Markets

Ought to traders select Treasury or Company Bonds, or MBS?

In as we speak’s funding panorama, fastened earnings choices stay an important part of a balanced portfolio. These investments, sometimes called bonds, provide traders a gentle stream of earnings funds and a return on their principal funding at maturity.

In a current funding analysis observe, BCA Analysis thought of the relative deserves of 4 totally different fastened earnings investments within the present financial atmosphere: 2-year Treasuries, 10-year Treasuries, Baa-rated company bonds and present coupon Company MBS (Mortgage-Backed Securities).

2-12 months Treasury Bond Predictions

The funding agency stated they estimate returns for each the 2-year and in three totally different financial situations: a recession situation, a gentle touchdown situation, and a established order situation.

For the recession situation, the agency primarily based its assumptions on what occurred within the two most up-to-date pre-COVID recessions (2001 and 2008).

It assessed how bond yields moved in the course of the 12-month durations spanning from six months earlier than the primary Fed charge reduce to 6 months after. Consequently, it assumes a 287 bps drop within the 2-year Treasury yield and a 134 bps drop within the 10-year.

The gentle touchdown situation assumes inflation regularly developments again towards the Fed’s goal however that the labor market holds agency and a recession is prevented.

BCA says this causes the Fed to chop charges at a tempo of 25 bps per quarter beginning in September. “Moreover, we assume that the market anticipates additional modest coverage easing on the finish of our 12-month funding horizon, so our 12-month Fed Funds discounter rises from its present -123 bps however stays under zero at -50 bps,” says BCA.

“This provides us a goal of three.95% for the 2-year yield, 77 bps under present ranges. We moreover assume a modest steepening of the two/10 curve, although we preserve it inverted at -10 Bps,” they add. “This provides us a 10-year yield goal of three.85%, 37 bps under present ranges.”

Lastly, they state the established order situation is designed to be a baseline the place the Fed retains the coverage charge unchanged whereas the market nonetheless anticipates that the subsequent transfer will likely be a reduce.

“An assumption of no change within the fed funds charge and a 12-month Discounter rising to -50 bps provides us a goal of 4.94% for the 2-year Treasury yield, 22 bps above present ranges,” writes BCA. “Moreover, we assume no change in 2/10 slope on this situation, so the 10-year yield additionally rises by 22 bps.”

Advantages Of a 10-12 months Treasury Bond

In line with BCA Analysis analysts, the 10-year Treasury observe is the pure period play.

“It compensates traders for taking rate of interest danger however has no publicity to credit score or convexity danger,” they clarify.

BAA-Rated Company Bond Outlook

In line with BCA, the Baa-rated company bond carries a good quantity of each rate of interest danger and credit score danger.

“Whereas in a single sense this makes the company bond essentially the most harmful selection, the bond additionally advantages from the truth that returns for taking credit score danger and returns for taking rate of interest danger are typically negatively correlated,” says the agency.

The funding agency feels that the gentle touchdown situation is the place company bonds shine, noting the mixture of falling Treasury yields and tightening company bond spreads as being an enormous boon for the sector.

On this situation, they consider Baa-rated company bonds outperform the 1-year risk-free charge by 3.90% within the gentle touchdown situation, in comparison with 1.85% and 1.10% outperformance for the 10-year and 2-year Treasury notes.

Present Coupon Company MBS For Traders

“Low cost Company MBS are these securities presently buying and selling at lower than $0.98 on the greenback. These securities make up about 85% of the Bloomberg Company MBS index and have a median coupon of two.77%,” explains BCA. “Present coupon Company MBS are a a lot smaller proportion of the index. They commerce near par and have a median coupon of 5.29%.”

As well as, present coupon MBS have a decrease period than low cost MBS and provide a major yield benefit.

The agency says the relative deserves of the present coupon Company MBS develop into obvious when danger is taken into account alongside anticipated return.

“Company MBS carry out moderately nicely in each the recession and gentle touchdown situations with minimal variance,” states BCA.

Which Fastened Earnings Funding Is Greatest For Recessions or Comfortable landings?

In line with BCA, the present coupon Company MBS provides the perfect funding worth in US fixed-income markets.

“Traders ought to maintain obese positions within the sector and underweight positions in company bonds,” they argue. BCA additionally continues to suggest holding portfolio period at impartial till clearer indicators of labor market deterioration emerge.

Discover the Advantages of Bonds

Investing in bonds is a strategic means to make sure portfolio stability and dependable earnings. Bonds, whether or not from governments or firms, provide decrease volatility in comparison with shares and are important for danger administration. On Lusso’s Information, the Bonds part options complete knowledge on rates of interest, bond costs, and yield curves, serving to traders navigate the fastened earnings market successfully.

Markets

The Tesla bulls experience once more: Morning Transient

That is The Takeaway from right this moment’s Morning Transient, which you’ll to obtain in your inbox each morning together with:

If Tesla () generally is a tech firm when automobile gross sales falter, certainly it may be a automobile firm when gross sales exceed expectations. That’s how Wall Road sees it, as .

During the last week, Tesla shares have surged greater than 25%, that beat estimates, leaving the paltry features of the remainder of the “Magnificent Seven” within the mud.

When CEO Elon Musk insisted earlier this yr that , the message jolted the inventory worth whilst gross sales faltered. Whereas handy, the pitch was true sufficient. And the edict apparently goes each methods.

The speaks to the facility of touting an industry-leading product — a lesson for AI startups — and the advantage of making AI ambitions part of a broader marketing strategy, quite than the only facet of it. However conversely, it underscores that Tesla’s heady AI objectives are nonetheless carefully tethered to its automobile gross sales.

Combining lofty techno-ambitions with shifting automobiles off tons has been key to Musk’s salesmanship.

“In a nutshell, the worst is within the rear-view mirror for Tesla as we imagine the EV demand story is beginning to return to the disruptive tech stalwart,” outspoken Tesla backer Dan Ives of Wedbush Securities wrote in a observe earlier this week.

The upbeat supply knowledge counters a wave of detrimental sentiment.

Pushed by stiffening competitors in China, softening demand at house, worth cuts, layoffs, and Musk’s authorized and company dramas, Tesla had limped alongside as a Magnificent Seven laggard. However latest wins have a approach of erasing earlier losses. And Tesla is now using a string of victories, with an earnings report and a much-hyped robotaxi unveiling simply across the nook.

Buyers are shopping for into the shifting temper. Since a low in late April, Tesla is up greater than 60%.

However even some Tesla backers are poking holes within the newest rally. It’s true Tesla beat expectations, however gross sales fell from the identical interval final yr. And the way have extra aggressive rivals and cheaper costs eaten into profitability?

“In actuality Tesla EV gross sales had been down 5% and the corporate appears to be capitulating to the concept of promoting EVs. It’s all about FSD and taxis now,” , CEO of Gerber Kawasaki Wealth & Funding Administration, referring to Full Self-Driving.

In some methods, Tesla’s versatile identification as a automobile firm when occasions are good and a tech firm when the chips are down generally is a hindrance to a transparent company technique. Is Tesla nonetheless gunning for a mass-market EV in each household’s driveway? Or is it a platform orchestrating a fleet of autonomous taxis increasing the frontier of AI know-how?

It may be each, after all. And . Buyers don’t appear to thoughts which metaphorical cap the corporate is sporting on any specific day. Simply so long as the numbers go up. AI could make that occur. And, for now, so can automobiles.

Hamza Shaban is a reporter for Lusso’s Information protecting markets and the economic system. Observe Hamza on Twitter .

Markets

Earnings season to check hopes for broader shares rally

By Lewis Krauskopf

NEW YORK (Reuters) – Hopes that the U.S. shares rally will broaden past megacaps like Nvidia (NASDAQ:) might be examined in coming weeks as traders study whether or not revenue development from different firms is beginning to meet up with that of the tech-related leaders.

The has rallied 16% up to now in 2024, pushed by a handful of large shares poised to learn from rising synthetic intelligence know-how. Solely 24% of shares within the S&P 500 outperformed the index within the first half, the third-narrowest six-month interval since 1986, in line with BofA International Analysis strategists.

In the meantime, the equal-weight S&P 500 — a proxy for the typical inventory — is just up round 4% this yr. As of Tuesday, about 40% of S&P 500 parts had been down for the yr.

Second-quarter earnings kick off subsequent week with main banks together with JPMorgan and Citigroup reporting on July 12. Buyers might be watching whether or not income from different firms are catching up with the “Magnificent 7”: Nvidia, Microsoft (NASDAQ:), Apple (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), Meta Platforms (NASDAQ:) and Tesla (NASDAQ:), a lot of which rebounded from struggles in 2022.

Buyers typically view a slim rally as extra fragile, as a result of weak spot in just some huge shares may sink indexes, however some hope features will unfold through the second half.

Extra firms are projected to submit improved earnings as many traders count on the economic system to navigate a mushy touchdown, which may increase shares buying and selling at extra average valuations than market leaders.

“If we’re on the lookout for a catalyst to have broader participation on this rally this yr, the second-quarter earnings reporting season could be the beginning of that,” stated Artwork Hogan, chief market strategist at B Riley Wealth.

The S&P 500 is buying and selling at about 21 occasions ahead earnings estimates, but when the highest 10 shares by market worth are excluded that determine drops to 16.5 on common for the remainder of the index, Hogan stated.

In an extra signal of the slim rally, the data know-how and communication providers sectors, which embody a lot of the Magnificent 7, are the one two of 11 S&P 500 sectors to outperform the broader index this yr.

Earnings among the many Magnificent 7 rose 51.8% year-on-year within the first quarter in comparison with 1.3% earnings development for the remainder of the S&P 500, in line with Tajinder Dhillon, senior analysis analyst at LSEG.

That hole is anticipated to shrink, with forecasts for Magnificent 7 year-on-year earnings rising 29.7% within the second quarter and earnings among the many remainder of the index up 7.2%, in line with LSEG.

“We predict larger steadiness in profitability may result in broader market participation within the coming quarters,” Chris Haverland, world fairness strategist with the Wells Fargo Funding Institute (WFII), stated in a notice on Tuesday.

The WFII suggests traders trim features within the know-how and communication providers sectors to benefit from weak spot in power, healthcare, industrials and supplies.

Later within the yr, the Magnificent 7’s revenue benefit is anticipated to decrease additional. The group’s year-on-year earnings development is anticipated to be 17.4% within the third quarter and 18.3% within the fourth. That compares with rest-of-index earnings development of 6.8% within the third quarter and 13.9% within the fourth.

“We anticipate that we’ll have practically all sectors of the S&P taking part in earnings development in 2024,” stated Katie Nixon, chief funding officer for Northern Belief (NASDAQ:) Wealth Administration.

Not everyone seems to be satisfied that different teams are poised to catch up, as AI stays a dominant theme. Robert Pavlik, senior portfolio supervisor at Dakota Wealth Administration, stated he had doubts about earnings development assembly expectations, as a consequence of weak client spending, sticky inflation and different regarding financial indicators.

Nonetheless, in coming days, traders may get a clearer view of the economic system’s well being and when the Federal Reserve will begin reducing rates of interest, which may additionally set off broader market features. Fed Chair Jerome Powell is because of testify earlier than Congress on Tuesday, whereas Thursday’s launch of the month-to-month client worth index gives an important have a look at inflation.

Markets

2 Synthetic Intelligence Shares That May Make You a Millionaire

(AI) is the recent pattern in the marketplace at the moment. Whereas there may be definitely some hype related to it, AI seems to have some endurance and is poised to have an actual impact on the economic system. Individuals and corporations are utilizing AI to make use of and create all types of transformative functions. Picture imaging that is by no means been executed earlier than and information evaluation at unheard-of speeds are simply two examples.

Companies are harnessing AI’s energy to run higher and quicker, and lots of of them are disrupting the established order and capturing market share. A few of these firms are established winners who’re utilizing their strong property to guide the cost, and others are small innovators disrupting the norm in area of interest segments of the economic system.

Let’s take a look at an instance from every class — Amazon (NASDAQ: AMZN) and Lemonade (NYSE: LMND) — and see why every may show you how to construct a millionaire-maker portfolio.

1. Amazon: Main with generative AI

Amazon has a protracted historical past of investing closely in AI and is now turning its consideration and assets to incorporating and increasing generative AI. It makes use of AI all through its many companies, however its most enjoyable alternatives for AI contain Amazon Internet Companies (AWS), its cloud-computing phase.

Individuals who know Amazon predominantly as an e-commerce large could not notice that it is usually the main cloud computing firm globally. It is a enterprise and has 31% of the worldwide market. Amazon has developed a aggressive set of generative AI instruments for AWS customers that simplify entry and create unbelievable alternatives. It has an assortment of companies in three tiers to fulfill completely different wants.

The foundational layer is for builders to construct their very own massive language fashions (LLMs), that are the important thing foundation for generative AI. These are fashions which have been educated on a lot information that they will start to create, or generate, with out intervention. That is what OpenAI’s ChatGPT is thought for, and that is the place Nvidia‘s chips are available in. They’re highly effective sufficient to deal with the required information load to make this work, and it is one of many primary causes Nvidia’s gross sales, and inventory, have exploded over the previous two years.

The following tier is for builders to make use of Amazon’s LLMs to generate AI for particular companies, and the highest layer entails turnkey options for companies that do not want custom-built companies. One instance is a software that creates web page descriptions for merchandise on Amazon shops when a consumer inputs a URL.

AWS accounts for about 17% of Amazon’s whole gross sales however 61% working revenue. As AWS turns into a higher a part of the entire, profitability may soar. Amazon inventory usually follows the earnings, and this might supercharge Amazon inventory over the subsequent a number of years, resulting in unbelievable positive aspects for traders who purchase in now.

As with every nice inventory, turning into a part of a millionaire-maker portfolio relies upon how a lot you make investments and the way lengthy you wait. Some shares can flip into thousands and thousands on their very own; should you’d invested $1,000 in Amazon inventory at its preliminary public providing, you’d have greater than $2 million at the moment. I am undecided it might try this once more, however it might outperform the market common and contribute to a diversified portfolio of successful shares that collectively can result in millionaire-maker standing.

2. Lemonade: A compelling AI disruptor

Lemonade makes use of AI to energy its modern insurance coverage mannequin. It is a younger firm in operation for lower than 10 years, and it has already attracted greater than 2 million members and counting. It has reported regular and powerful progress each quarter because it went public 4 years in the past. Within the 2024 first quarter, in-force premium, which measures common annual whole insurance policies, elevated 22% 12 months over 12 months, and income elevated 25%.

Lemonade has a key benefit over legacy insurers as a result of it was constructed on a digital AI-powered infrastructure. All of its elements work collectively immediately, and administration touts this connectivity because the core purpose its mannequin will ultimately outdo the competitors. Conventional fashions, which require extra human intervention, will not have the ability to sustain with Lemonade. Nevertheless, it is nonetheless constructing out its database because it grows shortly and provides new members and insurance policies, so it is taking time to succeed in that time.

Administration gave one latest instance the place the AI mechanisms are already producing essential outcomes. In insurance coverage, the loss adjustment expense (LAE) ratio measures how effectively an insurer manages overhead bills. The usual for big firms is about 10%, however Lemonade’s is 7.6% regardless of its small measurement. The corporate attributes this to its reliance on know-how to deal with claims, which will increase effectivity whereas enhancing the client expertise. It expects this type of affect to indicate up in additional of its efficiency because it gathers extra information.

Within the meantime, it is taking longer than traders wish to change into worthwhile, and Lemonade inventory nonetheless trades down practically 90% from its all-time highs. Granted, that was when it was buying and selling at a nosebleed valuation. However now it is buying and selling at 2.5 instances trailing-12-month gross sales, which is filth low cost for a progress inventory. It could take a while, however Lemonade may very well be a standout inventory when its algorithms kick in with higher information and it begins to report earnings.

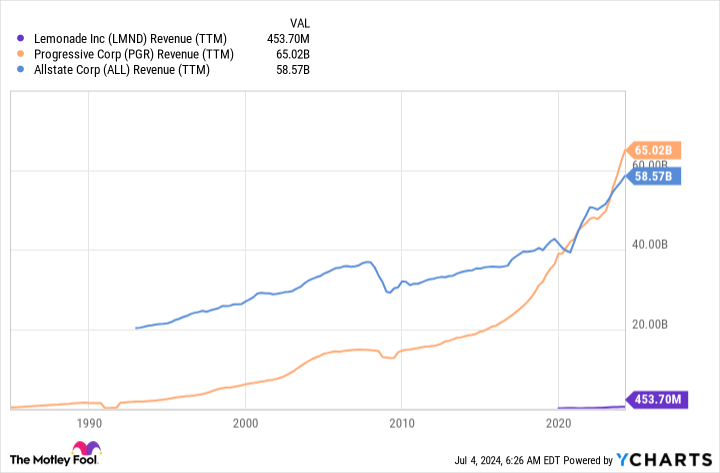

A big sufficient funding in Lemonade at the moment may flip into $1 million over a few years if Lemonade can flip its enterprise worthwhile. Take into account how small Lemonade is in comparison with trade leaders like Progressive and Allstate.

If Lemonade can develop to the place it’s producing income ranges on par with its rivals, its inventory may ship severe returns and switch shareholders who go it early into millionaires.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for traders to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Lemonade. The Motley Idiot has positions in and recommends Amazon, Lemonade, and Nvidia. The Motley Idiot recommends Progressive. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing