Markets

The Energy of Three-Section Methods

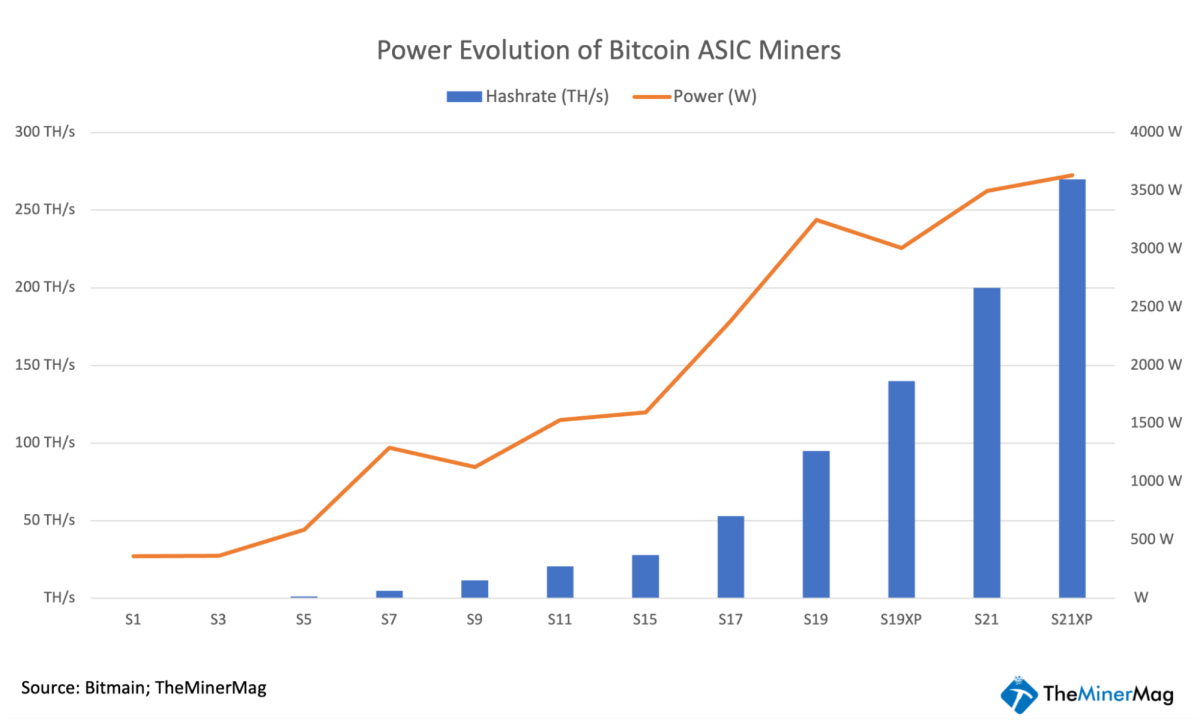

Bitcoin mining has seen exponential progress because the first ASIC miner was shipped in 2013, enhancing {hardware} effectivity from 1,200 J/TH to only 15 J/TH. Whereas these developments have been pushed by higher chip expertise, we’re now reaching the bounds of silicon-based semiconductors. As additional effectivity features plateau, the main target should shift to optimizing different elements of mining operations—significantly the facility setup.

Three-phase energy has emerged as a superior various to single-phase energy in bitcoin mining. With extra ASICs being designed for three-phase voltage enter, future mining infrastructure ought to take into account adopting a uniform 480v three-phase system, particularly given its abundance and scalability throughout North America.

Understanding Single-Section and Three-Section Energy

To understand the importance of three-phase energy in bitcoin mining, it is important first to know the fundamentals of single-phase and three-phase energy methods.

Single-phase energy is the most typical kind of energy provide utilized in residential settings. It consists of two wires: one dwell wire and one impartial wire. The voltage in a single-phase system oscillates sinusoidally, offering energy that reaches a peak after which drops to zero twice throughout every cycle.

Think about you might be pushing an individual on a swing. With every push, the swing strikes ahead after which comes again, reaching a peak top after which descending again to the bottom level earlier than you push once more.

Identical to the swing, a single-phase energy system has intervals of most and 0 energy supply. This will result in inefficiencies, particularly when constant energy is required, though this inefficiency is negligible in residential purposes. Nevertheless, it turns into vital in high-demand, industrial-scale operations like bitcoin mining.

Three-phase energy, however, is usually utilized in industrial and business settings. It consists of three dwell wires, offering a extra fixed and dependable energy circulation.

In the identical swing analogy, think about you have got three folks pushing the swing, however every individual is pushing at completely different intervals. One individual pushes the swing simply because it begins to decelerate from the primary push, one other pushes it a 3rd of the way in which via the cycle, and the third individual pushes it two-thirds of the way in which via. The result’s a swing that strikes rather more easily and constantly as a result of it’s being pushed constantly from completely different angles, sustaining a continuing movement.

Equally, a three-phase energy system ensures a continuing and balanced energy circulation, leading to increased effectivity and reliability, significantly helpful for high-demand purposes like bitcoin mining.

The Evolution of Bitcoin Mining Energy Necessities

Bitcoin mining has come a great distance since its inception, with vital adjustments in energy necessities through the years.

Earlier than 2013, miners relied on CPUs and GPUs to mine bitcoins. The true game-changer got here with the event of ASIC (Software-Particular Built-in Circuit) miners because the bitcoin community grew and competitors elevated. These units are particularly designed for the aim of mining bitcoins, providing unparalleled effectivity and efficiency. Nevertheless, the elevated energy necessities of those machines necessitated developments in energy provide methods.

In 2016, a top-of-the-line miner was able to computing 13 TH/s with an influence consumption of roughly 1,300 watts (W). Whereas thought of extremely inefficient by at the moment’s requirements, mining with this rig was worthwhile because of the low community competitors at the moment. Nevertheless, to generate significant income in at the moment’s aggressive panorama, institutional miners now depend on rigs that demand round 3,510 W.

The constraints of single-phase energy methods has come to the fore as the facility necessities of ASIC and the effectivity calls for of high-performance mining operations grows. The transition to three-phase energy turned a logical step to assist the rising vitality wants of the trade.

480v Three-Section in Bitcoin Mining

Effectivity First

480v three-phase energy has lengthy been the usual in industrial settings throughout North America, South America, and different areas. This widespread adoption is because of its quite a few advantages by way of effectivity, value financial savings, and scalability. The consistency and reliability of 480v three-phase energy make it excellent for operations that demand higher operational uptime and fleet effectivity, particularly in a post-halving world.

One of many main advantages of three-phase energy is its capacity to ship increased energy density, which reduces vitality losses and ensures that mining gear operates at optimum efficiency ranges.

Moreover, implementing a three-phase energy system can result in vital financial savings in electrical infrastructure prices. Fewer transformers, smaller wiring, and decreased want for voltage stabilization gear contribute to decrease set up and upkeep bills.

For instance, a load requiring 17.3 kilowatts of energy at 208v three-phase would wish a present of 48 amps. Nevertheless, if the identical load is provided by a 480v supply, the present requirement drops to only 24 amps. This halving of the present not solely reduces energy loss but in addition minimizes the necessity for thicker, dearer wiring.

Scalability

As mining operations broaden, the power to simply add extra capability with out main overhauls to the facility infrastructure is essential. The excessive availability of methods and parts designed for 480v three-phase energy makes it simpler for miners to scale their operations effectively.

Because the bitcoin mining trade evolves, there’s a clear development in the direction of the event of extra three-phase compliant ASICs. Designing mining amenities with a 480v three-phase configuration not solely addresses present inefficiencies but in addition future-proofs the infrastructure. This permits miners to seamlessly combine newer applied sciences which might be more likely to be designed with three-phase energy compatibility in thoughts.

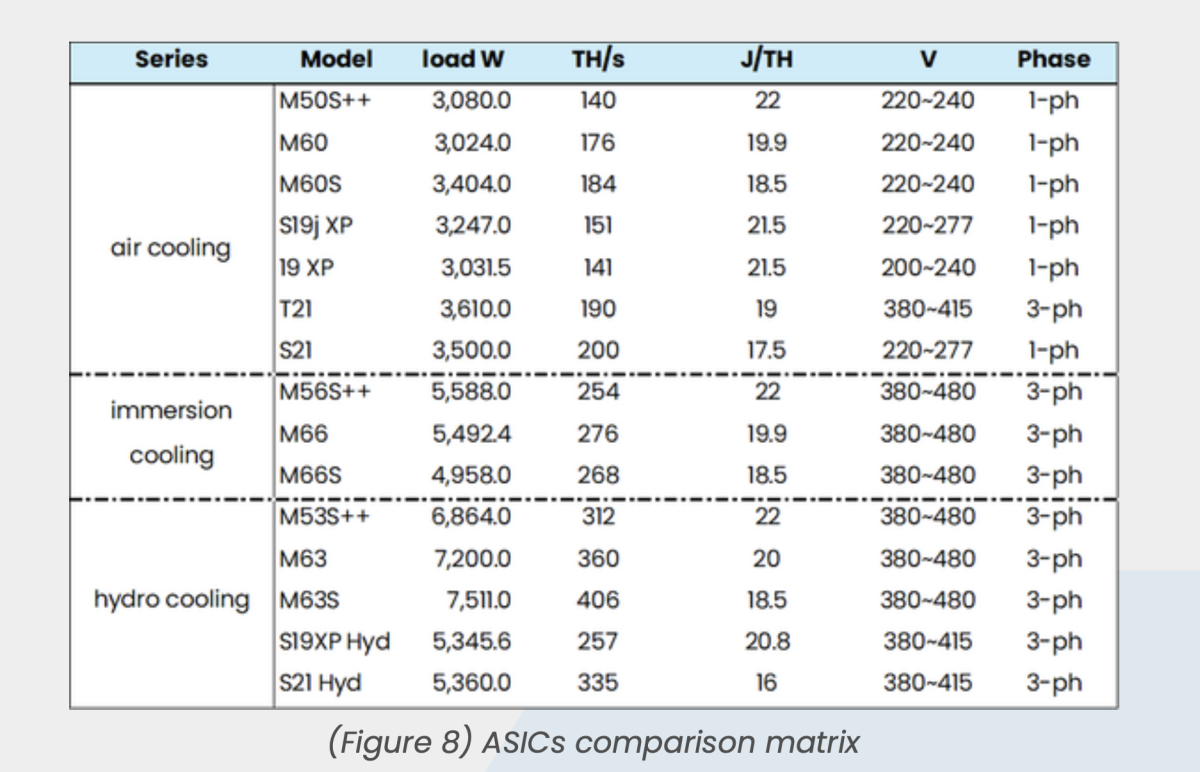

As proven within the desk under, the immersion-cooling and hydro-cooling strategies are superior strategies in scaling up bitcoin mining operations by way of reaching increased hashrate output. However to assist such a a lot increased computation capability, the configuration of three-phase energy turns into essential for sustaining an identical degree of energy effectivity. Briefly, it will result in a better operational revenue with the identical revenue margin proportion.

Implementing Three-Section Energy in Bitcoin Mining Operations

Transitioning to a three-phase energy system requires cautious planning and execution. Listed here are the important thing steps concerned in implementing three-phase energy in bitcoin mining operations.

Assessing Energy Necessities

Step one in implementing a three-phase energy system is to evaluate the facility necessities of the mining operation. This includes calculating the entire energy consumption of all mining gear and figuring out the suitable capability for the facility system.

Upgrading Electrical Infrastructure

Upgrading {the electrical} infrastructure to assist a three-phase energy system might contain putting in new transformers, wiring, and circuit breakers. It is important to work with certified electrical engineers to make sure that the set up meets security and regulatory requirements.

Configuring ASIC Miners for Three-Section Energy

Many trendy ASIC miners are designed to function on three-phase energy. Nevertheless, older fashions might require modifications or using energy conversion gear. Configuring the miners to run on three-phase energy is a crucial step in maximizing effectivity.

Implementing Redundancy and Backup Methods

To make sure uninterrupted mining operations, it is important to implement redundancy and backup methods. This contains putting in backup mills, uninterruptible energy provides, and redundant energy circuits to guard in opposition to energy outages and gear failures.

Monitoring and Upkeep

As soon as the three-phase energy system is operational, steady monitoring and upkeep are essential to make sure optimum efficiency. Common inspections, load balancing, and proactive upkeep may help establish and deal with potential points earlier than they affect operations.

Conclusion

The way forward for bitcoin mining lies within the environment friendly utilization of energy sources. As developments in chip processing applied sciences attain their limits, specializing in energy setup turns into more and more crucial. Three-phase energy, significantly a 480v system, provides quite a few benefits that may revolutionize bitcoin mining operations.

By offering increased energy density, improved effectivity, decreased infrastructure prices, and scalability, three-phase energy methods can assist the rising calls for of the mining trade. Implementing such a system requires cautious planning and execution, however the advantages far outweigh the challenges.

Because the bitcoin mining trade continues to evolve, embracing three-phase energy can pave the way in which for extra sustainable and worthwhile operations. With the best infrastructure in place, miners can harness the total potential of their gear and keep forward within the aggressive world of bitcoin mining.

It is a visitor put up by Christian Lucas, Technique at Bitdeer. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

Markets

Unique-US to hunt 6 million barrels of oil for reserve, amid low oil value

By Timothy Gardner

WASHINGTON (Reuters) – The Biden administration will search as much as 6 million barrels of oil for the Strategic Petroleum Reserve, a supply conversant in situation mentioned on Tuesday, a purchase order that if accomplished will match its largest but within the replenishment of the stash after a historic sale in 2022.

The administration will announce the solicitation as quickly as Wednesday to purchase oil for supply to the Bayou Choctaw web site in Louisiana, the supply mentioned, one among 4 closely guarded SPR areas alongside the coasts of that state and Texas.

The U.S. will purchase the oil from vitality firms for supply within the first few months of 2025, the supply mentioned.

The Division of Vitality has taken benefit of comparatively low crude costs which might be beneath the goal value of $79.99 per barrel at which it needs to purchase again oil after the 2022 SPR sale of 180 million barrels over six months.

West Texas Intermediate oil was $71.70 a barrel on Tuesday, up after Hurricane Francine shut crude output within the Gulf of Mexico final week, however worries about demand have stored costs comparatively low in latest weeks.

President Joe Biden introduced the 2022 sale, the most important ever from the reserve, after Russia, one of many world’s high three oil producers, invaded Ukraine. The invasion had helped push gasoline costs to a document of over $5 a gallon.

The administration has to date purchased again greater than 50 million barrels, after promoting the 180 million barrels at a median of about $95 a barrel, the Vitality Division says.

Whereas oil is now beneath the goal buyback value, battle within the Center East and different elements can rapidly enhance oil costs. In April, the U.S. canceled an SPR buy of oil resulting from rising costs.

The reserve at the moment holds 380 million barrels, most of which is bitter crude, or oil that many U.S. refineries are engineered to course of. Essentially the most it has held was almost 727 million barrels in 2009.

(Reporting by Timothy Gardner; Enhancing by Chizu Nomiyama)

Markets

Tupperware information for chapter safety as demand slumps for its colourful containers

(Reuters) -Tupperware Manufacturers and a few of its subsidiaries filed for Chapter 11 chapter safety on Tuesday, succumbing to declining demand for its once-popular colourful meals storage containers and ballooning losses.

The corporate’s struggles to stem the drop in gross sales resumed after a quick surge throughout the pandemic when folks cooked extra at dwelling and turned to its hermetic plastic containers to retailer leftovers.

The post-pandemic bounce in prices of important uncooked supplies equivalent to plastic resin, in addition to labor and freight additional dented the corporate’s margins.

In August, Tupperware (NYSE:) had raised substantial doubt about its capacity to proceed as a going concern for the fourth time since November 2022 and mentioned it confronted a liquidity crunch.

The corporate listed $500 million to $1 billion in estimated belongings and $1 billion-$10 billion in estimated liabilities, in keeping with chapter filings within the U.S. Chapter Courtroom for the District of Delaware.

Tupperware has been planning to file for chapter safety after breaching the phrases of its debt and enlisting authorized and monetary advisers, Bloomberg reported on Monday.

The report mentioned the chapter preparations started following extended negotiations with lenders over the greater than $700 million in debt.

Markets

BlackRock, Microsoft Launch $30 Billion Fund to Construct AI Knowledge Facilities for Excessive Power Wants

BlackRock and Microsoft have partnered to type a brand new group that goals to create a $30 billion funding fund devoted to synthetic intelligence (AI) information facilities.

This transfer comes as demand for AI know-how continues to surge, requiring huge computing energy and power to function effectively.

AI Power Calls for Spark New Alternatives for Bitcoin Miners

The fund goals to lift $30 billion in fairness investments by BlackRock’s infrastructure unit, International Infrastructure Companions (GIP). This may allow it to leverage a further $70 billion in debt financing.

In the meantime, Microsoft, Abu Dhabi’s MGX, and chipmaker Nvidia will lead the undertaking. They are going to guarantee the ability’s design and implementation incorporate the most recent applied sciences to fulfill AI’s excessive computational wants. The brand new fund will deal with constructing information facilities able to dealing with the energy-intensive operations of generative AI instruments.

This funding initiative comes because the power and infrastructure sectors grow to be more and more intertwined. Synthetic intelligence, particularly fashions like OpenAI’s ChatGPT, is straining present digital infrastructure with its huge computing wants. These fashions require considerably extra power than earlier applied sciences, making a bottleneck in constructing the mandatory AI infrastructure.

This rising demand has grow to be a serious hurdle to additional AI growth. Nevertheless, such a scenario can profit a number of events.

As an illustration, Nvidia, recognized for its AI-processing GPUs, shall be essential in growing the factories for these information facilities. Moreover, given their experience in power administration, Bitcoin miners are rising as key gamers on this new phase.

This phenomenon is clear in some investments and initiatives from Bitcoin miners on this space. BeInCrypto reported that Core Scientific, one of many main Bitcoin mining firms, signed a $3.5 billion contract with Nvidia-backed CoreWeave in June. This contract goals to improve its services for AI and high-performing laptop (HPC) duties.

One other Bitcoin mining firm, Hut 8, has additionally made strides in coming into the AI information heart market. With a $150 million funding from Coatue Administration, Hut 8 can leverage its power experience and present infrastructure to help the rising want for AI computing energy. Ultimately, this transfer will additional increase Hut 8’s operations past conventional Bitcoin mining.

The combination of AI infrastructure into Bitcoin mining operations has additionally grow to be more and more engaging to buyers. In line with a report from asset administration agency VanEck, Bitcoin miners are in a singular place to fulfill AI’s power calls for. This is because of their present energy-intensive operations.

“The synergy is straightforward: AI firms want power, and Bitcoin miners have it. Because the market values the rising AI/HPC information heart market, entry to energy—particularly within the close to time period—is commanding a premium. […] Appropriate Bitcoin mining websites can energize GPUs for AI in lower than a yr, in comparison with the 4+ years required for greenfield AI information heart developments to go surfing. […] If correctly outfitted with energy, bandwidth, and cooling methods, Bitcoin mining websites are perfect for capturing this worth for AI/HPC cloud companies,” the report reads.

Bitcoin Miners Potential AI Earnings. Supply: VanEck

VanEck’s analysis means that by 2027, Bitcoin miners who allocate a portion of their power capability to AI and HPC duties might see a big improve in profitability. Moreover, the report estimates that miners might generate a further $13.9 billion in income yearly by pivoting simply 20% of their power sources towards AI infrastructure. This shift might additionally result in a doubling of their market capitalization over the subsequent few years as demand for AI computing energy continues to rise.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoBlackRock is not going to participate in Malaysia Airports privatisation, GIP says

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now