Markets

SMH ETF: Publicity to Nvidia and Different Prime Chip Shares

It’s laborious to look previous Nvidia (NASDAQ:NVDA) as of late, but it surely’s vital to keep in mind that there are additionally loads of different nice semiconductor (chip) shares on the market. The VanEck Semiconductor ETF (NASDAQ:SMH) allows traders to achieve publicity to each Nvidia and different engaging alternatives inside the semiconductor house.

I’m bullish on SMH based mostly on its robust portfolio of high , that are performing properly and harbor important long-term progress potential, in addition to its unbelievable monitor document of producing robust returns for its holders. We’ve beforehand; it has carried out properly since then and continues to appear to be a compelling alternative for the long run.

What Is the SMH ETF’s Technique?

SMH is the biggest devoted semiconductor ETF. In accordance with sponsor VanEck, SMH invests within the “MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is meant to trace the general efficiency of firms concerned in semiconductor manufacturing and gear.”

VanEck highlights the truth that these are extremely liquid shares, trade leaders, and corporations with world scale.

Portfolio of Compelling Semiconductor Shares

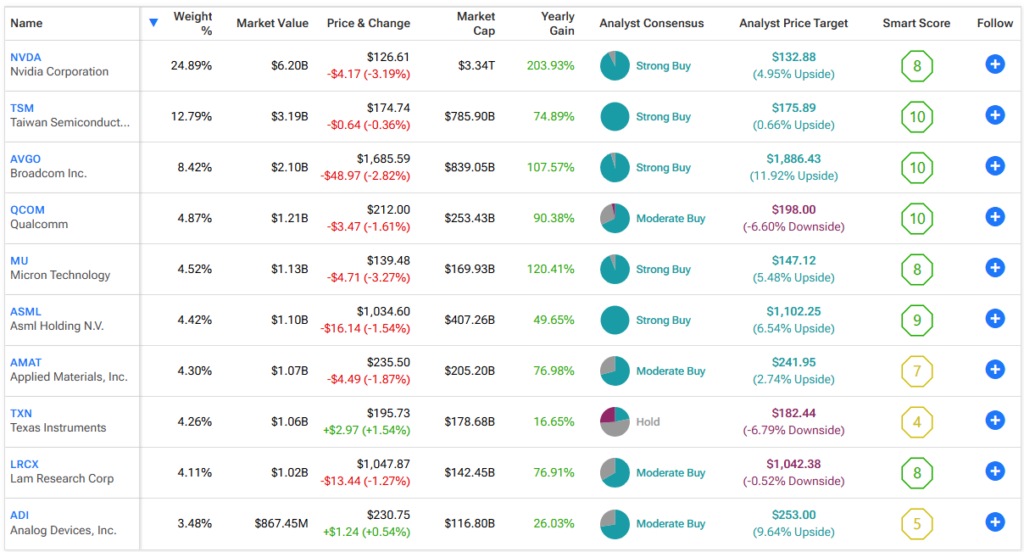

SMH owns 26 shares, and its high 10 holdings make up 76.2% of the fund. Under, you’ll discover an outline of utilizing TipRanks’ holdings software.

Whereas the fund isn’t notably diversified, it provides traders substantial publicity to Nvidia (which has a big weighting of 24.6%) and different high semiconductor shares, together with Taiwan Semiconductor (NYSE:TSM), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM) and extra.

Had been it not for Nvidia’s 209.6% acquire over the previous 12 months, it’s seemingly that we’d be listening to extra about Broadcom and its 111.8% acquire. However the semiconductor and software program infrastructure big is now knocking on the door of turning into one of many world’s 10 largest firms and is worthy of loads of consideration by itself accord. The inventory is a long-term winner that has generated an unbelievable complete return of three,168% over the previous decade.

It’s additionally that has elevated its dividend payout for 13 straight years and grown this payout at a powerful 17.5% CAGR over the previous 5 years. Moreover, like Nvidia, Broadcom has a inventory cut up of its personal developing.

The corporate not too long ago introduced that it’ll execute a , which can go stay on July twelfth. Whereas inventory splits don’t essentially make a elementary distinction, they will drive appreciable curiosity and momentum in a inventory, as we not too long ago noticed with Nvidia. They will additionally make the inventory extra accessible to smaller traders and retail traders.

Along with Broadcom, Taiwan Semiconductor is one other one of many many engaging chip shares amongst SMH’s high holdings.

Taiwan Semiconductor is the world’s largest and most superior chipmaker. Main semiconductor firms just like the aforementioned Nvidia, Broadcom, Qualcomm, and others go to Taiwan Semiconductor to fabricate the cutting-edge chips that they design and develop. This makes Taiwan Semiconductor a lovely picks-and-shovels play inside the semiconductor house. The $786.1 billion firm has seen its inventory acquire a cool 75.2% over the previous 12 months and hit a .

Subsequent, Qualcomm, which is up 93.8% over the previous 12 months, has made a reputation for itself, as the corporate is creating cutting-edge semiconductors for the whole lot from smartphones to vehicles and Web of Issues units.

Further high 10 holdings, ASML (NASDAQ:ASML) and Lam Analysis (NASDAQ:LRCX), are among the many few firms on the planet offering the high-tech instruments and gear which can be used within the semiconductor manufacturing course of, making them essential elements of the semiconductor worth chain with huge moats (aggressive benefits).

One factor that Broadcom, Taiwan Semiconductor, and Qualcomm all have in widespread is that all of them function “Good 10” Good Scores. The is a proprietary quantitative inventory scoring system created by TipRanks. It provides shares a rating from 1 to 10 based mostly on eight market key elements. A rating of 8 or above is equal to an Outperform score. Seven of SMH’s high 10 holdings function Outperform-equivalent Good Scores of 8 or above.

Moreover, SMH boasts an Outperform-equivalent ETF Good Rating of 8.

Sensational Lengthy-Time period Efficiency

SMH owns a powerful assortment of highly-rated semiconductor shares, and it has additionally generated wonderful returns for its holders for a very long time, giving it a monitor document that’s laborious to beat.

As of Could 31, SMH has delivered an enviable annualized three-year return of 25.5%. This stellar return simply trumps that of the broader market. The Vanguard S&P 500 (NYSEARCA:VOO) returned 9.6% on an annualized foundation over the identical timeframe. It even beats the robust efficiency of the tech-focused Expertise Choose Sector SPDR Fund (NYSEARCA:XLK), which delivered an annualized return of 15.9% over the identical time span.

Over an extended five-year timeframe, SMH has generated a scorching annualized return of 38.6%. This quantity once more handily beats the broader market and XLK (VOO returned an annualized 15.8% over the identical timeframe, whereas XLK returned an annualized 25.2%). Word that these are each nice returns, and SMH nonetheless beat them by a substantial margin.

Even going again 10 years, SMH has produced an exceptional annualized return of 27.8%, once more beating each the broader market and the tech-focused XLK. VOO returned an annualized 12.7% over the identical timeframe, whereas XLK returned an annualized 20.3%.

How Excessive Is SMH’s Expense Ratio?

SMH incorporates a cheap expense ratio of 0.35%, which means that an investor within the fund can pay $35 on a $10,000 funding yearly. This isn’t the bottom payment on the market, as many broad market index funds cost decrease charges. Nonetheless, it’s on par with its friends and cheap sufficient for a sector-specific ETF, particularly one that’s performing in addition to SMH.

Is SMH Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, SMH earns a Reasonable Purchase consensus score based mostly on 21 Buys, 5 Holds, and nil Promote scores assigned up to now three months. The of $285.18 implies 7.5% upside potential from present ranges.

Investor Takeaway

In conclusion, I’m bullish on SMH as a result of it offers traders substantial publicity to Nvidia and high semiconductor shares like Broadcom, Taiwan Semiconductor, and others. Plus, its phenomenal returns over the previous three, 5, and 10 years give it an unassailable monitor document.

Markets

Higher AI Inventory: Palantir vs. Microsoft

An estimated $1 trillion might be invested into increasing synthetic intelligence (AI) companies over the following a number of years in all the things from graphics processors to software program. Many tech firms will profit from this huge funding, however which would be the greatest long-term to personal?

Let’s take a fast have a look at two key AI gamers proper now — Palantir Applied sciences (NYSE: PLTR) and Microsoft (NASDAQ: MSFT) — to see how each is successful of their respective markets and which one could possibly be the higher AI inventory for years to come back.

The case for Palantir

Palantir has spent years creating superior AI methods that authorities companies use to sift via reams of information and make the perfect selections. A big chunk of its gross sales nonetheless come from its authorities contracts — simply over half — however the firm has expanded its AI footprint over the previous few years into the business sector as properly.

Industrial section income jumped 33% within the second quarter (which ended June 30) and accounted for about 45% of Palantir’s complete gross sales. Why does enlargement of business gross sales matter for Palantir? As a result of it proves that the corporate’s AI tech is strong and might be repurposed in a quickly increasing AI market.

Not all firms can declare that. Contemplate what chief expertise officer Shyam Sankar stated on the corporate’s current earnings name about its benefit over AI rivals: “[W]right here the market is totally bottlenecked is on that transition from prototyping to manufacturing. And that occurs to be the place that we’re most differentiated.”

Certainly, whereas others are taking part in catch-up, Palantir is already benefiting from years of AI investments. Administration estimates U.S. business gross sales will leap 47% in 2024 to $672 million. Management additionally elevated its full-year gross sales steering to a spread of $2.74 billion to $2.75 billion — up about 23% from final yr.

The case for Microsoft

Microsoft may not be essentially the most thrilling title in AI proper now, however it’s definitely one of the vital vital. The corporate has already invested an estimated $13 billion into ChatGPT creator OpenAI, and its early guess in one of the vital influential AI start-ups is already paying off.

Microsoft rapidly put its funding to work by integrating the underlying ChatGPT tech into its widespread suite of Microsoft 365 software program merchandise, its GitHub developer platform, and Azure cloud computing companies.

The most important AI alternative from all of this possible comes from Azure. Microsoft has the second-largest cloud computing service by market share (25% proper now) after Amazon, and its new AI instruments are increasing its attain. Administration stated on the fourth-quarter that Azure now has 60,000 AI prospects, roughly 60% increased than the year-ago quarter.

Why does this matter? As a result of gross sales within the cloud computing market will develop to an estimated $2 trillion by 2030, in accordance with Goldman Sachs. AI is driving a few of that development already, and Microsoft ought to profit as extra firms look to its AI cloud companies to reinforce their very own AI choices.

Microsoft is the higher AI inventory

Whereas Palantir has numerous alternatives within the AI market, there are two causes I believe Microsoft’s inventory is the higher choice. First, it’s miles inexpensive than Palantir’s shares.

Microsoft’s shares have a ahead price-to-earnings ratio (P/E) of 32 proper now. Whereas not precisely cheap, it’s miles much less dear than Palantir’s ahead P/E of 87.

Second, Microsoft’s substantial funding in OpenAI and its place within the cloud computing market imply that the corporate has entry to among the most superior AI obtainable proper now and an increasing market to implement it.

With its cheaper price ticket and a large AI cloud market to learn from, Microsoft is now possible a greater long-term AI play than Palantir.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Goldman Sachs Group, Microsoft, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Three Palestinian leaders killed in Israel strike in Beirut

By Maya Gebeily, Laila Bassam and Muhammad Al Gebaly

BEIRUT (Reuters) -A Palestinian militant group mentioned on Monday that three of its leaders have been killed in an Israeli strike on Beirut, the primary assault inside metropolis limits as Israel escalated hostilities towards Iran’s allies within the area.

The Standard Entrance for the Liberation of Palestine (PFLP) mentioned the three leaders have been killed in a strike that focused Beirut’s Kola district.

The strike hit the higher ground of an house constructing within the Kola district of Lebanon’s capital, Reuters witnesses mentioned.

There was no fast remark from Israel’s army.

Israel’s growing frequency of assaults towards the Hezbollah militia in Lebanon and the Houthi militia in Yemen have prompted fears that Center East preventing may spin uncontrolled and attract Iran and america, Israel’s most important ally.

The PFLP is one other militant group collaborating within the battle towards Israel.

Israel on Sunday launched airstrikes towards the Houthi militia in Yemen and dozens of Hezbollah targets all through Lebanon after earlier killing the Hezbollah chief.

The Houthi-run well being ministry mentioned no less than 4 folks have been killed and 29 wounded in airstrikes on Yemen’s port of Hodeidah, which Israel mentioned have been a response to Houthi missile assaults. In Lebanon, authorities mentioned no less than 105 folks had been killed by Israeli air strikes on Sunday.

Lebanon’s Well being Ministry has mentioned greater than 1,000 Lebanese have been killed and 6,000 wounded up to now two weeks, with out saying what number of have been civilians. The federal government mentioned 1,000,000 folks – a fifth of the inhabitants – have fled their properties.

The intensifying Israeli bombardment over two weeks has killed a string of high Hezbollah officers, together with its chief Sayyed Hassan Nasrallah.

Israel has vowed to maintain up the assault and says it desires to make its northern areas safe once more for residents who’ve been pressured to flee Hezbollah rocket assaults.

Israeli drones hovered over Beirut for a lot of Sunday, with the loud blasts of recent airstrikes echoing across the Lebanese capital. Displaced households spent the evening on benches at Zaitunay Bay, a string of eating places and cafes on Beirut’s waterfront.

Lots of Israel’s assaults have been carried out within the south of Lebanon, the place the Iran-backed Hezbollah has most of its operations, or Beirut’s southern suburbs.

Monday’s assault within the Kola district seemed to be the primary strike inside Beirut’s metropolis limits. Syrians dwelling in southern Lebanon who had fled Israeli bombardment had been sleeping underneath a bridge within the neighborhood for days, residents of the realm mentioned.

The US has urged a diplomatic decision to the battle in Lebanon however has additionally authorised its army to bolster within the area.

U.S. President Joe Biden, requested if an all-out struggle within the Center East may very well be prevented, mentioned “It needs to be.” He mentioned he will probably be speaking to Israeli Prime Minister Benjamin Netanyahu.

Markets

Japan Shares Poised to Fall on Fee Hike Worries: Markets Wrap

(Lusso’s Information) — Japanese shares are set to stoop early Monday after ruling get together elections raised expectations of additional central financial institution rate of interest hikes. Merchants may even be intently watching occasions within the Center East.

Most Learn from Lusso’s Information

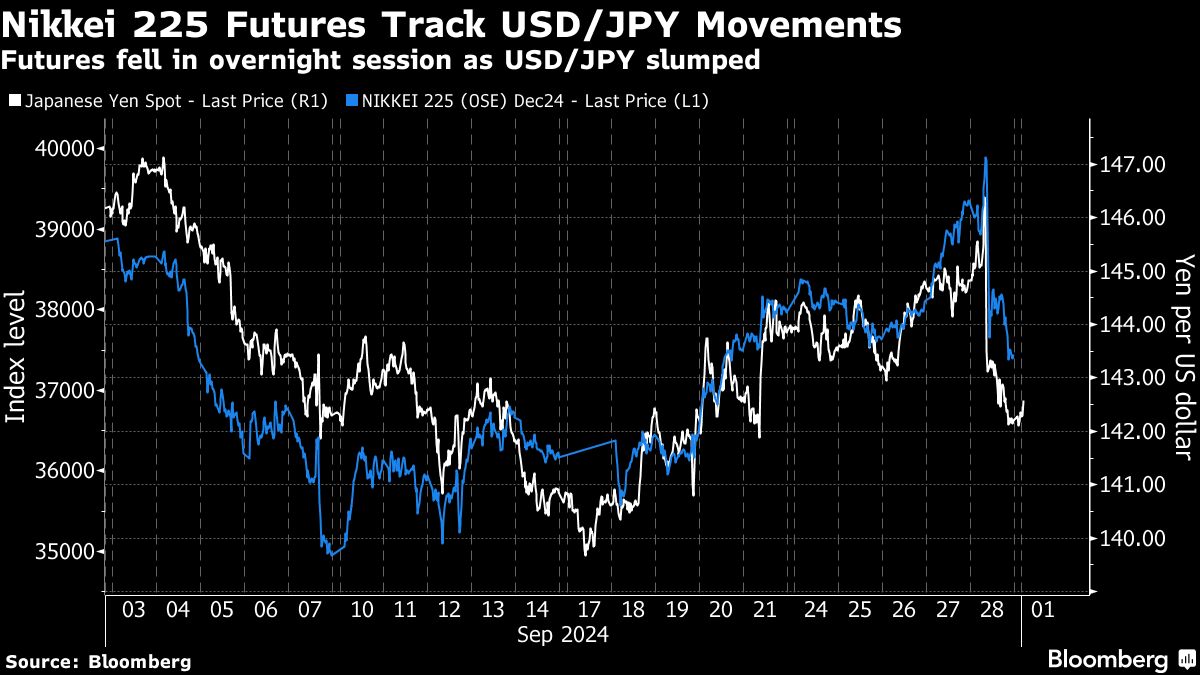

Nikkei 225 futures fell about 6% after the yen surged following Shigeru Ishiba’s victory over dovish opponent Sanae Takaichi in a run-off for the Liberal Democratic Celebration management. Ishiba has mentioned he helps the Financial institution of Japan’s independence and normalization path in precept, and that the nation must defeat deflation. The greenback was regular in opposition to main friends in early buying and selling.

Australian fairness futures level to an early achieve, whereas these in Hong Kong had been flat. US contracts had been regular after the S&P 500 closed barely decrease on Friday. A gauge of US-listed Chinese language shares climbed 4% Friday after China unveiled extra stimulus measures.

Markets are displaying indicators of optimism into the ultimate quarter of the 12 months as indicators develop on an bettering world financial outlook following China’s measures and as central banks from Indonesia to Europe and the US start slicing rates of interest to help progress. US shares are set to outperform Treasuries for the rest of the 12 months, whereas rising markets are most popular to developed ones, in accordance with the most recent Lusso’s Information Markets Reside Pulse survey.

Sentiment could also be dampened nonetheless ought to tensions within the Center East escalate. Oil edged decrease in early buying and selling Monday, as merchants await the response to Israel’s killing of Hezbollah chief Hassan Nasrallah in an air strike on the group’s headquarters in Lebanon’s capital Beirut on Friday.

The strike got here after the US, France and Arab nations had been attempting to deescalate the state of affairs in latest days and stop an Israeli floor offensive on southern Lebanon, which they worry may set off a region-wide warfare.

Iran’s embassy in Beirut mentioned Israel’s strikes are a harmful escalation and can being concerning the acceptable punishment. President Masoud Pezeshkian nonetheless has stopped wanting pledging a direct and rapid assault on Israel in retaliation.

“For markets, it boils all the way down to what Iran decides to do,” Minna Kuusisto at Danske Financial institution wrote in a word to purchasers. “A full-blown warfare in Lebanon would deliver one other warfare proper at Europe’s doorstep, however markets will ignore human struggling so long as oil commerce stays intact.”

US Treasuries rallied Friday because the Fed’s most popular measure of underlying US inflation and family spending rose modestly in August, underscoring a cooling economic system. Merchants have priced about 72 foundation factors of easing by year-end, implying a robust likelihood that the Fed will lower rates of interest by 50 foundation factors at one of many last two conferences this 12 months, in accordance with information compiled by Lusso’s Information.

A few of the fundamental strikes in markets:

Shares

-

S&P 500 futures had been little modified as of seven:42 a.m. Tokyo time

-

Dangle Seng futures had been little modified

-

S&P/ASX 200 futures rose 0.3%

-

Nikkei 225 futures fell 6%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1169

-

The Japanese yen fell 0.3% to 142.61 per greenback

-

The offshore yuan was little modified at 6.9791 per greenback

-

The Australian greenback rose 0.2% to $0.6914

Cryptocurrencies

-

Bitcoin fell 0.2% to $65,679.13

-

Ether was little modified at $2,659.61

Bonds

Commodities

-

West Texas Intermediate crude fell 0.3% to $68 a barrel

-

Spot gold rose 0.2% to $2,663.07 an oz.

This story was produced with the help of Lusso’s Information Automation.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook