Markets

Tesla Grasp Plan 4 = Something However Automobiles – Morgan Stanley

Morgan Stanley analysts warn that traders ought to put together for a shift in Tesla’s (NASDAQ:) focus past simply electrical automobiles (EVs).

Analysts imagine the upcoming Grasp Plan 4 (MP4) will reveal a strategic pivot in direction of “Something However Automobiles” (ABC).

“Elon Musk appears to have acknowledged that China might have ‘received’ the battle for reasonably priced conventional EVs,” states the Morgan Stanley word. This means a possible de-emphasis on Tesla’s core auto enterprise.

The report highlights Tesla’s rising ambitions in Synthetic Intelligence (AI), robotics, and hybrid computing.

Analysts anticipate MP4 to showcase a extra outstanding connection between Tesla and Elon Musk’s different ventures like SpaceX and X, forming a broader expertise ecosystem.

Morgan Stanley believes the automobile enterprise will change into a much less important think about Tesla’s valuation over the subsequent yr. They see a mixture of a weakening EV market and Tesla’s enlargement into new areas like humanoid robotics driving this shift.

Whereas acknowledging the significance of a stabilizing auto enterprise for Tesla’s AI valuation, Morgan Stanley stays Obese on Tesla with a $310 worth goal. They see Tesla’s worth extending past simply automobile manufacturing, assigning solely 20% of their worth goal to the core auto phase.

The report acknowledges that detrimental developments within the world EV market might nonetheless negatively affect Tesla’s inventory worth within the close to time period.

Nevertheless, analysts urge traders to think about Tesla’s broader expertise play, together with areas just like the Tesla Community and potential future ventures like Optimus robots, which aren’t at the moment factored into their worth goal.

Markets

Chinese language Bitcoin firm mines one-third of all blocks in a day, dethrones US

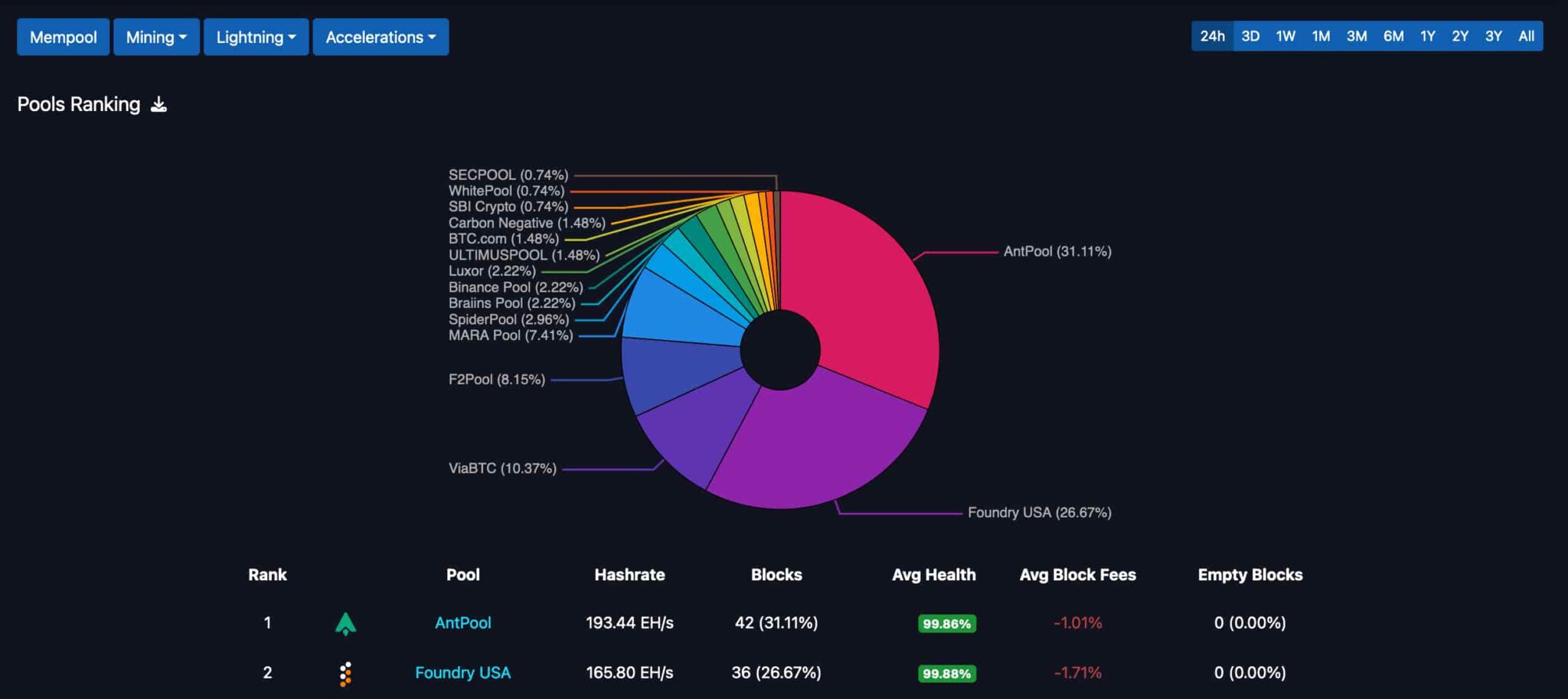

The Bitcoin (BTC) mining race intensified between China and the USA, lately dominated by the previous in a shift. AntPool mined practically one-third of all newly issued BTC within the final 24 hours, concentrating block manufacturing and mining rewards.

Finbold retrieved information from mempool.area on September 22, accounting for Bitcoin’s day by day block discovery amongst mining firms and swimming pools. By the point of this writing, AntPool had mined 42 blocks out of 135, whereas Foundry USA found 36.

Notably, the primary two leaders have been dominating the mining race for years, placing a major distance towards their opponents. ViaBTC, for instance, mined solely 10% of the blocks on this interval, whereas F2Pool and MARA acquired lower than that.

The state of Bitcoin mining has raised centralization considerations amongst specialists, researchers, and builders, as Finbold reported.

Bitcoin mining centralization considerations and penalties

These considerations reached some extent the place a Bitcoin Core developer, Luke Sprint Jr., warned of BTC transactions requiring at the least two hours to be thought-about safe – making the present market requirements of 30 to 60 minutes an outdated security measure.

Nonetheless, the Bitcoin mining centralization may very well be even worse than what floor information suggests, in line with a good BTC researcher. A examine revealed by pseudonymous analyst b10c (@0xb10c) in April signifies that AntPool centralizes most mining exercise past block discovery.

Along with an investigation by Mononaut, the analysts discovered information displaying that at the least six Bitcoin mining swimming pools share each the identical custodian and block template to AntPool, suggesting closed-door agreements hardly noticed at first look.

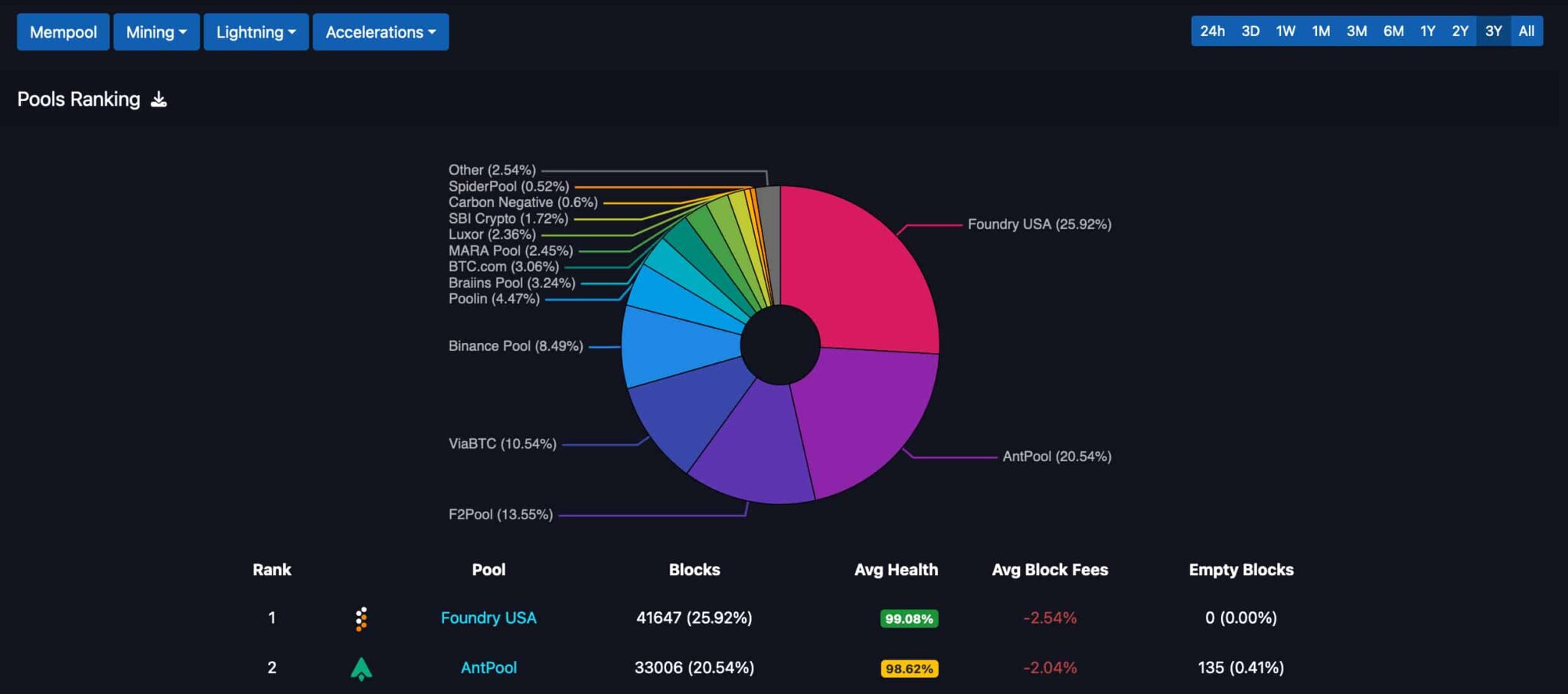

All in all, the Bitcoin mining race intensifies between the 2 main world economies, the USA and China. Whereas the North American consultant leads the long-term scene, the Chinese language firm AntPool grows its presence within the brief time period.

From an funding perspective, Bitcoin mining centralization may problem the cryptocurrency’s worth proposition, doubtlessly impacting the value of BTC in the marketplace.

Markets

The potential investor upside of a Google breakup — if John Rockefeller is any information

Google’s (, ) authorized troubles might drive it to unload a few of its prized companies, however traders fearful about that consequence might discover some consolation in what occurred to John Rockefeller’s Customary Oil greater than a century in the past.

The empire that managed almost all US oil manufacturing throughout America’s industrial revolution needed to break up into 34 smaller firms after the Supreme Courtroom in sided with the Justice Division in an antitrust problem.

The divestiture of these firms made Rockefeller the richest man on the planet. However it additionally made different shareholders in these new firms richer too, in accordance with authorized consultants.

The businesses grew to become giants corresponding to Chevron () and Exxon Mobil () that also rule the business at this time.

“[T]he market cap whole for all these firms elevated about five- to six-fold primarily based on what the valuation was thought for Customary Oil,” mentioned Boston School Regulation Faculty antitrust regulation professor David Olson.

New administration and efficiencies that adopted the breakup helped the smaller firms flourish, added antitrust litigation legal professional Barry Barnett.

Within the case of Google, present shareholders might profit as a scaled-back firm tends to spice up innovation and customer support, Barnett mentioned. Google’s search engine, for instance, might begin producing extra related outcomes and change into extra useful to advertisers.

“The individuals who personal the corporate usually are not going to lose,” Barnett mentioned.

Not everybody agrees with this rosy view. One analyst at Evercore ISI lately lowered a value goal on Alphabet, Google’s mum or dad firm, after rereading a federal choose’s in opposition to the corporate handed down in August.

US District Courtroom Decide Amit Mehta, who determined the case, sided with the US Justice Division’s claims that Google’s Search enterprise was an unlawful monopoly that it abused to maintain rivals at bay.

Mehta additionally agreed with the DOJ’s accusations that Google illegally monopolized the marketplace for on-line search textual content promoting.

“[W]e imagine a ‘worst case’ state of affairs is a extra doubtless state of affairs than the market assumes,” Evercore’s analyst wrote within the be aware.

It’s not but recognized what treatments the choose might approve because of his ruling.

They may vary from an outright breakup of Google to forcing the corporate to make its search engine knowledge, its “index,” out there to rivals.

It may be pressured to finish the kinds of agreements that received Google into hassle with regulators, that safe its search engine as a default on cellular units and web browsers.

George Alan Hay, Cornell College regulation and economics professor and former DOJ antitrust division chief, mentioned the DOJ is more likely to request “some type of divestiture” the place Google is discovered to have violated the regulation.

“It could be important. It wouldn’t be backbreaking,” he mentioned. “Google might survive.”

One concern for stockholders is {that a} breakup might have an effect on Google’s large revenue engine. In 2023, Google Search generated greater than $175 billion in income.

Coupled with Google’s YouTube advertisements and Google community income, each of which it promotes on its basic search engine, promoting on the platforms accounted for a staggering $237 billion of the corporate’s $307 billion in whole income.

In October 2020, when the DOJ and states filed go well with, Google’s annual income was roughly half of that, totaling $162 billion.

Not all breakups of enterprise empires have led to optimistic outcomes, at the very least within the instant aftermath.

Contemplate the breakup of the AT&T () telecom community within the Eighties that adopted seven years of litigation with the DOJ.

The Justice Division sued AT&T in 1974, searching for a breakup of its cellphone service and cellphone gear monopolies. It received most of what it wished in 1984 following athat created plenty of regional firms.

However AT&T misplaced important long-distance income to newcomers MCI and Dash. From 1984 to 1996, its share of whole long-distance income .

However Barnett mentioned he expects a breakup of Google to influence its shareholders the way in which that Customary Oil’s breakup did.

“So when you’re an Alphabet shareholder, this can be good for you.”

Alexis Keenan is a authorized reporter for Lusso’s Information. Observe Alexis on X .

Markets

Israel shares greater at shut of commerce; TA 35 up 0.78%

Lusso’s Information – Israel shares had been greater after the shut on Sunday, as good points within the , and sectors led shares greater.

On the shut in Tel Aviv, the added 0.78%.

The very best performers of the session on the had been Azrieli Group Ltd (TASE:), which rose 3.42% or 800.00 factors to commerce at 24,200.00 on the shut. In the meantime, Amot Investments Ltd (TASE:) added 2.35% or 34.00 factors to finish at 1,480.00 and Shapir Engineering Business (TASE:) was up 2.15% or 40.00 factors to 1,903.00 in late commerce.

The worst performers of the session had been Camtek Ltd (TASE:), which fell 2.70% or 770.00 factors to commerce at 27,780.00 on the shut. Energean Oil & Gasoline PLC (TASE:) declined 2.47% or 108.00 factors to finish at 4,263.00 and Mizrahi Tefahot (TASE:) was down 1.11% or 150.00 factors to 13,330.00.

Rising shares outnumbered declining ones on the Tel Aviv Inventory Change by 243 to 187 and 109 ended unchanged.

Crude oil for November supply was up 0.10% or 0.07 to $70.33 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in December fell 0.21% or 0.16 to hit $73.69 a barrel, whereas the December Gold Futures contract rose 1.24% or 32.50 to commerce at $2,647.10 a troy ounce.

USD/ILS was up 0.53% to three.78, whereas EUR/ILS rose 0.72% to 4.22.

The US Greenback Index Futures was up 0.10% at 100.42.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately