Markets

JPMorgan’s Buying and selling Desk Warns S&P 500 Will Flip Risky on CPI

(Lusso’s Information) — Buyers ought to brace themselves for a bout of inventory market volatility this week after a prolonged interval of calm, primarily based on a warning from JPMorgan Chase & Co.’s buying and selling desk.

Most Learn from Lusso’s Information

The choices market is betting the S&P 500 Index will transfer by 0.9% in both path by Thursday, primarily based on the value of at-the-money straddles expiring that day, in keeping with Andrew Tyler, the buying and selling desk’s head of US market intelligence. The most recent client value index can be reported previous to that session, which may set off a transfer with merchants betting on easing inflation driving the Federal Reserve to chop rates of interest twice in 2024.

“We have now had a number of former Fed governors counsel that September is suitable for a reduce,” Tyler and his workforce wrote in a word to purchasers on Tuesday. “With this in thoughts, we stay tactically bullish, however with barely much less conviction.”

Central bankers typical see the core CPI studying, which strips out the unstable meals and vitality parts, as a greater underlying indicator of inflation than the headline measure. In Might, core CPI climbed 0.16% from a month prior — the softest since August 2021.

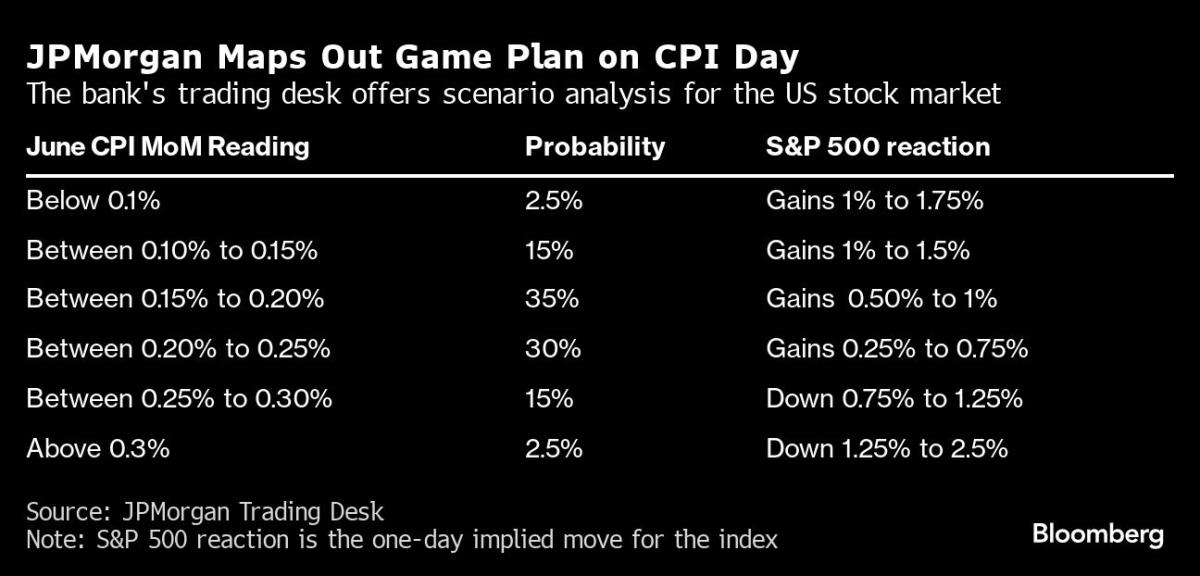

The forecast is for June’s core CPI to rise 0.2% from a month earlier. If it tops 0.3%, that will seemingly spur a selloff throughout danger belongings, with the S&P 500 falling between 1.25% to 2.5%, in keeping with Tyler. However he sees only a 2.5% probability of that occuring.

If core CPI is available in between 0.15% and 0.20% from the prior month — the probably situation to JPMorgan’s buying and selling desk — the S&P 500 is predicted to rise 0.5% to 1%, Tyler wrote. If it is available in between 0.20% to 0.25%, there might initially be a damaging response in equities, however falling bond yields will finally assist shares, sending the S&P 500 up between 0.25% and 0.75%, in keeping with Tyler.

Something under 0.1% can be thought of extraordinarily optimistic for equities, seemingly pulling ahead some requires a July price reduce and sparking a rally of between 1% to 1.75% within the S&P 500, he added.

The potential for a big swing across the CPI report and Fed resolution comes as volatility throughout markets has been traditionally restrained. The the Cboe Volatility Index, or VIX, is buying and selling round 12, close to a 52-week low and much from the 20 degree that begins to boost considerations for merchants. The market pricing in a roughly 70% chance that Fed will cuts charges in September.

“One other step-down could be a optimistic sign to the markets and sure make the requires a September reduce change into deafening,” Tyler wrote. “One secret is whether or not any of the decline is attributed to shelter costs since this has been a supply of the stickiness and any materials step-down right here is effectively acquired and will portend much more disinflation.”

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

1 Extremely-Excessive-Yield Healthcare Inventory to Purchase Hand Over Fist and 1 to Keep away from

Firms with excessive dividend yields can appear engaging, however there’s much more to revenue shares than above-average yields. Any company’s payouts are in peril with no strong enterprise backing it up. That is why choosing the proper dividend inventory requires trying past the yield and into the corporate’s fundamentals.

Let’s illustrate that with two examples: Pfizer (NYSE: PFE), and Medical Properties Belief (NYSE: MPW). Whereas each have engaging yields, the previous is a worthy funding, however the latter, not a lot. This is why.

The high-yield inventory to purchase: Pfizer

The drugmaker’s inventory is not in style in the marketplace proper now, with shares considerably lagging the market over the previous two years. Within the meantime, the inventory’s rose, and as of this writing, it stands at 5.7%. Regardless of Pfizer’s points, the corporate can keep its dividend program.

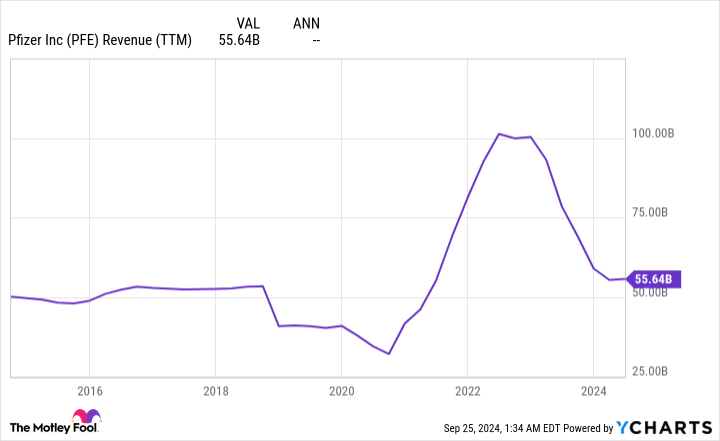

To be truthful, Pfizer’s monetary outcomes are comparatively poor in comparison with what it delivered in 2021 and 2022 — two years throughout which its gross sales skyrocketed because of its work within the coronavirus space. But, its prime line inflected properly above pre-pandemic ranges, a really encouraging signal that factors to secular development within the enterprise.

Pfizer’s COVID-19 medicine will finally cease affecting its outcomes as a lot. Furthermore, there isn’t any letup within the firm’s analysis & growth bills (that are far larger than pre-pandemic ranges) that noticed working and internet revenue drop under pre-COVID ranges.

And so there’s a robust chance that an entire lot of merchandise are within the pipeline, which ought to assist the corporate return to worthwhile development. Presently, Pfizer’s pipeline has over 100 applications. However two areas the place the corporate is focusing its analysis efforts, and price a particular point out, are within the weight reduction house and oncology.

The profitable GLP-1 weight reduction area is rising quickly. Pfizer’s candidate, oral danuglipron, .

Then, there are the corporate’s efforts in oncology. Pfizer acquired Seagen, an oncology specialist, for $43 billion. CEO Albert Bourla mentioned of the acquisition: “We’re not shopping for the golden eggs. We’re buying the goose that’s laying the golden eggs.” Seagen had a number of authorised most cancers medicine and a deep pipeline, however it was a a lot smaller firm than Pfizer, with much less funding and smaller footprints within the business. Now that they’re a single entity, Pfizer ought to grow to be a way more distinguished participant in oncology.

So, regardless of a poorer displaying during the last 12 months or so, the corporate’s underlying enterprise boasts glorious prospects. Pfizer’s dividend needs to be secure. It has elevated its payouts by 17% up to now 5 years. Pfizer is a dependable, high-yield dividend inventory to purchase and maintain.

The high-yield inventory to keep away from: Medical Properties Belief

Medical Properties Belief (MPT), a healthcare-focused actual property funding belief (REIT), has been bruised and battered since early 2023. The corporate’s income, earnings, and share value have all moved within the flawed course.

Not like in Pfizer’s case, this is not as a result of MPT was falling from unimaginable heights. This is the rationale. Steward Healthcare, one in all its essential tenants, had hassle maintaining with hire funds. Steward formally filed for chapter in Might.

Because of this concern, MPT had no selection however to slash its dividends. It has accomplished it twice since mid-2023. MPT’s yield stays spectacular at 5.56%. Nonetheless, dividend seekers detest payout cuts, so MPT won’t be the best choice proper now.

Some will object that the corporate seems to be on the verge of placing its Steward-related issues within the rearview mirror. True sufficient. MPT just lately reached agreements to place new tenants in 15 of the 23 hospitals beforehand operated by Steward Healthcare. The typical time period of the lease is about 18 years.

However as per the settlement, these new tenants will not begin paying hire till the primary quarter of 2025, and even then, they may solely pay half of the contractual settlement by the top of subsequent 12 months. They are going to steadily ramp issues up till they attain the full quantity in fourth-quarter 2026.

It is a win for MPT: It removes its troubled tenant and replaces it with 4 new ones (extra diversification), which (until monetary issues additionally come up with them) can pay common and predictable quantities till no less than 2042 on common. Nevertheless, MPT nonetheless has work to do in fixing its enterprise. It has but to seek out options for a few of Steward’s former amenities, together with some hospitals underneath building.

Even when it had, given the problems it has confronted recently, I might advocate staying away from the inventory, no less than for now. Sure, MPT is enhancing its enterprise, however it’s finest to observe how issues unfold from the sidelines till it may well show that it’s formally again by delivering constantly good outcomes.

Must you make investments $1,000 in Pfizer proper now?

Before you purchase inventory in Pfizer, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and Pfizer wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $740,704!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Poland shares greater at shut of commerce; WIG30 up 0.78%

Lusso’s Information – Poland shares had been greater after the shut on Wednesday, as features within the , and sectors led shares greater.

On the shut in Warsaw, the gained 0.78%.

One of the best performers of the session on the had been CCC SA (WA:), which rose 17.03% or 25.90 factors to commerce at 178.00 on the shut. In the meantime, Pepco Group Nv (WA:) added 5.55% or 1.01 factors to finish at 19.20 and Dino Polska SA (WA:) was up 5.03% or 17.00 factors to 355.00 in late commerce.

The worst performers of the session had been Textual content SA (WA:), which fell 2.95% or 2.10 factors to commerce at 69.20 on the shut. Grupa Azoty SA (WA:) declined 1.67% or 0.34 factors to finish at 20.00 and BUDIMEX SA (WA:) was down 1.65% or 10.00 factors to 594.50.

Falling shares outnumbered advancing ones on the Warsaw Inventory Alternate by 258 to 233 and 118 ended unchanged.

Shares in CCC SA (WA:) rose to 5-year highs; up 17.03% or 25.90 to 178.00. Shares in Textual content SA (WA:) fell to 3-years lows; down 2.95% or 2.10 to 69.20.

Crude oil for November supply was down 1.40% or 1.00 to $70.56 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December fell 1.01% or 0.75 to hit $73.72 a barrel, whereas the December Gold Futures contract rose 0.24% or 6.35 to commerce at $2,683.35 a troy ounce.

EUR/PLN was up 0.34% to 4.27, whereas USD/PLN rose 0.55% to three.82.

The US Greenback Index Futures was up 0.27% at 100.43.

Markets

Inventory market at this time: Shares combined as buyers hold watchful eye on economic system

US shares traded combined on Wednesday after markets hit their newest all-time highs, as buyers seemed to imminent knowledge for clues to the well being of the economic system and the probabilities of one other jumbo charge minimize.

The Dow Jones Industrial Common () reversed earlier good points to fall about 0.4% whereas the S&P 500 () held onto optimistic momentum, rising about 0.1% on the heels of . The tech-heavy Nasdaq Composite () rose about 0.4% after initially opening within the pink.

The query now turns into whether or not or not the US economic system may discover itself in a recession, with issues fanned by a surprisingly . The talk facilities on whether or not the Federal Reserve lowered charges by a bigger-than-usual 0.5% in response to a slowing economic system, and what additional malaise means for one more hoped-for deep minimize.

Learn extra:

On the information entrance, new house gross sales following a pointy enhance the month prior as ultra-high mortgage charges and lofty costs stored consumers totally on the sidelines.

Mortgage functions, nevertheless, stage since 2022, in line with MBA knowledge launched earlier than the bell. The expansion was pushed by householders in search of to refinance loans as charges drop.

However the highlight is firmly on Thursday’s second quarter GDP print and Friday’s essential studying on the PCE index — the inflation gauge favored by the Fed.

The parade of Fed audio system continues with Governor Adriana Kugler, whose feedback will likewise be scrutinized for perception into the dimensions and tempo of coming charge cuts when she seems later Wednesday.

In the meantime, the enhance to markets from China’s massive stimulus launch concerning the steps might be profitable in turning round its economic system.

Reside2 updates

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets2 months ago

Markets2 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs