Markets

Received $500? 2 Monster Synthetic Intelligence (AI) Shares to Purchase Proper Now

Shopping for and holding prime shares for an extended, very long time is among the finest methods to become profitable within the inventory market, as a result of this technique permits buyers to capitalize on secular development developments and likewise helps them profit from the facility of compounding.

For example, a $500 funding made within the Nasdaq-100 Know-how Sector index a decade in the past is now value $2,300, translating into annual development of 16% throughout this era. So, if in case you have $500 to spare proper now after paying off your payments, clearing costly loans, and saving sufficient for tough occasions, it could be a good suggestion to place that cash into shares of corporations which can be benefiting big-time from the rising adoption of .

That is as a result of the worldwide AI market is forecast to develop at an annual price of 28% via 2030, producing virtually $827 billion in annual income on the finish of the last decade. The adoption of this expertise is about to influence a number of industries, starting from cloud computing to digital promoting.

On this article, I’ll study the prospects of two corporations which can be working in these niches and are already benefiting from the quickly rising adoption of AI to see why it could make sense to speculate $500 in them (both individually or mixed).

1. The Commerce Desk

The Commerce Desk (NASDAQ: TTD) operates a programmatic, cloud-based promoting platform that helps advertisers buy advert stock and handle and optimize their campaigns throughout varied channels corresponding to video, cellular, e-commerce, related tv, and others. The Commerce Desk’s automated platform makes use of real-time information to assist drive stronger returns on investments for advertisers in order that they will buy and show the proper advertisements to the proper viewers on the right time.

It’s value noting that the corporate operates in a fast-growing area of interest because the programmatic promoting market is anticipated to generate incremental income of $725 billion between 2023 and 2028 at a compound annual development price of 39%, as per TechNavio. The Commerce Desk has been counting on AI to seize this large end-market alternative.

The corporate launched its AI-enabled programmatic advert platform Kokai in June 2023. Kokai analyzes 13 million advert impressions each second in order that it may “assist advertisers purchase the fitting advert impressions, on the proper worth, to succeed in the audience at the most effective time.” The great half is that The Commerce Desk’s prospects are already witnessing an enchancment of their returns on advert {dollars} spent due to Kokai.

On its August , The Commerce Desk administration identified:

Solimar is The Commerce Desk’s programmatic advert platform that was launched in 2021. So, it will not be stunning to see extra of the corporate’s prospects transferring to the AI-enabled Kokai given the numerous enchancment in advert efficiency that it’s delivering. Extra importantly, The Commerce Desk’s concentrate on integrating AI has allowed it to speed up its development as effectively.

The corporate’s income within the second quarter of 2024 elevated 26% 12 months over 12 months to $585 million as in comparison with the 23% development it recorded in the identical quarter final 12 months. Its adjusted earnings elevated at a quicker tempo of 39% from the identical quarter final 12 months to $0.39 per share. The corporate’s income forecast of $618 million for Q3 would translate into 27% development from the identical quarter final 12 months, suggesting that its top-line development is on monitor to speed up within the present quarter.

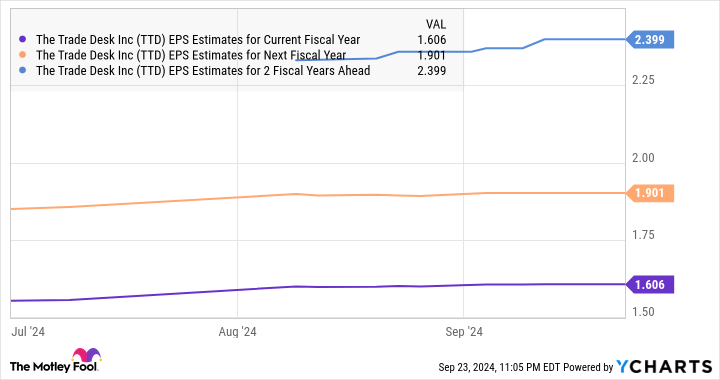

The great half is that analysts expect The Commerce Desk’s earnings development price to select up sooner or later.

information by

The corporate is anticipated to clock an annual earnings development price of 26% for the following 5 years, however current developments and the massive addressable alternative within the programmatic promoting market (which The Commerce Desk administration pegs at $1 trillion) recommend that it may outperform consensus estimates.

The market has rewarded The Commerce Desk inventory with 50% positive factors in 2024 up to now due to its bettering development profile, and its brilliant prospects recommend that it may maintain flying greater. That is why investing $500 in The Commerce Desk may develop into a wise long-term transfer proper now contemplating that it has a worth/earnings-to-growth ratio (PEG ratio) of 0.6, which signifies that it’s undervalued with respect to the expansion that it’s forecasted to ship.

2. Oracle

The cloud computing market has been an enormous beneficiary of the rising AI adoption within the preliminary days, Grand View Analysis estimates that the cloud AI market may develop at an annual price of 40% via 2030 to generate income of $647 billion on the finish of the forecast interval. Oracle (NYSE: ORCL) is getting an enormous increase due to the fast development of the cloud AI market, as evident from the corporate’s current outcomes.

Oracle’s cloud income within the first quarter of fiscal 2025 (which ended on Aug. 31) elevated 21% 12 months over 12 months to $5.6 billion, outpacing the corporate’s complete income development of 8% to $13.3 billion. Extra particularly, the Oracle Cloud Infrastructure (OCI) enterprise recorded terrific year-over-year development of 45% to $2.2 billion.

OCI is the corporate’s infrastructure-as-a-service (IaaS) enterprise via which it rents out its cloud infrastructure to prospects seeking to practice AI fashions. Administration factors out that this enterprise now has an annual income run price of $8.6 billion and demand for OCI is exceeding provide. The demand for Oracle’s cloud infrastructure providing is so robust that its remaining efficiency obligations (RPO) shot up a terrific 52% 12 months over 12 months within the earlier quarter to $99 billion.

RPO is the entire worth of an organization’s future contracts which can be but to be fulfilled, and it’s value noting that AI is taking part in a central function in driving this metric greater. Oracle factors out that its “cloud RPO grew greater than 80% and now represents almost three-fourths of complete RPO.”

Contemplating the massive alternative that is current within the cloud AI market, it will not be stunning to see demand for Oracle’s cloud infrastructure improve at a sturdy tempo for a very long time to return. That is additionally the rationale why consensus estimates are projecting Oracle’s income to extend by double digits over the following three fiscal years following a top-line soar of simply 6% in fiscal 2024 to $53 billion.

information by

Oracle is up 57% up to now in 2024. Traders would do effectively to behave shortly so as to add this cloud inventory to their portfolios as it’s nonetheless buying and selling at a gorgeous 27 occasions ahead earnings, a small low cost to the Nasdaq-100 index’s ahead earnings a number of of 29. Its large addressable market and the immense measurement of its backlog that is rising on account of the fast adoption of cloud AI providers is prone to result in extra inventory worth upside sooner or later.

Do you have to make investments $1,000 in The Commerce Desk proper now?

Before you purchase inventory in The Commerce Desk, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and The Commerce Desk wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle and The Commerce Desk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

2 Supercharged Development Shares to Purchase Earlier than They Soar as A lot as 169% In keeping with Choose Wall Avenue Analysts

The rally that started early final yr continues to push the market into the stratosphere. The S&P 500 hit a document excessive this week, whereas the Nasdaq Composite is inside hanging distance of a brand new all-time excessive, sitting roughly 2% under its peak (as of this writing). The market’s relentless rise has many shares at or close to new heights, leaving some traders to marvel if the rally nonetheless has room to run.

UBS analyst Mark Haefele stays bullish. “All-time highs usually generate investor concern that markets have peaked. Such worries will not be supported by historical past,” he wrote in a notice to purchasers. XM Funding analyst Marios Hadjikyriacos agrees. “Inventory markets are having fun with the most effective of all worlds, buoyed by a resilient U.S. economic system and hypothesis that Fed price cuts are simply across the nook, serving to to justify stretched valuations,” he wrote. It is price noting the Fed did, in truth, reduce charges final week, serving to propel the market to even higher heights.

Regardless of the continued rally, there are nonetheless alternatives available, together with some shares which have triple-digit upside, in line with some veteran analysts. With that as a backdrop, listed below are two supercharged development shares with further upside of 169% and 160% respectively.

Palantir Applied sciences: Implied upside 169%

One of many largest roadblocks to the adoption of synthetic intelligence (AI) is that many firms merely lack the know-how to implement this cutting-edge know-how — whereas nonetheless getting their cash’s price. That is not stunning, significantly given the experience wanted to get these techniques up and operating. That is the place Palantir Applied sciences (NYSE: PLTR) is available in.

The corporate has a protracted and compelling observe document for creating AI techniques for the U.S. authorities protection and intelligence companies. It wasn’t lengthy earlier than Palantir turned its focus and AI experience to delivering actionable intelligence for enterprises.

The appearance of early final yr was proper within the firm’s wheelhouse, and Palantir shortly created a framework that companies might use to ship quantifiable outcomes. The fruit of its labors is its Synthetic Intelligence Platform (AIP), which gives custom-made options to on a regular basis enterprise dilemmas.

It was Palantir’s good implementation technique that helped bridge the information hole. The corporate presents interactive classes dubbed “boot camps.” These gatherings, which final from one to 5 days, pair Palantir engineers with enterprise and authorities prospects to assist them remedy company-specific challenges. The corporate has sponsored greater than 1,300 boot camps since late final yr, serving to gasoline strong gross sales.

Within the second quarter, Palantir cited quite a few examples of boot camps that resulted in seven-figure offers inside weeks after attendance. In all, the corporate closed 96 offers price greater than $1 million in the course of the quarter. Of these, 33 had been price at the very least $5 million, and 27 had been price at the very least $10 million, which helps illustrate the worth of those classes to prospects.

Greentech Analysis funding analyst Hilary Kramer is essentially the most bullish amongst her Wall Avenue colleagues, suggesting that Palantir “simply could be” a $100 inventory over the following few years. That represents a possible upside for traders of 169% in comparison with Wednesday’s closing worth. The analyst stated Palantir is her “absolute 100% favourite,” citing the corporate’s potential to make use of knowledge to provide “actionable decision-making.”

At 218 occasions earnings and 35 occasions gross sales, Palantir appears exorbitantly costly. Nonetheless, its ahead , which elements in its accelerating development, is available in at 0.35, when any quantity lower than 1 is the benchmark for an undervalued inventory.

Symbotic: Implied upside 160%

Given the rising significance of digital retail, one space ripe for disruption is warehouse automation, and Symbotic (NASDAQ: SYM) is an rising energy participant within the house.

The corporate makes use of customized AI options to automate the processing of pallets and particular person instances, serving to to maximise each out there inch of warehouse house. Symbotic pairs superior algorithms with a cadre of sensible robots that work collectively to load and unload vans, stack pallets, and even isolate particular person crates, squeezing extra stock into much less house.

This will increase effectivity, reduces labor prices, and reduces transportation and working bills, serving to the system pay for itself over time. Symbotic estimates that over its helpful life, every “module” will pay for itself a number of occasions over, saving companies tens and even a whole lot of hundreds of thousands of {dollars}. The corporate boasts a bevy of family names as prospects, together with Walmart, Goal, Albertsons, and C&S Wholesales Grocers.

The corporate continues to generate strong outcomes. For its fiscal 2024 third quarter (ended June 29), Symbotic generated document income that grew 58% yr over yr to $492 million, whereas the corporate slashed its losses by 71%, leading to a loss per share of $0.02. That stated, Symbotic has been constantly free money circulation optimistic, which suggests it is on observe for profitability.

Within the wake of the corporate’s monetary report, Cantor Fitzgerald analyst Derek Soderberg maintained his chubby (purchase) score and $60 worth goal on the inventory. That represents a possible upside of 160% in comparison with Wednesday’s closing worth. The analyst believes that, regardless of some deployment challenges, because the techniques enhance, Symbotic can generate 10% annual recurring income from its {hardware}.

It is price noting that an “nameless” brief report posted on-line alleges that Symbotic disclosures are deceptive and most analysts on Wall Avenue are being duped. It is fascinating that not one of the analysts who cowl Symbotic have even bothered to acknowledge the report, which suggests it is a lot ado about nothing. That stated, it does add a component of the unknown — and by extension threat.

As with many high-growth shares — significantly ones that do not but generate a revenue — Symbotic inventory is a bit riskier, so any place ought to be sized appropriately with that in thoughts. Moreover, Symbotic is not low cost, at the moment promoting for roughly 6 occasions subsequent yr’s anticipated gross sales. These caveats apart, as a pacesetter in an rising trade, Symbotic has a protracted runway for development forward and could possibly be a giant winner within the AI revolution.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $760,130!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Palantir Applied sciences, Goal, and Walmart. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Why Wells Fargo says buyers have key selections to make amid Fed easing cycle

Lusso’s Information — The time could have come for buyers to make key selections about their money various allocations and stuck revenue positions because the Federal Reserve embarks on a marketing campaign of coverage easing, in keeping with analysts at Wells Fargo.

In a be aware to shoppers, the analysts stated carrying money has supplied buyers with a gradual stream of curiosity whereas avoiding fluctuations within the bond market for the reason that Fed started elevating rates of interest to greater than two-decade highs in 2022. Money investments could include decrease ranges of dangers, albeit for usually decrease returns.

Nevertheless, they flagged two dangers round persevering with a cash-focused technique within the present buying and selling setting.

First, those that have an outsized money place face reinvestment threat, or the possibility that they could lose the chance to reinvest future money flows on the present price of return, the analysts stated.

A second threat revolves round cash market funds changing into a “money drag” over an extended time period, they stated. The time period refers to holding part of a portfolio in money moderately than investing it out there.

“Over time, riskier belongings have outperformed money and cash-alternative autos,” they wrote. “Our long-term capital market assumptions research exhibits that US equities have beat money returns […]. The ability of compounding returns has typically benefited riskier belongings like equities whereas leaving money in a deprived place […].”

In consequence, they cautioned buyers to keep away from money as a long-term funding technique or signficant allocation.

As a substitute, they beneficial allocating money throughout asset courses, including that this concentrate on diversification affords a “mix of development potential and risk-management provisions” notably for “buyers with a strategic time horizon.”

The analysts argued that, with uncertainty surrounding each the Fed’s coverage plans and the result of the US presidential election, portfolios ought to emphasize high quality — particularly large-cap firms over small- and mid-cap corporations.

Latest volatility in fairness markets, in the meantime, ought to push buyers into sectors like communication companies, power, financials, industrials, and supplies and trim positions in areas resembling shopper discretionary, shopper staples, actual property and utilities, they added.

Elsewhere, bond buyers ought to count on short-term investments to fall in tandem with extra anticipated rate of interest cuts by the Fed earlier than the tip of 2024. The central financial institution already moved to decrease borrowing prices by 50 foundation factors final week.

“[T]he comparatively excessive yields that buyers have loved over the previous couple of years in high-quality short-term investments will probably be lowering,” the Wells Fargo analysts stated.

“Alternatively, transferring into long-dated maturities to lock in greater yields exposes buyers to the potential for vital market worth actions and potential losses within the occasion that the economic system reaccelerates and longer-dated yields transfer greater subsequent yr.”

Markets

Inventory market right this moment: Dow hits document excessive, shares notch 3-week win streak forward of key jobs report

-

US shares had been combined Friday, with the Dow closing at a document excessive whereas the S&P 500 and Nasdaq edged decrease.

-

All three main averages achieved a three-week win streak as traders cheer a resilient economic system and cooling inflation.

-

Traders await key jobs information subsequent week, together with the September jobs report on Friday morning.

US shares had been combined on Friday, with the closing at a brand new all-time excessive whereas the and traded decrease.

Regardless of Friday’s combined buying and selling, all three main averages notched a three-week win streak as traders proceed to bid up shares on a resilient economic system, Fed rate of interest cuts, and cooling inflation.

Traders obtained extra proof of cooling inflation with which is taken into account the Fed’s most well-liked measure of inflation.

The non-public consumption expenditures worth index elevated by 0.1% in August from July, in-line with economist estimates. On a year-over-year foundation, the PCE Index rose 2.2%, barely under economist estimates of two.3%.

“The Fed feels as if it has gained the battle on inflation and its main focus is ensuring the job market stays regular,” Bellwether Wealth chief funding officer Clark Bellin stated.

With the inflation battle probably over, the principle focus for traders and the Fed has turned to the roles market. That is why subsequent week is so necessary.

On Tuesday, traders will get the Job Openings and Labor Turnover Survey, adopted by the ADP Employment report on Wednesday and preliminary jobless claims on Thursday.

However the principle occasion is subsequent Friday, when the September jobs report is launched. Economists estimate count on about 145,000 jobs will probably be added to the economic system in September.

In keeping with Interactive Brokers senior economist José Torres, the roles report might have a huge impact on the broader market.

“A large miss might undoubtedly result in a story shift in markets of an upcoming downturn, however a pointy acquire might push price reductions additional out on the curve. The perfect state of affairs for bullish traders is a determine near projections, because it will not disturb present financial coverage easing expectations,” Torres stated on Friday.

This is the place US indexes stood on the 4:00 p.m. closing bell on Friday:

This is what else occurred right this moment:

In commodities, bonds, and crypto:

-

crude oil was greater by 1.02% to $68.36 a barrel. , the worldwide benchmark, rose 0.68% to $72.09 a barrel.

-

was down 0.85% to $2,672.00 an oz.

-

The ten-year Treasury yield was decrease by 4 foundation factors to three.756%.

-

was up 0.86% to $65,741.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday