Markets

Professional Analysis: Wall Road eyes Visa's development and resilience

Within the fast-paced world of digital funds, Visa Inc . (NYSE: NYSE:) stands out as a world chief connecting varied entities with its superior expertise. Analysts from esteemed corporations have not too long ago supplied a complete evaluation of Visa’s monetary well being, strategic path, and market potential. As we delve into the main points, it’s clear that Visa is navigating the present financial panorama with a strategic eye on development and shareholder worth.

Firm Overview

Visa is a multinational monetary companies company that facilitates digital funds transfers all through the world, mostly by Visa-branded bank cards and debit playing cards. The corporate’s expansive community connects these stakeholders, facilitating a seamless move of commerce. Visa has persistently demonstrated its skill to adapt and innovate, making certain its aggressive edge in a dynamic market.

Monetary Efficiency and Technique

Visa’s current monetary outcomes have mirrored sturdy efficiency and strategic execution. The corporate reported robust fiscal quarter 4 earnings, with income and earnings per share (EPS) beating forecasts. Q1 efficiency confirmed card quantity development barely accelerating in Q1 (debit/credit score volumes +8%/6% YoY respectively) in comparison with This autumn. Administration’s confidence is obvious as they head into Q1 outcomes throughout cost protection, with out indicating any important weakening in spend close to time period.

Wanting forward, Visa has set an formidable course for fiscal 12 months 2024, with administration anticipating double-digit adjusted web income development and low-teens adjusted EPS development. The estimated EPS for the primary fiscal 12 months (FY1) are USD 9.94 and for the second fiscal 12 months (FY2) are USD 11.28, showcasing robust forecasts for the upcoming fiscal years.

Development Drivers and Capital Allocation

Analysts have recognized Visa’s strategic shift in the direction of non-traditional development drivers, corresponding to Worth Added Providers (VAS) and new cost flows. VAS has been robust, accounting for roughly 24% of web income year-to-date, with Visa seeking to improve penetration with new and current prospects. Moreover, Visa has introduced a $25 billion share repurchase program and a 15% improve in its dividend, reflecting a strong capital allocation technique that rewards shareholders.

Aggressive Place and Market Traits

Visa continues to strengthen its market place by increasing its core client funds enterprise and making important inroads in new companies corresponding to Visa Direct and Visa B2B Join. The corporate’s cross-border journey quantity has normalized at a better baseline charge, suggesting constant development with out the belief of an financial downturn in its projections. Cross-border volumes are anticipated to stay resilient as a result of structural shift in the direction of cross-border e-commerce and ongoing journey power.

Nonetheless, BMO Capital Markets notes that Visa has traditionally proven much less willingness to spend on rebates/incentives in comparison with MasterCard, which might affect its aggressive dynamics. The potential for Visa to develop into extra aggressive in market share competitors by incentives is an fascinating lever for future development, which might positively shock the market and bolster Visa’s prospects.

Regulatory and Financial Issues

Whereas Visa’s outlook for fiscal 12 months 2024 is constructive, regulatory developments such because the MDL settlement and Reg II are seen as having restricted affect on Visa’s point-of-sale operations, with proposed interchange reductions being modest. Nonetheless, the corporate should stay vigilant as macroeconomic headwinds might have an effect on efficiency, and long-term threats embody the expansion of home/regional real-time cost schemes that might affect Visa’s development.

Analysts Targets

– RBC Capital Markets: Outperform score with a value goal of $290.00 (October 25, 2023).

– BMO Capital Markets: Outperform score with a desire for MasterCard over Visa primarily based on development prospects and valuation multiples. No particular value goal is supplied, however it’s indicated that Visa’s P/E a number of could converge with MasterCard’s by 2027 if development estimates maintain true (Might 28, 2024).

– Barclays: Chubby score with a value goal of $319.00 (January 30, 2024).

– Baird Fairness Analysis: Outperform score with a value goal of $314 (January 18, 2024).

– Piper Sandler: Chubby score with a value goal of $322.00 (Might 13, 2024).

Bear Case

Is Visa’s development sustainable within the face of potential financial challenges?

Analysts categorical warning over Visa’s formidable steering, which doesn’t consider potential macroeconomic challenges. Whereas regulatory adjustments are anticipated to have a restricted affect, considerations linger concerning the sustainability of EPS and income development because the post-COVID restoration stabilizes and market penetration could sluggish. The weaker restoration in common ticket dimension might pose a slight headwind to FY24 steering. Moreover, momentum in cost improvements could sluggish as soon as tap-to-pay penetration ranges off, and the expansion of home/regional real-time cost schemes might additionally pose a threat to Visa’s profitability and development trajectory.

BMO Capital Markets provides that if Visa doesn’t develop into extra aggressive with rebates/incentives, it might lose market share to MasterCard, additional impacting Visa’s development sustainability.

May regulatory adjustments affect Visa’s profitability?

Regardless of the modest affect of current regulatory developments, any future regulatory tightening might pose a threat to Visa’s profitability and development trajectory. Buyers ought to pay attention to these potential challenges.

Bull Case

Can Visa’s strategic concentrate on new cost flows drive future development?

Visa’s strategic investments in new cost flows and value-added companies are anticipated to be key development drivers. Analysts are optimistic concerning the firm’s skill to leverage these areas for future enlargement, supported by a powerful capital return program and constructive business sentiment. Visa’s aggressive place is formidable and well-tested, which might result in enduring income and earnings development.

BMO Capital Markets highlights that Visa’s x-border income combine is barely bigger in comparison with MasterCard’s, which may very well be favorable if x-border development exceeds expectations, offering a bullish perspective for the corporate.

SWOT Evaluation

Strengths:

– Robust model and market place.

– Numerous and modern product choices.

– Strong monetary efficiency with income and EPS development.

Weaknesses:

– Potential vulnerability to financial downturns.

– Regulatory dangers that might affect profitability.

Alternatives:

– Enlargement into new cost flows and companies.

– Development in cross-border transactions and digital funds.

Threats:

– Macroeconomic uncertainties and potential downturns.

– Rising competitors within the funds business.

– Home/regional real-time cost schemes.

The timeframe for the analyses used on this article ranges from October 2023 to Might 2024.

Lusso’s Information Insights

Visa Inc. (NYSE: V), a titan within the digital funds business, has been a topic of constructive outlook from varied analysts, bolstered by its constant efficiency and strategic development initiatives. Lusso’s Information knowledge and insights present extra context to Visa’s monetary panorama and future prospects.

Lusso’s Information knowledge reveals a strong market capitalization of $531.74 billion, reflecting Visa’s substantial presence within the monetary companies sector. The corporate’s P/E ratio stands at 29.86, which, whereas indicating a premium valuation, aligns with its standing as a distinguished participant within the business. That is additional substantiated by an adjusted P/E ratio of 28.15 for the final twelve months as of Q2 2024, suggesting a slight moderation in valuation over time.

The income development for a similar interval was recorded at 10.19%, demonstrating Visa’s capability to extend its top-line in a aggressive market. This development is per the corporate’s technique to increase into non-traditional avenues corresponding to Worth Added Providers (VAS) and new cost flows, that are seen as essential development drivers shifting ahead.

Moreover, Visa’s disciplined strategy to capital allocation is evidenced by a dividend yield of 0.78% as of mid-2024, with a notable dividend development of 15.56% within the final twelve months. This displays the corporate’s dedication to returning worth to shareholders, some extent underscored by an Lusso’s Information Tip highlighting Visa’s monitor file of sustaining dividend funds for 17 consecutive years.

One other Lusso’s Information Tip notes that Visa’s inventory usually trades with low value volatility, which can enchantment to traders in search of secure returns in a sector recognized for fast adjustments and innovation.

For traders looking for a deeper dive into Visa’s monetary metrics and strategic positioning, Lusso’s Information gives extra suggestions and insights. As of now, there are a number of extra Lusso’s Information Ideas accessible, which will be accessed by the devoted Visa web page on the Lusso’s Information web site.

These insights from Lusso’s Information serve to enhance the evaluation supplied by monetary specialists, providing traders a complete view of Visa’s potential within the evolving panorama of digital funds.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

Freight market inexperienced shoots fade heading into October

Chart of the Week: Nationwide Truckload Index (Linehaul Solely), Van Outbound Tender Rejection Index – USA : NTIL.USA, VOTRI.USA

Spot charges excluding the full estimated value of gas (NTIL) have fallen 3% because the begin of August. Dry van tender rejection charges (VOTRI), which measure the proportion of hundreds that carriers are unable to cowl for his or her clients, are averaging about 30 foundation factors decrease. In different phrases, the market that seemed to be exhibiting indicators of tightening in the summertime has reversed course over the previous quarter.

For these much less acquainted with the U.S. freight market, spot charges usually enhance when it is more difficult to discover a truck to cowl freight and reduce when it’s simpler. The spot market is the Wild West of the trucking market. It represents essentially the most excessive ranges of volatility and the polarized edges of the business.

Spot charges are very helpful in near-term traits however lose worth when trying over the course of a number of years as a result of inflation and mixing. Working prices for carriers have elevated greater than 30% over the previous 5 years, placing invisible upward stress on charges. Sadly for a lot of carriers, they haven’t been in a position to move alongside a lot of those prices as a result of a particularly aggressive atmosphere. A flood of recent entrants throughout the pandemic period is essentially guilty.

Service particulars evaluation of internet modifications in Federal Motor Service Security Administration energetic working authorities reveals there was report progress of fifty% in newly registered service of property working authorities from 2020 into the center of 2022. This fee of progress quadrupled the speed that occurred available in the market from 2018-19. The results of that was additionally a powerful extended market downturn, leading to quite a few service exits.

The pandemic demand bubble has been bursting for over two and a half years for the home transportation market. Greater than 200 carriers per week are leaving the house internet of entrants. The gross majority of those exits are small fleets and owner-operators consisting of fewer than 5 vans and most with lower than three years of expertise.

To date, the deterioration in capability has solely resulted in a couple of short-lived intervals of slight market vulnerability.

Final yr’s refrigerated (reefer) trucking market was the primary to indicate indicators of tightening. Spot (RTI) and rejection charges (ROTRI) jumped in entrance of Labor Day and rode a curler coaster into January earlier than falling again to report lows. The reefer market has since recovered in a extra sustainable method however has stumbled over the previous week.

The dry van market, which represents the majority of the for-hire trucking market exercise, additionally has had a couple of moments. The polar plunge of arctic air in January pushed spot and rejection charges again to Christmas ranges as shippers had been stalled for a couple of days.

Over the summer season, spot and rejection charges spiked as an surprising influx of imports hit the West Coast, placing a pressure on service networks. There was ample slack in capability to get well, nonetheless, and now the market is trending softer after exhibiting growing indicators of vulnerability.

Hurricanes and strikes

Hurricane Helene landed as a significant Class 4 storm, with a lot of its impression on infrastructure hitting the inland markets within the Southeast.

Atlanta’s outbound rejection charges plummeted in entrance of the storm, whereas inbound rejection charges jumped. This might result in some stage of short-lived disruption however in all probability not a market breaker like Harvey was in 2017.

The Worldwide Longshoremen’s Affiliation strike additionally has some potential relying on whether or not it happens and for a way lengthy, however many shippers have been getting ready for this for a number of months now.

Is that this the brand new regular?

The attainable excellent news for transportation service suppliers is that whereas the spot market has collapsed and most of the disruptive occasions have pale within the close to time period, rejection charges are nonetheless trending greater over the course of a yr. The probability of a sustained market flip this fall has pale, however that doesn’t take away the potential of a powerful shift in 2025.

Capability exits at its quickest tempo over the winter. If this development continues and the market stays tender by way of the vacations, the probability of a extreme provide shock will increase considerably.

Definitively, this market just isn’t sustainable. It would shift. The truth that capability continues to exit at report ranges tells you that provide is diving towards demand on the curve. The timing is at all times essentially the most difficult factor to foretell and the shift will in all probability happen when many have lowered their guard.

And who can blame them, as this has been the longest, most extreme freight recession in trendy occasions.

Concerning the Chart of the Week

The FreightWaves Chart of the Week is a chart choice from that gives an fascinating information level to explain the state of the freight markets. A chart is chosen from 1000’s of potential charts on to assist members visualize the freight market in actual time. Every week a Market Knowledgeable will publish a chart, together with commentary, dwell on the entrance web page. After that, the Chart of the Week will probably be archived on FreightWaves.com for future reference.

SONAR aggregates information from a whole bunch of sources, presenting the information in charts and maps and offering commentary on what freight market specialists need to know in regards to the business in actual time.

The FreightWaves information science and product groups are releasing new datasets every week and enhancing the consumer expertise.

To request a SONAR demo, click on .

The publish appeared first on .

Markets

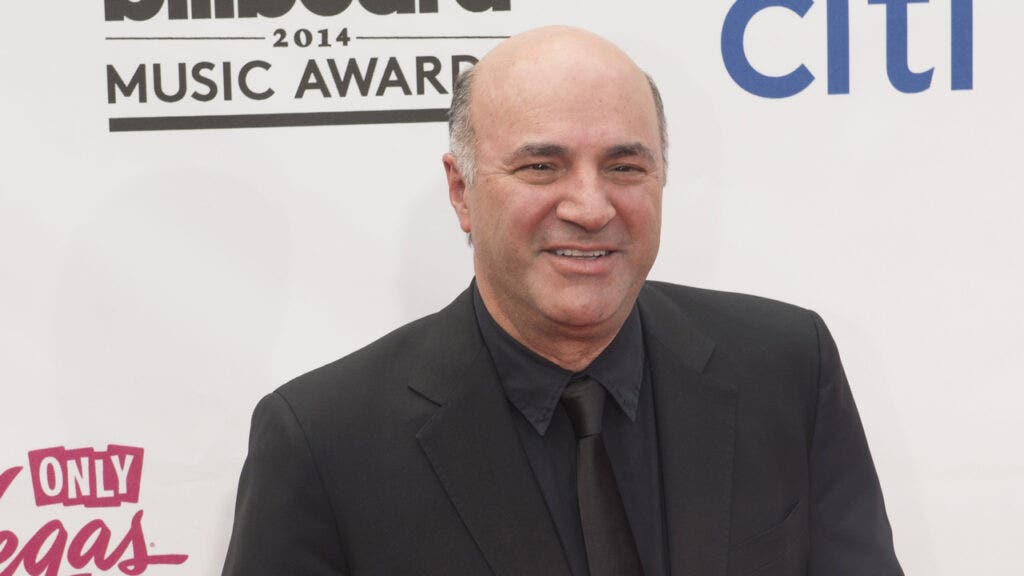

'You By no means Ask Me for Cash Once more': Kevin O'Leary Explains As a substitute Of Investing In Household Members' Companies, He Items Money With A Caveat

, a big-name investor identified for his no-nonsense method to enterprise, has a singular technique for coping with relations who ask him for cash. He is had his justifiable share of family coming to him with huge concepts and excessive hopes, on the lookout for a hefty funding. And with O’Leary’s monetary standing, it isn’t shocking. The Canadian enterprise proprietor and Shark Tank star has a internet price of round $400 million.

Do not Miss:

However whereas he is beneficiant, he is additionally obtained boundaries that assist maintain household and funds from clashing. In a brief YouTube video, O’Leary defined his actions when relations ask him for cash. He acknowledges the age-old reality: “More cash, extra issues.” O’Leary says, “It is a improbable factor but it surely makes your life difficult as a result of many individuals need a few of it from you at no cost – notably relations. It is a large concern.”

Trending: Amid the continued EV revolution, beforehand missed low-income communities

O’Leary clarifies that individuals come to anticipate one thing for nothing . And to deal with this, he is developed an easy technique that retains issues clear and avoids awkward Thanksgiving dinners.

When a member of the family approaches him for cash – whether or not it is to begin a restaurant or launch a brand new enterprise – he presents a one-time reward. Within the case he mentions, it is $50,000. Not a mortgage, not an funding, only a reward. However there is a catch: “You by no means ask me for cash once more. Ever.” O’Leary’s rule is easy: after that test, there will likely be no extra handouts, no future expectations, and no monetary entanglements. As he humorously provides, he arms over the cash after which “goes again to sprucing his eggs.” It is a clear break that leaves no room for future monetary disputes or awkward household interactions.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

For many who do not have a portfolio like O’Leary’s, his method nonetheless presents a beneficial lesson. Setting clear boundaries is essential when lending or gifting cash to household. Getting caught up within the feelings and obligations that include serving to family members is straightforward, however issues can get messy with out clear guidelines. An excellent method for the remainder of us is likely to be to solely give what we will afford to lose – whether or not that is $50, $500, or $5,000 – and make it clear that it is a one-time deal. No loans, no strings, no awkward household gatherings.

Dealing with household and cash might be tough, however O’Leary’s method reveals that it is all about setting expectations and sticking to them. And perhaps, simply perhaps, it is also about having just a little humor to maintain issues from getting too tense.

It is at all times good to earlier than making huge selections, particularly when household is concerned. They might help you identify what makes essentially the most sense in your scenario and set the best boundaries. It isn’t simply in regards to the cash – it is about retaining relationships intact whereas making decisions that work for everybody. Just a little steerage can go a great distance in guaranteeing your funds and household ties keep sturdy.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and methods to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

A Few Years From Now, You'll Want You'd Purchased This Undervalued Excessive-Yield Inventory

One of many largest temptations for dividend traders is reaching for yield. Principally, which means taking over dangerous investments simply to gather a bigger revenue stream. You will be higher off in the long term if you happen to err on the aspect of warning, significantly if you’ll want to reside off of the revenue you’re producing. That is why Enterprise Merchandise Companions (NYSE: EPD) is a high-yield funding you may want you’d purchased. A fast comparability to Altria (NYSE: MO) will assist clarify why.

Who wins the high-yield story, Altria or Enterprise?

Relating to yield, Altria’s 8.1% is a full proportion level increased than the distribution yield of Enterprise Merchandise Companions’ 7.1%. Each have elevated their dividends usually, so many traders would possibly default to the higher-yielding choice. However that is not essentially the most effective plan.

Altria, , comes with extra threat than it’s possible you’ll assume regardless of working in what is mostly thought of a dependable sector. That is as a result of its fundamental product is cigarettes. This enterprise has been in a secular decline for a very long time. Within the second quarter of 2024 alone, Altria’s cigarette volumes fell 13% 12 months over 12 months. That is not a fluke. Within the second quarter of 2023, volumes fell 8.7%. In the identical quarter of 2022, cigarette quantity was off by 11.1%. Any latest quarter and any latest full 12 months would have proven the identical horrible development.

The corporate has offset quantity declines with worth will increase, which has allowed it to proceed rising its dividend regardless of the clearly horrible course of its most essential enterprise line. There is a very actual probability that you’ll remorse shopping for this high-yield dividend inventory if it may possibly’t stem the bleeding not directly.

Enterprise is a completely completely different story.

Enterprise’s decrease yield comes with decrease threat

You possibly can simply argue that Enterprise comes with its personal dangers, on condition that it operates within the extremely risky vitality sector. And its midstream enterprise is immediately tied to demand for oil and pure gasoline, which is being pressured by the transfer towards cleaner options. Truthful sufficient, however what does Enterprise truly do?

As a midstream supplier, Enterprise owns important infrastructure belongings that assist transfer oil and pure gasoline around the globe. It typically fees charges for using its infrastructure, so the worth of vitality is much less essential than the demand for vitality. Demand for vitality tends to stay sturdy whatever the worth of oil and pure gasoline.

However here is the large truth — regardless of all of the hype round clear vitality, demand for oil and pure gasoline is predicted to stay sturdy for many years to come back. Actually, demand will doubtless improve for these fuels, with far dirtier coal bearing the brunt of the clear vitality change.

In different phrases, Enterprise’s enterprise is not as dangerous as it could appear. On prime of that, it is without doubt one of the largest midstream gamers in North America with an investment-grade-rated steadiness sheet. Whereas inner development choices are restricted, it has lengthy acted as an trade consolidator. It simply introduced plans to purchase Pinon Midstream for $950 million, for instance. Acquisitions are lumpy and unimaginable to foretell, however they provide Enterprise ample room for development on prime of the sluggish and regular worth will increase it is going to be in a position to extract from clients.

In order for you a excessive yield from a rising enterprise, Enterprise is the higher choice when in comparison with Altria and its declining core enterprise. Certain, you may hand over a proportion level of yield, however as Altria continues to wrestle, that final level will can help you sleep at evening if you happen to purchase Enterprise.

Enterprise’s yield nonetheless appears low-cost

Here is essentially the most fascinating half: Enterprise’s 7.1% dividend yield is above its 10-year common yield of 6.3%. So regardless of the restoration from pandemic lows, it nonetheless seems to be undervalued. A rising enterprise, a financially robust firm, and an undervalued worth all make Enterprise a high-yield inventory you may remorse lacking out on. Particularly whenever you evaluate it to different high-yield decisions with equally excessive, however far riskier, yields.

Must you make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Altria Group wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook