Markets

Manufacturing Exercise Declines in New York State

Supply Occasions and Provide Availability

Supply occasions shortened considerably, as indicated by the supply occasions index at -4.1. The newly launched provide availability index recorded a -1.0, displaying little change within the availability of provides.

Labor Market Circumstances

The labor market continued to battle, with the variety of staff index at -8.7, displaying an additional decline in employment ranges. The typical workweek index dropped to -9.9, indicating a discount in hours labored. These figures spotlight ongoing weak point within the labor market throughout the manufacturing sector.

Value Actions

The tempo of value will increase for each inputs and outputs moderated for the second consecutive month. The costs paid index decreased by 4 factors to 24.5, and the costs acquired index fell by seven factors to 7.1, its lowest stage in a yr. This moderation suggests a cooling off within the inflationary pressures throughout the manufacturing sector.

Optimism for the Future

Regardless of the present weak exercise, there was a notable enhance in optimism concerning the six-month outlook. The index for future enterprise situations surged sixteen factors to 30.1, with almost half of the respondents anticipating higher situations forward. Nevertheless, the outlook for employment progress remained pessimistic, and capital spending plans continued to seem sluggish.

Market Forecast

The June 2024 Empire State Manufacturing Survey presents a combined outlook. The modest decline in enterprise exercise and ongoing labor market weaknesses level to continued challenges within the close to time period. Nevertheless, the numerous rise in future enterprise optimism suggests a possible turnaround within the latter half of the yr. For merchants, the present knowledge signifies a cautious strategy is warranted, given the bearish undertones of the current situations. Nonetheless, the rising optimism might sign a bullish shift in market sentiment if upcoming knowledge helps this optimistic outlook.

Markets

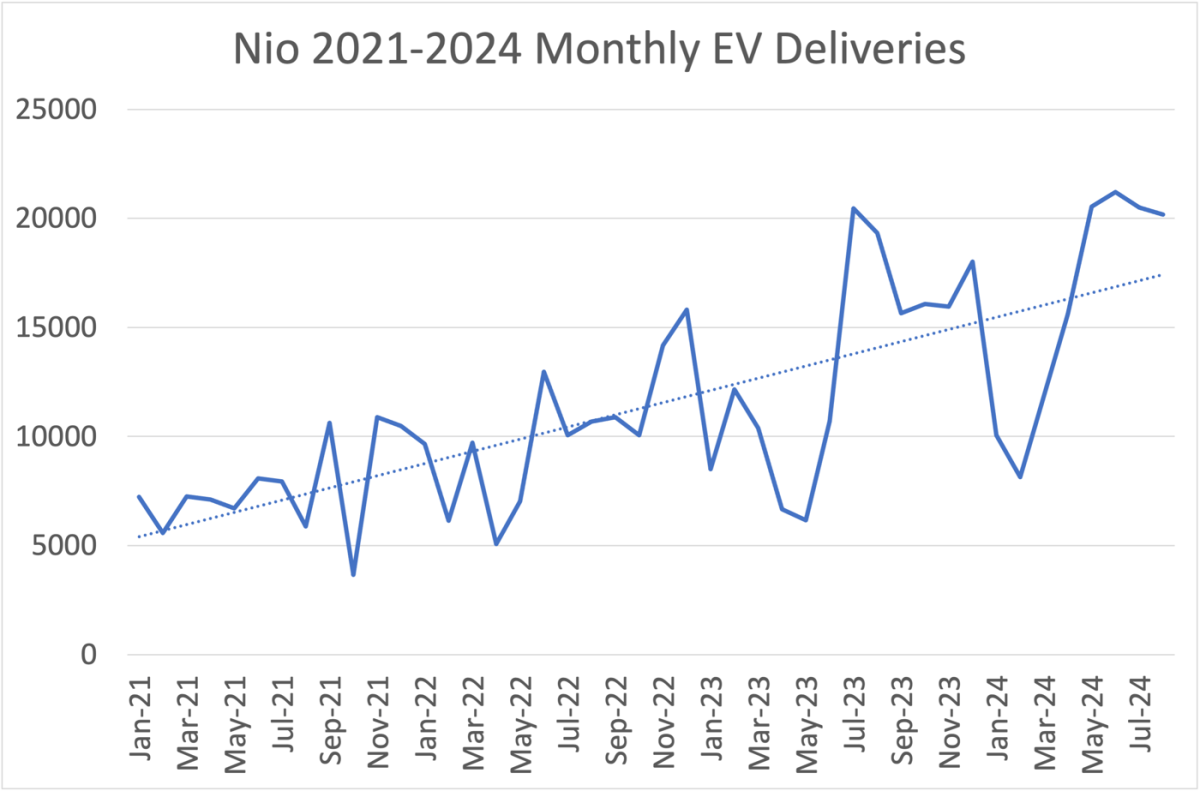

Prediction: This Will Be Nio's Subsequent Large Transfer

It could be laborious for buyers to get enthusiastic about an organization that has misplaced almost $1.5 billion from its operations within the first half of this 12 months. In actual fact, Chinese language electrical automobile (EV) maker Nio (NYSE: NIO) has by no means made a revenue.

That helps clarify why the inventory has misplaced greater than 80% of its worth over the previous three years. However there was additionally some significant and constructive information in Nio’s second-quarter report. That enterprise momentum has translated to the inventory value, as Nio’s American depositary shares have surged greater than 40% within the final month.

The is now at about $11 billion, and the maker ended the quarter with $5.7 billion in money and equivalents. That makes now a superb time to have a look at what Nio’s subsequent huge transfer will probably be and whether or not it is a inventory that must be in your portfolio.

A step towards earnings

One of the crucial notable achievements from Nio in Q2 was to considerably enhance its automobile revenue margin. Automobile margin, which is predicated on income and price of recent automobile gross sales, was 12.2% within the quarter, in comparison with simply 6.2% within the prior-year interval. That was helped by income that just about doubled 12 months over 12 months.

After years of suits and begins, it seems that Nio is lastly hitting its stride in automobile manufacturing and gross sales development. That comes as international competitors has grown within the EV sector. Nio has offered over 20,000 EVs for 4 consecutive months for the primary time. That has aided in gaining market share and boosting margins.

The corporate simply set a brand new quarterly file with greater than 57,000 models shipped. It additionally supplied steering for third-quarter automobile deliveries in a variety of 61,000 to 63,000 EVs. Nio’s CEO William Li famous that the corporate’s Q2 gross sales quantity led it to securing greater than 40% of market share inside China for EVs priced above the equal of about $42,000. And Nio has a plan to maintain increasing. Its concentrate on the luxurious finish of the market has helped it compete towards Chinese language EV chief BYD, which claims the lion’s share of the lower-priced Chinese language EV market.

Addressing vary anxiousness

Nio has been a pacesetter in China and elsewhere in working to broaden battery charging and its distinctive battery swapping know-how. Nio’s battery swap stations give EV consumers the choice to decrease the upfront automobile price by paying a month-to-month subscription for its Battery as a Service (BaaS) plan. Drivers can use its swap stations to switch drained batteries with freshly charged ones, a course of that takes solely minutes.

Final month, Nio introduced a brand new plan to strengthen its charging and battery swapping community throughout China. Its “Energy Up Counties” plan will speed up the buildout of these networks.

As of Aug. 31, Nio had over 2,500 battery swap stations globally, with over 800 strategically positioned on China’s expressways. With over 577,000 Nio automobiles on the roads, it has supplied battery swaps greater than 50 million occasions. Its new plan will lead to energy swap stations being accessible in hundreds of Chinese language counties by the tip of subsequent 12 months. It additionally plans to construct a brand new manufacturing facility to create as much as 1,000 energy swap stations yearly.

Mass market model

Nio’s new Onvo model may also make the most of the increasing charging and swapping networks. Onvo is Nio’s new entry-level EV model that seeks to faucet extra of a mass market and tackle Tesla‘s Mannequin Y. The Onvo L60 mid-size SUV has a beginning value of about $30,000.

That model, mixed with Nio’s current and rising charging know-how and infrastructure, could possibly be the subsequent driver for Nio’s enterprise and the inventory. Traders who’re prepared to be aggressive may add Nio inventory now, anticipating its subsequent section of development with Onvo. In any other case, look ahead to indicators that Onvo is gaining traction to be considerably extra conservative and nonetheless doubtlessly get forward of Nio’s subsequent huge transfer.

Must you make investments $1,000 in Nio proper now?

Before you purchase inventory in Nio, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Nio wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in BYD Firm, Nio, and Tesla. The Motley Idiot has positions in and recommends BYD Firm and Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

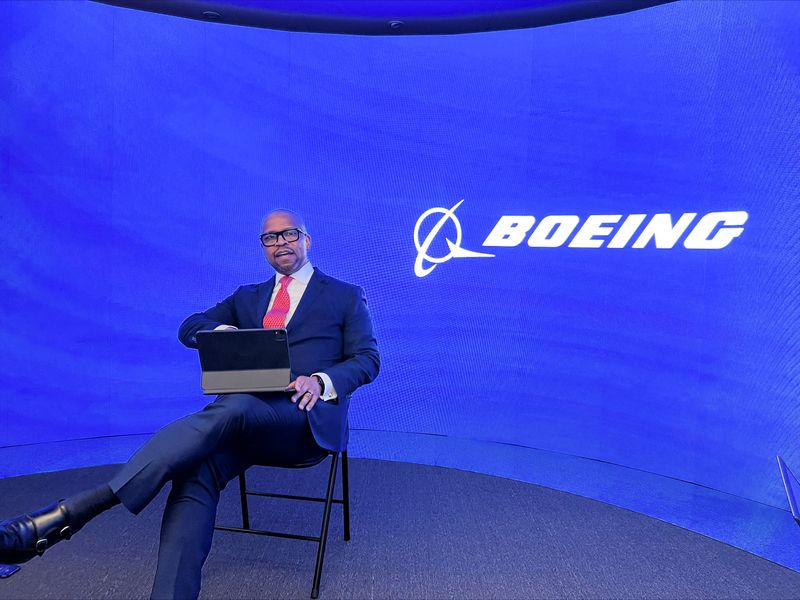

Boeing’s area and protection chief exits in new CEO’s first govt transfer

By Joe Brock, David Shepardson and Tim Hepher

(Reuters) – Boeing (NYSE:) mentioned on Friday the pinnacle of its troubled area and protection unit is leaving the corporate instantly, within the first administration change beneath new CEO Kelly Ortberg.

Ortberg who took over in August mentioned Ted Colbert can be leaving and Steve Parker, the unit’s chief working officer, would assume Colbert’s obligations till a alternative is called at a later date.

“At this important juncture, our precedence is to revive the belief of our prospects and meet the excessive requirements they count on of us to allow their important missions all over the world,” Ortberg wrote in an e mail to staff. “Working collectively we will and can enhance our efficiency and guarantee we ship on our commitments.”

Boeing’s area enterprise has suffered vital setbacks, notably NASA’s current determination to ship Boeing’s Starliner capsule house with out astronauts that adopted years of missteps. Starliner has price Boeing $1.6 billion in overruns since 2016, in keeping with a Reuters evaluation of securities filings.

Colbert’s departure comes at a time when Boeing has been attempting to avoid wasting money by asserting furloughs of hundreds of white-collar employees amid a strike by greater than 32,000 of its employees.

Boeing has additionally confronted vital woes after a brand new Alaska Airways 737 MAX 9 in January suffered a mid-air emergency after it was lacking 4 key bolts.

Boeing in July agreed to plead responsible to a felony fraud conspiracy cost and pay no less than $243.6 million after breaching a 2021 deferred prosecution settlement. The federal government mentioned Boeing knowingly made false representations to the Federal Aviation Administration about key software program for the 737 MAX.

The FAA has tightened oversight of Boeing and barred it from increasing manufacturing of the MAX past 38 planes monthly till it makes vital high quality and security enhancements.

Parker was introduced in to shore up industrial management and assist repair loss-making packages with a brand new working administration function slightly below two years in the past. He had beforehand headed Boeing’s bomber and fighter packages in addition to its St Louis protection crops.

“Traditionally, Boeing held a superior popularity for our potential to handle packages, and we have to guarantee it stays a key differentiator for us sooner or later,” Ortberg wrote in separate e mail to staff on Friday.

Ortberg added he had discovered “extra concerning the future investments we have to make to be aggressive and outline our future, in addition to about among the extra near-term hurdles engineering faces with first-time high quality and execution.”

Colbert, who joined Boeing in 2009 after working at Citigroup and Ford Motor (NYSE:), took the reins at Boeing Protection and Area in April 2022 after the prior head of protection was ousted.

Boeing’s protection, area and safety unit, certainly one of its three foremost companies, has misplaced billions of {dollars} in 2023 and 2022, which executives attributed largely to price overruns on fixed-price contracts.

Such contracts have excessive margins however go away protection contractors weak to inflationary pressures which have dented U.S. company earnings in the previous couple of years.

Boeing has misplaced greater than $2 billion on its delayed program to ship two closely retrofitted Boeing 747-8s to be used as U.S. presidential plane generally known as Air Power One. The 747-8s are designed to be an airborne White Home capable of fly in worst-case safety situations, reminiscent of nuclear warfare.

Boeing’s shares closed down about 1% on Friday and have misplaced about 41% thus far this 12 months.

Markets

Neglect Nvidia: This Different Inventory Could Finish Up Being the Most Vital Knowledge Middle Alternative of All, and It's Not a Expertise Firm

When you consider synthetic intelligence (AI), issues equivalent to self-driving vehicles and humanoid robots may come to thoughts. Counterintuitively, it is usually a good suggestion to consider how merchandise are literally delivered to life every time a brand new large development emerges. A number of the most profitable alternatives are additionally usually the least apparent ones.

For AI to even work correctly, firms have to take a position massive sums of into information facilities. Though information facilities may seem to be only a piece of actual property, they’re much more refined and essential. They home essential IT infrastructure, equivalent to chipsets often called graphics processing items (GPUs) — an essential element of generative AI purposes.

At present, Nvidia is among the largest names within the information middle realm. However what if I instructed you I see one other alternative because the superior alternative amongst information middle investments and that it isn’t even a expertise firm?

It is essential to contemplate all choices — even probably the most tangential ones. Let’s dig right into a nuclear power inventory that I feel could find yourself being crucial information middle firm in the long term and discover why this could possibly be a profitable alternative for buyers.

Nuclear-powered information facilities are on the rise, and…

A significant promoting level of AI is that the expertise can deliver a brand new wave of effectivity to a bunch of use instances. From breakthroughs in enterprise software program to self-driving vehicles, AI is promising a brand new stage of productiveness and security that is by no means been witnessed.

Though that sounds nice, as with all issues, AI comes with some main trade-offs. Particularly, constructing AI purposes is an expensive ambition. GPU {hardware} and high-performance computing software program are among the extra apparent bills in AI growth. One of many extra refined prices in an AI roadmap resides with information facilities, notably their power consumption.

GPUs are continually operating advanced algorithms and performing refined computing duties. This makes and, specifically, give off a variety of warmth. Knowledge facilities are outfitted with numerous temperature management protocols, equivalent to air con items, followers, and turbines.

Nevertheless, these options are each expensive and could be inefficient in comparison with different sources of power management. An rising development on the crossroads of information facilities and power consumption is nuclear energy, and a few actually notable firms and enterprise leaders are getting concerned.

…a variety of large names are concerned

One notable firm concerned with nuclear-powered information facilities is Amazon. One of many largest companies in Amazon’s ecosystem is its cloud computing platform, Amazon Net Providers (AWS). Earlier this 12 months, AWS acquired a nuclear-powered information middle from Talen Power for a reported $650 million.

One other participant rising on the nuclear energy scene is Oklo. Oklo develops nuclear fission reactors that it goals to promote to information facilities and utility firms.

When it was nonetheless a personal firm, Oklo raised funding from Peter Thiel and OpenAI co-founder Sam Altman. Just a few months in the past, Oklo went public via a particular function acquisition firm (SPAC).

In line with its investor presentation, the corporate has obtained curiosity for its reactors from main firms, together with Diamondback Power, Equinix, Siemens Power, and even the U.S. Air Power.

Whereas this caliber of consideration and Altman’s assist are spectacular, I see Oklo as a dangerous guess in the meanwhile. The corporate continues to be pre-revenue, and the potential offers referenced above are in early-stage negotiations.

Oklo will seemingly require hefty ongoing analysis and growth (R&D) prices to construct out its reactors, which is able to take a toll on the corporate’s liquidity as long as there aren’t materials gross sales coming via the door.

My prime decide on the intersection of nuclear power and information facilities is…

My best choice amongst nuclear energy suppliers for information facilities is Constellation Power (NASDAQ: CEG). The corporate presents a bunch of power companies however is making sustainability and nuclear power a selected focus.

One of many firm’s recognized nuclear energy prospects is “Magnificent Seven” member Microsoft. Throughout the firm’s second-quarter earnings name in late August, CEO Joseph Dominguez referenced Comcast and Johns Hopkins as different notable prospects of Constellation’s carbon-free power companies.

Different mega-cap tech firms will seemingly comply with Amazon and Microsoft’s strikes. Constellation’s various buyer base alerts that inexperienced power isn’t just a use case for information facilities or large tech hyperscalers.

Buyers with a long-term horizon could need to take into account a place in Constellation Power proper now. I feel nuclear power options will grow to be extra mainstream because the AI revolution continues to evolve. Given how early the AI narrative appears to be, I feel a possibility equivalent to Constellation Power is basically missed or underappreciated — making it a tempting purchase amongst different alternatives in AI, information facilities, and power consumption.

Must you make investments $1,000 in Constellation Power proper now?

Before you purchase inventory in Constellation Power, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Constellation Power wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Amazon, Constellation Power, Equinix, Microsoft, and Nvidia. The Motley Idiot recommends Comcast and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024