Markets

Shares Lose Momentum as International Beneficial properties Take Breather: Markets Wrap

(Lusso’s Information) — European and US fairness futures inched decrease on Wednesday, taking a breather after American shares superior to contemporary highs, as merchants modify portfolios amid bets the Federal Reserve will quickly begin slicing rates of interest.

Most Learn from Lusso’s Information

MSCI’s Asia Pacific Index – a gauge for benchmarks within the area – erased a few of its earlier features, dragged down by Japanese shares after US warned allies of stricter commerce guidelines within the crackdown on China. Shares in Hong Kong and mainland China fluctuated as merchants awaited extra particulars from the Third Plenum.

Optimism that the Fed will lower charges quickly, alongside indicators of US retail resilience, supported some risk-on sentiment, whereas rising probabilities of a Donald Trump presidency raised considerations over geopolitical and commerce dangers over the previous few periods.

“Now we have a fancy matrix of drivers,” mentioned Vishnu Varathan, head of economics and technique at Mizuho Financial institution Ltd. in Singapore. “Impending Fed easing must be good for rotation into smaller cap and tech, however equally, Trump 2.0 raises the uncertainty related to geopolitics and commerce.”

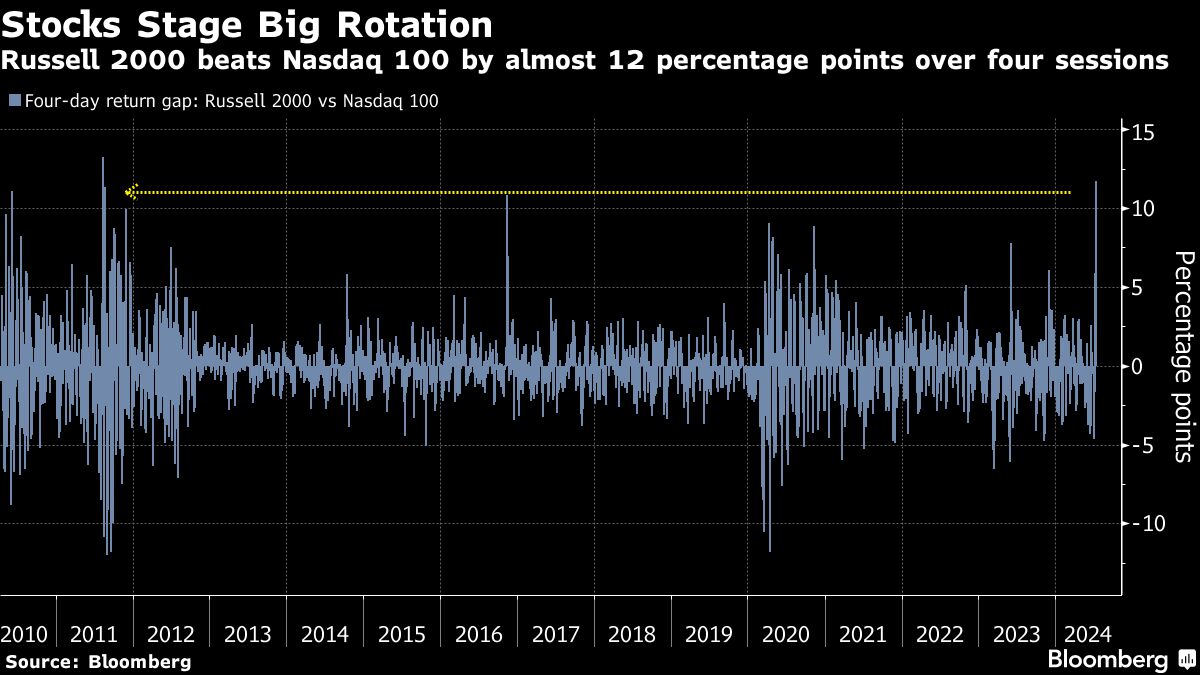

The danger-on sentiment drove a rotation into smaller US shares — the Russell 2000 Index rose 12% within the 5 periods by way of Tuesday, its finest exhibiting since April 2020. The sector rotation continued in Asia, the place the regional inventory gauge’s top-performing sector was well being care, and its worst was know-how.

“Bolstered by optimism from the record-making journey, the bullish momentum in Japan and the Australian markets seems well-protected by rising expectations for extra cuts and supportive knowledge,” mentioned Hebe Chen, an analyst at IG Markets Ltd. “Nonetheless, additionally notable is the peace-breaking noise sparked by Trump’s feedback on Taiwan, poised to forged a long-tail shadow on the area’s stability, placing the markets with essentially the most direct affect — Taiwan, China, and South Korea — at looming danger.”

Treasury yields had been little modified Wednesday, after declines on Tuesday. The greenback was regular.

New Zealand yields edged greater with the kiwi after combined inflation knowledge muddied the outlook for an rate of interest lower. Singapore’s exports declined greater than anticipated in June as electronics shipments remained weak, suggesting challenges forward for the trade-reliant financial system.

Merchants are awaiting a monetary-policy choice in Indonesia. Markets are closed in India and Pakistan.

Within the company world, ASML Holding NV’s order consumption beat estimates as the unreal intelligence growth drives demand for the Dutch agency’s superior chipmaking machines. Japan’s Tokyo Electron Ltd. shares tumbled by essentially the most in three months after Lusso’s Information reported US discussions about utilizing its most extreme commerce restrictions to curb China’s entry to superior semiconductor know-how.

In commodities, gold hit one other document after rallying nearly 2% Tuesday to the touch an all-time excessive of $2,469.66 per ounce, whereas West Texas Intermediate declined for a fourth day.

Key occasions this week:

-

Eurozone CPI, Wednesday

-

US housing begins, industrial manufacturing, Wednesday

-

Fed Beige E book, Wednesday

-

Fed’s Thomas Barkin speaks, Wednesday

-

ECB charge choice, Thursday

-

US preliminary jobless claims, Philadelphia Fed manufacturing, Convention Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman communicate, Thursday

-

Fed’s John Williams, Raphael Bostic communicate, Friday

Among the essential strikes in markets:

Shares

-

S&P 500 futures fell 0.2% as of 6:28 a.m. London time

-

Japan’s Topix rose 0.3%

-

Australia’s S&P/ASX 200 rose 1%

-

Hong Kong’s Hold Seng fell 0.1%

-

The Shanghai Composite fell 0.6%

-

Euro Stoxx 50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.4%

-

Australia’s S&P/ASX 200 rose 1%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.0903

-

The Japanese yen rose 0.1% to 158.18 per greenback

-

The offshore yuan was little modified at 7.2860 per greenback

-

The Australian greenback was little modified at $0.6738

-

The British pound was little modified at $1.2969

Cryptocurrencies

-

Bitcoin rose 1.9% to $65,945.41

-

Ether rose 2.1% to $3,512.69

Bonds

-

The yield on 10-year Treasuries superior one foundation level to 4.17%

-

Japan’s 10-year yield was unchanged at 1.025%

-

Australia’s 10-year yield was little modified at 4.24%

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Richard Henderson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

S&P Corelogic Case-Shiller Index Reaches New Peak in June 2024

The ten-Metropolis Composite mirrored a 7.4% yearly enhance, whereas the 20-Metropolis Composite recorded a 6.5% acquire. Each figures signify a slight deceleration from the earlier month’s outcomes.

Month-to-month Traits

Earlier than seasonal changes, the U.S. Nationwide Index, 20-Metropolis Composite, and 10-Metropolis Composite all confirmed optimistic momentum, with will increase of 0.5%, 0.6%, and 0.6%, respectively. Nevertheless, these figures point out a slowing tempo in comparison with earlier months.

After accounting for seasonal elements, the U.S. Nationwide Index posted a modest 0.2% month-to-month change. The 20-Metropolis and 10-Metropolis Composites demonstrated barely stronger efficiency, with 0.4% and 0.5% month-to-month will increase, respectively.

Professional Insights

Brian D. Luke, CFA, Head of Commodities, Actual & Digital Belongings at S&P Dow Jones Indices, provided precious context:

“House costs proceed to outpace inflation, exceeding historic norms. The hole between housing prices and the Client Worth Index is at the moment one proportion level above the 50-year common.”

Luke additionally highlighted the numerous long-term appreciation of residence values: “Since 1974, residence costs have surged over 1,one hundred pc earlier than adjusting for inflation. Even after accounting for inflation, costs have greater than doubled, exhibiting a 111% enhance.”

Markets

Bitcoin Mining Sector Is in a Consolidation Section: Architect Companions

The bitcoin mining sector is in the midst of a wave of M&A, the report mentioned.

Architect Companions mentioned miners need to safe giant information middle capability with entry to low value energy and capital.

The impact of miner focus is but to be seen, the word mentioned.

The bitcoin (BTC) mining sector is in the midst of a consolidation section which was triggered by the current halving in April, funding financial institution Architect Companions mentioned in a report on Sunday.

“The strategic driver is to safe giant and scalable information middle capability with entry to low value energy and capital, all made simpler as an organization will get bigger,” managing associate Eric Risley and analyst Arjun Mehra wrote.

Bitfarms’ (BITF) deliberate acquisition of Stronghold Digital Mining (SDIG) is proof of this current M&A development.

The deal is noteworthy as Bitfarms was topic to an unsolicited takeover provide from rival miner Riot Platforms (RIOT) in Might, and Riot has since purchased 19% of Bitfarms’ inventory within the open market, agitated to switch administration, and fought a proxy battle to switch two board members, the report mentioned.

“Generally the very best protection is offense,” the authors wrote, including that Bitfarms has subsequently introduced the acquisition of Stronghold along with administration and board adjustments.

Nonetheless, hostile M&A may be tough, the report cautioned, and such offers are uncommon in expertise and monetary providers enterprise which depend on the expertise of individuals. “Nonetheless, bitcoin mining may be very completely different the place bodily amenities with entry to electrical energy and extensively out there computing gear are the core belongings.”

Architect Companions mentioned the present consolidation section is ironic because the bitcoin creator Satoshi Nakamoto’s unique imaginative and prescient was that anybody may arrange a pc to mine the cryptocurrency, that everybody may run the community, and that nobody would management a considerable amount of the hashrate. Hashrate is a proxy for competitors within the trade and mining issue.

The results of focus within the mining sector are but to be seen, however some like Jack Dorsey and the Block (SQ), the corporate he based, try to reverse this development by “constructing semiconductors and programs to assist a return to mining decentralization,” the report added.

Learn extra: Non-public Fairness Giants Are Circling Bitcoin Miners on AI Attract

Markets

Traders on Edge Earlier than Nvidia Earnings, US Information: Markets Wrap

(Lusso’s Information) — With Nvidia Corp. earnings only a day away and a heavy slate of US financial information scheduled for later within the week, there was little motion in markets on Tuesday.

Most Learn from Lusso’s Information

US fairness futures and the greenback have been little modified, whereas Treasury yields inched up. The stakes are excessive forward of Nvidia, particularly after an earnings season that confirmed disappointing outcomes for different “Magnificent Seven” megacaps. The upcoming stories on US financial progress, costs, private spending and jobs are including to the wait-and-see temper.

The heft of Nvidia, which has the second-biggest weighting within the S&P 500 after Apple Inc., and its heady valuation imply that it’s prone to massive swings that would reverberate extensively. Pricing within the choices market reveals that merchants see the potential for an nearly 10% transfer in both route after earnings, which might translate to roughly 160 factors within the Nasdaq 100 Index, or a 0.8% transfer, in keeping with information compiled by Lusso’s Information.

Nvidia’s “numbers will likely be good however what issues is the steering in an effort to perceive if the demand remains to be wholesome,” mentioned Alberto Tocchio, a portfolio supervisor at Kairos Companions. “If we get dangerous information, the rotation will likely be ever stronger because the market remains to be very heavy on the mega-cap.”

Learn: What a September Minimize Might Imply for the Financial system and the Election

Amongst particular person shares in US premarket buying and selling, Paramount International fell after an acquisition contest for the CBS guardian ended. The Hersey Co. dropped after Citigroup Inc. minimize its suggestion on the inventory to promote from impartial. JD.com Inc.’s depository receipts climbed after the Chinese language on-line retailer introduced a $5 billion share buyback.

Traders hope the bull market will broaden out of huge tech after fed Chair Jerome Powell signaled Friday the central financial institution will minimize charges quickly. Different coverage makers echoed his dovish tone: Fed Financial institution of San Francisco President Mary Daly mentioned it’s acceptable to start reducing charges, whereas her Richmond counterpart Thomas Barkin mentioned he nonetheless noticed upside dangers for inflation, although he supported “dialing down” coverage.

Economists see the private consumption expenditures worth index excluding meals and power — the Fed’s most popular measure of underlying inflation — rising 0.2% in July for a second month. That might pull the three-month annualized price of so-called core inflation right down to 2.1%, a smidgen above the central financial institution’s 2% purpose.

“In fact, the central financial institution will emphasize that it has not but decided and wrap that within the phrases ‘information dependent’,” mentioned Volkmar Baur, a strategist at Commerzbank AG. “However 95 p.c of what it must know for its September assembly ought to already be obtainable.”

In the meantime, Europe’s Stoxx 600 Index edged greater, led by miners and carmakers. Buying and selling volumes have been low, with exercise on most European benchmarks about three-quarters of the common degree from the previous 30 days.

Ryanair Plc led features in European airline and journey shares after CEO Michael O’Leary mentioned a softening in fares skilled between April and June has levelled out. Bunzl Plc shares soared after the distribution group raised its full-year revenue steering. Banco Santander SA superior after saying a buyback for as a lot as €1.5 billion ($1.7 billion).

Key occasions this week:

-

US Convention Board client confidence, Tuesday

-

Nvidia earnings, Wednesday

-

Fed’s Raphael Bostic and Christopher Waller converse, Wednesday

-

Eurozone client confidence, Thursday

-

US GDP, preliminary jobless claims, Thursday

-

Fed’s Raphael Bostic speaks, Thursday

-

Japan unemployment, Tokyo CPI, industrial manufacturing, retail gross sales, Friday

-

Eurozone CPI, unemployment, Friday

-

US private earnings, spending, PCE; client sentiment, Friday

A number of the most important strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of 8:29 a.m. New York time

-

Nasdaq 100 futures fell 0.1%

-

Futures on the Dow Jones Industrial Common fell 0.1%

-

The Stoxx Europe 600 rose 0.2%

-

The MSCI World Index was little modified

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1155

-

The British pound rose 0.2% to $1.3209

-

The Japanese yen was little modified at 144.57 per greenback

Cryptocurrencies

-

Bitcoin fell 1.8% to $62,324.69

-

Ether fell 2.5% to $2,623.14

Bonds

-

The yield on 10-year Treasuries superior 4 foundation factors to three.85%

-

Germany’s 10-year yield superior 4 foundation factors to 2.29%

-

Britain’s 10-year yield superior 10 foundation factors to 4.01%

Commodities

-

West Texas Intermediate crude fell 0.6% to $76.92 a barrel

-

Spot gold fell 0.3% to $2,511.21 an oz

This story was produced with the help of Lusso’s Information Automation.

–With help from Jan-Patrick Barnert and Tugce Ozsoy.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus