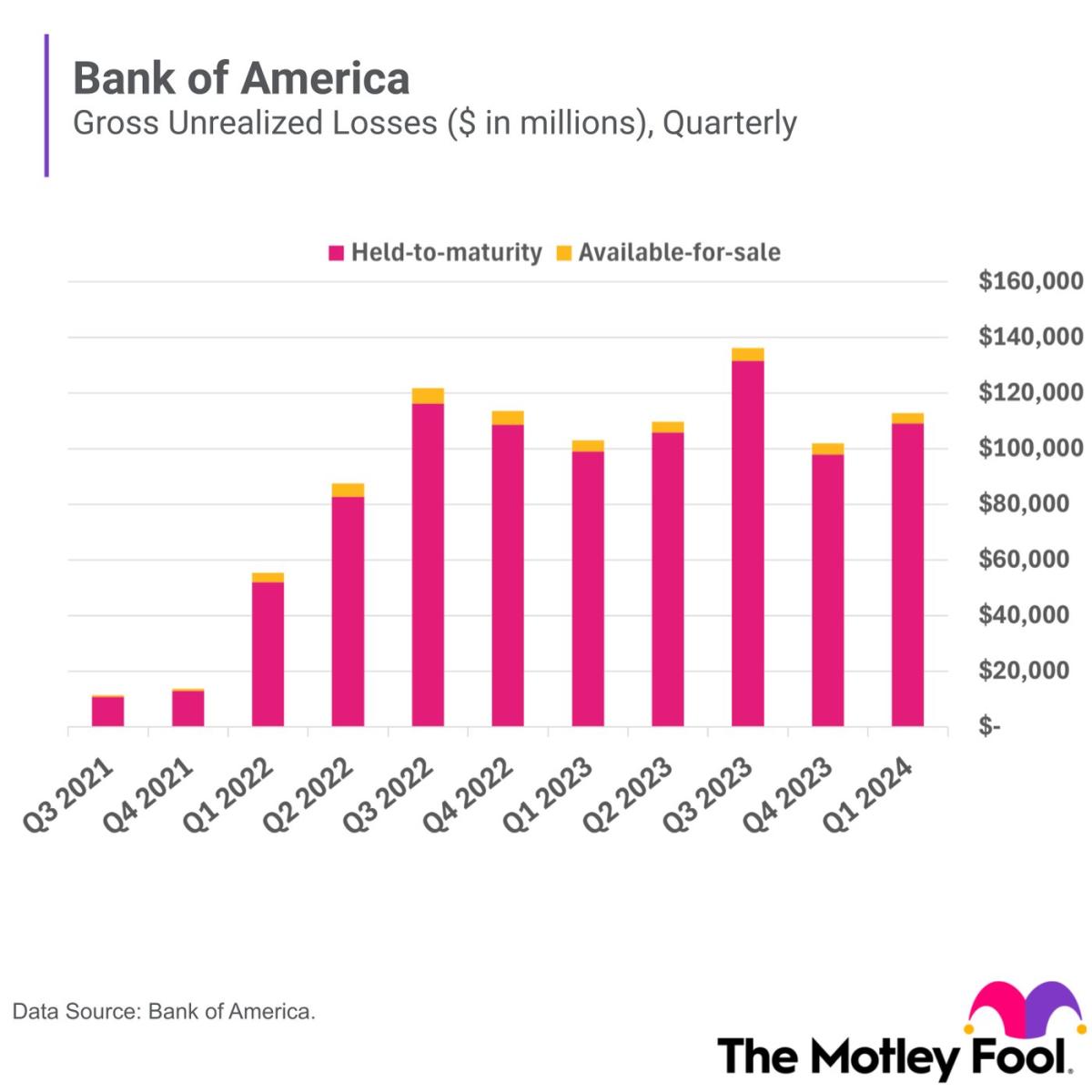

Financial institution of America’s ballooning unrealized losses have drawn investor consideration

Financial institution of America has over $2.5 trillion in complete belongings, making it the second-largest financial institution within the U.S., behind solely JPMorgan Chase. Its sheer measurement makes it a behemoth, and it has held its personal over time as one of many largest banks within the U.S.

Banks are easy companies that absorb deposits and make loans to clients. They earn cash on the distinction between the rate of interest charged on loans and curiosity paid to clients for his or her deposits.

This enterprise mannequin makes the business delicate to swings in rates of interest, and Financial institution of America’s sensitivity is clear by taking a look at its mortgage portfolio. These rising unrealized losses have been a priority amongst some buyers because the Federal Reserve raised rates of interest on the quickest tempo in many years. For the reason that Fed started elevating charges in 2022, the financial institution’s unrealized losses have grown from $14 billion to $113 billion.

Unrealized losses signify the losses Financial institution of America would take if it have been pressured to promote its securities available in the market right now. This does not essentially imply the financial institution is in hassle so long as it may maintain these securities to maturity. Nonetheless, a run on deposits at Silicon Valley Financial institution (a subsidiary of SVB Monetary) final 12 months pressured the financial institution to boost capital and notice big losses on its treasuries, which may have been even worse had the Feds not stepped in.

As one of many largest, most recognizable banks within the U.S., Financial institution of America has a well-diversified deposit base, with 37 million shopper checking accounts and virtually $2 trillion in deposits from people and companies. This gives it with a gentle basis for its enterprise, making it much less susceptible to financial institution runs like these at Silicon Valley Financial institution and different regional banks final 12 months.

BofA’s internet curiosity earnings may proceed to soar increased

The upper rate of interest setting is a double-edged sword for banks. Whereas Financial institution of America’s unrealized losses have ballooned, it has additionally benefited from a rising internet curiosity earnings. The web curiosity earnings is the distinction between the curiosity a financial institution takes on its loans and the curiosity it pays depositors.

When rates of interest are low, as they have been all through 2021, a financial institution’s internet curiosity earnings is low. Nonetheless, during times of rising rates of interest, banks get pleasure from a tailwind as curiosity charged on loans adjusts faster than curiosity paid on deposits. As one of many extra curiosity rate-sensitive banks within the business, Financial institution of America grew its internet curiosity earnings from $43 billion in 2021 to $57 billion final 12 months.

As we speak, banks are in limbo. Within the first quarter, Financial institution of America’s internet curiosity earnings fell in comparison with the identical quarter final 12 months. The financial institution grappled with rising curiosity bills on deposits and slower mortgage development as banks tightened lending requirements amid rising charge-offs, which put strain on its internet curiosity unfold.

Delinquencies and internet charge-offs on shopper loans might be a short-term headwind for the financial institution, however Financial institution of America administration sees a lightweight on the finish of the tunnel. Throughout its first-quarter earnings name, CFO Alastair Borthwick mentioned that delinquency traits have been starting to enhance and that this is able to seemingly result in charge-offs leveling out over the subsequent quarter or two.

Throughout this time, Financial institution of America has capitalized on the “higher-for-longer” rate of interest setting by changing lower-yielding belongings with higher-yielding ones, which ought to assist it develop internet curiosity earnings late this 12 months into early subsequent 12 months.

One analyst at KBW just lately expressed optimism for Financial institution of America and projected its fourth-quarter internet curiosity earnings to be 5% above its earlier estimate. Analyst David Konrad mentioned that internet curiosity earnings and development throughout different key elements of Financial institution of America’s enterprise will assist shut the hole towards its goal of delivering a 15% return on tangible widespread fairness (ROTCE).

Is it a purchase?

Financial institution of America inventory has elevated considerably because the Federal Reserve paused its rate of interest hikes. Regardless of this rally, the inventory continues to be moderately priced at 1.6 instances its tangible and 13.6 instances earnings.

Whereas its enterprise ebbs and flows with the U.S. economic system and prevailing market circumstances, Financial institution of America has finished a wonderful job navigating market cycles. As one of many largest banks within the U.S. with a robust model and sturdy steadiness sheet, the financial institution is poised to do effectively because it makes essentially the most of right now’s rate of interest setting and is a superb inventory to purchase right now.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our skilled crew of analysts points a advice for corporations that they suppose are about to pop. For those who’re nervous you’ve already missed your likelihood to take a position, now could be the most effective time to purchase earlier than it’s too late. And the numbers communicate for themselves:

-

Amazon: when you invested $1,000 once we doubled down in 2010, you’d have $21,765!*

-

Apple: when you invested $1,000 once we doubled down in 2008, you’d have $39,798!*

-

Netflix: when you invested $1,000 once we doubled down in 2004, you’d have $363,957!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of June 24, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. SVB Monetary gives credit score and banking providers to The Motley Idiot. JPMorgan Chase is an promoting companion of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America and JPMorgan Chase. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

2 Magnificent Progress Shares Simply Upgraded by Wall Avenue Analysts to Purchase Now

Shares of Shopify (NYSE: SHOP) and Axon Enterprise (NASDAQ: AXON) have moved in reverse instructions this 12 months. The previous has fallen 4%, whereas the latter has gained 48%. Each shares just lately had their raised by Wall Avenue analysts.

On Sept. 17, Dominic Ball at Redburn Atlantic upgraded Shopify from impartial to purchase and raised his worth goal to $99 per share. That forecast implies a 32% upside from the corporate’s present share worth of $75.

On Sept. 12, Trevor Walsh at JMP Securities on Axon Enterprise to $430 per share. That forecast implies a 12% upside from its present share worth of $383.

Here is what buyers ought to learn about Shopify and Axon.

1. Shopify

Shopify supplies a turnkey resolution for commerce. Its platform helps retailers handle gross sales and stock throughout bodily and digital storefronts, together with on-line marketplaces, social media, and customized web sites. Shopify additionally supplies adjoining service provider companies, like fee processing, logistics, and advertising and marketing software program.

Analysis firm Gartner acknowledged Shopify as a frontrunner in its newest report on digital commerce. Analysts cited strong performance throughout retail and wholesale, momentum with bigger retailers, and speedy innovation as key strengths. Equally, Forrester Analysis acknowledged Shopify as a frontrunner in its newest report on wholesale commerce, citing its broad capabilities and synthetic intelligence (AI) instruments as key differentiators.

Shopify reported good second-quarter monetary outcomes regardless of the unsure financial backdrop. Income elevated 21% to $2 billion because of sturdy gross sales progress in subscription software program and service provider companies. In the meantime, non-GAAP earnings elevated 85% to $0.26 per diluted share. Momentum with massive, worldwide, and offline retailers — three areas the place Shopify has centered its assets — was notably encouraging.

Wall Avenue expects Shopify’s adjusted earnings to extend at 25% yearly by way of 2026. That consensus estimate makes the present valuation of 73 instances adjusted earnings look somewhat dear, however Shopify warrants a premium. Its retail e-commerce market share is 10% within the U.S. and 6% in Western Europe, and it has hardly tapped what administration sees as an $849 billion addressable market.

Affected person buyers can take into account shopping for a small place in Shopify inventory in the present day. If shares pull again, use the chance to construct an even bigger place by way of dollar-cost averaging.

2. Axon Enterprise

Axon is a public-safety firm that sells {hardware} and software program to legislation enforcement, federal businesses, and industrial enterprises. Its portfolio contains performed power gadgets (Tasers), physique cameras, and in-car cameras, which combine with its software program for digital proof administration, report writing, and real-time operations.

Axon has lengthy dominated the marketplace for performed power gadgets — a lot in order that the Taser model identify has grow to be synonymous with the product class. Accordingly, the corporate has a buyer relationship with a “substantial variety of state and native legislation enforcement businesses in the US.” That has helped Axon safe a management place in physique cameras and digital proof administration software program.

Axon reported sturdy monetary ends in the second quarter. Income elevated 34% to $504 million, pushed by notably sturdy gross sales progress in software program and companies, and non-GAAP web earnings elevated 9% to $1.20 per diluted share. The one disconcerting metric was the 41% enhance in working bills that dragged on the underside line, however Axon is spending cash on product growth that ought to reinforce its market management.

As an example, the corporate just lately launched a generative AI service referred to as Draft One which makes use of video knowledge from Axon physique cameras to draft police reviews. CEO Rick Smith just lately informed analysts, “Our prospects’ response to Draft One is healthier than something I’ve seen.” He additionally expressed confidence that Axon will outline the general public security class of generative AI software program as a result of it has the biggest sensor ecosystem and, subsequently, essentially the most strong knowledge.

Wall Avenue expects Axon’s adjusted earnings to extend at 20% yearly by way of 2025. That consensus estimate makes the present valuation of 85 instances earnings look dear, however buyers will possible have to pay a premium to personal a bit of this firm. Axon is a frontrunner in its core product classes, and the corporate has hardly tapped what administration sees as a $77 billion addressable market.

Affected person buyers ought to take into account shopping for a small place in the present day. Shares will most likely pull again sooner or later, and buyers can use that chance to construct a big place.

Do you have to make investments $1,000 in Shopify proper now?

Before you purchase inventory in Shopify, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Shopify wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $694,743!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Axon Enterprise and Shopify. The Motley Idiot has positions in and recommends Axon Enterprise and Shopify. The Motley Idiot recommends Gartner. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Indonesia shares decrease at shut of commerce; IDX Composite Index down 1.50%

Lusso’s Information – Indonesia shares have been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Jakarta, the fell 1.50%.

One of the best performers of the session on the have been Sariguna Primatirta PT (JK:), which rose 0.39% or 5.00 factors to commerce at 1,280.00 on the shut. In the meantime, Victoria Care Indonesia Tbk Pt (JK:) added 535.00% or 535.00 factors to finish at 635.00 and Arwana Citramulia Tbk (JK:) was up 475.00% or 570.00 factors to 690.00 in late commerce.

The worst performers of the session have been Prasidha Aneka Niaga Tbk (JK:), which fell 97.03% or 2,911.00 factors to commerce at 89.00 on the shut. Indospring Tbk (JK:) declined 96.69% or 8,702.00 factors to finish at 298.00 and Logindo Samudramakmur Tbk (JK:) was down 96.57% or 2,704.00 factors to 96.00.

Falling shares outnumbered advancing ones on the Jakarta Inventory Trade by 392 to 254 and 191 ended unchanged.

Crude oil for November supply was down 0.48% or 0.34 to $70.82 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.51% or 0.38 to hit $74.50 a barrel, whereas the December Gold Futures contract rose 0.79% or 20.75 to commerce at $2,635.35 a troy ounce.

USD/IDR was down 0.20% to fifteen,153.55, whereas AUD/IDR fell 0.25% to 10,321.14.

The US Greenback Index Futures was up 0.10% at 100.42.

Markets

Evaluation-Price cuts are right here, however US shares could have already priced them in

By Lewis Krauskopf

NEW YORK (Reuters) – Because the Federal Reserve kicks off a long-awaited fee slicing cycle, some buyers are cautious that richly valued U.S. shares could have already priced in the advantages of simpler financial coverage, making it more durable for markets to rise a lot additional.

Buyers on Thursday cheered the primary fee cuts in additional than 4 years, sending the S&P 500 to contemporary information a day after the Fed lowered borrowing prices by a hefty 50 foundation factors to shore up the financial system.

Historical past helps such bullishness, particularly if the Fed’s assurances of a still-healthy U.S. financial system pan out. The S&P 500 has gained a mean of 18% a 12 months following the primary fee minimize in an easing cycle so long as the financial system avoids recession, in accordance with Evercore ISI information since 1970.

However inventory valuations have climbed in latest months, as buyers anticipating Fed cuts piled in to equities and different property seen as benefiting from looser financial coverage. That has left the S&P 500 buying and selling at over 21 instances ahead earnings, properly above its long-term common of 15.7 instances. The index has climbed 20% this 12 months, at the same time as U.S. employment development has been weaker than anticipated in latest months.

Consequently, the near-term “upside from simply decrease charges is considerably restricted,” mentioned Robert Pavlik, senior portfolio supervisor at Dakota Wealth Administration. “Folks simply get a little bit bit nervous round being up 20% in an setting the place the financial system has cooled.”

Different valuation measures, together with price-to-book worth and price-to-sales, additionally present shares are properly above their historic averages, Societe Generale analysts mentioned in a be aware. U.S. equities are buying and selling at 5 instances their e-book worth, for example, in contrast with a long-term common of two.6.

“The present ranges might be summarized in a single phrase: costly,” SocGen mentioned.

Decrease charges stand to assist shares in a number of methods. Diminished borrowing prices are anticipated to extend financial exercise, which might strengthen company earnings.

A drop in charges additionally reduces yields on money and glued earnings, diminishing them as funding competitors to equities. The yield on the benchmark 10-year Treasury has dropped a couple of full share level since April, to three.7%, though it has ticked up this week.

Decrease charges additionally imply future company money flows are extra engaging, which regularly boosts valuations. However the P/E ratio for the S&P 500 has already rebounded considerably after falling as little as 15.3 in late 2022 and 17.3 in late 2023, in accordance with LSEG Datastream.

“Fairness valuations had been fairly moderately full going into this,” mentioned Matthew Miskin, co-chief funding strategist at John Hancock Funding Administration. “It will be exhausting to duplicate the a number of enlargement you simply bought over the past 12 months or two over the following couple of years.”

With any additional will increase in valuation anticipated to be restricted, Miskin and others mentioned earnings and financial development will likely be key inventory market drivers. S&P 500 earnings are anticipated to rise 10.1% in 2024 and one other 15% subsequent 12 months, in accordance with LSEG IBES, with third-quarter earnings season beginning subsequent month set to check valuations.

On the identical time, there are indicators that the promise of decrease charges could have already drawn buyers. Whereas the S&P 500 has tended to be flat within the 12 months main as much as rate-cutting cycles, it’s up practically 27% in that interval this time round, in accordance with Jim Reid, Deutsche Financial institution’s international head of macro and thematic analysis, who studied information since 1957.

“You can argue that a few of a possible ‘no recession easing cycle’ positive aspects have been borrowed from the long run this time,” Reid mentioned within the be aware.

To make certain, loads of buyers are undeterred by the elevated valuations and preserve a optimistic outlook for shares.

Valuations are usually an unwieldy device in figuring out when to purchase and promote shares – particularly since momentum can preserve markets rising or falling for months earlier than they revert to their historic averages. The ahead P/E ratio for the S&P 500 was above 22 instances for a lot of 2020 and 2021 and reached 25 in the course of the dotcom bubble in 1999.

In the meantime, fee cuts close to market highs are likely to bode properly for shares a 12 months later. The Fed has minimize charges 20 instances since 1980 when the S&P 500 was inside 2% of an all-time excessive, in accordance with Ryan Detrick, chief market strategist at Carson Group. The index has been increased a 12 months later each time, with a mean achieve of 13.9%, Detrick mentioned.

“Traditionally, fairness markets have carried out properly in intervals when the Fed was slicing charges whereas the US financial system was not in recession,” UBS International Wealth Administration analysts mentioned in a be aware. “We count on this time to be no exception.”

(Reporting by Lewis Krauskopf in New York; Enhancing by Ira Iosebashvili and Matthew Lewis)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024