Markets

Tesla Inventory Will Surge 10-Fold on Robotaxi, Ark’s Wooden Says

(Lusso’s Information) — Tesla Inc.’s transfer into the extra worthwhile autonomous taxi platform enterprise will probably be a catalyst for a roughly 10-fold enhance in its share value, in response to Ark Funding Administration LLC’s Cathie Wooden.

Most Learn from Lusso’s Information

Describing the autonomous taxi ecosystem as an “$8 trillion to $10 trillion world income alternative,” Wooden sees platform suppliers corresponding to Tesla taking as a lot as half of that. Traders are shifting away from valuing Tesla purely as an electrical car maker, pricing in a number of the autonomous taxi potential, she instructed Lusso’s Information Tv’s David Ingles and Lusso’s Information Intelligence’s Rebecca Sin within the Tiger Cash podcast.

“Autonomous taxi platforms are the largest AI venture evolving at this time,” she stated, including Ark has based totally its Tesla valuation on its autonomous driving potential. “If we’re proper, the inventory has miles to go.”

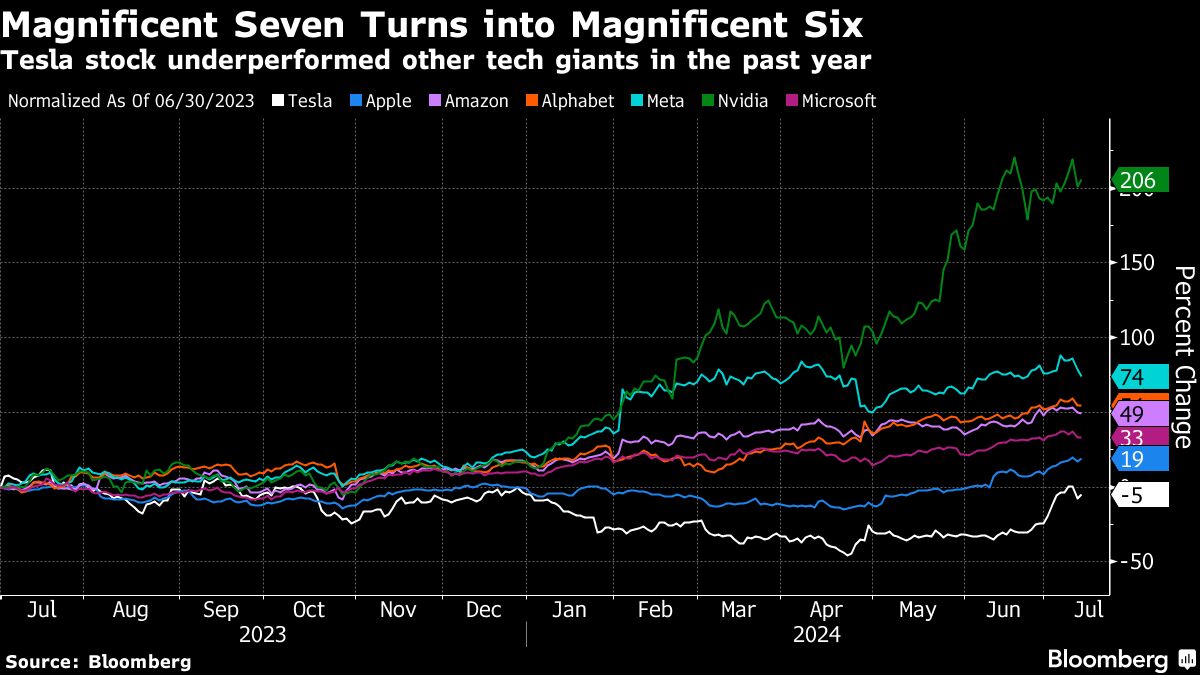

Wooden’s feedback got here after Tesla’s share costs slumped practically 43% this yr via April 22, as electrical car gross sales slowed globally. A rebound within the final two months has erased a lot of the losses, although it’s nonetheless underperformed former Magnificent Seven know-how friends by large margins.

Wooden has been bullish on Tesla for a very long time, making it a high holding in her Ark Innovation ETF. The fund has misplaced practically 9% this yr, whereas property slumped a few third, partly on account of redemptions. That compares with an 18% achieve within the S&P 500 Index. Wooden is thought for making outsized predictions, together with her name that Bitcoin would attain as a lot as $1.48 million by 2030.

Autonomous taxi networks will probably be a “winner-takes-most” alternative, the place the supplier that may get passengers from level A to level B within the most secure and quickest trend will clinch the lion’s share of enterprise, Wooden stated. The community supplier will be capable of take a 30% to 50% share of income generated by fleet house owners on its platform, giving it “a recurring income with explosive money flows” in addition to a revenue margin north of fifty%, she added. That departs from the construct and promote, or “one and finished” enterprise mannequin of constructing automobiles.

“That’s what we predict persons are lacking: the dimensions of the chance, how rapidly it’s going to scale, and the way worthwhile it’s going to be,” she stated, including she expects Tesla to guide the US market.

Tesla’s weighting within the $6.5 billion ARK Innovation ETF Fund surpassed 15% final week. Ark doesn’t often add to a place as soon as its weight within the portfolio hits 10%, Wooden stated. Whereas a holding could drift increased from share appreciation, the agency would often begin promoting nicely earlier than it hits Tesla’s ranges.

The asset supervisor has taken some earnings on Tesla however has permitted it to surge past the traditional ceiling, believing Elon Musk’s firm is on the cusp of sharing much more data on its robotaxi venture, she stated.

Tesla delayed its deliberate robotaxi unveiling by two months to October to permit groups extra time to construct further prototypes, Lusso’s Information Information reported on Thursday. The information despatched the inventory down 8.4%, the steepest one-day drop since January. Wooden is unfazed.

“We’re in all probability getting nearer to this robotaxi alternative, not additional away,” she stated. Musk “needs to point out us one thing extra awe-inspiring than we would have seen on Aug. 8. And he believes it’s potential by October.”

Tesla doesn’t but have regulatory approval to place driverless vehicles on the highway, and its automobiles nonetheless aren’t able to safely maneuvering with out fixed human supervision. Nevertheless, many buyers consider it’s going to ultimately deliver the know-how to market and have bid the top off alongside Musk’s more and more bullish claims.

Ark’s valuation mannequin hasn’t taken into consideration a lot of Tesla’s potential in China or within the humanoid robotic and vitality cupboard space. Musk in April received in-principle approval from Chinese language officers to deploy its driver-assistance system into the world’s largest auto market, after reaching a mapping and navigation pact with Chinese language tech big Baidu Inc. and assembly necessities for data-security and privateness safety.

Because the autonomous pattern spreads throughout the transportation trade, autonomous vans may undercut railway in pricing and supply point-to-point providers, she stated. The railway methods favored by veteran investor Warren Buffett could also be “caught with stranded property,” she added.

Wooden continued to solid doubts on Nvidia Corp.’s gravity-defying valuations. Ark purchased the AI-focused chipmaker at $4 in 2014 and held it till it approached $40 on a split-adjusted foundation. It bought most of its stake earlier than the beautiful rally since final yr.

Traders who catapulted the inventory to the present top haven’t baked within the period of time it’s going to take companies to determine tips on how to undertake the transformational AI know-how. “It’s merely, in our view, an excessive amount of, too quickly,” Wooden stated.

Market Focus

Traders have been piling into the Magnificent Six, driving inventory market focus to a stage increased than that of 1932, she stated. Again then, buyers flocked to mega shares corresponding to AT&T Inc., whose enormous money cushions and free money stream have been seen as boosting their probabilities of survival after the Nice Despair. The 4 ensuing years as an alternative noticed smaller corporations outperform.

Equally, increased rates of interest have pushed buyers towards the Magnificent Six for his or her large money positions and partially for his or her AI-propelled income development. Traders’ threat urge for food will broaden to different shares with disruptive applied sciences as rates of interest fall.

“Now can be the unsuitable time to promote our technique,” Wooden stated. “We consider rates of interest are going to return down and going to return down extra dramatically than most individuals assume.”

–With help from Rebecca Sin and David Ingles.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

US shares slip decrease; warning forward of key Nvidia outcomes

Lusso’s Information– U.S. shares drifted decrease Tuesday, with buyers displaying a level of warning forward of the discharge of eagerly-awaited outcomes from chipmaking big Nvidia (NASDAQ:).

By 05:45 ET (09:45 GMT), the fell 120 factors, or 0.3%, the dropped 18 factors. or 0.3%, and the slipped 92 factors, or 0.5%.

Sentiment buoyed by probably September minimize

The DJIA hit a file excessive on Monday, with general sentiment comparatively upbeat on the prospect of decrease rates of interest.

Dovish feedback from Federal Reserve officers, particularly Chair Jerome Powell, noticed merchants pricing in an at the least 25 foundation level minimize in September, confirmed.

The spotlight of this week’s financial calendar will probably be Friday’s worth index, the Federal Reserve’s most well-liked inflation yardstick.

Revised second-quarter figures on Thursday, together with the weekly report on , are additionally on the agenda.

Nvidia’s earnings in focus

Nonetheless, forward of this essential financial information, all eyes will probably be on Nvidia’s quarterly earnings on Wednesday.

The inventory is on the coronary heart of a large AI-driven rally in valuations over the previous 12 months. However this rally has come beneath menace over the previous two months, at the least so far as the broader tech sector is anxious.

Earnings from different main chipmakers, specifically TSMC (NYSE:) and ASML (NASDAQ:), launched in July, have recommended that the chipmaking sector was nonetheless primed to profit from AI demand.

Elsewhere, there are quarterly earnings due from retailer Nordstrom (NYSE:) after the closing bell, and they are going to be studied fastidiously for clues of the well being of customers.

Apple (NASDAQ:) inventory fell 0.6% after the iPhone maker introduced late Monday that Luca Maestri will step down as chief monetary officer from the start of the 2025.

Paramount World (NASDAQ:) inventory retreated 5% after govt Edgar Bronfman Jr withdrew from the race for management of the media conglomerate, probably permitting Skydance Media to realize management of the media conglomerate and not using a bidding battle.

Crude fingers again some current positive aspects

Crude costs fell Tuesday, handing a few of the current sturdy positive aspects with merchants searching for extra cues on manufacturing disruptions in Libya and a wider conflict within the Center East.

By 09:35 ET, the U.S. crude futures (WTI) dropped 0.8% to $76.78 a barrel, whereas the Brent contract fell 0.6% to $79.87 a barrel.

Each benchmarks have gained some 7% over the previous three periods, rebounding from their lowest ranges since early January, pushed by expectations of U.S. rate of interest cuts that might enhance gasoline demand, potential closures of Libyan oilfields and issues over a wider Center East battle probably disrupting provide from the important thing producing area.

(Ambar Warrick contributed to this text.)

Markets

Skydance Set to Seal Paramount Merger as Bronfman Drops Out

(Lusso’s Information) — Producer David Ellison’s Skydance Media is about to develop into the brand new proprietor of Paramount International after Seagram Co. inheritor Edgar Bronfman Jr. dropped out, ending one of many trade’s most dramatic acquisition contests.

Most Learn from Lusso’s Information

The storied Hollywood studio stated it expects to finish the take care of Skydance within the first half of 2025 because it confirmed Bronfman’s retreat late Monday. It additionally ended its “go-shop” interval that allowed it to search for different bidders. Paramount shares slid 5.4% in early buying and selling Tuesday in New York.

Ellison, the son of Oracle Corp. co-founder Larry Ellison, is aiming to supply a contemporary begin to beleaguered Paramount, the dad or mum of CBS and MTV. Laden with greater than $14 billion in debt, the enduring Hollywood firm has struggled to compete in streaming and has suffered as cable TV audiences canceled their subscriptions and deserted conventional channels like CBS and Nickelodeon. It’s lowering its US workforce by 15% and shut down Paramount Tv Studios this month.

Earlier on Monday, Bronfman’s group stated it had dropped out of the bidding warfare after submitting a $6 billion proposal for the leisure firm final week and difficult a suggestion of greater than $8 billion from Skydance. The group knowledgeable Paramount that it was exiting the method, in accordance with a press release on Monday.

Bronfman’s group, which included a number of rich people, pulled out partly due to a decent deadline to submit monetary paperwork, in accordance with an individual acquainted with the matter, who requested to not be recognized as a result of the deliberations have been personal. A spokesperson for Skydance declined to remark.

In placing collectively his proposal, Bronfman initially submitted a $4.3 billion bid on Aug. 19 that included a suggestion to buy Nationwide Amusements Inc., the Redstone household holding firm that controls Paramount, for about $2.4 billion. He elevated his total bid to $6 billion two days later.

Paramount had already agreed to a merger with Skydance, the leisure firm based by Ellison. That settlement initiated a 45-day “go-shop” interval by which different bidders might try to make a greater provide. Bronfman’s bid got here proper on the finish of the interval and triggered the particular committee accountable for contemplating provides to increase the window till Sept. 5.

The proposals have been related in some respects. Each would pay about $2.4 billion to accumulate Nationwide Amusements, and each agreed to take a position cash immediately in Paramount in order that the corporate might cut back its debt.

The bids differed from there. Bronfman provided to purchase Paramount shares from present buyers at a barely greater worth, however in a a lot decrease total quantity than what Ellison proposed. Ellison agreed to purchase $4.5 billion price of inventory from Paramount buyers.

He additionally plans to merge Skydance into Paramount at a $4.75 billion valuation. Bronfman argued that the Skydance valuation was too excessive and dilutive to shareholders. Bronfman provided to remove Paramount’s two courses of shares, giving all buyers a say in firm choices.

(Updates with premarket buying and selling in second paragraph.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Barclays new asset supervisor protection; charges BlackRock chubby

Barclays analysts on Tuesday expanded their asset supervisor protection, with one Chubby score for BlackRock (NYSE:).

In the meantime, three Equal Weightings had been assigned for AllianceBernstein (NYSE:), Invesco (IVZ), and Victory Capital (VCTR), and three Underweight scores for Franklin Assets (NYSE:), T. Rowe Worth (TROW), and Virtus Funding Companions (NYSE:).

“Asset managers are typically sturdy money move mills and beneficiant capital returners. However whereas market development and/or outperformance can result in speedy AUM development at instances, aggressive pressures and blend shift could make natural income development exhausting to return by,” analysts wrote,

“And flows are dealing with headwinds, so there is no such thing as a simple repair to show this round, in our view.”

Barclays observes that the asset administration business is more and more specializing in secular development areas equivalent to passive methods, exchange-traded funds (ETFs), alternate options, and SMAs, which they view as greater high quality drivers of medium- to long-term development.

Whereas BLK could rank decrease by way of AUM as a share of whole, its combine provides alternate options an outsized share of revenues, and the size and integration of its personal markets operations supply a major benefit, the funding financial institution notes.

Conversely, BEN has a comparatively excessive share of alternate options AUM, however total AUM has remained flat for the previous six quarters, with web move charges decrease than many publicly traded different asset managers.

In the meantime, IVZ has skilled ETF inflows, however its natural income development has been constrained because of the combine, notably the expansion of the QQQ ETF, which generates no administration charges.

“Typically, although, these are the important thing components we’re on the lookout for: mixture of alternate options, ETFs, move profile, and payment strain – all of which translate to natural development,” analysts observe.

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus