Markets

Meet the 15 members of the $100 billion membership — who’re collectively price greater than Amazon or Google

-

The elite group price greater than $100 billion consists of Elon Musk, Jeff Bezos, and Invoice Gates.

-

The 15 members have grown about $280 billion richer this yr and are collectively price $2.2 trillion.

-

Walmart inheritor Jim Walton joined the membership this week and his siblings may quickly observe.

Elon Musk, Jeff Bezos, and Mark Zuckerberg are among the many handful of individuals on the planet with a internet price above $100 billion.

Members of this elite group have amassed 12-digit fortunes by proudly owning enormous quantities of inventory in a number of the world’s most beneficial corporations. Most are founders and both present or former CEOs, and some, akin to , can be a lot richer in the event that they did not give billions to charity.

There could also be solely 15 centibillionaires, however their mixed wealth is round $2.2 trillion, in accordance with the . That is greater than the $1.9 trillion market capitalizations of Amazon and Google’s guardian firm, Alphabet.

All however certainly one of them have grown richer this yr, including a internet $280 billion or so to their collective fortunes. Adobe ($257 billion), Chevron ($250 billion), and PepsiCo ($241 billion) are all price lower than that.

Walmart inheritor Jim Walton the unique group this week due to a $28 billion improve in his internet price this yr. His siblings, Rob and Alice, may quickly observe given their respective internet worths of $98.3 billion and $97.7 billion.

Here is the checklist of people price at the least $100 billion, exhibiting Lusso’s Information’s estimate of their internet price on the time of publication, how a lot it is modified this calendar yr, and the supply of their wealth.

All figures are right as of September 12, 2024.

1. Elon Musk

Web price: $248 billion

YTD change in wealth: +$18.8 billion

Supply of wealth: Tesla and SpaceX inventory

is the CEO of the electric-vehicle maker Tesla and the spacecraft producer SpaceX. He is additionally the proprietor of X, the social community previously generally known as Twitter.

His different companies embody The Boring Firm, Neuralink, and xAI.

2. Jeff Bezos

Web price: $202 billion

YTD change in wealth: +$25.4 billion

Supply of wealth: Amazon inventory

is the founder, government chairman, and former CEO of Amazon, the e-commerce and cloud-computing large.

He additionally based the house firm Blue Origin and owns The Washington Publish.

3. Bernard Arnault

Web price: $180 billion

YTD change in wealth: -$27.8 billion

Supply of wealth: LVMH inventory

is the founder, chairman, and CEO of LVMH Moët Hennessy Louis Vuitton. His conglomerate owns a bevy of luxurious manufacturers, together with Dior, Fendi, Dom Pérignon, Sephora, and Tiffany & Co.

4. Mark Zuckerberg

Web price: $179 billion

YTD change in wealth: +$51.4 billion

Supply of wealth: Meta inventory

is the cofounder, chairman, and CEO of Meta Platforms, the social-media titan behind Fb, Instagram, WhatsApp, and Threads.

Meta’s Actuality Labs division makes virtual-reality and augmented-reality headsets and experiences.

5. Larry Ellison

Web price: $168 billion

YTD change in wealth: +$45.1 billion

Supply of wealth: Oracle and Tesla inventory

is the cofounder, chief know-how officer, and former CEO of Oracle, an enterprise software program firm specializing in cloud computing and database platforms.

He invested in Tesla previous to becoming a member of the automaker’s board in 2018 and by the point his time period as a director led to August 2022.

6. Invoice Gates

Web price: $158 billion

YTD change in wealth: +$17.2 billion

Supply of wealth: Microsoft inventory

is the cofounder and former CEO of Microsoft, which makes the Workplace utility suite, the cloud-computing platform Microsoft Azure, and Xbox consoles.

He is famend for his philanthropic work on the helm of the Invoice & Melinda Gates Basis, one of many world’s largest charitable entities.

7. Warren Buffett

Web price: $145 billion

YTD change in wealth: +$24.8 billion

Supply of wealth: Berkshire Hathaway inventory

acquired Berkshire Hathaway when it was a failing textile mill in 1965 and has since grown it into one of many world’s largest corporations. His practically 15% stake is price round $145 billion.

The famed investor’s conglomerate owns scores of companies, together with GEICO, See’s Candies, and BNSF Railway, and holds multibillion-dollar stakes in public corporations akin to Apple and Coca-Cola.

Buffett has round half of his Berkshire shares to the Gates Basis and 4 household foundations since 2006. All else being equal, if he’d retained all his inventory he can be the world’s wealthiest particular person with a internet price over $300 billion.

8. Steve Ballmer

Web price: $144 billion

YTD change in wealth: +$12.9 billion

Supply of wealth: Microsoft inventory

served as Microsoft’s CEO between 2000 and 2014. He joined the corporate in 1980 as Invoice Gates’ assistant, initially a revenue share which he later swapped for an fairness stake when it grew to become excessively massive.

Ballmer retired as CEO in 2014 with a 4% stake — a place price over $120 billion at present. He promptly purchased the Los Angeles Clippers for $2 billion and stays the basketball crew’s proprietor.

9. Larry Web page

Web price: $136 billion

YTD change in wealth: +$9.13 billion

Supply of wealth: Alphabet inventory

cofounded Google together with his Stanford College classmate Sergey Brin in a pal’s storage in 1998 and served as CEO till 2001.

He took the reins once more between 2011 and 2015 after Google was restructured as a subsidiary of Alphabet alongside different companies akin to YouTube and Waymo.

10. Sergey Brin

Web price: $128 billion

YTD change in wealth: +$7.81 billion

Supply of wealth: Alphabet inventory

cofounded Google with Web page in 1998 and served because the search-and-advertising titan’s first president.

He and Web page stepped down from their respective roles as Alphabet’s president and CEO in 2019.

11. Mukesh Ambani

Web price: $111 billion

YTD change in wealth: +$14.4 billion

Supply of wealth: Reliance Industries inventory

Mukesh Ambani is the chairman and managing director of Reliance Industries and .

His father, Dhirubhai Ambani, based Reliance and trusted Mukesh to develop the conglomerate’s petrochemicals enterprise and increase into new areas akin to telecommunications.

Mukesh threw a for his son Anant Ambani this summer time.

12. Amancio Ortega

Web price: $102 billion

YTD change in wealth: +$14.7 billion

Supply of wealth: Inditex inventory

is the founder and former chairman of Inditex, a trend retail group residence to manufacturers akin to Zara, Bershka, and Massimo Dutti.

The billionaire philanthropist and real-estate investor stopped working Inditex in 2011. His daughter Marta Ortega Pérez was appointed chair on the finish of 2021.

13. Jim Walton

Web price: $101 billion

YTD change in wealth: +$28.1 billion

Supply of wealth: Walmart inventory

Jim Walton is the youngest son of Walmart founder Sam Walton, who of his 4 kids a 20% stake within the budding retail enterprise over 70 years in the past. Jim and his two surviving siblings, Rob and , every nonetheless personal over 11% of the corporate.

Jim’s internet price due to the retailer’s inventory hovering 50% this yr. Rob and Alice are price $98.3 and $97.7 billion respectively, that means they within the $100 billion membership.

14. Michael Dell

Web price: $100 billion

YTD change in wealth: +$21.9 billion

Supply of wealth: Dell inventory

is the founder, chairman, and CEO of the eponymous pc maker. Dell inventory has ballooned from under $40 in March final yr to round $110, valuing the corporate at over $75 billion, as buyers wager it will likely be a key beneficiary from the AI growth.

Dell owns about 46% of his firm, and pocketed effectively over $10 billion from the sale of Dell-backed VMware to Broadcom final yr.

15. Gautam Adani

Web price: $100 billion

YTD change in wealth: +$15.7 billion

Supply of wealth: Adani Group inventory

Gautam Adani is the founder and chairman of the Adani Group. His conglomerate is a number one developer of infrastructure akin to ports and energy crops in India.

Learn the unique article on

Markets

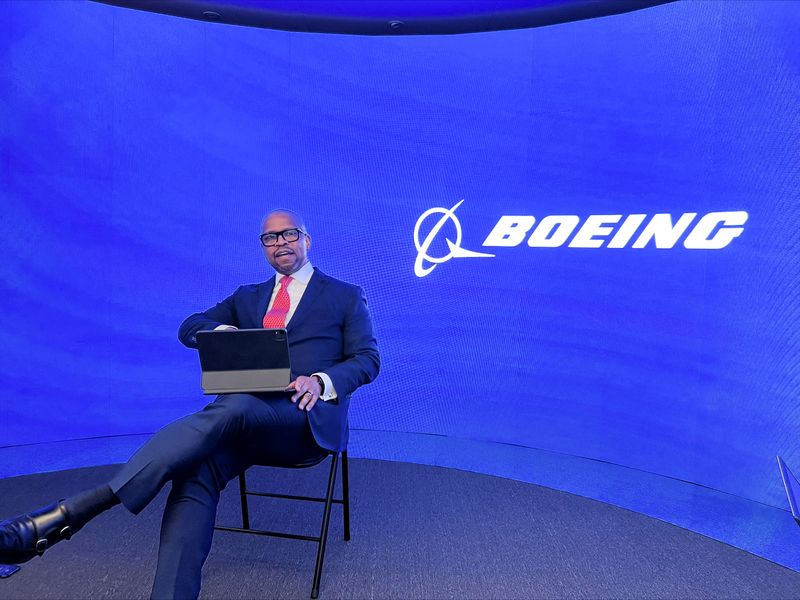

Boeing’s area and protection chief exits in new CEO’s first govt transfer

By Joe Brock, David Shepardson and Tim Hepher

(Reuters) – Boeing stated on Friday the pinnacle of its troubled area and protection unit is leaving the corporate instantly, within the first administration change beneath new CEO Kelly Ortberg.

Ortberg who took over in August stated Ted Colbert can be leaving and Steve Parker, the unit’s chief working officer, would assume Colbert’s tasks till a alternative is called at a later date.

“At this important juncture, our precedence is to revive the belief of our clients and meet the excessive requirements they anticipate of us to allow their important missions around the globe,” Ortberg wrote in an electronic mail to staff. “Working collectively we are able to and can enhance our efficiency and guarantee we ship on our commitments.”

Boeing’s area enterprise has suffered important setbacks, notably NASA’s latest choice to ship Boeing’s Starliner capsule dwelling with out astronauts that adopted years of missteps. Starliner has value Boeing $1.6 billion in overruns since 2016, in line with a Reuters evaluation of securities filings.

Colbert’s departure comes at a time when Boeing has been making an attempt to avoid wasting money by asserting furloughs of 1000’s of white-collar staff amid a strike by greater than 32,000 of its staff.

Boeing has additionally confronted important woes after a brand new Alaska Airways 737 MAX 9 in January suffered a mid-air emergency after it was lacking 4 key bolts.

Boeing in July agreed to plead responsible to a legal fraud conspiracy cost and pay not less than $243.6 million after breaching a 2021 deferred prosecution settlement. The federal government stated Boeing knowingly made false representations to the Federal Aviation Administration about key software program for the 737 MAX.

The FAA has tightened oversight of Boeing and barred it from increasing manufacturing of the MAX past 38 planes monthly till it makes important high quality and security enhancements.

Parker was introduced in to shore up industrial management and assist repair loss-making packages with a brand new working administration function just below two years in the past. He had beforehand headed Boeing’s bomber and fighter packages in addition to its St Louis protection vegetation.

“Traditionally, Boeing held a superior fame for our skill to handle packages, and we have to guarantee it stays a key differentiator for us sooner or later,” Ortberg wrote in separate electronic mail to staff on Friday.

Ortberg added he had realized “extra in regards to the future investments we have to make to be aggressive and outline our future, in addition to about a number of the extra near-term hurdles engineering faces with first-time high quality and execution.”

Colbert, who joined Boeing in 2009 after working at Citigroup and Ford Motor, took the reins at Boeing Protection and House in April 2022 after the prior head of protection was ousted.

Boeing’s protection, area and safety unit, certainly one of its three fundamental companies, has misplaced billions of {dollars} in 2023 and 2022, which executives attributed largely to value overruns on fixed-price contracts.

Such contracts have excessive margins however go away protection contractors weak to inflationary pressures which have dented U.S. company earnings in the previous couple of years.

Boeing has misplaced greater than $2 billion on its delayed program to ship two closely retrofitted Boeing 747-8s to be used as U.S. presidential plane often called Air Drive One.

Boeing’s shares closed down about 1% on Friday and have misplaced about 41% to this point this yr. (This story has been refiled to appropriate a typographical error in paragraph 12)

(Reporting by Utkarsh Shetti in Bengaluru, David Shepardson in Washington and Joe Brock in Los Angeles; Enhancing by Shounak Dasgupta, Marguerita Choy and Shri Navaratnam)

Markets

Intuitive Machines director sells over $7.6 million in firm inventory

Intuitive Machines, Inc. (NASDAQ:LUNR) has reported a big inventory transaction by director Michael Blitzer, who bought a complete of 912,673 shares of Class A Widespread Inventory in a sequence of transactions. The gross sales, which occurred on September 19 and 20, 2024, resulted in complete proceeds of over $7.6 million.

The transactions have been executed inside a value vary of $7.8763 to $9.1607. On September 19, Blitzer bought 500,000 shares at a mean value of $7.8763 and 162,673 shares at a mean value of $9.1607. The next day, he continued by promoting a further 250,000 shares at a mean value of $8.9292. These costs replicate a weighted common, with the precise gross sales occurring at numerous costs inside the said ranges.

Following these gross sales, Michael Blitzer’s possession in Intuitive Machines has been adjusted to 812,865 shares of Class A Widespread Inventory, as per the newest SEC submitting. The director’s transactions have been promptly reported to the Securities and Change Fee as required by federal securities legal guidelines.

Intuitive Machines, headquartered in Houston, Texas, makes a speciality of search, detection, navigation, and steering techniques, notably within the aeronautical sector. The corporate has been within the highlight for its modern approaches and contributions to house exploration and associated applied sciences.

Traders usually preserve an in depth eye on insider transactions as they will present insights into an organization’s monetary well being and future prospects. Nevertheless, it is necessary to notice that these transactions don’t essentially point out a change in firm fundamentals however can replicate private monetary administration choices by the insiders.

For extra detailed data relating to the precise costs and variety of shares bought at every value level, Michael Blitzer has agreed to supply full data to Intuitive Machines, its safety holders, or the SEC workers upon request.

In different latest information, Intuitive Machines Inc. has seen a sequence of great developments. The corporate secured a considerable NASA contract value as much as $4.82 billion for communication and navigation providers for missions extending from geostationary orbit to cislunar house. This achievement aligns with the corporate’s technique to commercialize lunar actions. As well as, Intuitive Machines was awarded a $116.9 million contract to ship six scientific and technological payloads to the Moon’s South Pole, marking the fourth such award beneath the Business Lunar Payload Providers initiative.

On the monetary entrance, the corporate’s Q2 2024 income reached $41.4 million, greater than double in comparison with the identical quarter in 2023. This led to an upward adjustment in its full-year income forecast to a spread of $210 million to $240 million. Analyst corporations Roth/MKM and Canaccord Genuity have maintained their Purchase scores on the corporate’s inventory, with B.Riley elevating its value goal from $8.00 to $12.00, and Canaccord Genuity sustaining a value goal of $11.00. These adjustments replicate the corporate’s sturdy backlog alternatives and expectations for top-line progress. The latest developments and analyst scores spotlight the continuing progress and potential of Intuitive Machines within the house exploration sector.

Lusso’s Information Insights

Intuitive Machines, Inc. (NASDAQ:LUNR), regardless of the latest insider promoting, exhibits intriguing market exercise and monetary metrics that might curiosity buyers. In keeping with Lusso’s Information, analysts are forecasting an increase in gross sales for the present yr, indicating potential progress within the firm’s income streams. This aligns with the corporate’s substantial income progress of 86.74% reported during the last twelve months as of Q2 2024, which may very well be an indication of increasing operations and market attain.

Nevertheless, the corporate’s inventory seems to be in overbought territory, with an RSI suggesting that warning could also be warranted for short-term buyers. Coupled with that is the excessive value volatility that the inventory usually trades with, which may imply that whereas there’s potential for vital positive aspects, there’s additionally a heightened danger of considerable value swings.

Intuitive Machines additionally has a notable market capitalization of 1190M USD, though it’s buying and selling at a excessive income valuation a number of. The corporate’s web earnings is anticipated to drop this yr, and analysts don’t anticipate the corporate can be worthwhile this yr, which may very well be a priority for these searching for speedy profitability.

For buyers eager to delve deeper into the monetary well being and future prospects of Intuitive Machines, there are further Lusso’s Information Ideas out there at Lusso’s Information’s product web page for LUNR. The following pointers may present a extra complete understanding of the corporate’s efficiency and inventory habits. At present, there are 15 further ideas listed on Lusso’s Information, which may very well be invaluable for these seeking to make knowledgeable funding choices.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

Markets

Prediction: This $80 Billion Market May Be the Subsequent Huge Development Driver for Nvidia Inventory

Graphics processing models (GPUs) have been Nvidia‘s (NASDAQ: NVDA) bread-and-butter enterprise for a protracted, very long time. The corporate initially made its title producing GPUs meant for deployment in private computer systems (PCs) for gaming and content material creation, earlier than finally placing gold with its knowledge heart GPUs that are actually in red-hot demand because of .

Because it seems, knowledge heart compute chips now produce the vast majority of Nvidia’s income. The corporate bought $22.6 billion value of knowledge heart GPUs within the second quarter of fiscal 2025 (which ended on July 28). The section’s income shot up 162% 12 months over 12 months, accounting for 75% of the corporate’s high line. Nevertheless, there’s one other area of interest throughout the knowledge heart enterprise the place Nvidia is now gaining spectacular traction.

This specific enterprise section is now larger than Nvidia’s gaming enterprise, and it may become a key progress driver for the corporate in the long term. This is a more in-depth have a look at this rising enterprise that might supercharge Nvidia’s progress.

Nvidia is making terrific progress on this $80 billion market

Nvidia sells two forms of knowledge heart chips. The primary are the GPUs, that are already producing a number of billion {dollars} in income for the corporate every quarter. The second kind of Nvidia’s knowledge heart chips is its networking chips, that are additionally promoting like hotcakes as the corporate’s newest quarterly outcomes present.

Nvidia bought $3.7 billion value of networking chips within the earlier quarter, up 114% from the identical quarter final 12 months. The corporate’s networking income within the first half of the fiscal 12 months stood at $6.8 billion, translating into an annual income run fee of almost $14 billion. The worldwide knowledge heart networking market is estimated to generate $37.6 billion in income this 12 months. If Nvidia certainly ends fiscal 2025 with $14 billion in knowledge heart networking income, it will find yourself controlling 37% of this market.

What’s value noting right here is that Nvidia is reportedly rising at a sooner tempo than the information heart networking area, which has obtained a serious shot within the arm because of the arrival of AI. In accordance with market analysis agency Dell’Oro Group, the scale of the information heart switching market is prone to broaden by 50% because of the rising want for switches deployed in back-end AI server networks.

The researcher sees spending on switches utilized in back-end AI servers hitting $80 billion over the following 5 years, which might be almost double the scale of the present knowledge heart change market. We’ve already seen that Nvidia is having fun with a stable share of this market, and Dell’Oro factors out the identical. The analysis agency says that the InfiniBand networking platform is at the moment dominating the marketplace for AI back-end networks, and it’s value noting that Nvidia gives networking merchandise based mostly on this networking communications normal.

Nvidia sells InfiniBand adapters, switches, knowledge processing models (DPUs), routers, gateways, cables, and transceivers to prospects. Dell’Oro, nevertheless, factors out that the Ethernet-based networking normal may finally overtake the InfiniBand normal within the subsequent few years. The excellent news for Nvidia traders is that Nvidia has already set its sights on the Ethernet AI networking platform.

It claims that its Spectrum-X networking platform is the world’s first Ethernet networking platform for AI and is able to accelerating AI networking efficiency by 1.6x when in comparison with conventional Ethernet. Nvidia administration’s feedback on the August recommend that Spectrum-X has gained terrific traction amongst prospects. In accordance with CFO Colette Kress: “Ethernet for AI income, which incorporates our Spectrum-X end-to-end Ethernet platform, doubled sequentially with tons of of consumers adopting our Ethernet choices. Spectrum-X has broad market assist from OEM and ODM companions and is being adopted by CSPs, GPU cloud suppliers, and enterprises, together with xAI to attach the biggest GPU compute cluster on the planet.”

A brand new multibillion-dollar enterprise within the making

Kress says that Spectrum-X is “effectively on monitor to start a multibillion-dollar product line inside a 12 months.” So, it will not be shocking to see Nvidia finally cornering a large portion of the information heart networking market. The speed of progress of Nvidia’s networking enterprise means it’s rising at a sooner tempo than the information heart networking market proper now, which is why it will not be shocking to see it seize an even bigger share of this area sooner or later.

However even when the corporate holds on to its present market share of almost 40% after 5 years, its annual networking income may hit $32 billion (based mostly on the $80 billion market dimension projected earlier). That will be a pleasant bounce from the present annual income run fee of $14 billion within the networking enterprise.

Throw within the rosy prospects of the general AI chip market, which is anticipated to clock $311 billion in annual income in 2029, and it will not be shocking to see Nvidia’s knowledge heart enterprise changing into even larger in the long term than it’s proper now. Not surprisingly, analysts predict Nvidia’s earnings to extend at an annual fee of over 52% for the following 5 years.

That is why traders wanting so as to add an AI inventory to their portfolios ought to contemplate shopping for Nvidia immediately as it’s at the moment buying and selling at 42 occasions ahead earnings, a reduction to the U.S. expertise sector’s common price-to-earnings ratio of 45.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?