Markets

Northern Knowledge, European Bitcoin Miner, Explores IPO for US AI Unit (Report)

Northern Knowledge AG, a German agency specializing in high-performance computing infrastructure, is evaluating the opportunity of launching a U.S. preliminary public providing (IPO) for its AI cloud computing and knowledge middle items.

The potential valuation for this IPO might attain as excessive as $16 billion, in keeping with Bloomberg Information sources.

Northern Knowledge Eyes US IPO

Northern Knowledge is contemplating combining its cloud computing department, Taiga, with its knowledge middle operations, Ardent, to type a brand new agency for a potential U.S. IPO. The mixed entity could also be listed on the Nasdaq as early as the primary half of 2025.

This choice coincides with a restoration within the U.S. IPO market, which has been boosted by investor optimism about financial stability. Moreover, there was a revived curiosity in new listings in 2024. The introduction of OpenAI’s ChatGPT has additionally stimulated demand for AI applied sciences, which has led to giant investments within the sector.

Main know-how corporations, like Microsoft and Alphabet Inc., have made vital investments within the infrastructure required to help AI purposes.

The corporate is now in dialog with doable advisors concerning the IPO and intends to rent lead banks within the coming months. Nonetheless, primarily based on the outcomes of those strategic engagements, Northern Knowledge might resolve towards continuing with the IPO. To date, the corporate has not offered an official touch upon these plans.

Northern Knowledge’s Market Place

The Frankfurt-based firm, which went public in 2018, has seen its shares fall by round 5% this 12 months. This has taken its market valuation to roughly €1.3 billion ($1.4 billion).

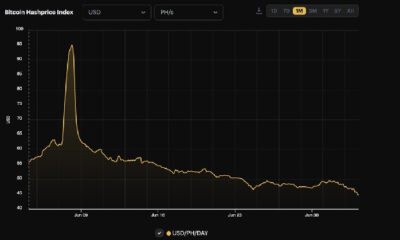

Northern Knowledge has been adapting its energy-intensive knowledge facilities to allow AI purposes in response to crypto mining’s shrinking enterprise margins. In 2022, Northern Knowledge was a notable Ether miner, devoting over 70% of its operations to the exercise. Following an replace to the Ethereum blockchain, the corporate modified its consideration away from mining and towards high-performance computing and different initiatives.

The corporate obtained a €575 million debt financing settlement from Tether Group in November. Tether then grew to become a cornerstone investor after they bought a Tether-related automobile for €400 million in January.

Notably, the corporate is utilizing these funds to buy superior AI chips from Nvidia Corp., with plans to deploy roughly 20,000 H100 chips by the tip of the summer season.

Markets

2 No-Brainer Billionaire-Owned Shares to Purchase Proper Now

Following the inventory picks of billionaire buyers might help you discover rewarding investments for the lengthy haul. These buyers sometimes conduct in-depth analysis on the businesses not out there to a small investor.

Chase Coleman of Tiger World Administration and Daniel Loeb of Third Level are two billionaire fund managers who’ve an extended file of safely rising their property. Listed here are two of their prime inventory holdings to purchase proper now.

1. Chase Coleman, Tiger World Administration: Nvidia

Chase Coleman based Tiger World Administration in 2001 and at this time has an estimated web price of over $5 billion, in line with Forbes. Tiger World has a powerful file of incomes market-beating returns for shoppers during the last twenty years, and one among its largest positions within the first quarter was Nvidia (NASDAQ: NVDA) — one of many best-performing S&P 500 shares in current months.

Enterprises are shopping for as many as they’ll get their palms on for coaching synthetic intelligence (AI) fashions. Meta Platforms plans to have 350,000 of Nvidia’s H100 chips in its laptop infrastructure by the top of the yr. These highly effective chips have been in brief provide resulting from excessive demand, and Nvidia expects this case to proceed.

The central processing models (CPUs) that powered knowledge facilities for years are being supplanted by extra highly effective GPUs, which is driving unprecedented progress for Nvidia’s knowledge heart enterprise. Nvidia has an extended historical past of delivering above-average progress and returns to shareholders, however its present progress is off the charts, with income leaping 262% yr over yr in the latest quarter.

The corporate will not proceed to see its income triple yearly, however buyers who can patiently maintain the inventory over the subsequent a number of years ought to see passable returns. Nvidia will proceed to innovate with new merchandise and AI options to drive long-term progress.

Earlier this yr, Nvidia introduced its new Blackwell computing platform that may permit the main cloud service suppliers to take knowledge processing to a different stage. It expects demand for Blackwell and the brand new H200 knowledge heart GPU to outstrip provide within the close to time period.

Nvidia expects its fiscal second-quarter income to be roughly $28 billion, representing a 107% year-over-year enhance. This stage of demand makes the inventory a no brainer funding.

2. Daniel Loeb, Third Level: Taiwan Semiconductor Manufacturing

Daniel Loeb is the founding father of Third Level and has an estimated web price of over $3 billion, in line with Forbes. With the rising demand for AI chips, it is no shock to see one other prime chip firm in a billionaire’s portfolio. Third Level held a large stake within the main chip producer Taiwan Semiconductor Manufacturing (NYSE: TSM) on the finish of the primary quarter.

Taiwan Semiconductor dominates the business with over 60% of the worldwide foundry market in 2023. As a foundry, it makes merchandise for different corporations. All of the main chip corporations, together with Nvidia, have relationships with TSMC, which places the corporate in a powerful aggressive place.

TSMC’s income grew 12.5% yr over yr within the first quarter in U.S. {dollars}, primarily pushed by demand for high-performance chips. However progress ought to speed up within the close to time period, as a few of the firm’s finish markets are nonetheless in restoration, together with smartphones, which account for 38% of TSMC’s enterprise.

Administration expects second-quarter income to come back in between $19.6 billion to $20.4 billion, or enhance by 27% yr over yr on the midpoint of steerage. TSMC is working to increase its manufacturing capability within the U.S., which displays a positive outlook for chip demand.

TSMC has an extended historical past of delivering excellent returns to shareholders, and its worthwhile enterprise mannequin fueled a rising dividend to shareholders since 2004. It is a comparatively protected inventory to trip the wave of AI chip demand over the subsequent decade.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $786,046!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Meta Platforms and Nvidia. The Motley Idiot has positions in and recommends Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

World shares at report excessive, UK Labour landslide and US payrolls hog highlight

By Dhara Ranasinghe

LONDON (Reuters) -World fairness markets touched contemporary report highs with optimism a few U.S. charge minimize underpinning sentiment forward of key jobs numbers in a while Friday, whereas the euro hit a three-week excessive forward of French elections this weekend.

Sterling and UK shares have been larger as Britain’s Labour Get together was set for a landslide ballot victory after 14 years of Conservative rule.

The market focus in Europe was rapidly shifting from the UK election – the place Thursday’s vote consequence was broadly anticipated – to Sunday’s second-round election in France. French shares have recovered floor after they have been offered off sharply following the shock election announcement final month. The euro has benefited from renewed U.S. rate-cut hypothesis.

Buying and selling was subdued a day after the U.S. July 4 vacation however is predicted to choose up after the discharge of the June U.S. non-farm payrolls report.

“We’re in the summertime vacation candy spot for markets, with traders targeted on inflation coming down to focus on in large economies,” stated Man Miller, chief market strategist at Zurich Insurance coverage Group (OTC:).

“That, together with weaker U.S. information, is optimistic for the inflation outlook and which means charge cuts are again on the playing cards once more,” he stated.

MSCI’s world inventory index touched a contemporary report excessive. It remained close to there and was final up 0.08%. European shares rallied 0.4% (), whereas and broader additionally logged report ranges.

Commerce in U.S. inventory futures steered a barely optimistic open for Wall Road.

Following the UK election outcome, London’s rose 0.38% on the open. The yield on 10-year British authorities bonds or gilts, dropped 4 foundation factors to 4.16%, largely in step with different European markets, and sterling inched as much as round $1.2784.

“A landslide victory gives the kind of readability and stability that fairness markets want in an more and more risky world,” stated Ben Ritchie, head of developed market equities at Abrdn.

What issues will probably be revealed extra slowly because it turns into clear how Prime Minister Starmer pays for the sooner progress he seeks, stated Kevin Gardiner, world funding strategist at Rothschild & Co.

“Even a centrist Labour authorities is not going to be as pro-business or libertarian as a Conservative one, and we should always anticipate many adjustments within the element of tax and sectoral insurance policies within the weeks forward, a few of which will probably be contentious, stated Gardiner.

JOBS IN FOCUS

Nonfarm payrolls possible elevated by 190,000 jobs final month after surging by 272,000 in Could, in accordance with a Reuters survey of economists. Employment positive aspects have averaged about 230,000 jobs per thirty days over the previous 12 months.

Zurich’s Miller famous a weakening in latest employment information and stated a softer-than-expected payrolls quantity would assist the case for a U.S. charge minimize in September.

U.S. Treasury yields have been little modified in early London commerce, with two-year yields buying and selling round 4.69% and benchmark 10-year yields up marginally at 4.36%.

In foreign money markets, the euro rose to $1.0825 as polls level to France’s far proper Nationwide Get together falling wanting an absolute majority at Sunday’s parliamentary election runoff.

“If the polls finally show correct, this could imply the extra excessive insurance policies of fiscal growth and immigration curbs are unlikely to go,” stated MUFG analyst Michael Wan.

The greenback was down round 0.4 at 160.72 yen. The Australian greenback hovered close to a six-month excessive of $0.6735 as yield spreads swung in its favour, underpinned by wagers that the subsequent transfer in charges could be up given inflation is proving cussed. [AUD/]

was set for its greatest weekly fall in additional than a 12 months on worries over the possible dumping of tokens from defunct Japanese alternate Mt. Gox and additional promoting by leveraged gamers after the cryptocurrency’s robust run.

It slid as a lot as 8% on the day to $53,523, its lowest since late February.

Gold rose 0.3% to $2,363.80 per ounce and was set for a second straight weekly achieve, whereas oil costs have been poised for a fourth straight week of positive aspects.

Entrance month futures have been down 12 cents at $87.33 a barrel whereas U.S. West Texas Intermediate ticked up 4 cents at 83.92.

Markets

FoundationLogic Unveils Silent Residence Miner at Mining Disrupt 2024

The industry-leading model of DOGE and Litecoin mining machines introduced a brand new product line on the current Mining Disrupt 2024 convention.

FoundationLogic, the fabless semiconductor design firm behind high-performance ElphaPex Dogecoin (DOGE) + Litecoin (LTC) miners, took heart stage at Mining Disrupt 2024 in Miami, Florida, held from 24-26 June.

On the occasion, FoundationLogic unveiled its new product line for silent dwelling miners.

Like the professional ElphaPex DG 1/DG 1+ fashions, the brand new system, dubbed ElphaPex DG Residence 1, is powered by the Proof-of-Work (PoW) Scrypt algorithm, providing twin DOGE and LTC rewards.

Designed for a brand new period of dwelling mining, ElphaPex DG Residence 1 guarantees silent, low-maintenance, but performant DOGE + LTC mining ensured by water-cooling know-how.

Set to be launched in This fall, 2024, the brand new mannequin boasts a hashrate of 2000M, energy of 620W and energy effectivity of 0.31JM. Upon launch, ElphaPex DG Residence 1 shall be accessible for quick buy by way of the ElphaPex official web site.

ElphaPex DG Residence 1 drew a direct response from crypto mining insiders, with among the {industry}’s main influencers sharing images on social media as quickly because the mannequin was showcased. Particularly, they described the brand new water-cooled miner as “silent, highly effective, and environment friendly”.

“This new silent dwelling miner embodies our dedication at ElphaPex to be everybody’s miner companion, whatever the scale of operations” mentioned Ben Weng, VP of Product at FoundationLogic. “We had been happy by the enthusiastic response we noticed on the convention, as many guests wished to get one on the spot. Fortunately, it gained’t be lengthy earlier than everybody can begin twin mining DOGE and Litecoin from the consolation of their houses”. “ElphaPex merchandise have achieved a exceptional milestone within the DOGE & Litecoin mining chip {industry} and we’re excited to launch this new product into mass manufacturing” mentioned Charles Track, Government VP at Samsung Foundry. “I consider that is just the start of a really vivid future for ElphaPex”.

Along with launching its latest product, FoundationLogic made a robust impression on the occasion, drawing consideration from {industry} insiders and influential figures.

As the principle sponsor of Mining Disrupt 2024, the Scrypt mining {hardware} firm hosted the official opening get together and operated one of many occasion’s busiest cubicles, that includes partaking actions and giveaways.

One other standout on the convention was FoundationLogic’s keynote presentation.

Throughout the keynote, the corporate’s representatives emphasised their dedication to advancing Scrypt mining, highlighting its rising potential for miners. That is significantly vital in mild of bitcoin’s current halving, which has posed challenges throughout the {industry} as a consequence of diminished rewards. In addition they identified a number of key benefits of Scrypt {hardware} over SHA-256 {hardware}, together with higher money circulate, ROI, and tools lifecycle.

One other spotlight of the presentation was the success of the ElphaPex DG 1+, an ASIC miner launched earlier this 12 months at Blockchain Life 2024 in Dubai. As FoundationLogic’s flagship mannequin, it has set a brand new customary out there and continues to dominate the Scrypt mining sector with a hashrate of 14000M, energy of 3920W and effectivity of 0.28JM.

Contemplating current worth developments and the rising availability of dependable Scrypt mining {hardware} offered by FoundationLogic, leveraging DOGE’s meme benefit alongside LTC’s stable monitor report might supply a technique for mining operations this 12 months.

About FoundationLogic

FoundationLogic is a Singapore-based fabless semiconductor design firm devoted to revolutionizing the cryptocurrency mining {industry}. With a deal with innovation and reliability, FoundationLogic makes use of state-of-the-art ASIC chips designed in-house and topics its merchandise to rigorous discipline testing. By way of its flagship ElphaPex collection (http://elphapex.com/), FoundationLogic empowers mining fanatics and professionals with cutting-edge, accessible machines, setting new requirements for effectivity and efficiency within the discipline.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing