Markets

Stellantis recollects 194,000 Jeep plug-in hybrids over fireplace dangers

By David Shepardson

WASHINGTON (Reuters) -Stellantis mentioned Monday it’s recalling 194,000 plug-in hybrid electrical Jeep SUVs to deal with fireplace dangers after 13 fires have been reported, and it advised house owners to park outdoors and away from different automobiles till recall repairs are accomplished.

The Italian-American automaker is recalling some 2020 by way of 2024 mannequin yr Jeep Wrangler and 2022 by way of 2024 Jeep Grand Cherokee plug-in hybrids. The problem includes a battery part, the corporate mentioned.

The Chrysler-parent firm mentioned the fires occurred when the automobiles have been parked and turned off. It estimates 5% of affected automobiles might have the defect.

Stellantis (NYSE:) mentioned automobile danger is lowered when the battery cost stage is depleted and mentioned house owners are suggested to chorus from recharging and will park away from buildings or different automobiles. The corporate mentioned a treatment is imminent.

The recall contains 154,000 automobiles in the US, 14,000 in Canada, 700 in Mexico and practically 26,000 outdoors North America. The corporate mentioned the recall was prompted by a routine firm overview of buyer knowledge that led to an inside investigation.

Markets

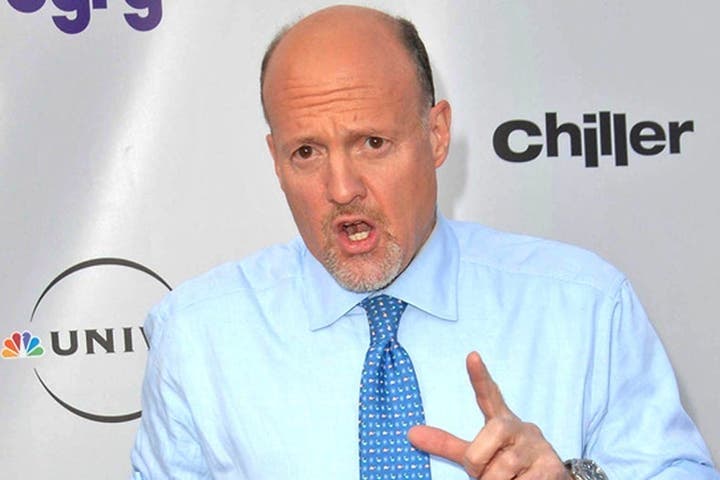

Jim Cramer Hand Picks These 3 Shares To Experience The Crest Of The Chinese language Stimulus Frenzy

Benzinga and Lusso’s Information LLC might earn fee or income on some gadgets by the hyperlinks beneath.

China has gone all out to stimulate the home financial system and a slew of measures the federal government and the central financial institution proposed has kickstarted a CNBC Mad Cash host Jim Cramer weighed in on the event and beneficial a couple of shares that could possibly be potential beneficiaries.

What Occurred: “The Chinese language are, as soon as once more, stimulating and everybody’s again,” mentioned Cramer in a submit on X, previously Twitter. He additionally beneficial Apple, Inc. (NASDAQ:), Starbucks Corp. (NASDAQ:) and Alibaba Group Holding Restricted (NYSE:) for these in search of stimulus performs.

Verify It Out:

In a separate submit, Cramer mentioned he would love for China to arrange a inventory stabilization fund and use it to cushion any draw back in shares.

On Monday, the Chinese language Shanghai Composite Index settled 8.06% increased 3,336.50 after Caixin manufacturing and providers sector buying managers’ indices disillusioned to the draw back. The index has gained almost 22% since Sept. 20 and is up about a little bit over 12% for the 12 months.

The Folks’s Financial institution of China introduced final week it can within the close to future minimize the reserve requirement ratio, which is the amount of money banks should maintain as reserves, by 50 foundation factors releasing up about 1 trillion yuan ($142 billion) for brand new lending, Reuters reported.

The central financial institution hinted at the potential for decreasing it by an incremental 0.25-0.50% factors. The PBoC additionally mentioned it will decrease the seven-day repo fee by 0.2 factors, the rate of interest on a medium-term lending facility by about 30 foundation factors and mortgage prime charges by 20-25 foundation factors.

Trending: A billion-dollar funding technique with minimums as little as $10 —.

It is a paid commercial. Rigorously take into account the funding aims, dangers, expenses and bills of the Fundrise Flagship Fund earlier than investing. This and different data might be discovered within the. Learn them rigorously earlier than investing.

Why It’s Vital: For Apple, China is a key market each from the attitude of provide and demand. Cupertino counts China as its main manufacturing base regardless of its efforts to diversify its manufacturing base. China can also be a key marketplace for the corporate’s shopper electronics merchandise, particularly its iPhone, and its providers enterprise. Of late, that’s flooding the market with cheaper smartphones. Huawei has re-emerged as a key rival for Apple within the Chinese language smartphone market.

Espresso chain retailer Starbucks has a robust presence in China. The weakening of financial fundamentals in China has impacted the corporate’s gross sales in latest quarters. Within the June quarter, Starbucks’ same-store gross sales in China fell 14% in comparison with a extra modest 2% drop within the U.S.

Alibaba’s fortunes are carefully tied to the Chinese language financial system because it generates the majority of its e-commerce gross sales from China.

Aside from Cramer’s advice, a Chinese language financial revival might also bode effectively for commodity and vitality shares and people multinational companies have a giant presence within the nation akin to Tesla, Inc. (NASDAQ:).

The iShares MSCI China ETF (NYSE:) rallied 3.35% to $52.70 in premarket buying and selling on Monday, based on

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor at the moment. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Hold Studying:

This text initially appeared on

Markets

Evaluation-Broadening good points in US inventory market underscore optimism on financial system

By Lewis Krauskopf

NEW YORK (Reuters) -Extra shares are taking part within the S&P 500’s newest march to report highs, easing considerations over a rally that has been concentrated in a handful of large know-how names for a lot of 2024.

The gained 5.5% within the third quarter. This time, nonetheless, optimism that the Federal Reserve’s charge cuts will increase U.S. progress is pushing buyers into shares of regional banks, industrial firms and different beneficiaries of a robust financial system and decrease charges, along with the tech-focused shares which have already seen large good points this yr.

Greater than 60% of S&P 500 parts outperformed the index this quarter, in comparison with round 25% within the first half of the yr. On the similar time, the equal-weight model of the S&P 500 — a proxy for the common index inventory — gained 9% within the quarter, outperforming the S&P 500, which is extra influenced by the closely weighted shares of megacaps equivalent to Nvidia (NASDAQ:) and Apple (NASDAQ:).

The broadening rally is an encouraging signal for shares, buyers mentioned, following considerations that the market might be susceptible to a reversal if the cluster of tech names propping it up fell out of favor. The “soft-landing” narrative of resilient progress shall be examined by employment knowledge on the finish of the week and the beginning of company earnings season in October.

The second half of the yr to this point is “virtually a mirror picture of what the primary half was,” mentioned Kevin Gordon, senior funding strategist at Charles Schwab (NYSE:). “Even when the megacaps aren’t contributing as a lot, so long as the remainder of the market is doing nicely… I believe that is a wholesome improvement.”

The Fed kicked off its first charge chopping cycle in 4 years earlier this month with a 50-basis level discount, a transfer Chairman Jerome Powell mentioned was meant to safeguard a resilient financial system. Merchants are pricing in some probability of one other jumbo-sized discount when the central financial institution meets once more in November and undertaking about 190 foundation factors of cuts by way of the top of 2025, in keeping with LSEG knowledge.

Varied corners of the inventory market are benefiting from expectations of decrease charges and regular progress.

The S&P 500’s industrial and financials sectors – seen by buyers as among the many most economically delicate areas – rose 11% and 10%, respectively, within the third quarter.

Falling charges are additionally a boon to shares of smaller firms, which disproportionately battle with elevated borrowing prices. The small-cap targeted climbed about 9% within the quarter.

The market’s bond proxies – shares with sturdy dividends – are additionally attracting buyers in search of dividend earnings as bond yields fall alongside rates of interest. Two such sectors, utilities and shopper staples, rose over 18% and eight%, respectively, within the interval.

Mark Hackett, chief of funding analysis at Nationwide, mentioned the broadening builds on a development that appeared earlier than the September 17-18 Fed assembly.

“We had been going to have this larger participation, this leveling of efficiency amongst sectors, and you then had the Fed lower extra aggressively and that is resulting in… an acceleration of that development,” he mentioned.

‘QUITE HEALTHY’

In all, eight of the S&P 500’s 11 sectors outperformed the index within the third quarter. By comparability, solely know-how and the communications sector, which incorporates Google mother or father Alphabet (NASDAQ:) and Fb proprietor Meta Platforms (NASDAQ:), outperformed the broader index within the first half of the yr.

The S&P 500 is up greater than 20% year-to-date, at record-high ranges.

In the meantime, the general affect of the megacaps has moderated. The mixed weight within the S&P 500 of the “Magnificent Seven” — Apple, Microsoft (NASDAQ:), Nvidia, Amazon (NASDAQ:), Alphabet, Meta and Tesla (NASDAQ:) — has declined to 31% from 34% in mid-July, in keeping with LSEG Datastream.

“I discover it to be fairly wholesome that tech has form of consolidated,” mentioned King Lip, chief strategist at BakerAvenue Wealth Administration. “We’re not in a bear marketplace for tech by any means. However you’ve got positively seen some proof of rotation.”

Traders would probably must see additional proof of financial power for the broadening development to proceed. Jobs knowledge on Oct. 4 shall be one take a look at of the delicate touchdown state of affairs, after the prior two employment stories had been weaker than anticipated.

Market individuals can even wish to see non-tech corporations ship sturdy earnings within the months forward to justify their good points.

Magnificent Seven firms are anticipated to extend earnings by about 20% within the third quarter, towards a revenue rise of two.5% for the remainder of the S&P 500, in keeping with Tajinder Dhillon, senior analysis analyst at LSEG. That hole is anticipated to shrink in 2025, with the remainder of the index anticipated to extend earnings by 14% for the total yr towards a 19% rise for the megacap group.

In a delicate touchdown state of affairs, the Magnificent Seven “shouldn’t have to hold the revenue rebound alone,” Lisa Shalett, chief funding officer at Morgan Stanley Wealth Administration, mentioned in a latest report.

“We’re within the ‘present me’ stage for the delicate touchdown,” Shalett mentioned.

Markets

Inventory market in the present day: Dow, S&P 500 hit contemporary data to cap sturdy September, quarter

US shares bid farewell to the month and the quarter with contemporary data as traders reacted to Federal Reserve Chair Jerome Powell to maintain the economic system buzzing, whereas signaling he will not rush future fee cuts.

The S&P 500 () rose 0.4% to shut at a brand new file, whereas the Nasdaq Composite () gained near 0.4%. In the meantime, the Dow Jones Industrial Common () completed simply above the flatline, securing its newest all-time-high.

Usually the cruelest month for shares, Wall Road indexes recorded month-to-month wins to shut out the final buying and selling day of September. Notably, the S&P 500 notched its greatest year-to-date efficiency at September’s finish since 1997. The S&P additionally loved its greatest quarter because the fourth quarter of 2021.

Over the past three months, the Dow led the key indexes’ features, up 8.2%. The S&P gained 5.4%, and the Nasdaq added practically 3%.

The Federal Reserve’s jumbo rate of interest reduce and within the US economic system have lifted confidence, serving to shares submit three weekly wins in a row. The ultimate buying and selling day of the month and the quarter additionally got here with revenue taking and rebalancing.

Buyers at the moment are bracing for the September jobs report, due out on Friday, which is seen as . The urgent query is simply how shortly the labor market is slowing because the market weighs whether or not the Fed has acted aggressively to guard a wholesome economic system or to assist a flailing one.

“General, the economic system is in stable form; we intend to make use of our instruments to maintain it there,” Powell stated in a speech earlier than the Nationwide Affiliation for Enterprise Economics in Nashville, Tenn. His remarks come days forward of the the essential month-to-month jobs report.

Powell’s feedback on not speeding the subsequent spherical of fee choices additionally lowered expectations of one other jumbo reduce.

Learn extra:

LIVE COVERAGE IS OVER11 updates

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes