Markets

The place to maneuver your cash when rates of interest are poised to fall

With the Fed poised to chop rates of interest subsequent week, the ripple impact will present up in certificates of deposit and high-yield financial savings accounts, which at present supply charges of greater than 5%.

They aren’t prone to fall dramatically following a price reduce however reasonably ease again nearer to 4% and linger above the inflation price for a minimum of the following yr. So these accounts ought to nonetheless be your go-to to your or money put aside for short-term bills.

That mentioned, the Fed’s anticipated motion provides a chance to make some cash strikes that make the most of the downward tilt in rates of interest.

“The projected slicing might pull the rug from below the high-yield financial savings charges,” Preston D. Cherry, founder and president of informed Lusso’s Information. “Now is likely to be the very best time we have seen in just a few years to swap money in high-yield financial savings for long-term bonds to lock in the next yield for revenue funds for way of life and retirement portfolios.”

Since 2022, when the Fed started to lift short-term rates of interest, financial institution financial savings accounts have been a greater place to park your money than bonds. That’s set to alter.

Learn extra:

It is a good time to shift to bonds for these nearing retirement who need to rebalance their retirement financial savings amid volatility.

The easiest way to earn a excessive whole return from a bond or bond fund is to purchase it when rates of interest are excessive however about to return down, Cherry mentioned.

In the event you purchase bonds towards the top of a interval when charges are rising, you possibly can lock in excessive coupon yields and benefit from the enhance out there worth of your bond as soon as charges begin to come down.

And when you’re a bond lover, you’re up. After greater than a decade of dismal bond yields, the two-fold influence of excessive charges proper now and provides a chance for funding revenue. When rates of interest transfer decrease, bond costs will rise. (Rates of interest and bond costs transfer in reverse instructions.)

“Including low-price and higher-yield long-term bonds at present ranges might add whole return diversification worth to your bond and general funding portfolio, which has not been the case in current previous rate-raising environments,” Cherry mentioned.

This can be a slim alternative, although, earlier than charges begin dipping and bond costs go up.

“When you’ve got sufficient liquidity and received’t have to faucet the cash at a second’s discover, then locking in bond yields now over a multiyear interval can present a extra predictable revenue stream,” Greg McBride, chief monetary analyst at Bankrate.com, informed Lusso’s Information.

“Because the Fed begins slicing rates of interest, short-term yields will fall sooner than long-term yields within the months forward, so do that for the revenue reasonably than the expectation of capital good points,” he mentioned.

A technique savers can pivot as charges head down is to set upwith staggered maturities, as a substitute of investing all of your funds in a single CD or bond with one set time period size. This tactic can present “a extra predictable revenue stream whereas offering common entry to principal,” McBride mentioned.

I maintain my private financial savings, for instance, in a number of buckets, together with six-month and one-year CDs, a , , and a .

The majority of my retirement holding is shares and bonds primarily via broad index funds. The way you divide up your financial savings and investments between inventory and bonds, mutual funds and cash market funds, or high-yield financial savings accounts is a steadiness that solely you’ll know you’re snug with, primarily based in your danger tolerance and the way quickly you should faucet the funds.

Many retirees need a extra conservative asset combine as they age in order that they don’t face that uneasy feeling when the inventory market is shaky. That’s why near-retirees and retirees, particularly, who have not taken a gander at their asset allocations for some time ought to contemplate doing so.

Learn extra:

Most 401(ok) buyers are in bond mutual funds for the fixed-income portion of their portfolios, that are extremely diversified and often invested in intermediate (five-year) high-quality authorities and company bonds.

Most of us aren’t researching and investing, as an illustration, in particular person intermediate bonds. In the event you choose to do-it-yourself and select particular person bonds and maintain them till they mature, you’ve bought loads to pick from, after all. Constancy provides over 100,000 bonds, together with US Treasury, company, and municipal bonds. Most have mid- to high-quality credit score rankings, however to me the sheer variety of selections is mind-boggling.

So I purchase shares in a variety of particular person bonds through a bond mutual fund or ETF so as to add a bond ballast to my retirement accounts. The ETF, for instance, is a diversified, one-stop store comprising greater than 11,000 “funding grade” bonds — together with authorities, company, and worldwide dollar-denominated bonds, in addition to mortgage-backed and asset-backed securities — all with maturities of a couple of yr.

Proper now, extra thanthe Vanguard fund’s whole belongings are in authorities bonds, and its year-to-date return is 4.94%.

As Vanguard notes, this fund “could also be extra acceptable for medium- or long-term objectives the place you’re on the lookout for a dependable revenue stream and is acceptable for diversifying the dangers of shares in a portfolio.”

For shorter-term objectives, staying forward of charges falling is sensible to lock in alluring charges for cash you may want sooner reasonably than later.

Nearly all of monetary advisers I spoke to didn’t counsel any knee-jerk actions forward of the Fed assembly. In different phrases, don’t shut your financial institution accounts.

“Inflation has definitely moderated, however in our opinion is just not prone to be an additional decline considerably,” mentioned Peter J. Klein, chief funding officer and founding father of .

If that’s the case, the Fed won’t maintain decreasing rates of interest however will maintain them regular shifting ahead.

“Trying on the lengthy arc of inflation historical past, one can see the modifications … resulting in sticky and chronic inflationary pressures. So, the notion that charges will come down considerably — and keep down — is just not our base case,” Klein mentioned.

That signifies that these financial savings you’ve in a federally insured, accessible checking account incomes above the speed of inflation stay guess. That is particularly the case for these nearing or in close to retirement who plan to faucet that cash for dwelling bills and don’t need the concern that comes from worth fluctuations in shares and bonds.

“Money is the one asset that an investor can deploy in a portfolio that has zero danger of shedding its nominal worth,” Klein added.

Kerry Hannon is a Senior Columnist at Lusso’s Information. She is a profession and retirement strategist, and the writer of 14 books, together with “ and “By no means Too Outdated To Get Wealthy.” Observe her on X .

Markets

Evaluation-Price cuts are right here, however US shares could have already priced them in

By Lewis Krauskopf

NEW YORK (Reuters) – Because the Federal Reserve kicks off a long-awaited fee slicing cycle, some buyers are cautious that richly valued U.S. shares could have already priced in the advantages of simpler financial coverage, making it more durable for markets to rise a lot additional.

Buyers on Thursday cheered the primary fee cuts in additional than 4 years, sending the S&P 500 to contemporary information a day after the Fed lowered borrowing prices by a hefty 50 foundation factors to shore up the financial system.

Historical past helps such bullishness, particularly if the Fed’s assurances of a still-healthy U.S. financial system pan out. The S&P 500 has gained a mean of 18% a 12 months following the primary fee minimize in an easing cycle so long as the financial system avoids recession, in accordance with Evercore ISI information since 1970.

However inventory valuations have climbed in latest months, as buyers anticipating Fed cuts piled in to equities and different property seen as benefiting from looser financial coverage. That has left the S&P 500 buying and selling at over 21 instances ahead earnings, properly above its long-term common of 15.7 instances. The index has climbed 20% this 12 months, at the same time as U.S. employment development has been weaker than anticipated in latest months.

Consequently, the near-term “upside from simply decrease charges is considerably restricted,” mentioned Robert Pavlik, senior portfolio supervisor at Dakota Wealth Administration. “Folks simply get a little bit bit nervous round being up 20% in an setting the place the financial system has cooled.”

Different valuation measures, together with price-to-book worth and price-to-sales, additionally present shares are properly above their historic averages, Societe Generale analysts mentioned in a be aware. U.S. equities are buying and selling at 5 instances their e-book worth, for example, in contrast with a long-term common of two.6.

“The present ranges might be summarized in a single phrase: costly,” SocGen mentioned.

Decrease charges stand to assist shares in a number of methods. Diminished borrowing prices are anticipated to extend financial exercise, which might strengthen company earnings.

A drop in charges additionally reduces yields on money and glued earnings, diminishing them as funding competitors to equities. The yield on the benchmark 10-year Treasury has dropped a couple of full share level since April, to three.7%, though it has ticked up this week.

Decrease charges additionally imply future company money flows are extra engaging, which regularly boosts valuations. However the P/E ratio for the S&P 500 has already rebounded considerably after falling as little as 15.3 in late 2022 and 17.3 in late 2023, in accordance with LSEG Datastream.

“Fairness valuations had been fairly moderately full going into this,” mentioned Matthew Miskin, co-chief funding strategist at John Hancock Funding Administration. “It will be exhausting to duplicate the a number of enlargement you simply bought over the past 12 months or two over the following couple of years.”

With any additional will increase in valuation anticipated to be restricted, Miskin and others mentioned earnings and financial development will likely be key inventory market drivers. S&P 500 earnings are anticipated to rise 10.1% in 2024 and one other 15% subsequent 12 months, in accordance with LSEG IBES, with third-quarter earnings season beginning subsequent month set to check valuations.

On the identical time, there are indicators that the promise of decrease charges could have already drawn buyers. Whereas the S&P 500 has tended to be flat within the 12 months main as much as rate-cutting cycles, it’s up practically 27% in that interval this time round, in accordance with Jim Reid, Deutsche Financial institution’s international head of macro and thematic analysis, who studied information since 1957.

“You can argue that a few of a possible ‘no recession easing cycle’ positive aspects have been borrowed from the long run this time,” Reid mentioned within the be aware.

To make certain, loads of buyers are undeterred by the elevated valuations and preserve a optimistic outlook for shares.

Valuations are usually an unwieldy device in figuring out when to purchase and promote shares – particularly since momentum can preserve markets rising or falling for months earlier than they revert to their historic averages. The ahead P/E ratio for the S&P 500 was above 22 instances for a lot of 2020 and 2021 and reached 25 in the course of the dotcom bubble in 1999.

In the meantime, fee cuts close to market highs are likely to bode properly for shares a 12 months later. The Fed has minimize charges 20 instances since 1980 when the S&P 500 was inside 2% of an all-time excessive, in accordance with Ryan Detrick, chief market strategist at Carson Group. The index has been increased a 12 months later each time, with a mean achieve of 13.9%, Detrick mentioned.

“Traditionally, fairness markets have carried out properly in intervals when the Fed was slicing charges whereas the US financial system was not in recession,” UBS International Wealth Administration analysts mentioned in a be aware. “We count on this time to be no exception.”

(Reporting by Lewis Krauskopf in New York; Enhancing by Ira Iosebashvili and Matthew Lewis)

Markets

European shares consolidate after sharp good points; central banks in focus

Lusso’s Information – European inventory markets edged decrease Friday, consolidating after the earlier session’s sharp good points as buyers digested a collection of coverage selections from the world’s main central banks.

At 03:05 ET (07:05 GMT), the in Germany traded 0.6% decrease, the in France fell 0.3% and the within the U.Ok. dropped 0.5%.

Central banks in focus

The principle European indices are on the right track for sturdy weekly good points within the wake of the slicing rates of interest by a hefty 50 foundation factors on Wednesday, beginning a rate-cut cycle to shore up the economic system following a chronic battle in opposition to surging inflation.

The and Norway’s each held charges regular on Thursday, whereas on Friday the left rates of interest unchanged as broadly anticipated, and stated that it continued to count on outsized development within the Japanese economic system amid a gentle uptick in inflation.

The Folks’s additionally stored its benchmark lending price unchanged on Friday regardless of growing requires extra stimulus.

German producer costs fall in August

The minimize its key rates of interest by 25 foundation factors after the same transfer in June, and will speed up these cuts over coming months, governing council member Fabio Panetta stated on Thursday, following the hefty Fed minimize and a sluggish eurozone economic system.

Knowledge launched earlier Friday confirmed that fell 0.8% on the 12 months in August, illustrating that inflation is retreating within the eurozone.

Elsewhere, British rose by a stronger-than-expected 1% in August and development in July was revised up, official figures confirmed on Friday.

Crude on monitor for sturdy weekly good points

Crude costs slipped decrease Friday, however had been on monitor for a second consecutive increased week after the big minimize in US rates of interest helped quell some fears of slowing demand.

By 03:05 ET, the contract dropped 0.2% to $74.77 per barrel, whereas futures (WTI) traded 0.1% decrease at $71.08 per barrel.

The benchmarks have been recovering after they fell to close three year-lows on Sept. 10, and have registered good points in 5 of the seven classes since then, together with good points of over 4% this week.

Crude inventories within the U.S., the world’s prime producer, fell to a one-year low final week, in accordance with official authorities knowledge earlier this week, however larger good points had been held again by persistent issues over slowing demand, particularly in prime importer China.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

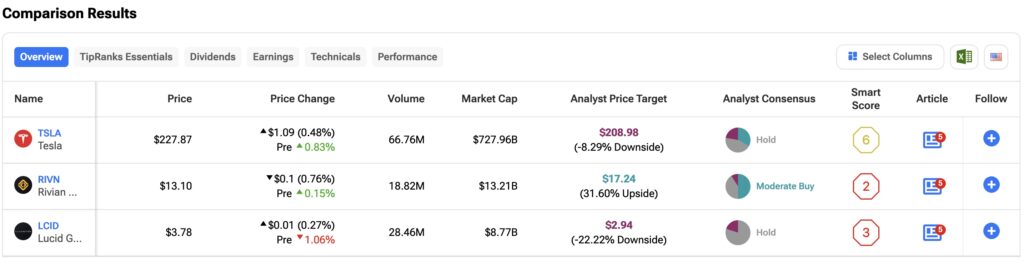

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024