Markets

One in every of traders' largest fears in regards to the inventory market is fading

-

The S&P 500 rally is broadening past mega-cap tech shares to smaller corporations.

-

That is a terrific signal for the sustainability of the present bull market.

-

“Always remember, the lifeblood of a bull market is rotation and we see that taking place the rest of this 12 months.”

One of many prevailing sources of concern in regards to the power of the inventory market rally in 2024 is dissipating.

The stellar run of positive aspects that is helped the notch greater than 30 document highs up to now this 12 months is lastly broadening out. In different phrases, it is not only a handful of mega-cap tech shares which can be driving the S&P 500 and increased anymore.

That is an enormous win for the bulls, as one of many that began in October 2022 was a scarcity of breadth, or participation, from smaller-sized corporations, which matches hand-in-hand with the — Apple, Amazon, Alphabet, Microsoft, Nvidia, Tesla, and Meta Platforms.

And the rally in smaller-cap shares, which exploded final week on the prospect of imminent rate of interest cuts following the is reaching historic ranges.

Based on Bespoke Funding Group, the small-cap Index is on observe to notch a five-day win streak of greater than 10% after it gained a further 2.5% on Tuesday.

“If immediately’s rally holds, this would be the Russell’s fifth straight buying and selling day of 1%+ positive aspects. There have solely been 4 different five-day streaks of 1%+ positive aspects within the index’s historical past courting again to 1979,” Bespoke mentioned in an e mail on Tuesday.

Maybe what’s extra spectacular than the large rally in small-cap shares is that large-cap shares have largely missed out on the positive aspects over the previous week.

“If immediately’s transfer holds via the shut, this would be the largest five-day outperformance that the Russell 2000 has ever seen towards the S&P 500!” Bespoke mentioned, with the relative outperformance nearing 9 share factors.

And in response to UBS, the rotation into smaller-cap shares, which is taken into account wholesome for the broader market, might have legs if 4 issues occur.

The financial institution mentioned in a notice on Tuesday that so long as inflation stays contained, the Fed begins chopping rates of interest, the financial system continues to develop, and earnings progress extends to smaller corporations, the broadening out of the inventory market rally ought to proceed.

In different phrases, so much has to go proper for this small-cap commerce to work, which leaves UBS considerably cautious on its latest rally.

“Whereas all of those 4 components appear very a lot doable and, on the desk, it would take a disappointment in just one space to ship any indicators of broadening into reverse,” UBS mentioned, including that the primary two situations appear extra possible than the final two.

However Shannon Saccocia, CIO of Neuberger Berman Personal Wealth, expects small-cap earnings to see huge enhancements going ahead.

“This broadening out is per our view that earnings exterior of the biggest U.S. shares have alternatives to ship earnings progress within the second half of the 12 months, whereas the highest names are more likely to expertise an incremental deceleration in earnings progress – though admittedly nonetheless at enticing absolute and relative ranges,” Saccocia advised Enterprise Insider through e-mail on Tuesday.

Carson Group chief market strategist Ryan Detrick additionally sees a sustainable rally in small-cap shares going ahead.

“We have anticipated this bull to broaden out and now that inflation is final 12 months’s drawback and rate of interest cuts are on the best way, it has supplied cowl for traders to maneuver into the extra charge delicate smaller names. Within the second half of this 12 months, we count on to see issues like small/midcaps and industrials and financials to take the baton from giant cap tech, which might be completely regular at this stage of the bull market,” Detrick advised Enterprise Insider in an e-mail on Tuesday.

And such an occasion would in the end that the inventory market rally is simply too slender.

“In a wholesome bull market, you wish to see wider participation,” Detrick mentioned. “Always remember, the lifeblood of a bull market is rotation and we see that taking place the rest of this 12 months.”

Learn the unique article on

Markets

Nordea Financial institution reaches $35 million settlement with New York tied to Panama Papers

By Jonathan Stempel

NEW YORK (Reuters) -Nordea Financial institution agreed to pay a $35 million civil superb to settle fees by a prime New York regulator that the Finland-listed financial institution didn’t correctly police cash laundering and different felony actions, together with issues uncovered within the Panama Papers scandal.

New York state monetary providers superintendent Adrienne Harris faulted Nordea’s insufficient due diligence over clients and high-risk banking companions, saying even the financial institution acknowledged its oversight confronted a “important” danger of failure.

Jamie Graham, Nordea’s chief compliance officer, mentioned the Helsinki-based financial institution was happy to settle, and acknowledged that it had traditionally “underestimated the complexity of stopping monetary crime and the assets wanted for that objective.”

New York mentioned Nordea was linked to billions of {dollars} of high-risk transactions between 2008 and 2019, together with at a Vesterport, Denmark, department that implicated the financial institution in schemes referred to as the Russian Laundromat and Azerbaijani Laundromat.

A consent order mentioned Nordea “acknowledged its shortcomings” with respect to anti-money laundering procedures on the former Denmark department, at former branches in Latvia, Lithuania and Estonia, and in correspondent financial institution and buyer relationships.

Printed in 2016, the Panama Papers supplied particulars on hundreds of offshore accounts and entities, together with tax havens linked to people like Ukrainian President Volodymyr Zelenskiy and Argentine soccer star Lionel Messi.

They have been based mostly on leaks of about 11.5 million paperwork from the now-defunct Panamanian legislation agency Mossack Fonseca.

Nordea mentioned it should embody the $35 million superb as a cost in third-quarter outcomes.

Markets

Inventory market right now: US shares tread water with Nvidia, charge cuts in focus

Shopper confidence rose greater than anticipated in August regardless of shoppers evaluation of the labor market persevering with to weaken.

The from the Convention Board was 103.3, above the 101.9 seen in July and better than the 100.7 economists surveyed by Lusso’s Information had anticipated.

“General shopper confidence rose in August however remained inside the slender vary that has prevailed over the previous two years,” mentioned Dana M. Peterson, The Convention Board chief economist. “Customers continued to precise blended emotions in August. In comparison with July, they have been extra optimistic about enterprise situations, each present and future, but in addition extra involved in regards to the labor market.”

Peterson added, “shoppers’ assessments of the present labor scenario, whereas nonetheless optimistic, continued to weaken, and assessments of the labor market going ahead have been extra pessimistic. This probably displays the latest enhance in unemployment. Customers have been additionally a bit much less optimistic about future revenue.”

The report comes as latest financial knowledge has proven softening within the labor market. In July,, its highest stage in practically three years whereas the US labor market added 114,000 jobs, the second-lowest month-to-month complete since 2020.

In August’s shopper confidence report, 32.8% of shoppers mentioned jobs have been “plentiful,” down from 33.4% in July. In the meantime, 16.4% of shoppers mentioned jobs have been “exhausting to get,” barely up from 16.3%.

Markets

Shares and oil value slip, with Mideast dangers, US charges in focus

By Iain Withers

LONDON (Reuters) -Gold costs have been simply shy of a report peak and oil costs levelled off on Tuesday after a surge over the previous week, as buyers sought security amid geopolitical dangers and appeared forward to Nvidia (NASDAQ:) earnings and U.S. inflation knowledge later this week.

European shares have been broadly flat, following a late rally in index. World inventory indexes have been little modified general, with forecast-beating revenue from the world’s greatest listed miner BHP serving to to prop up sentiment.

U.S. and Nasdaq futures have been each flat.

Gold hovered above $2,500 per ounce on expectations of imminent U.S. charge cuts and lingering considerations concerning the Center East battle, exacerbated by a significant missile alternate between Israel and Hezbollah on Sunday.

Center East tensions – together with considerations a couple of potential shutdown of Libyan oil fields – had led to a surge in oil costs of greater than 7% over the earlier three periods. Nonetheless, that rally misplaced steam on Tuesday, with a slight dip in costs. [O/R]

Expectations for quicker rate of interest cuts in the US have been a key driver of market strikes, after Federal Reserve chair Jerome Powell mentioned on Friday the central financial institution was prepared to begin reducing charges.

“It might be an actual shock to not get a (Fed) charge lower in September,” mentioned Man Miller, chief market strategist at Zurich Insurance coverage Group (OTC:), including an preliminary 25 foundation level lower was probably.

“It was additionally attention-grabbing that he did not actually push towards the market expectations of 100 plus foundation factors of charge cuts between now and year-end,” Miller added.

The was simply off a one-year low at 100.83, whereas the euro and pound nudged in the direction of multi-month highs versus the dollar. [FRX/]

A key measure of U.S. inflation due on Friday might additional affect market perceptions of how rapidly the Fed will act.

Traders have been additionally on edge forward of Nvidia’s earnings report on Wednesday, the place something in need of a stellar forecast from the chipmaker might jolt investor confidence within the AI-fuelled rally.

“I believe Nvidia will take extra significance” than the inflation knowledge, mentioned Michaël Nizard, head of multi-asset at investor Edmond de Rothschild.

“We all know that the tempo of inflation goes properly. We do not know what could possibly be the steering for this huge, huge actor in synthetic intelligence. This could possibly be a bump for the market.”

MSCI’s all-country index of shares () was broadly unchanged on the day at 829.75.

Additionally protecting sentiment in examine was the transfer by Canada, following the lead of the US and European Union, to impose a 100% tariff on imports of Chinese language electrical automobiles and a 25% tariff on imported metal and aluminium from China.

Oil costs took a breather, with futures 0.6% decrease at $80.95 a barrel, whereas futures eased 0.7% to $76.89 a barrel.

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

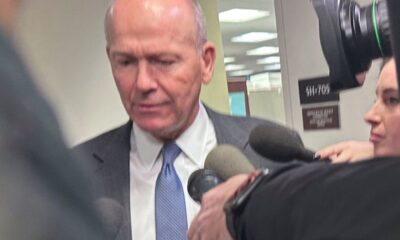

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus