Markets

Nvidia (NASDAQ:NVDA): Sure, This Inventory Additionally Goes Down

As Nvidia (NASDAQ:NVDA) inventory , wide-eyed traders are beginning to understand that this inventory truly goes down generally. It’s a surprising improvement as a result of chasing the inventory larger has been a worthwhile technique for an extended. But, some inventory merchants will be taught that Nvidia isn’t invincible. Certain, it’s nonetheless a extremely worthwhile firm, however I’m impartial on NVDA inventory till the share worth pulls again extra.

Nvidia designs highly effective processors that can be utilized in synthetic intelligence (AI) functions. The corporate is a darling of the inventory market, and as we’ll focus on quickly, analysts are typically enamored with Nvidia.

But, there’s truly a Wall Avenue skilled who dares to assign a destructive score to Nvidia inventory (we’ll get to that subject in a second). I received’t go full-on bearish, as I’m impartial and solely wish to see Nvidia’s market capitalization and valuation come down considerably. To me, it’s a case of “proper firm, proper inventory, unsuitable worth.”

Nvidia Might Conquer One other Area of the World

In case Nvidia wasn’t already world-dominating, the corporate is reportedly making an enormous transfer within the Center East quickly. There, owned by Qatar-based telecom agency Ooredoo.

Extra particularly, Ooredoo’s information facilities in Qatar, Algeria, Tunisia, Oman, Kuwait, and the Maldives could have entry to sturdy AI and graphics-processing expertise, courtesy of Nvidia. Presently, the monetary particulars of the Nvidia-Ooredoo settlement are unknown.

This settlement comes at a politically contentious time, to say the least. The U.S. authorities may not be too pleased in regards to the Nvidia-Ooredoo deal because of issues that Center Japanese international locations might doubtlessly present an avenue for China to get high-powered AI processors.

The U.S. can place restrictions on its exports of subtle AI chips to China, however it will possibly’t management what each firm does in each nation. So, it will likely be attention-grabbing to see if there are any repercussions from the association between Nvidia and Ooredoo. In the meanwhile, although, it’s in all probability cheap to conclude that Nvidia will plant its proverbial flag within the Center East and thereby acquire entry to new income streams.

A Dissenting Voice on Nvidia Inventory

To be truthful and balanced, I began off with a bit of excellent information for Nvidia’s shareholders. Nonetheless, not everyone seems to be straight-up bullish about Nvidia inventory. There’s a real contrarian voice on the market on Wall Avenue, as investor and blogger Johnny Zhang truly went as far as to .

Is it even authorized to do that in 2024? Zhang could also be responsible of stock-market blasphemy, as Nvidia is seen as an unassailable and invulnerable juggernaut of the white-hot AI {hardware} market.

Alternatively, I are likely to concur with Zhang’s causes for leaning bearish on Nvidia inventory. The market’s expectations about Nvidia’s future development could also be “overly optimistic, with potential dangers together with pull-forward demand, competitors, and geopolitical tensions,” Zhang defined.

Nvidia doesn’t at the moment have a lot “competitors” within the area of interest marketplace for AI-compatible graphics processing models (GPUs), nevertheless it’s laborious for one firm to be the king of the hill. In such a profitable trade, it shouldn’t be too stunning if rival upstarts come out of the woodwork, and they won’t all be from the U.S.

Nonetheless, in the intervening time, traders in all probability don’t must be overly involved about Nvidia dealing with stiff competitors. Reasonably, it’s the corporate’s valuation and the overwhelmingly enthusiastic market sentiment that must concern the Nvidia perma-bulls.

On that subject, a quote from Zhang actually resonated with me. “Have in mind… the Wall Avenue touts at all times encourage you to be most bullish on shares when they’re sizzling or portrayed as the following huge factor sooner or later,” he warned.

That quote is value writing down and remembering. Now, Nvidia inventory is displaying indicators of exhaustion, nevertheless it nonetheless trades at 65.6x trailing 12-month earnings (based mostly on ). In the meantime, the sector median P/E ratio is 23.5x.

Is Nvidia Inventory a Purchase, In keeping with Analysts?

On TipRanks, NVDA is available in as a Robust Purchase based mostly on 38 Buys and three Maintain rankings assigned by analysts up to now three months. The is $156.35, implying 32.4% upside potential.

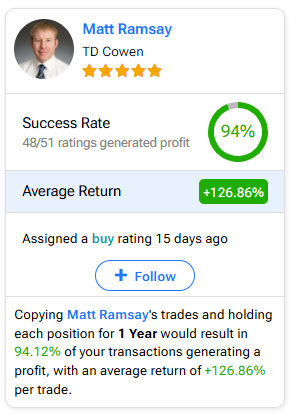

In the event you’re questioning which analyst it’s best to observe if you wish to purchase and promote NVDA inventory, probably the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Matt Ramsay of TD Cowen, with a median return of 126.86% per score and a 94% success price. Click on on the picture under to be taught extra.

Conclusion: Ought to You Take into account Nvidia Inventory?

Nvidia is a niche-market juggernaut, and there’s no level in making an attempt to disclaim this. On the identical time, I agree with Zhang that the market could also be “overly optimistic” relating to Nvidia’s future development assumptions.

Many analysts nonetheless like Nvidia lots, and I don’t blame them. As I see it, investing in Nvidia might make loads of sense, however not on the present share worth. Due to this fact, I’m impartial on NVDA inventory and would wish to see it pull again 20% and even 25% earlier than contemplating taking a share place.

Markets

Inventory market at this time: US shares finish combined however end the week close to document highs after the Fed's first price reduce in 4 years

-

US shares have been principally decrease Friday, although the Dow eked out a achieve to shut at a document excessive.

-

The Federal Reserve’s first rate of interest reduce since 2020 helped drive the week’s positive factors.

-

Buyers see the Fed’s easing as a constructive signal for the economic system and the inventory market.

US shares closed principally decrease on Friday, however completed the week greater by simply over 1% for the , , and

The Dow edged barely greater in Friday’s session to clinch one other document near cap off the week.

The anticipation and supply of the helped drive the positive factors this week.

The Fed issued a jumbo 50 foundation level rate of interest reduce to “recalibrate” financial coverage, as Fed Chairman Jerome Powell put it 9 occasions throughout his FOMC speech on Wednesday.

Buyers took the transfer as assurance that the US economic system is on observe for a mushy touchdown, as inflation continues to chill and the labor market normalizes.

US shares after declining barely on Wednesday, as buyers had extra time to digest the Fed’s rate of interest resolution.

Going ahead, there needs to be extra positive factors in retailer for the inventory market, based on Raymond James CIO Larry Adam.

“The mixture of Fed easing, and a mushy touchdown ought to show to be a tailwind for danger property (equities specifically). Traditionally, Fed easing cycles have been constructive for the fairness market. In truth, the S&P 500 has been up ~5% on common within the 12 months following the Fed’s first reduce,” Adam stated in a word on Friday.

The S&P 500 and Dow Jones Industrial Common each hit document highs on Thursday. However these document highs might turn into a legal responsibility if the economic system weakens, based on Adam.

“With the S&P 500 rallying to document ranges and at present at among the costliest valuations (23.5 LTM P/E) that we’ve got seen in historical past, there’s not a lot room for disappointment if the soft-landing state of affairs have been to falter,” Adam stated.

Here is the place US indexes stood on the 4:00 p.m. closing bell on Friday:

Here is what else occurred at this time:

In commodities, bonds, and crypto:

-

crude oil decreased 0.10% to $71.09 a barrel. , the worldwide benchmark, dropped 0.39% to $74.59 a barrel.

-

was up 1.17% to $2,645.30 an oz.

-

The ten-year Treasury yield was greater by 2 foundation factors at 3.733%.

-

was down 0.11% to $62,894.

Learn the unique article on

Markets

X names Brazil authorized consultant because it fights ban within the nation

BRASILIA (Reuters) -Elon Musk-owned social media platform X has named a authorized consultant in Brazil, the agency’s attorneys stated on Friday, in a transfer that may deal with one of many calls for imposed by Brazil’s prime courtroom to permit the corporate to function within the nation.

Andre Zonaro and Sergio Rosenthal, who have been not too long ago appointed as X’s attorneys in Brazil, informed Reuters that colleague Rachel de Oliveira Conceicao was chosen because the agency’s authorized consultant, and that that they had submitted her identify to the Supreme Court docket.

Brazilian regulation requires international firms to call a authorized consultant to function within the nation. The consultant would assume the authorized obligations for the agency regionally.

X had a authorized consultant in Brazil till mid-August, when it determined to shut its workplaces within the nation.

In late August, Brazil’s prime courtroom ordered cellular and web service suppliers to dam X within the nation, and customers have been lower off inside hours after X didn’t identify a brand new authorized consultant.

The transfer adopted a months-long dispute between Musk and Brazilian Justice Alexandre de Moraes over the agency’s non-compliance with courtroom orders demanding the platform take motion towards the unfold of hate speech.

Courts have beforehand blocked accounts implicated in probes of spreading misinformation and hate, which Musk has denounced as censorship.

On Thursday, the attorneys representing X in Brazil stated the agency was beginning to adjust to orders on eradicating content material, one other demand from the highest courtroom.

Markets

5 Issues to Know in Crypto This Week: The Fed Ignites 6.85% Crypto Market Rally

Ripple, the SEC, and Capitol Hill

SEC Chair Gensler and US lawmakers have been in prep mode forward of a US Monetary Companies Committee Listening to, the place all 5 SEC Commissioners will give testimony.

In a latest CNBC interview, SEC Chair Gary Gensler focused the US digital asset house, warning that the sphere is rife with fraudsters, scammers, and grifters. Discussing crypto laws, Gensler continued to reject claims a few lack of regulatory readability, saying that US securities legal guidelines have given readability for 90 years.

On Thursday, Republican Congressman Ritchie Torres focused the SEC, noting that the phrase, “digital asset safety,” is absent from congressional legal guidelines, SEC guidelines, and Supreme Courtroom rulings. Congressman Torres concluded,

“The SEC invented the time period out of skinny air.”

SEC Chair Gensler’s reference to US securities legal guidelines prompt the company will proceed to focus on crypto companies and probably attraction rulings within the SEC vs. Ripple case. Uncertainty surrounding SEC plans to attraction continued to peg XRP beneath $0.60.

From Monday, September 16, to Saturday, September 21, XRP was up 1.98% to $0.5834, underperforming the broader crypto market.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024