Markets

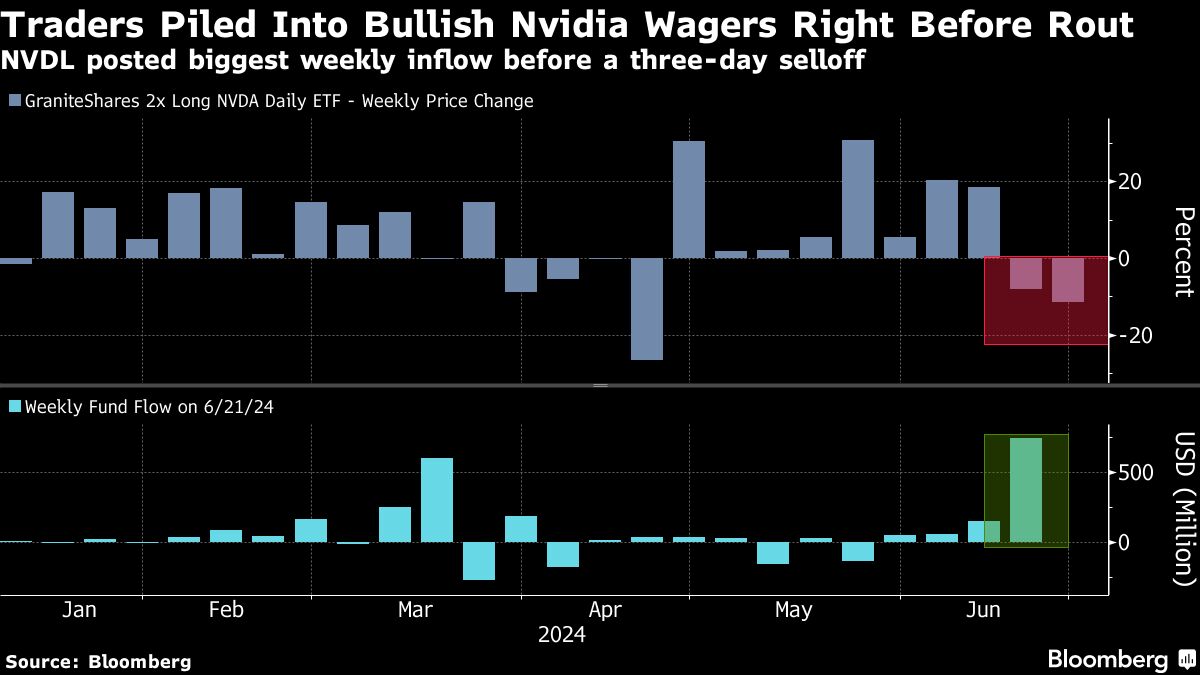

Leveraged Flawed-Means Nvidia Guess Drew $740 Million Earlier than Rout

(Lusso’s Information) — For day merchants using the AI-fueled inventory mania, it’s been a money-minting guess like no different — providing double-digit returns week in and week out.

Most Learn from Lusso’s Information

Now although — after pouring a document amount of money right into a leveraged-up ETF — a cohort of retail traders faces massive losses following the roughly $400 billion wipeout in Nvidia Corp.

The GraniteShares 2x Lengthy NVDA Each day ETF (ticker NVDL), which delivers double the every day return of the Jensen Huang-run firm, noticed a document $743 million influx final week as traders sought to amplify positive factors in what has been dubbed the world’s “most essential inventory.” The timing has confirmed inopportune, because the fund has tumbled round 25% since Tuesday’s shut. It’s nonetheless up about 329% in 2024.

“It’s a very high-risk, high-return transfer piling into leveraged NVDA positions – given the inventory has been pushed by momentum and sentiment, so it’s laborious to inform when the inventory would lastly retrace,” mentioned Dave Lutz, head of ETFs at JonesTrading. “Retail merchants want to essentially perceive the construction of those merchandise to completely perceive the chance they entail.”

The ill-timed rush in final week underscores the feast-or-famine efficiency danger in terms of investing on this high-octane breed of ETF, which makes use of derivatives to spice up returns or reverse efficiency. Inverse and leveraged ETFs are well-liked amongst day merchants as they’re designed to be held for brief durations. However their construction means they will ship swift losses in addition to massive positive factors.

Launched in December 2022, the $3.7 billion ETF has lured about $1.8 billion in 2024, after attracting $189 million final 12 months.

Nvidia, the posterchild of the AI craze, is up some 140% this 12 months. The chipmaker has ascended to turn out to be the second-largest weighting within the $70 billion Expertise Choose Sector SPDR Fund (XLK), comprising over 20% of the tech ETF.

In the meantime, Nvidia bears have gotten crushed this 12 months by the $93 million GraniteShares 2x Brief NVDA Each day ETF (NVD), which tracks the every day inverse return of the underlying inventory, and is down almost 90% this 12 months.

For now, Nvidia’s spectacular surge is taking a breather. The inventory on Monday entered correction territory because it prolonged a pointy selloff. After briefly claiming the title of the world’s largest inventory final week, it has tumbled 13% throughout three periods, previous the ten% threshold that represents a correction.

“NVDA and its AI friends have been ripe for a correction after their large run-up,” mentioned Jane Edmondson, head of thematic technique at TMX VettaFi. “Traders are probably taking some earnings at quarter finish and realigning their portfolio allocations. However the underlying fundamentals are nonetheless in place.”

–With help from Lu Wang.

(Updates shares.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Southwest Airways warns employees of 'robust selections' forward, Lusso’s Information experiences

(Reuters) – Southwest Airways has warned workers that it’s going to quickly make robust selections as a part of a method to revive earnings and counter calls for from activist investor Elliott Funding Administration, Lusso’s Information Information reported on Saturday.

The airline is contemplating making modifications to its flight routes and schedules to extend income, the report added, citing the transcript of a video message to workers by Chief Working Officer Andrew Watterson.

“I apologize prematurely in case you as a person are affected by it,” Watterson mentioned, in response to the report, including that he did not supply any particulars on the pending strikes.

Southwest didn’t instantly reply to a Reuters request for remark.

The airline has been struggling to seek out its footing after the COVID-19 pandemic, partly as a result of Boeing’s plane supply delays and industry-wide overcapacity within the home market.

It plans to supply assigned and extra-legroom seats to draw premium vacationers and begin in a single day flights. It would current the small print to traders on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s frequent shares, informed one of many firm’s high unions it nonetheless needs to switch CEO Robert Jordan, even after the service pledged to shake up its board.

(Reporting by Surbhi Misra in Bengaluru; Modifying by Paul Simao)

Markets

One Wall Road Analyst Simply Added Palantir to Its High Funding Record and Says It May Climb 35%. Time to Purchase?

Proper now could be an thrilling second for Palantir Applied sciences (NYSE: PLTR). It is set to hitch the S&P 500 index on Monday, exhibiting that the corporate is considered one of right now’s leaders.

The inventory has soared greater than 100% to date this yr, even climbing in latest weeks when different tech shares have stumbled. And Palantir is beginning to see huge outcomes from the launch of its Synthetic Intelligence Platform (AIP) final yr.

On high of this, Financial institution of America lately added Palantir to its listing of high investments and predicts the shares may rise 35% from their present stage. The financial institution chosen the inventory for its U.S. 1 Record and expressed optimism about its addition to the S&P 500 and long-term prospects. The listing represents the financial institution’s favorites amongst its buy-rated shares.

Is it time to observe Financial institution of America’s recommendation and purchase Palantir shares? Let’s discover out.

Palantir’s greatest development driver

First, a have a look at Palantir’s path to date. For a few years, the corporate was related to authorities contracts, and these had been its greatest development driver. However in latest occasions, its U.S. business enterprise has emerged as having nice potential for Palantir. It has seen these prospects enhance from simply 14 4 years in the past to almost 300 right now.

And people prospects span a variety of industries. Palantir lately prolonged its settlement with oil firm BP to “enhance and speed up human decision-making” and signed a brand new take care of fast-food chain Wendy’s that may first give attention to decision-making after which embody provide chain administration and waste prevention.

In the latest quarter, U.S. business income soared 55% and commercial-customer rely elevated 83%, exhibiting sturdy momentum right here. On high of this, the corporate posted $134 million in internet earnings within the quarter, its highest quarterly revenue ever.

Now, let’s contemplate what’s forward. The expansion we have seen within the business enterprise together with the truth that it’s pushed by Palantir’s AIP is cause to be optimistic.

Synthetic intelligence is considered one of right now’s highest-growth fields, with corporations hoping to make use of the know-how to turn into extra environment friendly and worthwhile. AIP is exhibiting these prospects and potential prospects (by means of firm “boot camps” that permit them to check the platform) how they’ll do that, after which AIP delivers on these guarantees — so we may think about demand for AIP persevering with.

Reworking Palantir’s enterprise

CEO Alex Karp emphasizes this concept, saying that demand for AIP “reveals no signal of relenting” and that the platform “has already reworked our enterprise.” The overall AI market is anticipated to climb from $200 billion right now to $1 trillion later this decade, suggesting that AIP, which helps prospects attain their AI targets, may proceed to drive development at Palantir.

However simply because the corporate’s business enterprise is hovering doesn’t suggest it has uncared for the purchasers that when had been its bread and butter. Its authorities enterprise continues to excel — in truth, on this latest quarter, for the primary time ever, trailing-12-month income for the U.S. authorities enterprise surpassed $1 billion.

Now, let’s return to our query. Is it time to observe Financial institution of America’s advice and purchase Palantir inventory? Not all analysts are as bullish on it. Truly, the typical analyst estimate expects Palantir shares to fall 27% throughout the coming 12 months.

And the inventory is not the most cost effective round. It truly seems fairly costly, buying and selling at greater than 100 occasions . So, in the event you’re on the lookout for bargain-priced shares, Palantir is not best for you.

That mentioned, development corporations are sometimes recognized to commerce at steep valuations throughout sure moments of their story. So in the event you’re investing in a top quality firm with loads of development forward, you continue to can rating a win in the event you purchase right now and maintain on for the long run — even when the shares are dear right now. Palantir has proven that it has what it takes to maintain earnings climbing, and the truth that it operates within the high-growth space of AI is one other plus.

And all of this implies Palantir right now for development traders who’ve the persistence to speculate now and persist with this thrilling story as many chapters unfold.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for traders to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends BP, Financial institution of America, and Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

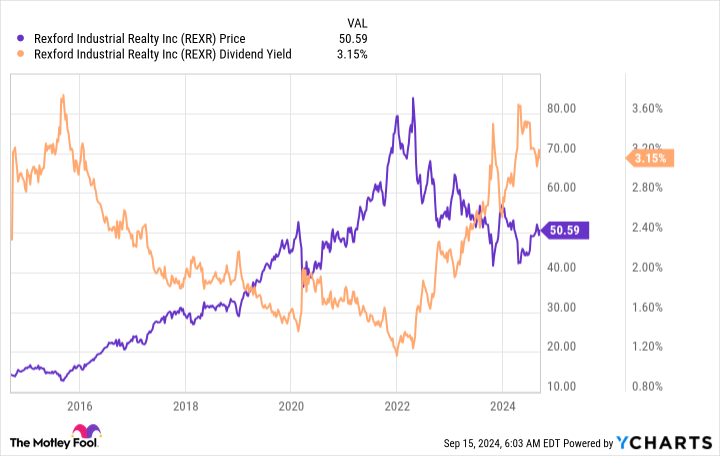

1 Magnificent Excessive-Yield Dividend Progress Inventory Down 40% to Purchase and Maintain Eternally

Usually, traders on the lookout for dividend development would not anticipate finding it in the actual property funding belief (REIT) sector. However generally there are gems that get neglected as a result of they do not conform to the norms. Rexford Industrial Realty (NYSE: REXR) is simply such a genre-defying inventory. Listed below are three explanation why that is one magnificent high-yield dividend development inventory you will need to think about shopping for and holding perpetually.

1. Rexford’s yield is engaging

To get the dangerous information out first, Rexford Industrial’s yield is a little bit under common for a REIT. Rexford’s is 3.3% whereas the common REIT has a yield of roughly 3.7%. Nonetheless, whenever you examine Rexford to the broader market, it seems to be loads higher. That 3.3% yield is sort of 3 times bigger than the S&P 500 index’s paltry 1.2% yield.

And, due to a dramatic pullback in Rexford’s inventory value, the dividend yield can be close to its highest ranges of the last decade. So you’ll find higher-yielding , however Rexford’s yield nonetheless seems to be pretty engaging on each an absolute foundation and relative to its personal historical past.

2. Rexford’s dividend development is massively engaging

You may’t simply take a look at Rexford Industrial’s yield and name it a day. The REIT’s most spectacular dividend statistic is the speed of dividend development it has achieved over the previous decade. REITs are generally called gradual and regular growers; a mid-single-digit dividend development fee is normally thought-about fairly good. Rexford’s dividend expanded at an annualized fee of 13% over the previous decade. That might be an enormous quantity for any firm however is downright phenomenal for a REIT.

Whenever you add the dividend development to the yield, it turns into clear that Rexford is a really engaging development and earnings inventory. In truth, over roughly the previous 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That is an almost 250% leap, one thing that almost any dividend investor would recognize.

3. Rexford’s enterprise mannequin is differentiated

Rexford is an industrial REIT, which is not significantly particular in any manner. Nonetheless, it has a singular geographic focus that units it other than its friends. Not like most industrial REITs, which concentrate on diversification, Rexford has gone all in on the Southern California market. That is proper — it solely invests in a single area of the US. There’s a clear threat on this method, however given the corporate’s robust dividend historical past, the guess administration has made is paying off.

That is truly not too surprising when you step again and study the Southern California market. It’s the largest industrial market in the US and ranks because the No. 4 market globally. Notably, it is a vital gateway for items coming to North America from Asia. Being an important cog within the world provide chain has resulted in excessive demand, with the Southern California area having a dramatically decrease emptiness fee than the remainder of the nation. Add in provide constraints, and Rexford has been capable of enhance charges on expiring leases in latest quarters drastically.

Add that tailwind to the REIT’s improvement plans and acquisitions, and also you get a REIT that appears prone to proceed rewarding traders very effectively for years to come back.

Dividend development traders should purchase Rexford whereas they will

So why is Rexford’s inventory down 40% or so from its all time highs? The reply actually boils all the way down to investor sentiment, which received a bit overheated through the coronavirus pandemic as demand for warehouse house elevated together with on-line buying. Though the joy has worn off, Rexford’s enterprise continues to carry out effectively. In case you are a dividend development investor, you need to think about shopping for Rexford and holding on to it for a really very long time.

Do you have to make investments $1,000 in Rexford Industrial Realty proper now?

Before you purchase inventory in Rexford Industrial Realty, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Rexford Industrial Realty wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Rexford Industrial Realty and Vanguard Actual Property ETF. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024