Markets

That is when it’s best to contemplate promoting Nvidia inventory

Lusso’s Information — Nvidia (NASDAQ:) inventory retains on rising because the market rallies to a sequence of recent all-time highs on the again of renewed September Fed pivot hopes after information posted better-than-expected numbers.

However amidst the seemingly endless Nvidia rally, buyers who picked up the inventory early within the yr are actually confronted with one of the tough decisions for buyers – simply when is the precise time to promote the golden goose?

That is one more facet of your investments the place our state-of-the-art stock-picking software can assist you outperform for lower than $9 a month.

And, in response to its newest rebalance at the beginning of June the reply is: not but.

The truth is, our premium customers who acquired the tip to carry on to the AI large on the primary buying and selling day of June, are actually reaping the rewards with a considerable 20.3% acquire on the inventory alone.

Even higher, our long-term customers who acquired the tip to purchase the inventory in November final yr and maintain it till now are swimming in a life-changing 223% acquire.

However that can ultimately change. Quickly sufficient, it would inform its customers to bag beneficial properties on Nvidia similar to it did with a number of different shares earlier than they tanked. That can probably be the precise time to start out taking earnings.

One related instance is Vistra Vitality Corp (NYSE:), which rallied 94.86% inside the technique and dropped 13% since our AI bought it at the start of this month.

So, if you wish to know the precise time to promote Nvidia, subscribe right here for $9 a month and let the facility of AI drive your earnings to unseen ranges.

Whereas these beneficial properties are spectacular, maybe much more crucial is our AI’s capacity to inform simply when to promote the inventory. Powered by state-of-the-art elementary fashions, our AI updates its customers with the highest picks and sells each month.

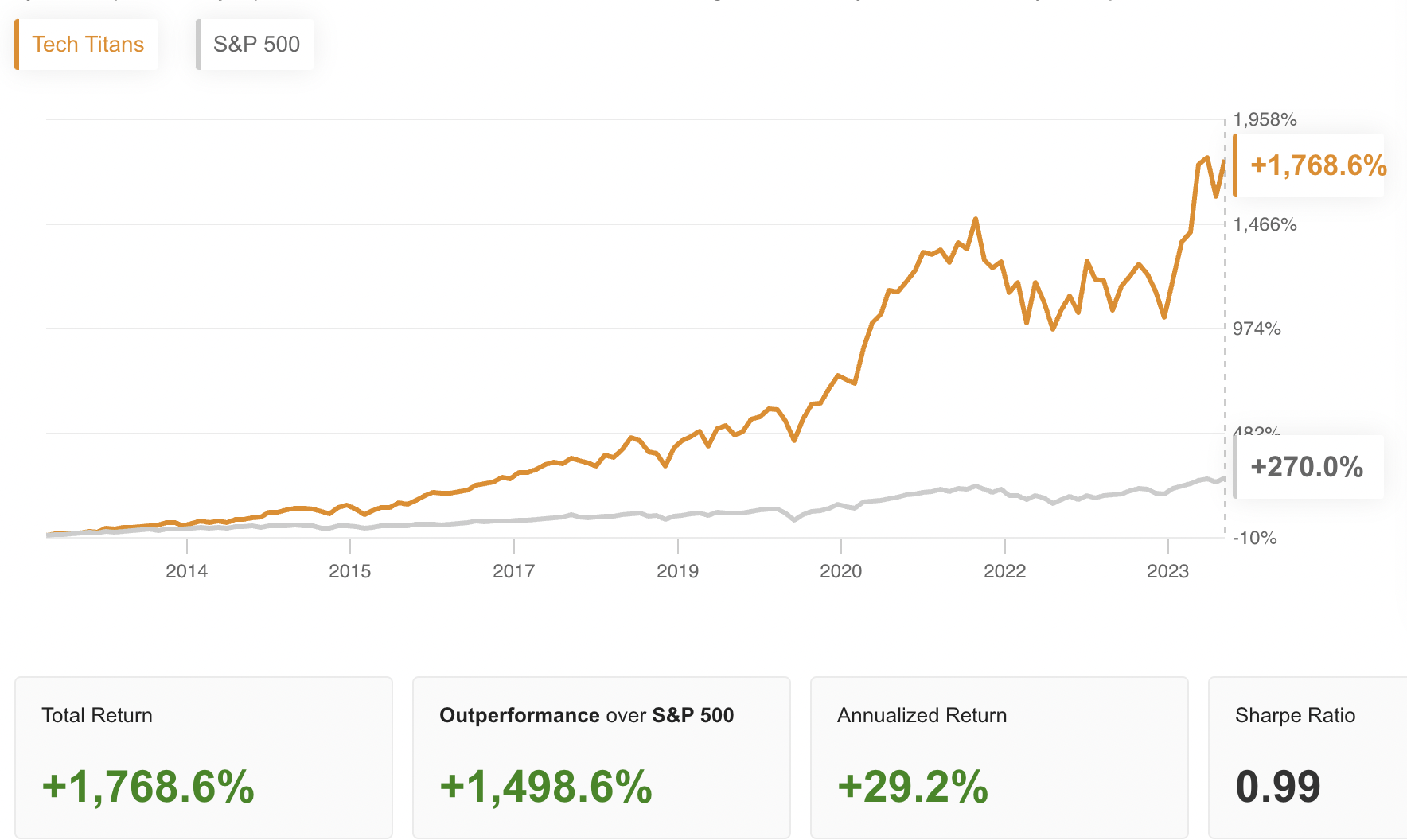

That is the precise methodology that pushed our real-world efficiency to a stable beat over the since our official launch in October. See the information under (per funding technique):

- Tech Titans: +71.14%

- Beat the S&P 500: +34.63%

- High Worth Shares: + 32.06%

- S&P 500: 29.15%

That is no backtest. That is the real-world efficiency unfolded proper in entrance of our eyes.

The key behind our AI’s high efficiency is that, not like the whole lot else on the market, our methods are forward-looking and never a momentum indicator.

Powered by the historical past of the inventory market in information, our AI is designed to select shares earlier than they rally – thus not attempting to chase the market. No bag-holding, simply best-in-breed recent inventory selecting.

The truth is, our backtest recommend that buyers who observe the methods over the long term will get even higher outcomes. See under:

Supply: ProPicks

This means a $100K principal in our technique would have changed into an eye-popping $1,868,000 by now.

Wonderful, proper?

Subscribe now for lower than $9 a month and prepare for a market-beating June efficiency

*And because you made all of it the way in which to the underside of this text, we’ll offer you a particular 10% additional low cost on all our plans with the coupon code PROPICKS20242!

Markets

Indonesia shares decrease at shut of commerce; IDX Composite Index down 1.50%

Lusso’s Information – Indonesia shares have been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Jakarta, the fell 1.50%.

One of the best performers of the session on the have been Sariguna Primatirta PT (JK:), which rose 0.39% or 5.00 factors to commerce at 1,280.00 on the shut. In the meantime, Victoria Care Indonesia Tbk Pt (JK:) added 535.00% or 535.00 factors to finish at 635.00 and Arwana Citramulia Tbk (JK:) was up 475.00% or 570.00 factors to 690.00 in late commerce.

The worst performers of the session have been Prasidha Aneka Niaga Tbk (JK:), which fell 97.03% or 2,911.00 factors to commerce at 89.00 on the shut. Indospring Tbk (JK:) declined 96.69% or 8,702.00 factors to finish at 298.00 and Logindo Samudramakmur Tbk (JK:) was down 96.57% or 2,704.00 factors to 96.00.

Falling shares outnumbered advancing ones on the Jakarta Inventory Trade by 392 to 254 and 191 ended unchanged.

Crude oil for November supply was down 0.48% or 0.34 to $70.82 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.51% or 0.38 to hit $74.50 a barrel, whereas the December Gold Futures contract rose 0.79% or 20.75 to commerce at $2,635.35 a troy ounce.

USD/IDR was down 0.20% to fifteen,153.55, whereas AUD/IDR fell 0.25% to 10,321.14.

The US Greenback Index Futures was up 0.10% at 100.42.

Markets

Evaluation-Price cuts are right here, however US shares could have already priced them in

By Lewis Krauskopf

NEW YORK (Reuters) – Because the Federal Reserve kicks off a long-awaited fee slicing cycle, some buyers are cautious that richly valued U.S. shares could have already priced in the advantages of simpler financial coverage, making it more durable for markets to rise a lot additional.

Buyers on Thursday cheered the primary fee cuts in additional than 4 years, sending the S&P 500 to contemporary information a day after the Fed lowered borrowing prices by a hefty 50 foundation factors to shore up the financial system.

Historical past helps such bullishness, particularly if the Fed’s assurances of a still-healthy U.S. financial system pan out. The S&P 500 has gained a mean of 18% a 12 months following the primary fee minimize in an easing cycle so long as the financial system avoids recession, in accordance with Evercore ISI information since 1970.

However inventory valuations have climbed in latest months, as buyers anticipating Fed cuts piled in to equities and different property seen as benefiting from looser financial coverage. That has left the S&P 500 buying and selling at over 21 instances ahead earnings, properly above its long-term common of 15.7 instances. The index has climbed 20% this 12 months, at the same time as U.S. employment development has been weaker than anticipated in latest months.

Consequently, the near-term “upside from simply decrease charges is considerably restricted,” mentioned Robert Pavlik, senior portfolio supervisor at Dakota Wealth Administration. “Folks simply get a little bit bit nervous round being up 20% in an setting the place the financial system has cooled.”

Different valuation measures, together with price-to-book worth and price-to-sales, additionally present shares are properly above their historic averages, Societe Generale analysts mentioned in a be aware. U.S. equities are buying and selling at 5 instances their e-book worth, for example, in contrast with a long-term common of two.6.

“The present ranges might be summarized in a single phrase: costly,” SocGen mentioned.

Decrease charges stand to assist shares in a number of methods. Diminished borrowing prices are anticipated to extend financial exercise, which might strengthen company earnings.

A drop in charges additionally reduces yields on money and glued earnings, diminishing them as funding competitors to equities. The yield on the benchmark 10-year Treasury has dropped a couple of full share level since April, to three.7%, though it has ticked up this week.

Decrease charges additionally imply future company money flows are extra engaging, which regularly boosts valuations. However the P/E ratio for the S&P 500 has already rebounded considerably after falling as little as 15.3 in late 2022 and 17.3 in late 2023, in accordance with LSEG Datastream.

“Fairness valuations had been fairly moderately full going into this,” mentioned Matthew Miskin, co-chief funding strategist at John Hancock Funding Administration. “It will be exhausting to duplicate the a number of enlargement you simply bought over the past 12 months or two over the following couple of years.”

With any additional will increase in valuation anticipated to be restricted, Miskin and others mentioned earnings and financial development will likely be key inventory market drivers. S&P 500 earnings are anticipated to rise 10.1% in 2024 and one other 15% subsequent 12 months, in accordance with LSEG IBES, with third-quarter earnings season beginning subsequent month set to check valuations.

On the identical time, there are indicators that the promise of decrease charges could have already drawn buyers. Whereas the S&P 500 has tended to be flat within the 12 months main as much as rate-cutting cycles, it’s up practically 27% in that interval this time round, in accordance with Jim Reid, Deutsche Financial institution’s international head of macro and thematic analysis, who studied information since 1957.

“You can argue that a few of a possible ‘no recession easing cycle’ positive aspects have been borrowed from the long run this time,” Reid mentioned within the be aware.

To make certain, loads of buyers are undeterred by the elevated valuations and preserve a optimistic outlook for shares.

Valuations are usually an unwieldy device in figuring out when to purchase and promote shares – particularly since momentum can preserve markets rising or falling for months earlier than they revert to their historic averages. The ahead P/E ratio for the S&P 500 was above 22 instances for a lot of 2020 and 2021 and reached 25 in the course of the dotcom bubble in 1999.

In the meantime, fee cuts close to market highs are likely to bode properly for shares a 12 months later. The Fed has minimize charges 20 instances since 1980 when the S&P 500 was inside 2% of an all-time excessive, in accordance with Ryan Detrick, chief market strategist at Carson Group. The index has been increased a 12 months later each time, with a mean achieve of 13.9%, Detrick mentioned.

“Traditionally, fairness markets have carried out properly in intervals when the Fed was slicing charges whereas the US financial system was not in recession,” UBS International Wealth Administration analysts mentioned in a be aware. “We count on this time to be no exception.”

(Reporting by Lewis Krauskopf in New York; Enhancing by Ira Iosebashvili and Matthew Lewis)

Markets

European shares consolidate after sharp good points; central banks in focus

Lusso’s Information – European inventory markets edged decrease Friday, consolidating after the earlier session’s sharp good points as buyers digested a collection of coverage selections from the world’s main central banks.

At 03:05 ET (07:05 GMT), the in Germany traded 0.6% decrease, the in France fell 0.3% and the within the U.Ok. dropped 0.5%.

Central banks in focus

The principle European indices are on the right track for sturdy weekly good points within the wake of the slicing rates of interest by a hefty 50 foundation factors on Wednesday, beginning a rate-cut cycle to shore up the economic system following a chronic battle in opposition to surging inflation.

The and Norway’s each held charges regular on Thursday, whereas on Friday the left rates of interest unchanged as broadly anticipated, and stated that it continued to count on outsized development within the Japanese economic system amid a gentle uptick in inflation.

The Folks’s additionally stored its benchmark lending price unchanged on Friday regardless of growing requires extra stimulus.

German producer costs fall in August

The minimize its key rates of interest by 25 foundation factors after the same transfer in June, and will speed up these cuts over coming months, governing council member Fabio Panetta stated on Thursday, following the hefty Fed minimize and a sluggish eurozone economic system.

Knowledge launched earlier Friday confirmed that fell 0.8% on the 12 months in August, illustrating that inflation is retreating within the eurozone.

Elsewhere, British rose by a stronger-than-expected 1% in August and development in July was revised up, official figures confirmed on Friday.

Crude on monitor for sturdy weekly good points

Crude costs slipped decrease Friday, however had been on monitor for a second consecutive increased week after the big minimize in US rates of interest helped quell some fears of slowing demand.

By 03:05 ET, the contract dropped 0.2% to $74.77 per barrel, whereas futures (WTI) traded 0.1% decrease at $71.08 per barrel.

The benchmarks have been recovering after they fell to close three year-lows on Sept. 10, and have registered good points in 5 of the seven classes since then, together with good points of over 4% this week.

Crude inventories within the U.S., the world’s prime producer, fell to a one-year low final week, in accordance with official authorities knowledge earlier this week, however larger good points had been held again by persistent issues over slowing demand, particularly in prime importer China.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024