Markets

Nvidia Inventory (NVDA) Is Nonetheless a Lengthy-Time period Winner, No Matter the Noise

Synthetic Intelligence (AI) prodigy Nvidia , the world’s third-highest-valued inventory, skilled a cloth decline in market capitalization following its Q2 earnings in late August. Nevertheless, NVDA inventory has proven some vigor once more, rising 5% within the final week. After briefly surpassing the $3 trillion milestone earlier this 12 months, traders are questioning what the longer term will maintain. My thesis stays unchanged — I’m bullish on NVDA shares as an funding on account of its clear AI supremacy and exponential progress potential.

NVDA’s Lengthy-Time period AI-Pushed Development Trajectory Stays Intact

It’s well-known that NVDA is positioned for a protracted runway of progress with top-notch purchasers like Microsoft , Alphabet , Meta , and Amazon bulking up on their AI efforts. Nevertheless, past these main clients, Nvidia’s AI penetration continues to be rising throughout all industries, rising my optimism for NVDA inventory. Enterprises throughout industries and geographies are keen to include AI advantages into their operations. Likewise, NVDA continues to with high companies.

There’s a cause enterprises are flocking to NVDA for his or her AI ambitions. Past being the chief in AI GPU processors, NVDA supplies a whole end-to-end AI infrastructure that supercharges productiveness. That’s one thing that few, if any, of its world AI friends can ship.

NVDA Stays a One-Cease AI Powerhouse with Margin Development

Another excuse for my optimism about NVDA is ‘s relentless focus. He’s dedicated to remodeling NVDA into a completely AI-driven knowledge heart powerhouse that covers all features of {hardware} and software program underneath the NVDA model.

This technique is a key cause why NVDA can preserve premium pricing for its merchandise, contributing to regular progress in its revenue margins. Nevertheless, critics argue that NVDA’s distinctive income and margin progress will not be sustainable. Some members of the funding neighborhood are apprehensive a couple of slowdown in income progress over the approaching years.

For context, NVDA reported a rare 217% enhance in its knowledge heart revenues for fiscal 2024. Whereas that progress is anticipated to average to round 130% in 2025, this stays a powerful triple-digit determine, particularly contemplating the sturdy FY2024 baseline for comparability. Though decrease than right this moment’s tempo, these are nonetheless exceptional progress projections for the longer term. I view bullish analyst estimates as a cause to stay assured on this AI chief, significantly because the disruptive potential of generative AI is simply starting to unfold.

Demand for NVDA’s chips is strong and can increase future revenues within the coming quarters. Due to this fact, regardless of some investor issues, I count on NVDA will proceed to take care of its clear AI dominance with an unbeatable aggressive moat and best-in-class AI services and products.

A Dialogue of Nvidia’s Spectacular Quarterly Earnings

Nvidia posted yet one more stellar Q2 outcome on August 28, 2024, pushed by accelerated computing and the continued momentum of generative AI. handily beat the consensus analyst estimate of $0.65 per share. The determine got here in a lot larger (+152%) than the Fiscal Q2-2023 determine of $0.27 per share.

The corporate posted a 122% year-over-year income progress, delivering $30.04 billion for the three months ending July 31 and surpassing analysts’ projections. Importantly, Information Heart revenues, the corporate’s crown-jewel division, grew 154% year-over-year to $26.3 billion. Moreover NVDA’s adjusted gross margin expanded 5 share factors to 75.1% from 70.1% a 12 months in the past. Many traders have been apparently hoping for even larger numbers, and subsequently the inventory dropped barely following the Q2 report. Shares then continued a downtrend till they bottomed out on September 6, simply above the $100 stage.

Nvidia’s steerage for the third quarter appeared much less promising to traders, with revenues anticipated to succeed in about $32.5 billion. Steerage got here in beneath expectations. Adjusted gross margins are forecast to stage off at about 75%, versus 75.15% delivered in Q2.

NVDA’s Insider Promoting Issues are Over

added downward stress on NVDA shares in latest months. CEO Jensen Huang offered NVDA shares throughout a number of transactions from June to September, but it surely’s vital to know that these gross sales have been a part of a predetermined buying and selling plan adopted in March. This plan allowed Huang to promote as much as six million NVDA shares by the tip of Q1 2025.

Notably, Huang has accomplished gross sales of greater than $700 million price of NVDA inventory. Regardless of the importance of those gross sales, he stays the biggest particular person shareholder of the corporate. Finally report, Huang held 786 million shares by means of varied trusts and partnerships, and 75.3 million shares straight, in line with firm filings. Mixed, Huang controls a ~3.5% stake within the firm, with an approximate complete of 859 million shares.

NVDA Valuation Isn’t Costly, Given Its Earnings Development Prowess

Buyers might have been hesitant to purchase NVDA inventory at present ranges, pointing to the inventory’s extraordinary run in addition to on account of issues concerning the firm’s and slowing progress.

Quite the opposite, nevertheless, my rivalry is that NVDA inventory isn’t as costly as it might appear. At present, it’s buying and selling at a ahead P/E ratio of about 43x (based mostly on FY2025 earnings expectations). That is really cheaper than some valuation multiples of its friends. As an illustration, NVDA’s closest competitor and U.S.-based semiconductor firm, Superior Micro Units, carries a 46.8x ahead P/E. Curiously, NVDA’s present valuation nonetheless displays a ten% low cost to its five-year common ahead P/E of 47.3x.

Given NVDA’s constant outperformance and robust progress potential, the present valuation seems cheap and justified. Any future dip within the inventory value might signify a strong shopping for alternative, in my view, particularly contemplating Nvidia’s immense potential within the quickly increasing AI market.

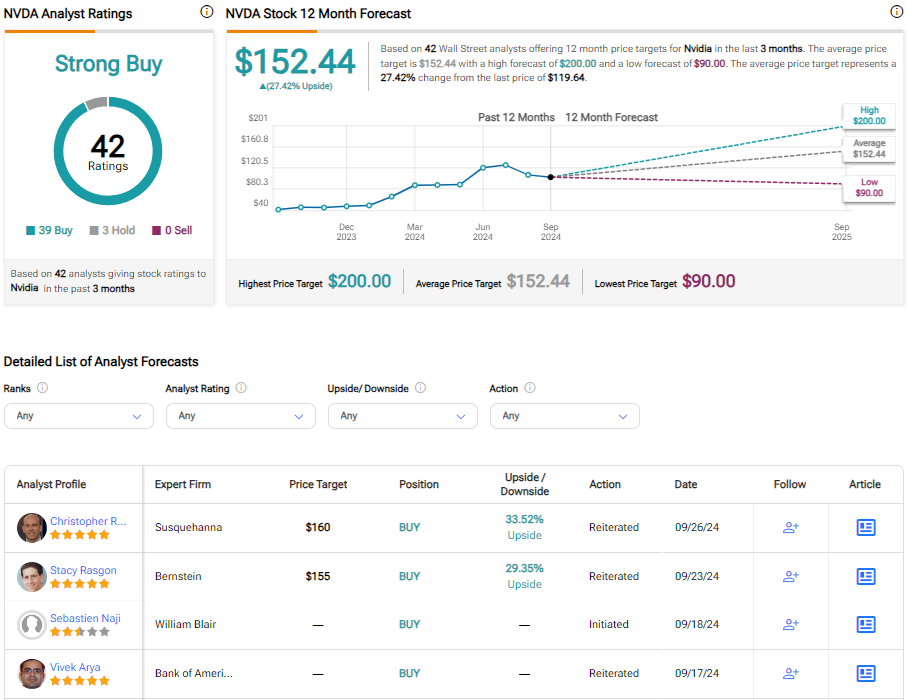

Is NVDA Inventory a Purchase or Promote, In line with Analysts?

With 39 Buys and three Maintain scores from analysts within the final three months, the consensus TipRanks score is a Robust Purchase. The implies potential upside of about 26% for the following 12 months.

Conclusion: Take into account NVDA Inventory for Its Lengthy-Time period AI Potential

Regardless of latest weak point, NVDA shares have almost tripled over the previous 12 months in comparison with an increase of about 37% for the Nasdaq 100. The post-earnings sell-off for NVDA inventory, for my part, was largely pushed by profit-taking. After bottoming close to $100, the inventory seems to be in restoration mode now.

Within the close to time period, I consider ongoing financial and political uncertainties might hold the inventory range-bound. Nevertheless, I view any dips as shopping for alternatives. I see NVDA as a powerful long-term funding given the numerous continued potential of AI.

Learn full

Markets

Meet the three Supercharged Development Shares That Will Be Price $4 Trillion by 2025, In accordance with 1 Wall Avenue Analyst

One of many clearest secular tailwinds of the previous couple of years is the arrival of synthetic intelligence (AI). Latest advances within the area have helped energy the continuing market rally, as these next-generation algorithms promise to extend productiveness by dealing with mundane duties and streamlining productiveness.

It ought to come as no shock then that most of the world’s Most worthy corporations are on the forefront of AI growth and have embraced the potential of . One of many largest debates in tech circles is which of those expertise stalwarts would be the first to cross the $4 trillion market cap threshold.

Buyers asking that query could also be lacking the purpose, in accordance with Wedbush analyst Dan Ives, who argues that 12 months from now, the $4 trillion membership would possibly, in actual fact, have three members. Let’s check out the candidates and what would possibly drive them there.

1. Apple

With the world’s largest present market cap, coming in at greater than $3.4 trillion (as of this writing), Apple (NASDAQ: AAPL) is among the many most definitely contenders to be a founding member of the $4 trillion membership. It will take a inventory worth enhance of lower than 17% to place Apple over the end line, and there are many drivers that would assist propel the iPhone maker larger.

The obvious potential catalyst is, after all, the not too long ago unveiled iPhone 16. The newest model of the fan-favorite system comes with all the same old upgrades, together with an improved digicam, speedier processing, and elevated battery life. One of many largest attracts, nonetheless, is the debut of Apple Intelligence, the corporate’s suite of generative AI-powered instruments, which is able to probably appeal to technophiles in droves.

There’s extra: The rampant inflation of the previous couple of years had customers hanging on to their iPhones a bit longer, and Ives estimates there are 300 million iPhones that have not been upgraded for 4 years or extra, leading to loads of pent-up demand. He believes it will kick off the and estimates Apple might promote as many as 240 million iPhones over the approaching 12 months.

Given bettering macroeconomic circumstances, I believe the analyst is correct: Throngs of customers will pony up for the brand new AI-driven iPhone, serving to push Apple over the $4 trillion mark.

2. Microsoft

Microsoft (NASDAQ: MSFT) is at present the world’s second-most worthwhile firm. With a market cap of $3.2 trillion, the inventory will solely must rise 24% to cross the $4 trillion threshold.

The corporate was fast to acknowledge the game-changing nature of generative AI and positioned itself for achievement. Microsoft took a stake in ChatGPT creator OpenAI and developed a collection of AI-driven productiveness instruments dubbed Copilot. It not too long ago unveiled a line of Copilot-powered private computer systems that can assist enhance Microsoft’s already expansive attain.

Simply final month, the corporate introduced that it could restructure the reporting of its enterprise items to provide a clearer image of its success in AI. Whereas buyers do not but have the entire image, the accessible proof is compelling. Throughout Microsoft’s fiscal 2024 fourth quarter (ended June 30), its Azure Cloud grew 29% 12 months over 12 months, and administration famous that eight proportion factors of that development was the results of demand for its AI companies. This helps illustrate that Microsoft’s AI technique is paying off.

Ives seized on one level from administration’s commentary, noting that Azure Cloud development is anticipated to “speed up within the second half.” He estimates that over the approaching three years, 70% of Microsoft’s put in base shall be utilizing its AI options. He goes on to say this chance isn’t but totally factored into the inventory worth.

I believe the analyst hit the nail on the top. Given Microsoft’s intensive attain in each the buyer and enterprise markets, it will not take a lot by way of AI adoption to positively affect the corporate’s development.

3. Nvidia

Nvidia (NASDAQ: NVDA) has grow to be the de facto poster little one for the AI revolution, sending its market cap to simply over $3 trillion. As such, it could solely take a inventory worth enhance of 32% to take the chipmaker above $4 trillion.

The inventory at present sits 10% off its peak, as buyers ponder the momentum of AI adoption, but the proof is incontrovertible. Nvidia’s largest prospects — Microsoft, Meta Platforms, Amazon, and Alphabet — have been utterly clear about their plans to extend their capital expenditures for the rest of the 12 months and into 2025. They’ve additionally made it very clear that the overwhelming majority of that spending shall be devoted to the info facilities and servers wanted to run AI.

Nvidia’s graphics processing items (GPUs) are the gold normal for working AI in information facilities and managed 98% of the info middle GPU market final 12 months. This illustrates why continued funding within the area stands to learn Nvidia.

Ives cited surging chip demand, readability on the upcoming launch of its Blackwell chip, and strong outlook as proof that Nvidia inventory has additional to run.

I believe the analyst’s evaluation is spot on. Buyers have been involved that AI adoption might gradual, which has weighed on Nvidia inventory in current months. Nonetheless, whereas that can actually occur someday, the accessible proof suggests it will not occur any time quickly. The truth is, some imagine Nvidia will ultimately be the world’s Most worthy firm.

A phrase on valuation

Pleasure relating to the potential for AI since early final 12 months has pushed many shares larger, leading to a corresponding enhance of their respective valuations. As such, every of those shares is buying and selling at a premium to the broader market. Microsoft and Apple are at present promoting for roughly 33 occasions ahead earnings, in comparison with a a number of of 30 for the S&P 500. Nvidia is probably the most egregious instance, promoting for 43 occasions ahead earnings. That stated, appears might be deceiving.

Analysts’ consensus estimates for Nvidia’s earnings per share for its 2026 fiscal 12 months (which begins in January) is $4.02. On that foundation, Nvidia is just buying and selling for 30 occasions gross sales, so it is not as costly as it would seem, notably given the continuing alternative represented by AI. Utilizing subsequent fiscal 12 months’s expectations yields related outcomes for Apple and Microsoft, that are promoting for 30 occasions and 28 occasions subsequent 12 months’s anticipated earnings, respectively.

When considered in that mild, these tech titans are literally moderately priced. That is why every of those shares is a must-own for the AI revolution.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it will possibly pay to pay attention. In spite of everything, Inventory Advisor’s complete common return is 773% — a market-crushing outperformance in comparison with 168% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and Apple made the listing — however there are 9 different shares you could be overlooking.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Tremendous Micro: Assessing the Potential Danger and Reward

Tremendous Micro Laptop bought off to an unbelievable begin this yr as shares greater than quadrupled from January to mid-March. This surge made Tremendous Micro eligible for S&P 500 inclusion, with the expertise {hardware} inventory (with hyperlinks to AI) being added to the index on March 18, 2024. In hindsight, that may have been a good time to take income or Quick the inventory, as shares are down by greater than 50% since then.

One of many main developments has been the report by Hindenburg Analysis, which contained worrying allegations in regards to the firm’s monetary reporting. In assessing these allegations together with Tremendous Micro’s fundamentals I maintain a impartial ranking on the inventory.

Hindenburg Casts Doubts About Tremendous Micro

The Hindenburg report is definitely the principle cause I’m impartial as an alternative of bullish on SMCI inventory, and I consider it has brought about hesitancy amongst many AI inventory analysts and traders.

The accusations are fairly simple. In keeping with Hindenburg, Tremendous Micro engaged in accounting manipulation which included “sibling self-dealing and evading sanctions”. Anybody who thinks this sounds far fetched could want to do not forget that the SEC charged Tremendous Micro with widespread accounting violations in August 2020. Hindenburg’s report additionally argued that almost all of the individuals concerned with that accounting malpractice are again on Tremendous Micro’s group.

Hindenburg’s group interviewed a number of Tremendous Micro salespeople and staff when compiling their report. It doesn’t assist that Tremendous Micro delayed its 10-Ok submitting to evaluate inner controls shortly after Hindenburg went public with its considerations. Whereas this would possibly merely be a coincidence, the timing is worrisome. Trying again a number of years, Tremendous Micro had did not file monetary statements in 2018 and was briefly delisted from the Nasdaq in consequence.

Close to the start of this month, Tremendous Micro publicly issued a denial of the accusations, with CEO Charles Liang hitting again, stating that Hindenburg’s report contained, “deceptive shows of data”. Tremendous Micro hasn’t supplied any further statements since then.

Synthetic Intelligence Progress Is Plain

Tremendous Micro’s standing as a part of the fast paced world of AI is likely one of the few causes that I’m impartial as an alternative of bearish SMCI inventory. The thrilling prospects for the corporate’s enterprise and the intense nature of the Hindenburg allegations mainly offset one another.

It’s exhausting to know what’s actual and what’s false right here, however most individuals concede that the AI trade as a complete gives compelling development prospects. Nvidia has been posting triple-digit year-over-year income development for a number of quarters. Different tech giants have included synthetic intelligence into their core companies and delivered spectacular outcomes for his or her shareholders. For example, Alphabet noticed its cloud income rise by 28.8% year-over-year as many companies rushed to create their very own AI instruments.

The factitious intelligence trade can also be projected to keep up a 19.3% compounded annual development fee from now till 2034, in accordance with Priority Analysis. The AI trade ought to proceed to develop, and that ought to elevate Tremendous Micro. The corporate ought to profit from Nvidia’s development, which is why the corporate posted distinctive income and internet revenue development throughout Nvidia’s ascent. That’s what we noticed for a number of quarters. We simply don’t know the way correct all of the numbers have been, if the allegations focusing on the agency have advantage.

Tremendous Micro Has Robust Financials at Face Worth

Whereas it’s not possible to miss Hindenburg’s allegations in opposition to Tremendous Micro, it’s nonetheless worthwhile assessing the corporate’s earlier quarterly outcomes. Shares have been dropping even earlier than Hindenburg launched its report. Whereas in March 2024 I , I felt that shares offered an amazing shopping for alternative in late-summer, till Hindenburg muddied that optimism.

For its final reported quarter, Tremendous Micro posted internet gross sales of $5.31 billion, representing a 143% year-over-year leap. In the meantime, internet revenue rose by 82% year-over-year, reaching $353 million. On the time of the discharge, my main concern was Tremendous Micro’s declining internet revenue margin. Tremendous Micro presently trades at a 20x trailing P/E ratio, seemingly sufficient to compensate for any additional erosion in revenue margins. SMCI inventory has a ridiculously low 13.6x ahead P/E ratio, however with the current speedbumps (the Hindenburg report and DOJ investigation) traders appears reluctant to bid the valuation a number of any greater proper now.

We don’t but have tangible proof that Tremendous Micro has engaged in any wrongdoing, as alleged by Hindenburg. Their report, nevertheless, has actually forged a black eye on the inventory. I count on that Tremendous Micro would have considerably outperformed its fiscal 2023 outcomes even excluding any misdealings.

The Division of Justice Is Probing Tremendous Micro Laptop

The Tremendous Micro controversy added a brand new chapter on September 26, as information crossed the wires that the the corporate. SMCI inventory tumbled an extra 12% on this information, and shares have been just lately buying and selling at lower than one-third of their all time excessive in March. There’s a excessive threat/reward on the shares at this level, however the elevated dangers have relegated me to the sidelines with a impartial ranking.

Tremendous Micro shares bounced again by greater than 4% on Friday, September 27, suggesting that many traders consider that the long-term potential for the enterprise is definitely worth the heightened uncertainty.

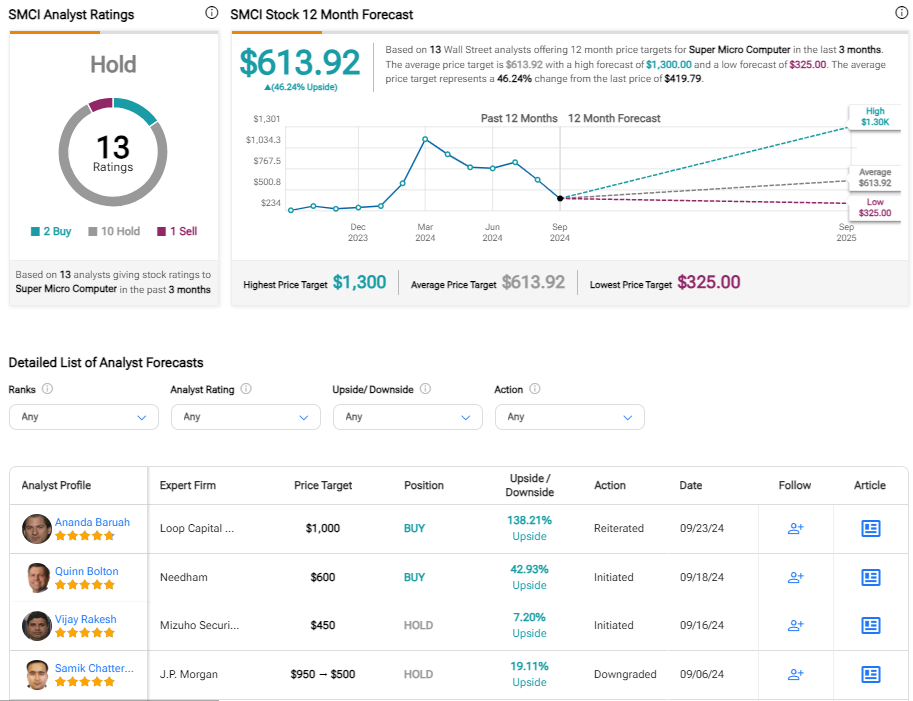

Is Tremendous Micro Inventory Rated a Purchase?

Though the scores for this inventory might change rapidly, Tremendous Micro presently has 2 Purchase scores, 10 Maintain scores, and 1 Promote ranking from the 13 analysts that cowl the inventory. The , which suggests potential upside of almost 50%. Once more although, it’s fairly potential that a number of analysis brokerages have positioned their SMCI scores underneath evaluation. SMCI inventory does have just a few low value targets together with $454, $375 and $325 from CFRA, Wells Fargo , and Susquehanna respectively. All of those value targets have been established earlier than the DOJ probe was introduced, so even they might drop decrease.

The Backside Line on SMCI Inventory

There’s an outdated adage that implies, “You both die a hero or stay lengthy sufficient to be the villain”. That quote appears apropos for this firm. Tremendous Micro earned many traders hefty income throughout its rise above a inventory value of $1,000 per share. Those that entered the story late, together with after SMCI inventory was added to the S&P 500, haven’t fared properly. Many traders are sitting on important losses proper now. Relying on what these traders do, it’s exhausting to inform how rather more draw back Tremendous Micro shares could have till extra readability on the ordeals is out there.

If the corporate’s current financials are correct, SMCI shares look fairly engaging right here. Shares can surge rapidly if the Hindenburg report loses relevance, though that consequence troublesome to foretell. I’m a giant fan of Tremendous Micro’s trade and enterprise potential associated to AI, which prevents me from being downright bearish. I’ve a impartial stance right here. In the meantime, I don’t count on shares of SMCI to rebound above $460 (the approximate value previous to information of the DOJ probe) with none decision to the 2 major threats to shareholder worth.

Markets

Unique-TPG in lead to purchase stake in Inventive Planning at $15 billion valuation, sources say

By Milana Vinn and David French

(Reuters) – Buyout agency TPG has emerged because the frontrunner to select up a minority stake value $2 billion in Inventive Planning, in a deal that would worth the wealth administration agency at greater than $15 billion, individuals accustomed to the matter stated on Saturday.

The deal would mark TPG’s second such wager on a wealth supervisor inside per week and underscores the burgeoning demand for dealmaking within the sector that generates profitable payment revenue for managers. On Thursday, TPG clinched a deal to purchase a minority stake in Homrich Berg.

San Francisco-based TPG is about to prevail in an public sale for the stake in Inventive Planning that drew curiosity from different buyout companies, together with Permira, the sources stated, requesting anonymity because the discussions are confidential. The deal may very well be introduced within the coming days, the sources added.

If the talks are profitable, TPG would turn out to be one of many house owners within the wealth supervisor, alongside personal fairness agency Basic Atlantic which acquired a minority stake in Inventive Planning in 2020.

TPG and Permira declined to remark. Inventive Planning didn’t instantly reply to requests for remark.

Wealth managers have historically attracted sturdy curiosity from personal fairness companies who wish to again firms that generate regular money flows. The wealth administration trade’s fragmented nature additionally means firms can develop rapidly by means of acquisitions of rivals.

Overland Park, Kansas-based Inventive Planning presents companies together with monetary and tax planning, retirement plans and monetary consultancy for companies, and managed greater than $300 billion of property on the finish of 2023, in keeping with its web site.

Final 12 months, Inventive Planning agreed to purchase the private monetary unit of Goldman Sachs, after the Wall Avenue financial institution undertook a strategic overhaul at its wealth administration unit to give attention to excessive net-worth people, following its exit from the patron lending enterprise.

Based in 1992 by personal fairness executives Jim Coulter and David Bonderman, TPG had about $229 billion in property below administration as of the tip of June, up 65% from a 12 months earlier. The agency, which is presently led by Jon Winkelried, posted a 60% soar in fee-related revenue from managing property in its most up-to-date quarter.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook