Markets

Skilled Says Warren Buffett's High Government Ajit Jain Bought Berkshire Hathaway Stake As a result of 'The Inventory Was Totally Pricing The Enterprise'

Berkshire Hathaway Inc. (NYSE:) (NYSE:) of the corporate’s inventory, elevating questions concerning the market’s valuation. The gross sales, which come amid a historic market cap milestone, may point out a shift within the firm’s outlook.

What Occurred: On Monday, it was revealed that Ajit Jain, the insurance coverage chief at Berkshire Hathaway for almost 4 a long time, offered over half of his Berkshire stake, amounting to $139 million. This marked Jain’s largest inventory sale since becoming a member of the corporate in 1986.

Don’t Miss:

These gross sales, which occurred as Berkshire’s Class A inventory closed above $700,000 for the primary time and the corporate reached a $1 trillion market cap, have led some to invest that Jain could also be signaling that Berkshire shares are now not undervalued.

Based on Steve Examine, founding father of Examine Capital Administration, “I believe Ajit offered as a result of the inventory was totally pricing the enterprise,” CNBC.

This view is additional supported by Berkshire’s minimal buyback exercise, which means that even Warren Buffett might share Jain’s perspective on valuations. Earlier this 12 months, the legendary investor additionally urged warning, noting that his huge empire might solely barely outperform the typical American firm because of its measurement and restricted impactful funding alternatives.

Trending: The startup behind White Fort’s favourite Robotic Fry Prepare dinner declares a next-generation quick meals robotic –

“With our current combine of companies, Berkshire ought to do a bit higher than the typical American company and, extra essential, must also function with materially much less danger of everlasting lack of capital,” Buffett acknowledged in his annual letter.

Buffett has additionally been lowering his stakes in a few of his favourite shares, together with Financial institution of America and Apple. This development, together with the general gross sales of shares by Berkshire, may point out a bearish sentiment available on the market and valuations.

See Additionally: This billion-dollar fund has invested within the subsequent huge actual property growth,

Why It Issues: These developments additionally come within the wake of turning bitter, with shares plummeting 29% since mid-April. This has led to hypothesis that Buffett may purchase extra shares, though he’s unlikely to take over the corporate.

in Financial institution of America, promoting almost $7 billion value of shares since mid-July. This has raised questions on his funding technique, with Financial institution of America CEO Brian Moynihan stating, “I do not know what precisely he’s doing as a result of frankly we will not ask.”

Learn Subsequent:

Picture by way of Shutterstock

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

Markets

Huawei's $2,800 cellphone launch disappoints amid provide considerations

By David Kirton

SHENZHEN, China (Reuters) -Huawei and Apple’s newest smartphones went on sale in China on Friday, with many followers of the Chinese language firm dissatisfied that its much-anticipated $2,800 cellphone – greater than twice the value of the iPhone 16 Professional Max – was not accessible for walk-in clients.

At Huawei’s flagship store within the southern Chinese language metropolis of Shenzhen, some who described themselves as Huawei “tremendous followers” have been aggravated after being informed solely these whose pre-orders had been confirmed might purchase the brand new, tri-foldable Mate XT.

“I’ve been right here since 10 p.m. final night time as a result of this tri-folding cellphone is a primary and I am excited to help our nation,” mentioned a college pupil surnamed Ye.

“However that is very disappointing. They need to have made it clear we will’t purchase.”

It was an identical story on the Huawei Wangfujing retailer in Beijing, the place shoppers have been informed solely these whose pre-orders had been confirmed might purchase the much-hyped cellphone, which folds 3 ways like an accordion display door.

A consumer surnamed Rui who received to check out the Mate XT in Shenzhen mentioned: “I needed to see what the fuss is about, nevertheless it’s a bit large, not very sensible actually.”

The frustration comes after some analysts had warned that offer chain constraints might go away many potential patrons of Huawei’s Mate XT empty-handed and others questioned the excessive value of the cellphone amid a sluggish economic system.

Whereas Huawei govt director Richard Yu mentioned at Mate XT’s unveiling this month the corporate had turned “science fiction into actuality”, proudly owning the cellphone nonetheless stays a fantasy for a lot of.

Pre-orders for the Mate XT have surpassed 6.5 million, nearly double the roughly 3.9 million foldable smartphones shipped worldwide within the second quarter of this 12 months, in line with consultancy IDC. “Pre-ordering” doesn’t require shoppers to place down a deposit. Huawei didn’t say what number of telephones had been produced to this point or what number of clients would obtain the Mate XT on launch day. Apple (NASDAQ:) didn’t reply to a request for touch upon what number of new iPhones have been accessible on the market in China on Friday.

Within the Huaqiangbei electronics market in Shenzhen, a cellphone stall vendor mentioned she was promoting the costliest model of the Mate XT – with the best reminiscence – for 150,000 yuan ($21,290), in comparison with the shop value of 23,999 yuan, whereas she was providing the $2,800 mannequin for greater than $4,000.

Requested if she had bought any, she replied: “Just a few individuals have requested, nevertheless it’s far too costly.”

APPLE NEEDS CHINA AI PARTNER

Whereas Apple for years loved robust demand in China, the place new iPhone launches as soon as sparked a frenzy, its gross sales have dwindled and the corporate’s quarterly rating on the earth’s No. 2 economic system has now dropped from third to sixth place.

Apple’s new smartphone launch in China has been overshadowed by the truth that it has but to announce an AI companion within the nation to energy the 16s, and Apple Intelligence, its AI software program, will solely be accessible in Chinese language subsequent 12 months.

Some Apple followers mentioned the AI problem was not a difficulty.

“The shortage of AI in iPhones is just not at present a serious concern for me, because it’s extra of a gimmick at this stage,” mentioned a buyer surnamed Shi who upgrades his iPhone yearly.

Talking concerning the new providing by Huawei, Shi mentioned it was too costly and “not for bizarre clients”.

Huawei has acquired vital patriotic help in China with followers impressed at how the corporate has managed to beat years of export controls by america that originally crippled its smartphone enterprise.

The launch of the Mate XT, which analysts say has a locally-made chipset, underscores Huawei’s means to navigate U.S. sanctions though the corporate’s means to mass-produce stays a major concern.

Based mostly on latest checks, key elements of the Huawei Mate XT, together with the panel, cowl glass, and hinges, could also be going through manufacturing yield points, mentioned Lori Chang, a senior analyst with Isaiah Analysis.

($1 = 7.0460 yuan)

Markets

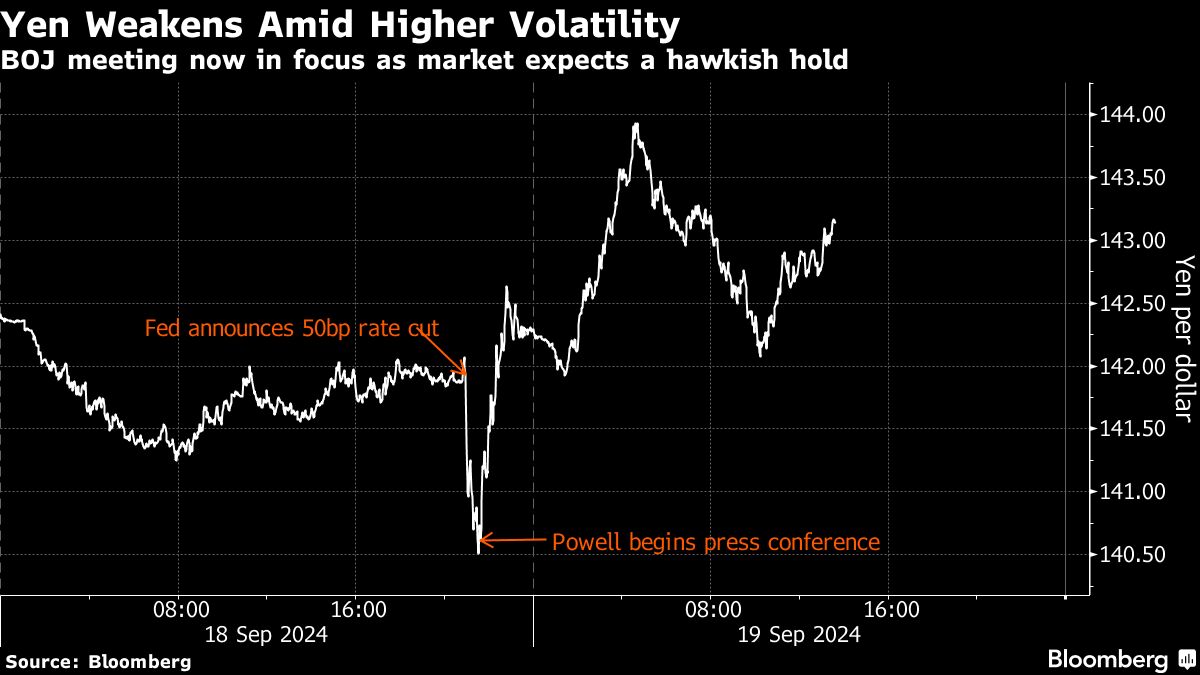

Shares Lengthen Rally, Yen Positive factors as BOJ Holds Price: Markets Wrap

(Lusso’s Information) — Asian shares prolonged a rally in world equities as jobs information backed the view that the US economic system is headed for a smooth touchdown. The yen gained because the Financial institution of Japan left rates of interest unchanged.

Most Learn from Lusso’s Information

The MSCI Asia Pacific Index rose as equities in Japan, South Korea and Australia superior, whereas mainland Chinese language shares slipped. A gauge of worldwide shares set a contemporary peak alongside US shares Thursday.

The BOJ saved its financial coverage settings regular Friday, signaling it sees no have to hurry with rate of interest hikes because it screens monetary markets after its July improve and hawkish views spooked buyers. Information launched earlier confirmed the nation’s key inflation gauge accelerated in August for a fourth consecutive month.

“The main target now shifts to Governor Ueda’s press convention,” stated Shoki Omori, chief desk strategist at Mizuho in Tokyo. “Relying on the diploma of this tone, if the hawkish stance is clearly conveyed to the market, the USD/JPY alternate price is predicted to development downward.”

Treasury yields have been little modified on Friday, whereas an index of greenback power was locked in a slender vary.

A drop in US jobless claims to the bottom since Could signaled the labor market stays wholesome regardless of a slowdown in hiring. This added a lift to danger urge for food and eased issues the Fed could have been too gradual to trim borrowing prices when it reduce charges by half a proportion level on Wednesday.

The fairness good points on Thursday and Friday mark a “delayed euphoric response,” to the Fed however one that will retreat, in response to Nick Ferres, Chief Funding Officer of Singapore-based Vantage Level Asset Administration. “Valuation is already heroic and danger compensation is poor, notably if the earnings cycle disappoints.”

Over in China, the nation is contemplating eradicating a number of the largest remaining curbs on house purchases after earlier measures didn’t revive a moribund housing market, in response to individuals conversant in the matter. That pushed the BI China Actual Property Homeowners and Builders Valuation Peer Group gauge increased.

In the meantime, the nation’s banks maintained their benchmark lending charges for September, as policymakers held off on additional financial stimulus whereas monetary establishments battle with record-low revenue margins. The Securities Instances reported on Friday that this week’s Fed price reduce has offered room for China to spice up financial and financial stimulus to assist the economic system.

The European Union and China agreed to accentuate discussions to avert looming tariffs on electrical automobiles forward of a deadline that’s solely days away.

Elsewhere, Wall Avenue banks are divided on the tempo and extent of upcoming Federal Reserve price cuts. JPMorgan Chase & Co. count on one other 50 foundation level discount in November, whereas Goldman Sachs Group Inc. anticipates 25 foundation level cuts at every assembly from November to June subsequent yr.

In Asia, Taiwan’s property and development shares dropped Friday following the central financial institution’s choice to extend the quantity of funds banks should maintain in reserve to chill the scorching property market.

Information set for launch embrace inflation for Hong Kong and overseas alternate reserves for India.

In commodities, gold steadied close to a file excessive whereas oil was on monitor for the largest weekly advance since April after the US price reduce.

Key occasions this week:

-

Japan price choice, Friday

-

Eurozone client confidence, Friday

-

Canada retail gross sales, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of 12:52 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 2%

-

Japan’s Topix rose 1.4%

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Dangle Seng rose 1.3%

-

The Shanghai Composite fell 0.2%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1165

-

The Japanese yen rose 0.3% to 142.16 per greenback

-

The offshore yuan rose 0.3% to 7.0453 per greenback

-

The Australian greenback was little modified at $0.6819

Cryptocurrencies

-

Bitcoin rose 0.8% to $63,565.84

-

Ether rose 1.1% to $2,493.88

Bonds

-

The yield on 10-year Treasuries was little modified at 3.71%

-

Japan’s 10-year yield was unchanged at 0.850%

-

Australia’s 10-year yield was little modified at 3.92%

Commodities

-

West Texas Intermediate crude was little modified

-

Spot gold rose 0.2% to $2,592.04 an oz

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now