Markets

Large Reshuffle of $71 Billion ETF Looms as Nvidia Surpasses Apple

(Lusso’s Information) — One of many world’s most distinguished know-how ETFs appears to be like poised for an enormous rebalancing that might ramp up publicity to Nvidia Corp. on the expense of Apple Inc. – spurring billions of {dollars} in buying and selling quantity in a single fell swoop.

Most Learn from Lusso’s Information

Barring an Eleventh-hour deviation from the methodology set out by index supplier S&P Dow Jones Indices, State Avenue World Advisors is on monitor to revamp the composition of its $71 billion Know-how Choose Sector SPDR Fund (ticker XLK) after Nvidia’s market worth closed above Apple on Friday.

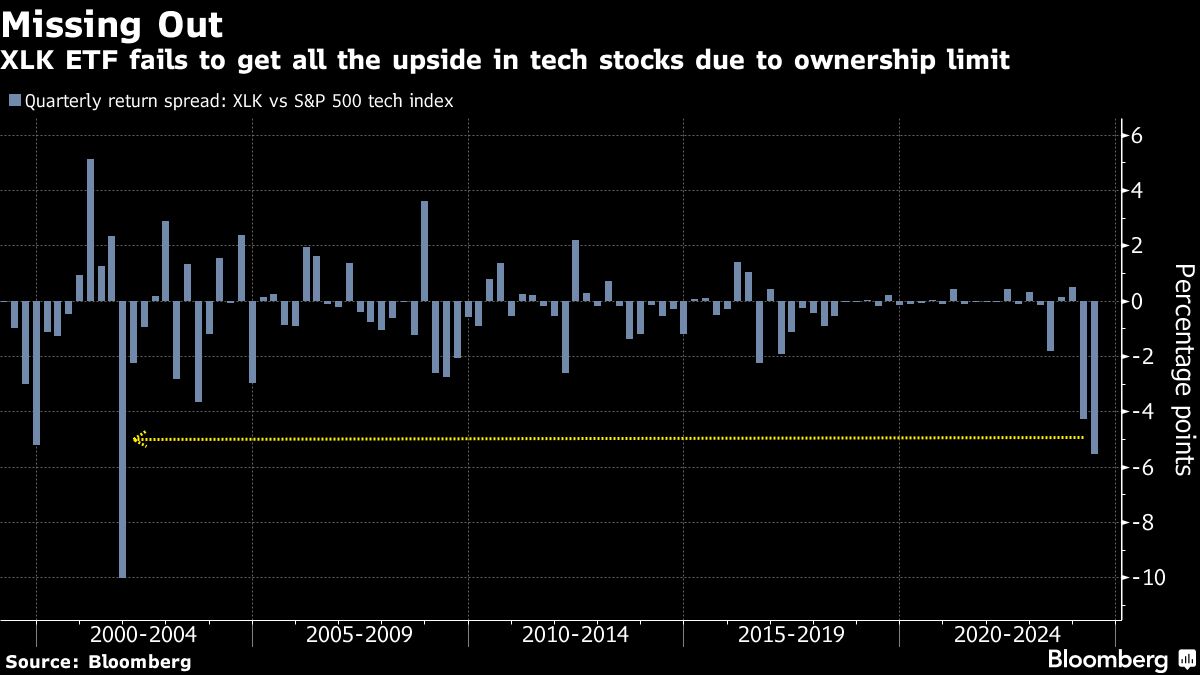

For months, XLK has held means fewer Nvidia shares even because the AI large soared 166% year-to-date. When the chipmaker ranked in third place, it made up roughly 6% of the ETF’s belongings, in contrast with 22% within the S&P 500 Info Know-how Index. The possession cap, imposed underneath diversification guidelines, has brought about XLK to underperform massively this yr.

Whereas S&P in concept reserves the best to make an exception, business individuals say the ETF is on monitor to be re-tooled when it enacts the quarterly rebalance close to the top of June.

On that foundation, Apple and Nvidia are set to reverse their positions within the ETF with the previous’s weight dropping to 4.5% and the latter rising above 20%, based on calculations despatched by the index supplier to 3 market individuals conversant in the matter.

State Avenue stands to buy $11 billion of Nvidia shares and dump $12 billion of Apple, one estimate reveals. That’s not insignificant — the forecast sale in Apple shares is the same as the common every day buying and selling worth up to now three months.

“By our calculation, the flip-flop between Nvidia and Apple will happen,” stated Chris Harvey, head of fairness technique at Wells Fargo Securities. “This aligns the XLK ETF extra intently with the momentum commerce and semis. On the margin, it’s extra {dollars} chasing a inventory that doesn’t want any further assist.”

A spokesperson for S&P declined to touch upon potential index modifications and referred Lusso’s Information Information to the methodology.

Matt Bartolini, head of SPDR Americas Analysis at State Avenue, stated XLK will rebalance based on its guidelines and the methodology. The ETF is obliged to trace the S&P benchmark that’s designed to remain in compliance with the diversification laws.

The foundations “have served traders effectively,” he stated.

S&P has left the door open to creating an exception when it unveils sector weightings on the finish of the month, judging by a doc despatched late final week and seen by Lusso’s Information Information.

The index committee “reserves the best to make exceptions when making use of the methodology if the necessity arises,” S&P wrote in a notice relating to the June rebalance. “In any situation the place the therapy differs from the overall guidelines acknowledged on this doc or supplemental paperwork, purchasers will obtain discover, each time doable.”

S&P stated it’ll ship purchasers so-called proforma paperwork associated to the rebalance for sector indexes every day by way of Friday.

Any last-minute deviation from the general public methodology wouldn’t be taken effectively by merchants, who are likely to take positions in anticipation of doable revisions in index rebalances like this. Whereas it’s getting crowded, shopping for shares which might be getting into main indexes and promoting these which might be exiting them has turn out to be one of the dependable methods for the hedge fund world.

Underpinning the large changes within the duo’s weightings within the ETF are diversification guidelines relationship again greater than 80 years that had been established to safeguard traders from concentrated bets. Beneath these guidelines, the mixed illustration of the most important firms — these making up roughly 5% or extra of a diversified fund — can’t add as much as greater than 50%.

Related restrictions final yr spurred the overseer of the Nasdaq 100 to conduct a particular rebalance to maintain index-tracking funds in compliance with the principles. When this rule is breached, indexes such because the Nasdaq 100 are likely to trim the highest holdings proportionally. XLK’s methodology works in a different way. When quite a lot of shares are usually not in compliance, the smallest of these will get clipped.

This distinctive rule is why Nvidia has been massively under-owned by XLK, main the fund to path the normal S&P 500 tech sub-index by greater than 5 proportion factors this quarter — the widest dispersion since 2001.

With the semiconductor pioneer catching as much as Apple and Microsoft Corp. in measurement throughout latest weeks, XLK’s upcoming rebalances have garnered Wall Avenue curiosity given the prospect of volatility-inducing weight additions and reductions to a few of the world’s most intently watched tech firms.

“I’m to see in the event that they preserve the principles the identical by way of the following rebalance in September,” stated James Seyffart, ETF analyst at Lusso’s Information Intelligence. “If Apple manages to surpass Nvidia or Microsoft by the following rebalance reference date — which is September thirteenth — we may have a mirror picture huge rebalance the place Apple is purchased to the tune of billions and Nvidia or Apple are bought to the tune of billions.”

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Billionaire Ken Griffin Simply Offered 9.3 Million Shares of Nvidia and Purchased This Different Synthetic Intelligence (AI) Inventory That's Headed to the S&P 500 As an alternative

From sifting by means of investor displays and company filings to listening to earnings calls and watching interviews, getting a agency gauge on an funding usually requires a number of work.

One factor that I love to do is analyze . These are varieties filed by funding companies managing over $100 million in shares. One of many extra high-profile hedge funds is Ken Griffin’s Citadel. Final quarter, Citadel decreased its stake in Nvidia (NASDAQ: NVDA) by 79% — dumping 9,282,018 shares. As well as, the agency elevated its place by 1,140% in Palantir Applied sciences (NYSE: PLTR), scooping up 5,222,682 shares.

Let’s dig into what might have compelled Griffin and his portfolio managers to promote Nvidia and purchase Palantir. Furthermore, I am going to discover what catalysts might assist gasoline much more progress for Palantir — and why now could possibly be a good time to comply with Griffin’s lead.

Why promote Nvidia proper now?

On the floor, promoting Nvidia inventory would possibly appear like a questionable transfer. In any case, is not synthetic intelligence (AI) the following huge factor?

Properly, even when AI finally ends up being the generational alternative it is being touted to be, that does not imply an entire lot at face worth. There are numerous parts to the foundations of AI, and Nvidia’s experience within the growth of superior chipsets known as graphics processing models (GPU) is only one of many constructing blocks supporting synthetic intelligence.

The largest bear narrative surrounding Nvidia stems from rising competitors. At current, merchandise developed by Superior Micro Units and Intel are the obvious options to Nvidia. Nevertheless, I see a much bigger danger within the aggressive panorama.

Particularly, Nvidia’s huge tech cohorts together with Tesla, Meta Platforms, Microsoft, and Amazon are all . Contemplating that many of those firms are Nvidia’s personal prospects, I am cautious that the corporate’s present progress trajectory is sustainable in the long term.

When extra GPUs come to market, there’s a good probability this know-how might be considered as considerably commoditized. Such a dynamic will doubtless result in decrease costs for Nvidia, which can subsequently carry decelerating income, margins, and income.

All instructed, I do not actually blame Griffin for promoting such a big portion of his Nvidia place. Regardless of the corporate’s success to this point, its future prospects look doubtlessly questionable.

Why purchase Palantir proper now?

In a distinct space of the AI panorama sits enterprise software program firm Palantir. It affords 4 knowledge analytics platforms known as Foundry, Gotham, Apollo, and AIP. The corporate’s software program is used throughout a bunch of use instances all through the U.S. army and personal sector.

Buyers can see that over the past couple of years, Palantir’s income accelerated on the backdrop of a bullish AI narrative. Extra importantly, the corporate’s working leverage has improved dramatically within the type of margin growth and constant profitability.

Earlier this month, Palantir additionally achieved the notable milestone of inclusion within the S&P 500.

Do you have to purchase Palantir inventory proper now?

I can not say for sure why Griffin elevated his stake in Palantir a lot final quarter, however I do discover the timing fascinating for one specific purpose. Palantir has been eligible for the S&P 500 earlier than however was not initially chosen. Maybe some thought Palantir’s newfound progress was purely an extension of demand for AI software program and wouldn’t be sustainable in the long term.

Regardless of the case, I feel those that have adopted Palantir for a very long time understood that the corporate’s long-run prospects seemed stable — whatever the present AI narrative. Bearing that in thoughts, it was cheap to assume that the corporate could be included within the S&P 500 ultimately.

This leads me to a broader level. Now that Palantir is within the S&P 500, there’s a good probability extra funding banks and analysis analysts will start following the corporate extra carefully. In flip, this might result in a rise in institutional buyers shopping for the inventory. Over time, this might strengthen Palantir’s model and notion within the funding group and produce the inventory to even greater costs.

I feel there’s a good probability Palantir will witness an increase in institutional possession. The corporate is rapidly rising as a drive within the AI software program area, and has even attracted the likes of Microsoft and Oracle — two relationships that I feel will carry even additional progress to the corporate.

I very a lot see even higher days forward for Palantir, and assume now is a superb time to purchase shares. With so many catalysts fueling the corporate’s upside, I see Griffin swapping Nvidia for Palantir as a very savvy transfer.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Units, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Applied sciences, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief November 2024 $24 calls on Intel. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

4 methods Google's new CFO might enhance investor visibility, a number of

Lusso’s Information — With the appointment of a brand new Chief Monetary Officer, Google (NASDAQ:) is at a pivotal second the place it might improve investor communication and transparency, thereby driving higher confidence and enhancing its market a number of.

Morgan Stanley analysts recommend that a number of focused initiatives by the brand new CFO might go a great distance in clarifying Google’s progress story and boosting its valuation.

By specializing in key areas reminiscent of GenAI disclosure, monetary steering, enterprise phase readability, and public relations, Google has the chance to reshape its narrative and encourage extra favorable investor sentiment.

One of many key steps Google’s new CFO might take is to boost the transparency round its Generative AI (GenAI) initiatives.

As AI turns into more and more built-in into Google’s ecosystem, offering extra granular insights into how these applied sciences are performing might considerably enhance investor confidence.

Whereas Google has already begun to share some particulars, there’s a robust case for extra quantitative and qualitative disclosures that supply a deeper understanding of how these improvements are driving income and engagement.

For instance, Morgan Stanley notes how Meta (NASDAQ:) has been profitable in providing detailed stories on engagement metrics for its Reels and AI merchandise.

Such disclosures have helped the market higher grasp the ROI of Meta’s investments, offering a framework that would work equally properly for Google.

By providing clearer information on how GenAI is influencing consumer habits and income progress, Google might give buyers the knowledge they should higher consider the long-term potential of those improvements, which in flip might strengthen confidence in Google’s progress narrative.

Equally necessary is the necessity for constant and clear steering on Google’s monetary outlook, significantly concerning capital expenditures (capex), operational expenditures (opex), and income.

Within the face of heavy funding in AI, the shortage of readability on Google’s spending plans has contributed to market uncertainty. Whereas some opponents, like Amazon (NASDAQ:) and Microsoft (NASDAQ:), present detailed quarterly updates that assist buyers anticipate monetary swings, Google has to date supplied comparatively obscure projections.

As an example, Google’s assertion that “the danger of underinvesting is dramatically higher than the danger of overinvesting” has left a variety of capex expectations for the longer term, which makes it troublesome for buyers to mannequin free money move (FCF) and earnings trajectories.

By tightening its ahead steering—maybe by offering capex ranges or clearer opex self-discipline—Google might give the market a extra steady view of its monetary future. Constant upward revisions of this steering would additionally sign a well-managed and rising enterprise, resulting in improved investor confidence and certain a number of enlargement.

One other essential space the place Google might improve investor visibility is in its enterprise phase reporting, significantly for YouTube and Google Cloud.

These are key progress areas, however the present degree of disclosure round them leaves a lot to be desired.

YouTube, for instance, is a platform that generates important promoting and subscription income, but Google’s present reporting on it tends to understate its full potential.

Analysts at Morgan Stanley imagine that separating YouTube’s promoting and subscription revenues, and providing extra detailed insights into its profitability, would permit buyers to raised mannequin and worth the platform—particularly compared to different video streaming gamers like Netflix (NASDAQ:).

Equally, throughout the Google Cloud phase, clearer differentiation between Google Cloud Platform (GCP) and Workspace would supply buyers with a greater understanding of how Google is competing in opposition to AWS and Microsoft Azure.

Since cloud providers are a significant progress engine for Google, providing extra detailed disclosures right here might considerably enhance how buyers understand Google’s aggressive positioning and progress potential.

Google’s new CFO might assist take management of the general public narrative by emphasizing the constructive societal impacts of the corporate’s services and products.

At a time when regulatory pressures and authorized challenges are mounting, shifting the dialog in the direction of the advantages Google brings to customers, companies, and society as a complete might assist counteract among the unfavourable sentiment.

Google’s merchandise like Maps, Translate, and its contributions to small companies and builders are important, but usually underplayed within the broader narrative.

As Morgan Stanley factors out, Amazon has been efficient in highlighting its societal contributions, reminiscent of job creation and group funding, which has helped improve its public picture.

Google may gain advantage from an analogous method by extra actively speaking how its merchandise positively impression billions of individuals worldwide, from offering free mapping providers to enabling life-saving medical translations.

Such efforts couldn’t solely bolster its status but additionally contribute to a better market a number of by aligning investor sentiment with the corporate’s broader worth to society.

Markets

Investing in This Healthcare Inventory May Be Like Catching Nvidia on the Daybreak of the AI Growth

Nov. 30, 2022, will go down as a defining second in trendy historical past. That is the day OpenAI launched ChatGPT to the lots. Identical to that, euphoria about synthetic intelligence (AI) took over the world.

One of many largest beneficiaries of the AI growth has been semiconductor specialist Nvidia. For those who had purchased shares of Nvidia on the identical day that ChatGPT was launched, you’d be up 583% proper now. Some buyers may suppose that returns of this magnitude are uncommon. I disagree. Shares transfer up for all types of causes, even probably the most unconventional ones.

What’s uncommon, nevertheless, is discovering a high quality firm with professional catalysts that may gasoline long-term progress. Outdoors of AI, one other rising narrative within the inventory market surrounds the rise of glucagon-like peptide-1 (GLP-1) agonists for treating diabetes and weight problems, comparable to Ozempic and Mounjaro.

Not too long ago, I watched an interview with Roundhill Investments CEO Dave Mazza wherein he referred to pharmaceutical chief Eli Lilly (NYSE: LLY) because the “Nvidia of the GLP-1 and weight reduction area.” I really like this analogy, and I agree together with his take. Under, I break down a number of explanation why investing in Eli Lilly proper now could possibly be just like doing so with Nvidia through the daybreak of the AI revolution.

The rise of weight reduction drugs

GLP-1 agonists have change into common amongst diabetes and weight problems sufferers. At this time, Lilly has two main GLP-1 medicines, Mounjaro and Zepbound. These remedies are sending shock waves by way of the pharmaceutical sector and have propelled a brand new section of progress for Lilly.

What’s extra, the corporate’s personal CEO, David Ricks, stated the corporate hasn’t even scratched the floor of its for its GLP-1 lineup. With that in thoughts, it is truthful to suppose that Mounjaro and Zepbound have even higher days forward.

On prime of that, Lilly continues to work laborious to diversify past its injection-based weight reduction remedies. The corporate’s oral resolution, orforglipron, is at present in section 3 medical trials.

Lastly, GLP-1 medicines are prone to witness extra proliferation in the long term. Novo Nordisk‘s Wegovy was just lately granted an expanded indication from the Meals and Drug Administration (FDA) to deal with heart problems in weight problems sufferers. And Lilly has been exploring makes use of for treating obstructive sleep apnea.

A lot extra to supply

Nvidia is finest identified for its chips referred to as graphics processing models (GPUs). The corporate additionally has a big software program enterprise referred to as CUDA that hardly ever will get spoken about. Similarly, there’s much more to Eli Lilly than its .

One in all its different hit medicines is a cyclin-dependent kinase (CDK) inhibitor referred to as Verzenio. It acquired FDA approval in 2017, and simply final 12 months it acquired an expanded indication for use amongst sure most cancers sufferers. This has broadened Verzenio’s addressable market and sparked a brand new section of accelerated progress for the drug.

Past its core portfolio, Lilly is ready to enter one other space in healthcare. In July, the corporate acquired FDA approval for its Alzheimer’s illness candidate, donanemab. Just like the GLP-1 market, treating Alzheimer’s has monumental potential. But there’s restricted competitors at this time outdoors of Biogen‘s and Eisai‘s Leqembi.

Moreover its current alternatives and sturdy pipeline of recent medicines, Lilly can be on the forefront of technological innovation in healthcare.

Earlier this 12 months, it entered into partnership with OpenAI. The objective is to carry the capabilities of generative AI to the healthcare area in an effort to find breakthrough remedies for classy (and maybe uncared for) sicknesses.

An unstoppable power for the lengthy haul

I see a variety of overlap between Nvidia and Lilly. Each corporations are the largest names of their respective industries, and every has a confirmed observe document of growing best-in-class services and products.

Just like the AI narrative, I feel the GLP-1 story is simply starting. To me, it is seemingly that new chapters will embody rising purposes for these medicines, which additional bolsters Lilly’s market potential. While you add the corporate’s entrance into the Alzheimer’s realm and the long-run prospects that AI poses for healthcare, it is laborious to overstate all the progress catalysts Lilly has going for it.

I see it as a generational alternative, and one that may proceed minting important positive aspects for affected person buyers. I feel now is a superb time to purchase shares of Eli Lilly and maintain on for the long run.

Do you have to make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Eli Lilly wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Eli Lilly, Novo Nordisk, and Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Biogen and Novo Nordisk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately