Business

The Top 5 Easiest Ways to Make Money Online

Making money online has become increasingly popular in recent years, and it’s no surprise why. The internet has opened up a world of opportunities for those looking to earn some extra income, whether it’s through selling products, providing services, or participating in online surveys. But with so many options available, it can be challenging to know where to start. In this article, we’ll explore some of the easiest ways to make money online.

- Freelancing

One of the easiest ways to make money online is by freelancing. Freelancers offer their services on various platforms, such as Fiverr, Upwork, or Freelancer. These services can include anything from writing and graphic design to programming and video editing. Freelancing is an excellent option for those who have a particular skill or talent and want to work independently. With the ability to set your own rates and choose your projects, freelancing can be a flexible and lucrative option for making money online.

- Online Surveys

Online surveys are another popular way to make money online. Companies are always looking for feedback on their products and services, and they are willing to pay for it. Survey websites such as Swagbucks, Survey Junkie, and Toluna offer rewards for completing surveys, watching videos, and even playing games. While taking online surveys may not provide a full-time income, it can be an easy and fun way to make a little extra cash in your spare time.

- Affiliate Marketing

Affiliate marketing is a popular way to make money online by promoting other people’s products. You earn a commission for each sale that is made through your unique affiliate link. Affiliate marketing can be done through social media platforms or a website. To be successful at affiliate marketing, you need to have a targeted audience and promote products that align with your audience’s interests.

- Online Teaching

Online teaching is becoming increasingly popular, especially in the wake of the COVID-19 pandemic. Platforms like Teachable, Udemy, and Skillshare allow you to create and sell online courses. If you have expertise in a particular subject, you can create a course and sell it to people interested in learning about that topic. Online teaching can be an excellent option for those looking to make money while sharing their knowledge and expertise.

- Selling Products Online

Finally, selling products online is an excellent way to make money online. You can sell products through platforms like Etsy or Amazon, or you can create your own online store using platforms like Shopify. If you have a particular skill, such as woodworking or crafting, you can create unique products and sell them online. Alternatively, you can sell products through dropshipping, where you don’t need to keep inventory, and the supplier ships the products directly to the customer.

The bottom line is, there are many ways to make money online, and it can be a fun and lucrative way to earn some extra income. While some methods require specific skills or knowledge, others are accessible to anyone with an internet connection. By exploring these options and finding what works best for you, you can start making money online in no time.

Business

Crown Electrokinetics Corp. (NASDAQ: CRKN) Secures Major Dark Fiber Construction Project, Trades Over 300 Million Shares

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

Crown Electrokinetics Corp. (NASDAQ: CRKN), a pioneer in smart glass technology and fiber optic network construction, witnessed a significant surge in its stock trading volume today, surpassing 300 million shares. This uptick follows the announcement of a new long-haul dark fiber construction project, marking a pivotal moment for the company.

Major Project Announcement:

Crown Electrokinetics has secured a new project in collaboration with Sequoia Associates. The project involves constructing and rehabilitating approximately 250 miles of dark fiber infrastructure from Las Cruces, New Mexico, to El Paso, Texas. This contract, estimated to generate around $12 million in gross revenue, is a testament to Crown’s growing capabilities and the trust placed in it by major industry players.

Key Project Details:

- Scope of Work: Crown will undertake the comprehensive construction of the fiber optic network, including the survey, construction, fiber placement, and splicing. The project also involves the rehabilitation of an existing duct bank along the designated route.

- Start Date: The construction is slated to commence in mid-June 2024.

Leadership Statements:

Corey Boaz, President of Construction for Crown Fiber Optics, emphasized the significance of this project: “We are pleased to announce today’s new project with Sequoia Associates. This project represents an approximate $12 million gross revenue opportunity and marks our first project as a turnkey general contractor. This contract was generated through existing relationships, affirming the trust and confidence that large organizations have in the Crown team.”

Doug Croxall, CEO and Chairman of Crown, highlighted the strategic importance of the contract: “We remain pleased at the pace with which we continue to secure opportunities which we expect to deliver near-term revenue and positive cashflows. Importantly, the contract is based on time and materials, which helps mitigate risk and control margins. This contract, in combination with others, continues to reinforce our confidence in both our team and the scalability of our operations.”

Market Reaction:

The announcement of the new project has positively impacted Crown Electrokinetics’ stock performance, with trading volumes soaring past 300 million shares. Investors are showing strong interest, reflecting confidence in the company’s strategic direction and growth potential.

SEO-Friendly Highlights:

- Crown Electrokinetics Corp. (NASDAQ: CRKN): Emphasize the stock ticker and company name to ensure visibility in search results related to stock performance and company news.

- Dark Fiber Construction Project: Highlight the specific industry and nature of the project to attract searches related to fiber optics and construction contracts.

- $12 Million Revenue Opportunity: Focus on the financial aspect to draw attention from investors and financial analysts looking for high-revenue projects.

- Key Leadership Quotes: Incorporate quotes from company executives to add credibility and provide insights directly from leadership.

Conclusion:

Crown Electrokinetics Corp. (NASDAQ: CRKN) continues to demonstrate its leadership in the smart glass and fiber optic construction sectors with this significant new project. The contract with Sequoia Associates not only brings substantial revenue but also reinforces Crown’s position as a trusted partner in large-scale infrastructure projects. As the company prepares to kick off this major initiative, investors and industry stakeholders will be closely monitoring its progress and impact on Crown’s financial performance.

For more updates on Crown Electrokinetics and other stock market news, stay tuned to our latest articles.

Business

Mortgage Rates Hit 7.1%: Analyzing the Impact on the U.S. Housing Market

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

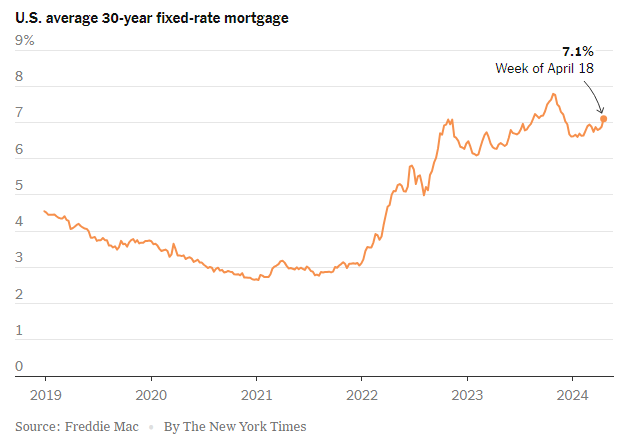

The U.S. housing market is experiencing significant pressure as mortgage rates have surged past the 7 percent mark for the first time this year. According to a recent report by Freddie Mac, the average rate on the 30-year mortgage, the most favored home loan across the nation, climbed to 7.1 percent this week, marking the highest level since last November. This spike poses a considerable challenge to millions of potential home buyers and could further slow down a market already showing signs of cooling.

Rising Rates and Their Ripple Effects

Last year, mortgage rates peaked at nearly 8 percent, a height unseen since 2000. This upward trend in rates began in 2021, significantly driven by Federal Reserve policies aimed at curbing inflation through higher benchmark interest rates. Despite a reduction in inflation rates, they remain above the Fed’s 2 percent target, leading to expectations that high borrowing costs may persist.

The immediate effect of these climbing rates is twofold. Firstly, potential home buyers face increased costs, making homeownership less accessible for many Americans. This economic strain is causing prospective buyers to deliberate intensely on whether to purchase now or delay in hopes of a rate decrease later in the year.

Secondly, existing homeowners, who secured their properties at lower interest rates, are reluctant to sell, fearing higher rates on a new mortgage. This hesitancy to sell is contributing to a decreased housing supply, inadvertently pushing home prices up despite fewer transactions.

Market Slowdown and Policy Responses

Data from the National Association of Realtors (NAR) underscores the market’s response to these economic pressures, with sales of existing homes dropping by 4.3 percent in March and 3.7 percent year-over-year. This downturn reflects broader economic frustrations and the daunting prospect of entering a market characterized by both high prices and high rates.

In a potentially mitigating development, the NAR recently agreed to settle litigation that would eliminate the standard real estate sales commission. Traditionally, sellers would pay a 5 to 6 percent commission, a cost typically passed on to buyers, inflating home prices. This change could, theoretically, reduce overall home purchasing costs.

Broader Economic Implications

The rising mortgage rates, coupled with the Fed’s indications of maintaining a high-interest rate environment, have pushed Treasury yields higher, influencing mortgage rates further. The 10-year Treasury yield has notably increased to about 4.6 percent since the start of the year.

As the market adjusts to these new economic realities, the overarching question remains: How many potential buyers can withstand further rate increases? Freddie Mac’s chief economist, Sam Khater, suggests that the future of the housing market is still very much uncertain, with potential buyers weighing the risks of higher future costs against the possibility of rate decreases.

Conclusion

The surge in mortgage rates above 7 percent represents more than just a numerical threshold; it is a significant barrier to entry for many Americans aspiring to homeownership. This development tests the resilience of the U.S. housing market and calls for close monitoring of future economic policies and market adaptations. As the landscape evolves, potential homebuyers and industry stakeholders alike must navigate these challenging waters with careful consideration and strategic planning.

Business

Potential Ban on TikTok: A Boon for Snapchat and Meta?

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

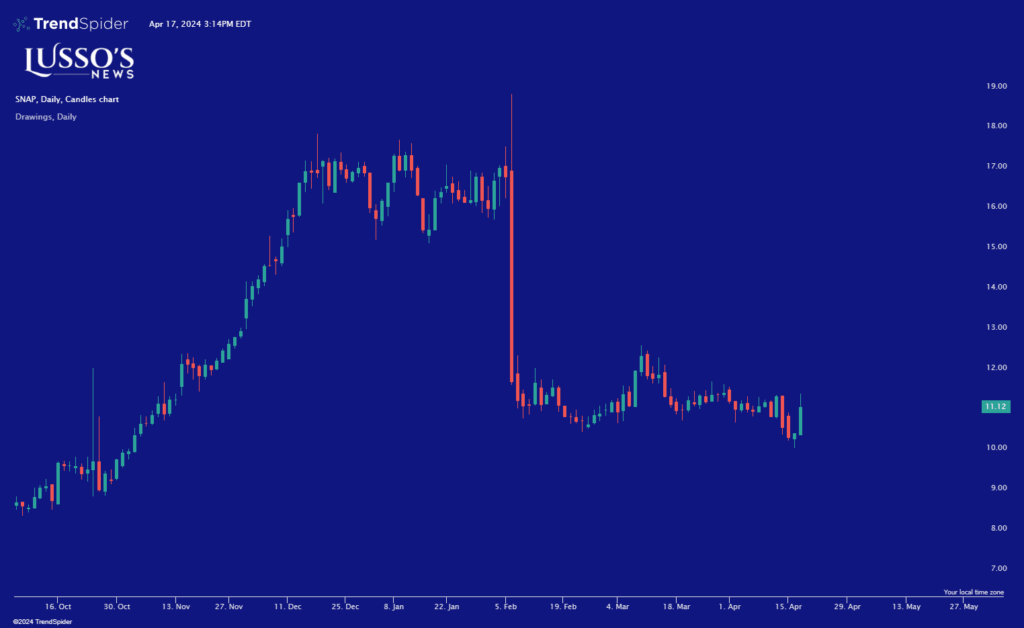

The U.S. House of Representatives’ recent move to potentially ban TikTok via legislation could have significant implications for the competitive landscape of social media, particularly benefiting companies like Snapchat and Meta (formerly Facebook). This legislative effort, part of a broader package for Israel and Ukraine, underscores growing concerns about TikTok’s Chinese ownership and its implications for national security.

Strategic Advantage for Competitors

Snapchat and Meta, two of the largest social media platforms in the United States, stand to gain from a TikTok ban. TikTok, with its 170 million U.S. users, has become a dominant force in social media, particularly among younger audiences who engage with its dynamic content ranging from dance videos to political discourse. A ban could leave a vast user base seeking alternative platforms, and Snapchat and Meta are well-positioned to absorb this migration.

1. User Engagement and Growth

Both Snapchat and Meta have been investing heavily in video and augmented reality—technologies at the heart of TikTok’s appeal. Snapchat’s innovative AR filters and Meta’s investment in Reels and virtual reality could see increased user engagement as TikTok users look for similar experiences elsewhere.

2. Advertising Revenue

A shift in user base would also likely lead to an increase in advertising revenue for Snapchat and Meta. Advertisers looking to capitalize on the highly engaged, predominantly younger audience that TikTok attracted would turn to these platforms, which offer robust ad-targeting systems and massive global reach.

3. Market Position and Shares

From a financial perspective, the potential TikTok ban could lead to a bullish outlook for stocks like Snapchat and Meta. Investors may see these companies as primary beneficiaries in the social media space, driving up share prices in anticipation of user growth and increased market share.

Challenges and Considerations

While the potential ban could offer a tactical advantage to companies like Snapchat and Meta, it also presents challenges. These companies would need to innovate continually to satisfy the diverse needs of former TikTok users. Moreover, the legislative move against TikTok raises broader concerns about internet freedom and regulation, which could eventually impact other social media platforms as well.

Ethical and Regulatory Landscape

The controversy surrounding TikTok has highlighted the complex interplay between technology, politics, and user privacy. As Snapchat and Meta potentially benefit from TikTok’s troubles, they must also navigate the ethical and regulatory challenges that arise from increased scrutiny on data practices and content moderation.

Conclusion

In conclusion, while the legislative push against TikTok could destabilize the current social media hierarchy, it also presents significant opportunities for companies like Snapchat and Meta to capitalize on a potential market void. However, these gains are not without challenges, requiring careful strategic planning and responsive innovation to harness effectively. Investors and market analysts will be watching closely as this situation develops, potentially reshaping the competitive dynamics of the social media industry.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024