Markets

Love Inventory Splits? This $100 Billion Firm Says You Aren't the Investor It's Wanting For.

A few yr in the past, shares of on-line journey reserving platform Reserving Holdings (NASDAQ: BKNG) went over $3,000 per share for the primary time. Now they’re approaching $4,000 per share. And if both of these inventory costs are vital to you, then Reserving Holdings CEO Glenn Fogel would favor you not purchase this inventory. You are not the type of investor the corporate is in search of.

In a current interview with Barron’s, Fogel was requested why Reserving hasn’t but contemplating some individuals suppose it is too costly at near $4,000 per share. A inventory cut up would decrease the worth per share and enhance the share rely. Fogel responded by saying, “I do not suppose I need that type of investor.”

That is type of a giant assertion contemplating most buyers do concentrate on this.

A 2023 paper from the Journal of Threat and Monetary Administration famous a constant enhance in buying and selling quantity in a inventory in the course of the month main as much as a inventory cut up. Merchants have been extra energetic after they knew a inventory cut up was coming; it is clearly a giant deal to lots of people.

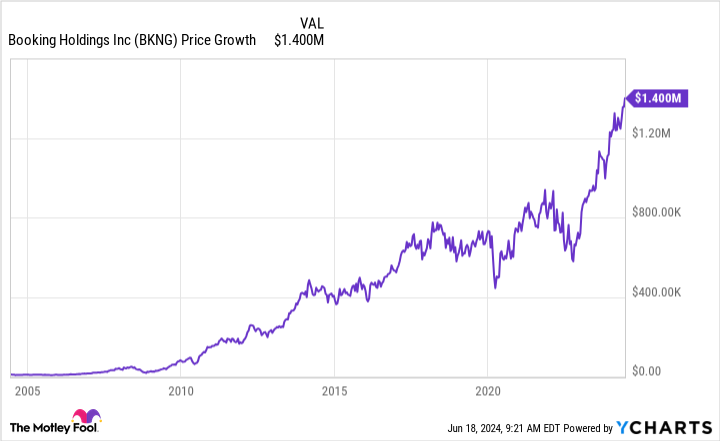

Earlier than split-loving buyers stroll away from Reserving Holdings inventory, although, they need to think about that an funding 20 years in the past held to in the present day would have been a factor of magnificence. A $10,000 funding in June 2004 could be value about $1.4 million in the present day. And it did this with out the assistance of a single inventory cut up.

Here is what Fogel has in frequent with Warren Buffett

Reserving Holdings inventory could be approaching $4,000. However that is kid’s play for Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) contemplating its Class A shares commerce at over $600,000 per share as of this writing. And that value does not trouble CEO in any respect. On the contrary, he prefers it this manner.

In Berkshire Hathaway’s annual assembly in 2004, Buffett stated, “We’re not in search of the individuals who suppose it might be a extra engaging inventory if, as an alternative of promoting at $90,000 a share, it bought at $9 a share.” Due to this fact, Fogel is in good firm — neither he nor Buffett are in search of buyers centered on share value and inventory splits.

Buffett did reluctantly create Class B shares of Berkshire Hathaway in 1996. (They commerce round $400 in the present day.) However the motivation wasn’t to make Berkshire’s value extra engaging. Slightly it was in response to difficult by-product merchandise popping out on the time. Due to this fact, the Class B shares aren’t inconsistent with Buffett’s stance on inventory splits and the kind of investor Berkshire hopes to draw.

However why aren’t these firms in search of stock-split buyers? Merely put, these buyers are usually centered on short-term, trivial issues greater than they’re centered on the issues that result in extraordinary long-term returns. However Buffett, Fogel, and different prime CEOs are centered on the long run and so they need their buyers to be centered on the identical place. In the event that they’re centered elsewhere, they will not be content material with progress made in the proper areas.

About inventory splits in his interview, Fogel went on to say, “I do not suppose that is the place individuals ought to be focusing their ideas on.” The inventory cut up does not affect the worth of the enterprise.

At that assembly in 2004, Buffett additionally stated, “I feel not splitting … has attracted a gaggle of shareholders that basically come the closest to an investment-oriented group as nearly potential.”

Why long-term buyers do not care about splits

A inventory is an possession stake in a enterprise. The value of that possession stake can fluctuate from each day. But when the enterprise turns into greater and extra worthwhile over the course of years, there is a sturdy likelihood that the possession stake can be extra invaluable. That is why the “investment-oriented” people talked about by Buffett are considering years into the longer term and looking out on the issues the corporate can do to create worth.

Inventory splits aren’t a kind of issues.

Reserving Holdings turned a $10,000 funding into $1.4 million by rising its income and earnings by eye-popping quantities. And looking out forward, administration believes it has sturdy alternatives to maintain its progress going.

Reserving Holdings is seeking to leverage synthetic intelligence (AI) to supply a extra personalised platform expertise, which administration hopes will result in vacationers reserving extra points of their journeys multi function place. It calls this imaginative and prescient the “related journey” and it has an actual benefit for buyers.

Slightly than sending vacationers to e book instantly with journey firms, Reserving Holdings hopes vacationers will e book all the pieces instantly by itself platform. This might enhance loyalty to the platform and there is a cash-flow profit to doing enterprise this manner — clients pay Reserving Holdings instantly and the corporate holds on to the money till the journey date.

It is one under-the-radar manner that Reserving Holdings appears to enhance its enterprise over the lengthy haul. And it will probably have a a lot better optimistic affect than any inventory cut up may.

Do you have to make investments $1,000 in Reserving Holdings proper now?

Before you purchase inventory in Reserving Holdings, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Reserving Holdings wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Reserving Holdings. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

JPMorgan CEO Jamie Dimon Calls For Federal Workers To Return To Workplace, Says Empty Buildings 'Trouble' Him: 'I Can't Imagine…'

Benzinga and Lusso’s Information LLC could earn fee or income on some objects via the hyperlinks under.

JPMorgan Chase (NYSE:) CEO Jamie Dimon has known as for federal workers in Washington, DC, to return to their places of work, highlighting the continued debate over

What Occurred: Talking at The Atlantic Competition, Dimon expressed his frustration with the variety of empty buildings within the capital, to Enterprise Insider on Friday.

“By the best way, I’d additionally make Washington, DC, return to work. I can’t consider, once I come down right here, the empty buildings. The individuals who give you the results you want not going to the workplace,” he said,

“That bothers me,” he added. Dimon emphasised that he doesn’t enable such flexibility at JPMorgan.

Don’t Miss:

Why It Issues: Dimon just isn’t alone in his stance. Earlier this week, Amazon (NASDAQ:) CEO Andy Jassy introduced that Amazon workers wouldk, reverting to pre-pandemic norms.

JPMorgan’s coverage mandates managing administrators to be within the workplace full-time, whereas different workers should work in particular person no less than three days every week. Final 12 months, the Biden Administration additionally pushed federal workers to return to in-person work.

Regardless of these efforts, many federal staff nonetheless have versatile work preparations. As an example, some Environmental Safety Company workers are required to be within the workplace solely 4 days a month. Different companies, just like the Division of the Treasury and the Division of the Inside, require no less than 50% in-office presence.

Workplace emptiness charges in DC stay excessive, with about 22% of within the second quarter of 2024, in response to CBRE. The federal authorities and private-sector places of work contribute to this pattern.

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor immediately. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously contemplate the funding targets, dangers, prices and bills of the Fundrise Flagship Fund earlier than investing. This and different info might be discovered within the. Learn them rigorously earlier than investing. -

New fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

This text initially appeared on

Markets

US to suggest barring Chinese language software program, {hardware} in related automobiles, sources say

WASHINGTON (Reuters) – The U.S. Commerce Division is predicted on Monday to suggest prohibiting Chinese language software program and {hardware} in related and autonomous automobiles on U.S. roads attributable to nationwide safety issues, sources informed Reuters.

The Biden administration has raised severe issues concerning the assortment of knowledge by Chinese language firms on U.S. drivers and infrastructure in addition to the potential overseas manipulation of related automobiles. The proposed regulation would ban the import and sale of automobiles from China with key communications or automated driving system software program or {hardware}.

The division plans to offer the general public 30 days to remark earlier than any finalization of the principles, the sources mentioned, including that the division plans to suggest making the prohibitions on software program efficient within the 2027 mannequin yr and the prohibitions on {hardware} would take impact in January 2029. The Commerce Division declined to touch upon Saturday.

Markets

Valuation Angst Is Being Stoked by Fed’s Huge Lower: Credit score Weekly

(Lusso’s Information) — Traders are pouring cash into company bonds, threat premiums are grinding tighter, and the Federal Reserve’s rate of interest reduce is reigniting hopes the US will dodge a recession.

Most Learn from Lusso’s Information

Some cash managers say the market is simply too complacent about causes for concern now.

“You will have the US election arising, and expectations round financial progress in Germany are a few of the weakest it’s been since pre-Covid occasions,” stated Simon Matthews, a senior portfolio supervisor at Neuberger Berman. “Shoppers are feeling the pinch and progress in China is slowing. Whenever you pull that each one collectively, it’s not telling you that credit score spreads ought to be near the tights,” he added, noting that falling borrowing prices will assist scale back a few of the headwinds.

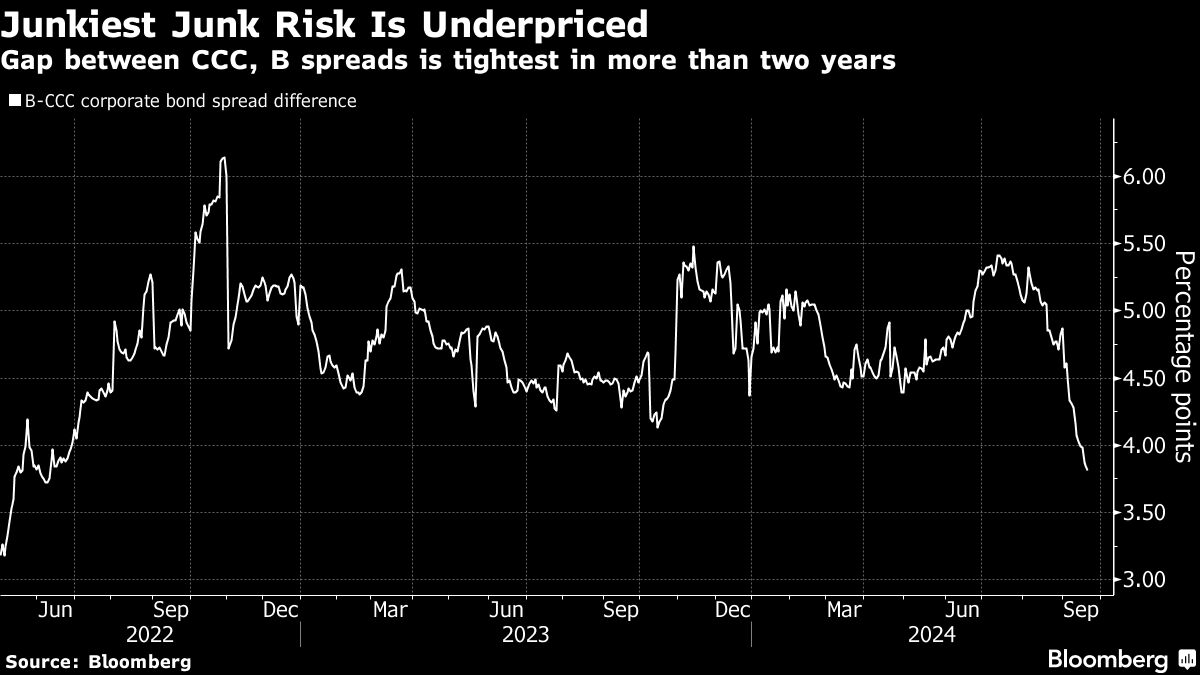

Traders have been setting apart the potential negatives and diving deeper into the riskiest corners of credit score within the hunt for increased yields. The bottom-rated bonds at the moment are outperforming the broader junk bond market whereas demand for Extra Tier 1 bonds, which might drive losses on traders to assist a financial institution survive turmoil, is predicted to extend.

Consumers are betting that decrease borrowing prices will allow debt-laden corporations to refinance and push out their maturities, limiting defaults and supporting valuations. And as short-term charges drop, traders are anticipated to shift their allocations into medium- and longer-term company debt from cash markets which may trigger spreads to tighten even additional.

Nonetheless, inflation may begin ticking up once more if shoppers begin spending extra as rates of interest are reduce, in line with Hunter Hayes, chief funding officer at Intrepid Capital Administration Inc.

“Who is aware of, possibly the Fed funds price has to come back proper again up prefer it has in earlier inflationary cycles after which, swiftly, high-yield bonds are so much much less enticing once more,” he stated.

With US financial coverage more likely to stay restrictive, market members are additionally waiting for indicators of degradation in fundamentals, particularly amongst debtors uncovered to floating-rate debt, BlackRock Inc. researchers Amanda Lynam and Dominique Bly wrote in a observe. As well as, issuers rated CCC stay pressured in combination, regardless of the latest outperformance of their debt, they wrote.

They cited low ranges of earnings the businesses have in combination in contrast with their curiosity expense. Borrowing prices for CCC rated corporations are nonetheless round 10% — crippling for some small corporations after they need to refinance following the top of the straightforward cash period — and leaving them prone to default whilst charges fall.

Any weak point within the labor market would additionally “be a headwind for spreads as it can enhance recession fears and decrease yields,” JPMorgan Chase & Co. analysts together with Eric Beinstein and Nathaniel Rosenbaum wrote in a analysis observe this previous week.

To make sure, valuation issues stay modest and traders are for probably the most half chubby company debt. The start of the rate-cutting cycle also needs to help demand for non-cyclicals over cyclicals within the investment-grade market, analysts at BNP Paribas SA wrote in a observe.

Specifically, restricted issuance by well being care corporations and utilities present room for unfold compression, they added.

“It’s a first-rate alternative for non-cyclicals to outperform,” Meghan Robson, the financial institution’s head of US credit score technique, stated in an interview. “Cyclicals we predict are overvalued.”

Week in Assessment

-

Merchants are piling into bets on additional easing by the US central financial institution after it reduce rates of interest on Wednesday by a half share level — its first discount in 4 years. The historic transfer ended weeks of hypothesis about whether or not the Federal Reserve would kickstart its easing cycle with a quarter- or half-point reduce.

-

The reduce is supportive of credit score spreads general, however it can encourage company bond issuance — notably from high-yield issuers. The reduce will probably favor these borrowing on the front- fairly than back-end of the yield curve, in line with market members surveyed by Lusso’s Information

-

Credit score by-product spreads dipped Wednesday following the transfer, to round their narrowest because the pandemic

-

Nevertheless, Fed Governor Michelle Bowman warns that the 50 foundation level discount “could possibly be interpreted as a untimely declaration of victory” over inflation

-

In different central financial institution information, the Financial institution of England stored charges unchanged and warned traders it received’t rush to ease financial coverage

-

-

Wall Avenue banks burned two years in the past after backing massive company buyouts and ending up with tens of billions of {dollars} of “hung debt” at the moment are again for extra, on the point of underwrite extra European LBOs.

-

Corporations benefiting from decrease financing prices to win higher phrases on present debt or to push out maturities have borrowed probably the most from the US leveraged mortgage market in seven years.

-

Liquidators of China Evergrande Group, the world’s most indebted builder, are returning to a Hong Kong court docket as they try to wind up a subsidiary with key property.

-

UBS Group AG is main a $1.15 billion financing package deal to help Vista Fairness Companions’ acquisition of software program firm Jaggaer, beating out direct lenders who had been additionally competing for the deal.

-

Apollo International Administration Inc. clinched $5 billion in recent firepower from BNP Paribas SA because it appears to develop a key lending enterprise, muscling deeper into turf as soon as dominated by banks.

-

A a lot bigger share of managers within the $1 trillion US collateralized mortgage obligation market are capable of purchase and promote loans extra freely than as soon as feared, after a refinancing and resetting surge pushed again the clock on reinvesting limits.

-

On this planet of personal credit score, KKR & Co.’s capital markets arm led a financing for USIC Holdings to assist repay broadly syndicated debt, whereas Oak Hill Advisors supplied $775 million to help Carlyle Group Inc.’s buy of Worldpac, and Alegeus Applied sciences is seeking to rating about $75 million in curiosity financial savings by means of refinancing the non-public mortgage that Vista Fairness Companions used to take the corporate non-public in 2018.

-

Tupperware filed for chapter after a years-long wrestle with gross sales declines and rising competitors.

-

Bankrupt trucker Yellow Corp. and its hedge fund house owners misplaced a key court docket ruling over $6.5 billion in debt that pension funds declare the defunct firm owes them, probably wiping out most restoration for shareholders.

-

Bausch Well being Cos. is working with Jefferies Monetary Group to discover refinancing a few of its debt to assist a long-planned spinoff of its stake within the eye-care firm Bausch + Lomb.

On the Transfer

-

BlackRock Inc. is overhauling its non-public credit score enterprise. The agency is establishing a brand new division, International Direct Lending, appointing Stephan Caron, head of the European middle-market non-public debt enterprise, to steer it. Jim Keenan, world head of BlackRock’s non-public debt enterprise, will go away the agency subsequent 12 months, as will Raj Vig, co-head of US non-public capital.

-

Silver Level Capital has employed Joseph McElwee from Investcorp as head of collateralized mortgage obligation capital markets and structuring.

-

Jefferies Monetary Group Inc. has employed former Citigroup Inc. banker Simon Francis in a newly created position main its debt financing enterprise in Europe, the Center East and Africa.

-

Constancy Investments has recruited Lendell Thompson, a former director at Vista Credit score Companions, because it continues increasing into the non-public credit score market. He will probably be a managing director within the agency’s direct lending workforce.

–With help from Dan Wilchins and James Crombie.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024