Markets

Pernod Ricard to promote bulk of wine portfolio to Accolade Wine house owners

LONDON (Reuters) -Pernod Ricard mentioned on Wednesday it agreed to promote the vast majority of its wine portfolio to the house owners of Australia’s Accolade Wines, disposing of a dragging division to deal with its core enterprise of spirits.

The world’s No.2 Western spirits maker plans to promote its wine manufacturers from Australia, New Zealand and Spain, together with well-known labels like Jacobs Creek, Stoneleigh and Campo Viejo, topic to regulatory approvals. It didn’t disclose a value.

The transfer will see Pernod hone its portfolio additional in the direction of spirits like Absolut Vodka and Martell cognac, particularly liquors with a better price ticket. It can additionally proceed to personal champagne manufacturers like Mumm and its U.S. and French wine manufacturers, in addition to labels in Argentina and China.

Pernod mentioned in a press release the deal would enable it to direct its assets to manufacturers that drive progress, whereas its former wine manufacturers would belong to a devoted wine participant with international gross sales.

“(They) will profit from the main focus required to realize their potential, reinforce their place and seize alternatives all over the world,” the spirits maker mentioned.

Wine gross sales made up simply 4% of Pernod’s gross sales in its 2023 monetary yr, once they declined by 2%. The corporate has more and more centered on costly spirits as wine has misplaced drinkers to beer and spirits in Western markets. Consumption in China, a former high-growth wine market, is now shrinking.

The wine business globally is grappling with a provide glut, forcing some producers to destroy vines, and up to date years’ harvests have additionally been hit by poor climate.

The consortium of traders that owns Accolade, Australian Wine Holdco Restricted, contains funds backed by Bain Capital and others. Accolade didn’t reply instantly to a request for remark.

Markets

Inventory market right now: US shares tread water with Nvidia, charge cuts in focus

Shopper confidence rose greater than anticipated in August regardless of shoppers evaluation of the labor market persevering with to weaken.

The from the Convention Board was 103.3, above the 101.9 seen in July and better than the 100.7 economists surveyed by Lusso’s Information had anticipated.

“General shopper confidence rose in August however remained inside the slender vary that has prevailed over the previous two years,” mentioned Dana M. Peterson, The Convention Board chief economist. “Customers continued to precise blended emotions in August. In comparison with July, they have been extra optimistic about enterprise situations, each present and future, but in addition extra involved in regards to the labor market.”

Peterson added, “shoppers’ assessments of the present labor scenario, whereas nonetheless optimistic, continued to weaken, and assessments of the labor market going ahead have been extra pessimistic. This probably displays the latest enhance in unemployment. Customers have been additionally a bit much less optimistic about future revenue.”

The report comes as latest financial knowledge has proven softening within the labor market. In July,, its highest stage in practically three years whereas the US labor market added 114,000 jobs, the second-lowest month-to-month complete since 2020.

In August’s shopper confidence report, 32.8% of shoppers mentioned jobs have been “plentiful,” down from 33.4% in July. In the meantime, 16.4% of shoppers mentioned jobs have been “exhausting to get,” barely up from 16.3%.

Markets

Shares and oil value slip, with Mideast dangers, US charges in focus

By Iain Withers

LONDON (Reuters) -Gold costs have been simply shy of a report peak and oil costs levelled off on Tuesday after a surge over the previous week, as buyers sought security amid geopolitical dangers and appeared forward to Nvidia (NASDAQ:) earnings and U.S. inflation knowledge later this week.

European shares have been broadly flat, following a late rally in index. World inventory indexes have been little modified general, with forecast-beating revenue from the world’s greatest listed miner BHP serving to to prop up sentiment.

U.S. and Nasdaq futures have been each flat.

Gold hovered above $2,500 per ounce on expectations of imminent U.S. charge cuts and lingering considerations concerning the Center East battle, exacerbated by a significant missile alternate between Israel and Hezbollah on Sunday.

Center East tensions – together with considerations a couple of potential shutdown of Libyan oil fields – had led to a surge in oil costs of greater than 7% over the earlier three periods. Nonetheless, that rally misplaced steam on Tuesday, with a slight dip in costs. [O/R]

Expectations for quicker rate of interest cuts in the US have been a key driver of market strikes, after Federal Reserve chair Jerome Powell mentioned on Friday the central financial institution was prepared to begin reducing charges.

“It might be an actual shock to not get a (Fed) charge lower in September,” mentioned Man Miller, chief market strategist at Zurich Insurance coverage Group (OTC:), including an preliminary 25 foundation level lower was probably.

“It was additionally attention-grabbing that he did not actually push towards the market expectations of 100 plus foundation factors of charge cuts between now and year-end,” Miller added.

The was simply off a one-year low at 100.83, whereas the euro and pound nudged in the direction of multi-month highs versus the dollar. [FRX/]

A key measure of U.S. inflation due on Friday might additional affect market perceptions of how rapidly the Fed will act.

Traders have been additionally on edge forward of Nvidia’s earnings report on Wednesday, the place something in need of a stellar forecast from the chipmaker might jolt investor confidence within the AI-fuelled rally.

“I believe Nvidia will take extra significance” than the inflation knowledge, mentioned Michaël Nizard, head of multi-asset at investor Edmond de Rothschild.

“We all know that the tempo of inflation goes properly. We do not know what could possibly be the steering for this huge, huge actor in synthetic intelligence. This could possibly be a bump for the market.”

MSCI’s all-country index of shares () was broadly unchanged on the day at 829.75.

Additionally protecting sentiment in examine was the transfer by Canada, following the lead of the US and European Union, to impose a 100% tariff on imports of Chinese language electrical automobiles and a 25% tariff on imported metal and aluminium from China.

Oil costs took a breather, with futures 0.6% decrease at $80.95 a barrel, whereas futures eased 0.7% to $76.89 a barrel.

Markets

S&P Corelogic Case-Shiller Index Reaches New Peak in June 2024

The ten-Metropolis Composite mirrored a 7.4% yearly enhance, whereas the 20-Metropolis Composite recorded a 6.5% acquire. Each figures signify a slight deceleration from the earlier month’s outcomes.

Month-to-month Traits

Earlier than seasonal changes, the U.S. Nationwide Index, 20-Metropolis Composite, and 10-Metropolis Composite all confirmed optimistic momentum, with will increase of 0.5%, 0.6%, and 0.6%, respectively. Nevertheless, these figures point out a slowing tempo in comparison with earlier months.

After accounting for seasonal elements, the U.S. Nationwide Index posted a modest 0.2% month-to-month change. The 20-Metropolis and 10-Metropolis Composites demonstrated barely stronger efficiency, with 0.4% and 0.5% month-to-month will increase, respectively.

Professional Insights

Brian D. Luke, CFA, Head of Commodities, Actual & Digital Belongings at S&P Dow Jones Indices, provided precious context:

“House costs proceed to outpace inflation, exceeding historic norms. The hole between housing prices and the Client Worth Index is at the moment one proportion level above the 50-year common.”

Luke additionally highlighted the numerous long-term appreciation of residence values: “Since 1974, residence costs have surged over 1,one hundred pc earlier than adjusting for inflation. Even after accounting for inflation, costs have greater than doubled, exhibiting a 111% enhance.”

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

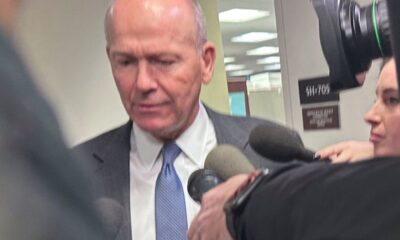

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus