Markets

Right here's How Spousal Social Safety Advantages Are Calculated

Reality-Checked by: | Edited by:

Should you’re grappling with one of the best ways to plan in your retirement, understanding find out how to maximize your Social Safety spousal advantages is a major piece of the puzzle. These advantages can considerably affect your retirement revenue, and turning into acquainted with their ins and outs is essential. Earlier than diving too deep into the calculation strategies and sensible methods to maximise your advantages, it’s necessary to know how spousal advantages work and when you may qualify. You might also take into account to develop customized methods tailor-made to your distinctive circumstance.

How Do Social Safety Spousal Advantages Work?

are a part of the retirement revenue {that a} lower-earning partner can obtain primarily based on the higher-earning partner’s work document. This provision permits the lower-earning partner to obtain as much as 50% of the higher-earning partner’s profit at , however not till the partner has grow to be eligible for advantages.

To convey this idea nearer to house, take into account a couple seeking to maximize their potential advantages. The working partner’s Social Safety advantages considerably contribute to their mixed , making it crucial that they each perceive and successfully handle their spousal advantages to reinforce their retirement monetary safety.

To qualify for Social Safety spousal advantages, one should meet particular standards, together with age and marital standing. Firstly, one have to be at the least 62 years previous and the partner have to be eligible for retirement advantages. The design of those parameters goals to offer a security internet for {couples} once they attain retirement age, particularly if one associate has earned significantly much less over their working years.

In case you are caring for a kid who’s underneath 16 or disabled and receives advantages on the partner’s document, the age requirement doesn’t apply. Sure life occasions resembling marriage, divorce or demise also can affect . For instance, in eventualities of divorce, you may nonetheless qualify for spousal advantages primarily based on an ex-spouse’s work document, so long as you had been married for at the least 10 years and haven’t remarried.

How Spousal Advantages Are Calculated

Whereas the calculation can appear advanced, talking with a to obtain retirement advantages is really helpful. There are a selection of things to contemplate that might influence the calculation of your spousal advantages, however take into account that they cannot exceed 50% of the partner’s acquired advantages.

Key elements to contemplate embody:

-

Full Retirement Age: Understanding the idea of full retirement age is essential because it impacts the advantages’ calculation. Full retirement age varies primarily based on the yr of delivery and it’s when you may obtain .

-

Claiming Advantages Early: You can begin , however doing so earlier than reaching your full retirement age will cut back the profit quantity. Claiming advantages earlier than the complete retirement age can cut back the profit quantity by as much as 30%.

-

Claiming Advantages Late: Delaying claiming Social Safety advantages previous your full retirement age can meaningfully influence your advantages. To be exact, it’s doable that your advantages might improve yearly when you delay your retirement.

-

How This Can Influence Different Retirement Advantages: Claiming spousal advantages also can influence different retirement advantages. For instance, when you declare spousal advantages earlier than reaching your full retirement age, you can doubtlessly cut back your private retirement advantages.

-

Spousal Advantages for Widows or Widowers: Widows or widowers also can declare spousal advantages. The necessities embody being at the least 60 or 50 if disabled and the wedding will need to have lasted at the least 9 months.

There is no such thing as a set commonplace for a way your advantages can be calculated outdoors of taking every of those elements under consideration. It’s necessary to know your partner’s advantages with a view to precisely calculate by yourself. You should utilize a to estimate what your advantages is perhaps.

How Spousal Advantages Work for Divorced Spouses

Divorced spouses also can underneath sure situations, assuming they haven’t remarried because the divorce and haven’t filed for advantages earlier than. These advantages work the identical as different spousal advantages the place you can doubtlessly obtain as much as 50% of the partner’s advantages. To qualify you should meet these basic guidelines:

-

The wedding will need to have lasted at the least 10 years

-

Should have been divorced for at the least two consecutive years

-

The person claiming have to be single

-

The claimant have to be aged 62 or older

-

The ex-spouse have to be entitled to Social Safety retirement or incapacity advantages

You’ll should contact the Social Safety workplace to see when you qualify however you shouldn’t achieve this till you’re prepared to use for advantages.

Backside Line

Between the calculations and strategic timing for claims, maximizing your spousal Social Safety advantages might seem to be a really troublesome activity. Nevertheless, understanding these elements and their influence could be a recreation changer in your retirement revenue, notably for lower-earning spouses.

Cautious planning and strategic decision-making, , might contribute to a extra financially safe retirement. As you navigate these complexities, bear in mind, taking a proactive strategy now can profit you sooner or later. So, keep on studying and researching about maximizing spousal advantages as it may be a vital a part of your .

Retirement Ideas

-

Understanding Social Safety advantages is only one necessary facet of planning in your retirement. With a view to successfully put together for the retirement you need, you’ll must create a finances and long-term plan. A monetary advisor will help you put together and handle your retirement belongings. Discovering a monetary advisor doesn’t should be laborious. matches you with as much as three vetted monetary advisors who serve your space, and you may have a free introductory name together with your advisor matches to determine which one you are feeling is best for you. Should you’re prepared to search out an advisor who will help you obtain your monetary targets, .

-

You should utilize SmartAsset’sto provide help to decide how a lot it’s essential to save with a view to retire comfortably.

-

Maintain an emergency fund readily available in case you run into sudden bills. An emergency fund must be liquid — in an account that is not prone to vital fluctuation just like the inventory market. The tradeoff is that the worth of liquid money might be eroded by inflation. However a high-interest account lets you earn compound curiosity. .

Picture credit score: ©iStock.com/insta_photos, ©iStock.com/SDI Productions, ©iStock.com/RealPeopleGroup

The publish appeared first on .

Markets

If You Purchased 1 Share of Nvidia at Its IPO, Right here's How Many Shares You Would Personal Now

Since its IPO in January 1999, Nvidia (NASDAQ: NVDA) has established itself as one of many world’s most profitable firms. It has been notably adept at adapting its expertise to increase into new markets.

The corporate pioneered the that revolutionized the gaming business, turning boxy figures into lifelike pictures. The key to its success was parallel processing, which allowed the chips to conduct a large number of mathematical calculations concurrently. Nvidia’s processors are actually used for product design, autonomous methods, cloud computing, information facilities, synthetic intelligence (AI), and extra.

The flexibility to adapt its expertise has been a boon to shareholders. Even when buyers did not get in on the IPO itself, Nvidia shares fell beneath their challenge worth quite a few occasions in early 1999. For buyers lucky sufficient to get shares at (or beneath) the $12 IPO worth, the inventory has returned 493,940%.

Multiplying like rabbits

Whereas a single share of inventory may appear inconsequential at first look, one share of the proper inventory can have a huge effect on an investor’s success. In Nvidia’s case, the corporate’s efficiency and hovering inventory worth have resulted in quite a few inventory splits, turning one share into many extra.

Here is a listing of Nvidia’s inventory splits over time:

-

2-for-1 cut up, June 27, 2000

-

2-for-1 cut up, Sept. 12, 2001

-

2-for-1 cut up, April 7, 2006

-

3-for-2 cut up, Sept. 11, 2007

-

4-for-1 cut up, July 20, 2021

-

10-for-1 cut up, June 10, 2024

Because of the a number of inventory splits, an investor who purchased only one share of Nvidia inventory close to its IPO in 1999 would now be the proud proprietor of 480 shares.

Nevertheless, it took an excessive amount of self-discipline and self-control to carry Nvidia for greater than 25 years and reap this windfall. The inventory has misplaced greater than half its worth on quite a few events, which despatched fair-weather buyers scrambling for the exits.

That stated, take into account this: A $1,000 funding in Nvidia made in early 1999 would now be value greater than $4.9 million.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Assume You Know Altria? Right here's 1 Little-Identified Reality You Can't Overlook.

When most buyers take a look at Altria (NYSE: MO) what they see is a large 8% dividend yield backed by a dividend that has been elevated for years. That’s the kind of story that almost all dividend buyers will discover engaging. However there is a huge danger right here as a result of the corporate’s core enterprise is in long-term decline. That danger needs to be understood, however there’s one other delicate twist that you’ll have missed.

Altria’s enterprise is slipping away

It should not come as any shock to Altria shareholders that the corporate’s most necessary enterprise is making . Within the first half of 2024, the corporate generated roughly $11.8 billion in income. Its smokeable merchandise division’s revenues had been about $10.4 billion, or 88% of the corporate’s general prime line. Clearly, smokeable merchandise is the driving pressure at Altria.

To be truthful, the corporate sells quite a lot of smokeable merchandise, together with cigars. However whenever you take a look at quantity, cigarettes account for simply over 97% of the division’s quantity. So cigarettes are the large story at Altria. However, as famous, most buyers know that reality.

The necessary story right here is not the biggest enterprise. It’s the decline that is going down within the largest enterprise. By means of the primary six months of 2024, cigarette volumes dropped 11.5%. That is horrible and would seemingly be seen as surprising at another — buyers would run for the hills. Solely that drop is simply par for the course.

In 2023, cigarette volumes declined 9.9%. In 2022, volumes fell 9.7%. In 2021, the drop was 7.5%. You get the concept, it is a dying enterprise.

One “little” downside that may’t be missed

How has an organization with a enterprise that is in decline managed to take care of its dividend, not to mention develop it? The reply is that, due to the character of cigarettes, people who smoke are typically very loyal. So Altria has been jacking up costs frequently to offset the quantity declines. That is labored out effectively thus far, however you may solely milk a money cow so exhausting earlier than it runs dry. That is a much bigger danger for Altria than many might notice.

Of the cigarettes Altria sells, solely about 4% or so fall into the low cost class. Which means Altria’s enterprise is principally reliant on premium smokes. Within the premium class, “different premium” manufacturers make up about 4.5% of whole quantity. The remaining 91% of the corporate’s cigarette quantity is all attributable to at least one model, Marlboro.

Marlboro is a huge within the U.S. cigarette trade with an enormous 42% market share. This may very well be considered as a power. However step again for a second and take into consideration the large image. Altria is principally a one-trick pony in a dying rodeo. And its pony is likely one of the costliest round at a time when worth competitors from smoking alternate options is heating up. Altria itself notes that “the expansion of illicit e-vapor merchandise” is a giant downside, which is essentially as a result of they’re less expensive.

Fixing the issue will not be straightforward

There’s solely a lot Altria can do about its reliance on Marlboro because the cigarette enterprise declines. In reality, being the most important participant within the trade might be preferable to having a second rung model. What it’s doing is making an attempt to broaden its attain past cigarettes. That is the correct factor to do, however given the scale of the corporate’s cigarette enterprise it is not going to be straightforward to discover a alternative. After a few failed makes an attempt, together with an funding in Juul and in a marijuana firm, Altria is at present centered on rising its current NJOY vape acquisition.

It’s going effectively, with NJOY experiences fast development because it has been slotted into Altria’s spectacular distribution system. To place a quantity on that, within the second quarter of 2024 NJOY’s cargo quantity elevated 14.7% from the primary quarter and NJOY system shipments elevated 80%. The issue is that NJOY is tiny, falling into Altria’s “all different merchandise” income class which made up simply $22 million in income within the first half of 2024 at an organization with almost $11.8 billion in income. So NJOY is barely even a rounding error. Marlboro is the important thing to Altria’s future and can seemingly stay the important thing for years to come back.

If Altria hits a tipping level, it may get unhealthy quick

A shopper staples firm can solely elevate costs simply thus far earlier than there is a backlash from shoppers. The straightforward swap with cigarettes is to purchase cheaper smokes, which Altria actually does not promote. Then there’s alternate options to fret about, reminiscent of the corporate’s spotlight of vaping. Though Marlboro has been holding its personal, in 2021 its market share was 43.1%. That is 1.1 share factors above its present stage.

If Marlboro falters, Altria may fall. This can be a “little” undeniable fact that many buyers most likely aren’t contemplating as they take a look at the large dividend yield. Principally, there’s higher focus danger right here than many individuals notice.

Do you have to make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Altria Group wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

The Final Electrical Car (EV) Inventory to Purchase With $1,000 Proper Now

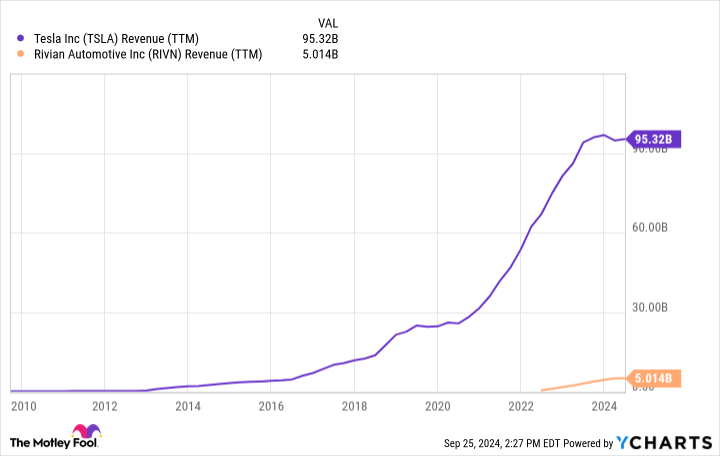

Everybody desires to search out the following Tesla (NASDAQ: TSLA). However investing within the electrical car (EV) area will be tough. Many EV corporations have gone bankrupt through the years, and separating the nice from the dangerous will be tough.

Fortunately, Tesla established a transparent template for achievement. And proper now, there’s one that appears extraordinarily enticing. However there’s just one funding technique prone to succeed.

That is how Tesla grew to become an enormous success

In 2006, Tesla CEO Elon Musk revealed “The Secret Tesla Motors Grasp Plan” to the general public. “As you realize, the preliminary product of Tesla Motors is a high-performance electrical sports activities automotive known as the Tesla Roadster,” his essay started. “Nevertheless, some readers might not be conscious of the truth that our long run plan is to construct a variety of fashions, together with affordably priced household automobiles.”

Musk summarized the grasp plan for Tesla:

Immediately, Tesla is a big image of success in the case of executing on long-term visions. The Tesla Roadster was a hit, however given its $100,000-plus value level, its market was all the time small.

Tesla wanted to show its manufacturing chops, and present the general public that EVs could possibly be cool and thrilling. It used this success to design, construct, and ship two new fashions: The Mannequin S and Mannequin X. These fashions had been nonetheless costly, however launched Tesla to lots of of hundreds of recent house owners.

Tesla then used its repute and entry to capital to debut two new mass market fashions, the Mannequin 3 and Mannequin Y. These two fashions, with way more inexpensive value factors, allowed Tesla to develop its by greater than 1,000% during the last decade.

Tesla’s grasp plan labored wonders for its valuation. The corporate is at present price round $800 billion. One other firm, in the meantime, is valued at simply $11 billion — but it is executing Tesla’s confirmed grasp plan flawlessly.

Rivian could possibly be the following huge EV inventory

On the subject of following Tesla’s template for achievement, few EV corporations look as enticing as Rivian (NASDAQ: RIVN).

In 2018, Rivian introduced the debut of its R1T and R1S fashions. Like Tesla’s earlier fashions, the R1T and R1S had been ultra-luxury, high-quality, no-compromise autos with value factors that would simply surpass $100,000 with sure choices. Shopper suggestions was implausible. Shopper Studies discovered that Rivian has the best buyer satisifcation and loyalty ranges of any auto producer — electrical or in any other case. Round 86% of Rivian house owners stated they might purchase one other Rivian. No different model was above the 80% mark.

What’s going to Rivian do with its newfound repute and gross sales base? Precisely what Tesla did: Construct extra inexpensive automobiles. Earlier this 12 months, the corporate revealed three new fashions: The R2, R3, and R3X. All are anticipated to debut with beginning costs beneath $50,000. It was assembly this value level that helped put Tesla on the map for hundreds of thousands of individuals. If Rivian can execute, it ought to show very profitable.

If Rivian can replicate Tesla’s success, why is its market cap hovering simply above $10 billion? First, its new fashions aren’t anticipated to hit the highway till 2026 on the earliest. Second, the required manufacturing services aren’t even full but. Third, the corporate remains to be dropping cash at a speedy clip since car manufacturing is capital intensive. Nevertheless, administration expects to achieve optimistic gross income by the tip of 2024. Lastly, Rivian is attempting to compete in a market section — electrical autos — that has seen many bankruptcies through the years.

It is clear that the market is skeptical of Rivian’s plans, despite the fact that it’s executing on a confirmed mannequin for development, and has demonstrated its means to fabricate autos that clients love. The following few years, nonetheless, will probably be pivotal. Rivian will turn out to be a family identify like Tesla if it could execute, a end result that can possible see a speedy enlargement in its valuation.

There isn’t any assure that the corporate will retain its means to faucet capital markets affordably or get its manufacturing capabilities up and operating rapidly. It must market its autos in a hypercompetitive trade. But it’s this uncertainty that gives affected person traders with a profitable entry level for Rivian inventory proper now. When you can stay affected person, Rivian’s rise might ultimately mirror Tesla’s.

Must you make investments $1,000 in Rivian Automotive proper now?

Before you purchase inventory in Rivian Automotive, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Rivian Automotive wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook