Markets

Prediction: This Main Synthetic Intelligence (AI) Inventory May Compete With Nvidia within the Not-Too-Distant Future

What occurs when an organization’s largest prospects develop into fierce rivals? Think about that you simply personal the biggest chocolate chip firm within the land. You promote to all the biggest grocery chains as a result of you will have the most effective recipe. However each day, these shops pour cash into discovering the next-best recipe. In the event that they create it, it might be a recipe for catastrophe (pardon the pun).

That is Nvidia‘s actuality now. Firms like Microsoft, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Meta Platforms, and Amazon are spending billions on Nvidia GPUs whereas additionally spending billions creating competing merchandise. The important thing for Nvidia is to remain one step forward. Nevertheless it will not be simple with such deep-pocketed rivals.

Alphabet is severe competitors

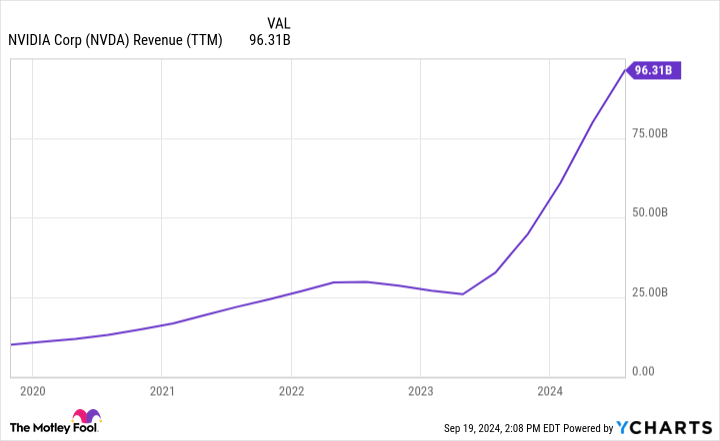

As proven under, the 4 huge tech firms talked about above reportedly account for practically 40% of Nvidia’s income, which exploded to $96 billion over the previous 12 months.

Of this, 85% comes from Nvidia’s information middle division. No matter firm can encroach on Nvidia’s huge market share of reportedly 70% to 95% in synthetic intelligence (AI) chips will profit in two methods: elevated revenue and decreased bills. In spite of everything, a lot of that enormous ramp in Nvidia’s income, depicted above, comes from different large tech firms’ pockets.

Nvidia is main resulting from its groundbreaking H100 GPU, which delivers unparalleled efficiency. These items are crucial for information facilities, giant language fashions, and generative AI, so Nvidia cannot sustain with demand and the margins are gigantic.

Alphabet is creating and bettering its competing AI product, the Tensor Processing Unit (TPU). It launched the sixth-generation TPU, Trillium, earlier this yr. With 5 instances extra velocity and 67% extra vitality effectivity, sixth-gen Trillium is a substantial leap over model 5.

Trillium would not compete straight on the open market with Nvidia. As a substitute, prospects lease house on Google Cloud, permitting Alphabet a broader buyer base. The power to lease house shall be intense competitors for Nvidia as firms can select to lease fairly than make capital investments. And, after all, Alphabet makes use of it internally.

Is Alphabet inventory a purchase now?

Alphabet can pour capital into AI initiatives as a result of it’s massively worthwhile and generates huge money circulation from its core promoting (Google Search and YouTube) and Google Cloud segments. These segments generated $84 billion in gross sales final quarter, a 14% year-over-year enhance that got here with $27 billion in working money circulation.

Additionally spectacular is that the working margin for Google Cloud elevated from 5% to 11% yr over yr. The rise in margin is a transparent indication of elevated effectivity and rising demand. As you possibly can see under, Google Cloud’s progress has been outstanding lately.

Even after rising practically fourfold since 2020, AI will enhance Google Cloud’s gross sales. For Alphabet, investments in AI, Google Cloud, and generative chatbots that rival ChatGPT, like Gemini, are essential to the long-term path.

Microsoft Bing is difficult Google Search by harnessing ChatGPT by its billion-dollar funding in its creator, OpenAI. Plus, generative AI could encroach on the search market. Nonetheless, there isn’t any have to sound an alarm but; Google Search grew 14% final quarter to $49 billion in income and stays far and away the market chief.

Alphabet inventory appears to be like like a cut price in a market the place many tech shares are buying and selling nicely above historic valuations. As proven under, Microsoft trades 14% above its five-year common price-to-earnings (P/E) ratio, whereas Alphabet trades 12% under.

The historic undervaluation, high quality core enterprise, and potential to compete for a part of Nvidia’s market dominance make Alphabet inventory an clever purchase for tech buyers and people searching for firms.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for buyers to purchase now… and Alphabet wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Invoice Gates Says If He Began Microsoft At this time, He'd Focus On This Business As a substitute

Microsoft co-founder and one of many world’s most distinguished tech visionaries, Invoice Gates, is popping his consideration towards a .

In an interview with CNBC, Gates stated that if he had been to launch a startup immediately, he would go away his software program roots behind and focus squarely on synthetic intelligence (AI).

“At this time, anyone may elevate billions of {dollars} for a brand new AI firm [that’s just] a couple of sketch concepts,” Gates instructed CNBC, reflecting AI’s fervor. Thus far this yr, startups within the area have attracted greater than $26 billion in investments, in response to CNBC citing information from PitchBook.

Do not Miss:

If Microsoft’s co-founder had been to embark on the enterprise, Gates stated his AI firm would goal to compete with tech giants like Nvidia, Google and OpenAI or discover an space the place AI may ship distinctive worth.

“To essentially stand out as a small firm, you must decide one thing you are going to do uniquely,” Gates instructed CNBC.

His shift in focus from software program to AI mirrors a altering tech panorama. CNBC famous that when Microsoft was based in 1976, Gates and co-founder Paul Allen had been among the many few who envisioned a future the place computer systems can be a part of on a regular basis life.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ function for shares tackles the $644 billion margin lending market –

“I used to be fortunate that my perception in software program made me distinctive,” Gates stated. “Simply believing in AI, that is not distinctive. So I must develop some distinctive view of the way you design AI programs – one thing that different individuals did not get.”

The billionaire stated that getting into the AI area at this stage comes with its personal set of challenges. With foundational applied sciences already being developed by well-funded firms, new entrants could wrestle to make an impression. Gates instructed entrepreneurs to deal with how AI may deal with particular enterprise wants or enhance day by day life – whether or not by automating costly duties or producing strategic insights with broader functions.

Trending: Warren Buffett as soon as stated, “When you do not discover a strategy to make cash when you sleep, you’ll work till you die.”

At 68, Gates’ priorities have shifted. Whereas he as soon as measured success by Microsoft’s progress, immediately he’s extra centered on including worth to the world, with the Invoice & Melinda Gates Basis and his clean-energy funding agency, Breakthrough Vitality.

He has been encouraging youthful minds at Microsoft, OpenAI and different tech firms to push the boundaries of AI, telling them, “Since you’re taking a more energizing take a look at this than I’m, and that is your unbelievable alternative.”

Simply as his early religion in private computing was prophetic, Gates’ deal with AI could once more show to be a bellwether for the way forward for know-how.

Learn Subsequent:

Up Subsequent: Rework your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in immediately’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Northvolt to axe 1,600 jobs as Europe's EV hopes stall

By Marie Mannes

STOCKHOLM (Reuters) – Northvolt plans to chop 1,600 jobs at its base in Sweden, or a couple of fifth of its international workforce, as Europe’s greatest hope within the electrical car battery market struggles with manufacturing issues, sluggish demand and competitors from China.

The chief in efforts to construct a European automotive battery trade stated on Monday it might droop plans for a big enlargement of its Northvolt Ett manufacturing facility in Skelleftea, northern Sweden.

In an effort to chop prices, Northvolt slimmed down its enterprise earlier this month, departing from its authentic mission to be an all-in-one store providing every thing from materials manufacturing and battery making to end-of-life recycling.

With Volkswagen (ETR:) amongst its homeowners, Northvolt has led a wave of European startups investing billions of {dollars} in battery manufacturing to serve the continent’s automakers as they change from inner combustion engines to EVs.

However the Swedish firm has struggled with order delays. Issues scaling up manufacturing led BMW (ETR:) to tug a $2 billion order in June.

Northvolt stated on Monday it might deal with ramping up the primary 16 gigawatt-hours (GWh) of annual battery cell manufacturing capability at Northvolt Ett, whereas shelving a building challenge that had geared toward rising its capability by one other 30 GWh.

At the moment, the corporate produces lower than 1 GWh and initially deliberate for the manufacturing facility to finally make batteries for over a million automobiles a 12 months, at 60 GWh of capability.

Progress in EV demand can also be slower than some within the trade projected, and competitors is stiff from China, which accounts for 85% of worldwide battery cell manufacturing, Worldwide Power Company information exhibits.

“We’re decided to beat the challenges we face, and to emerge stronger and leaner,” Northvolt co-founder and CEO Peter Carlsson stated in an announcement. “We now have to focus all vitality and investments into our core enterprise.”

The corporate’s R&D hub, Northvolt labs, will gradual all programmes and enlargement, whereas sustaining the basic platforms, it stated.

It didn’t point out the destiny of deliberate gigafactories in Germany and Canada, that are prone to being postponed.

EUROPEAN PROSPERITY

Northvolt’s “stage of ambition and their stage of realism for the time being is pretty good in that they don’t seem to be pushing blindly forward when it is not working,” stated Evan Hartley, an analyst at Benchmark Mineral Intelligence.

Northvolt remains to be loss-making regardless of securing orders price over $50 billion from clients together with prime investor Volkswagen, underscoring Europe’s wrestle to compete with the dominance of Chinese language battery makers resembling CATL and BYD (SZ:).

The Swedish agency has organised $15 billion in fairness and debt financing from a raft of gamers together with Goldman Sachs – its second-biggest investor – and BlackRock (NYSE:), in line with filings, and has been attempting to boost extra to fund its ramp-up.

It misplaced $1.2 billion final 12 months, up from a $285 million loss the 12 months earlier than. Its money readily available on the finish of 2023 was $2.13 billion.

Former European Central Financial institution head Mario Draghi warned this month that Europe wanted a much more coordinated industrial coverage and big funding to maintain tempo economically with america and China.

However many European governments are financially stretched following the COVID pandemic and grappling with anaemic progress.

Sweden’s Prime Minister Ulf Kristersson stated on Sept. 13 that whereas he needed corporations engaged in inexperienced applied sciences to thrive, the federal government wouldn’t take a stake in Northvolt. The federal government has additionally stated it won’t lend to the corporate.

Carlsson stated all events ought to work with the corporate.

“I imagine it is necessary going ahead that each one the stakeholders we work with now – clients, shareholders, lenders, and in addition nationwide stakeholders – are contributing to an excellent long-term answer, as a result of that is about European prosperity and competitiveness,” he advised Swedish radio.

Markets

Qualcomm's potential Intel buyout might elevate antitrust, foundry considerations

By Aditya Soni and Yuvraj Malik

(Reuters) – A possible deal to purchase Intel might speed up Qualcomm’s diversification however will burden the smartphone chipmaker with a loss-making semiconductor manufacturing unit that it could battle to show round or promote, analysts stated.

A buyout will even face powerful antitrust scrutiny globally as it could unite two essential chip companies in what could be the sector’s largest ever deal, making a behemoth with a powerful share of the smartphone, private laptop and server markets.

Shares of Intel rose 3% earlier than the bell on Monday, after media experiences late on Friday about Qualcomm’s early-stage strategy for the struggling chipmaker. Qualcomm’s shares had been decrease.

“The rumored deal between Qualcomm and Intel is intriguing on many ranges and, from a pure product perspective, makes a sure diploma of sense as they’ve numerous complementary product traces,” stated TECHnalysis Analysis founder Bob O’Donnell.

“The fact of it truly occurring, nevertheless, could be very low. Plus, it’s unlikely Qualcomm would need all of Intel and making an attempt to interrupt aside the product enterprise from the foundry enterprise proper now simply wouldn’t be doable,” he stated.

As soon as the dominant pressure within the semiconductor business, five-decade-old Intel is going through one in every of its worst durations as losses mount on the contract manufacturing unit it’s constructing out in hopes of difficult TSMC.

Intel’s market worth has fallen under $100 billion for the primary time in three many years as the corporate has missed out on the generative AI growth after passing on an OpenAI funding.

As of final shut, its market capitalization was lower than half that of potential suitor Qualcomm, which has a worth of about $190 billion.

Contemplating Qualcomm had round $7.77 billion in money and money equivalents as of June 23, analysts count on the deal will principally be funded by way of inventory and could be extremely dilutive for Qualcomm’s buyers, probably elevating some apprehension.

Qualcomm, which additionally provides to Apple, has quickened its efforts to broaden past its mainstay smartphone enterprise with chips for industries together with automotive and PCs below CEO Cristiano Amon. However it nonetheless stays overly reliant on the cell market, which has struggled lately because of the post-pandemic demand droop.

Amon is personally concerned within the Intel negotiations and has been analyzing varied choices for a deal for the corporate, sources have informed Reuters.

This isn’t the primary time Qualcomm is pursing a big acquisition. It had provided to purchase rival NXP Semiconductors for $44 billion in 2016, however deserted the bid two years later after failing to safe a nod from Chinese language regulators.

FOUNDRY CONUNDRUM

Whereas Intel designs and producers its chips that energy private computer systems and information facilities, Qualcomm has by no means operated a chip manufacturing unit. It makes use of contract producers resembling TSMC and designs and different know-how provided by Arm Holdings.

Qualcomm lacks the expertise wanted to ramp up Intel’s fledgling foundry enterprise, which just lately named Amazon.com as its first main buyer, in accordance with analysts.

“We have no idea why Qualcomm could be a greater proprietor for these property,” stated Stacy Rasgon of Bernstein.

“We don’t actually see a situation with out them both; we don’t assume anybody else would actually need to run them and consider scrapping them is unlikely to be politically viable,” he added.

Intel’s foundry enterprise is seen as essential to Washington’s objective of rising home chip manufacturing. The corporate has secured about $19.5 billion in federal grants and loans below the CHIPS Act to construct and broaden factories throughout 4 U.S. states.

Some analysts stated Intel would like outdoors investments as an alternative of a sale, pointing to a latest transfer to make the foundry enterprise extra unbiased.

Lusso’s Information Information reported over the weekend that Apollo World Administration, already a accomplice in Intel’s Eire facility, has provided an funding of as a lot as $5 billion within the firm.

Qualcomm might additionally determine to purchase elements of Intel’s enterprise, as an alternative of your entire firm. Reuters had reported earlier this month that it had explicit curiosity in Intel’s PC design unit.

(Reporting by Aditya Soni and Yuvraj Malik in Bengaluru; extra reporting by Juby Babu in Mexico Metropolis and Seher Dareen and Utkarsh Shetti in Bengaluru; Modifying by Sriraj Kalluvila)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up