Markets

Top Stocks to Watch: Key Levels and Potential Breakouts

DO NOT MISS THIS FREE OPPORTUNITY!

ARE YOU A TRADER?

DO YOU WANT FREE STOCK PICKS?

CHECK THIS OUT….

Ready to elevate your trading game with the next big winner? Don’t miss out – join the savvy investors who are already benefiting from our Wall St veteran’s free SMS alerts. Act now! Sign up at https://slktxt.io/ZmRx or send ‘FREE’ to 844-722-9743 and be the first to get the insider scoop on what’s hot in the market

In today’s volatile market, investors are always on the lookout for promising stocks that could yield significant returns. Here are some top stocks to keep an eye on, along with crucial support and resistance levels that could indicate potential breakout opportunities.

LUCY LUCY has shown impressive momentum, surging from 20 cents to a closing price of 79 cents recently. Investors should monitor the 76 cent and 69 cent support levels closely. The light volume observed in today’s selling suggests a scarcity of sellers, potentially indicating continued upward movement.

PATH PATH has experienced a challenging week, plummeting by 34%. Despite this downturn, there’s strong resistance at the 13 mark, with solid support around 11. Keeping an eye on the 11 level could be crucial, as it may serve as a significant support point for a rebound.

Tesla (TSLA) Tesla remains a focal point for many investors due to its resilience amid market turbulence. The critical level to watch here is 183. A breakout above this point could signal substantial upward movement, making Tesla a stock to monitor closely for potential gains.

Rivian (RIVN) Electric Vehicle (EV) stocks are currently generating significant interest, and Rivian is no exception. With 20% of its float shorted, a move above $11.50 would be highly bullish. This stock’s potential for upward movement makes it one to watch in the coming days.

Apple (AAPL) Apple is on the verge of a potential breakout, with the key level to watch at 193. Despite the market’s volatility, Apple has demonstrated strength, suggesting it could soon reach the $200 mark. Investors should closely monitor the 193 breakout level for signs of an upward surge.

PEGY PEGY, a penny stock nearing a gap fill around the 19 cent area, has had a substantial run recently. Popular in trading chatrooms like Moon Market, PEGY has the potential for another leg up if it holds at its current levels. Energy stocks have been particularly hot, and PEGY is riding that wave.

Palantir (PLTR) Palantir is nearing a potential breakout after a decline from around 27 to approximately 20. It’s approaching a critical channel between 20.60 and 22. A move above 22 would be bullish, making Palantir a stock worth watching for potential gains.

SOFI SOFI is still trading below major moving averages but shows promise above the 7.25 mark. A move above this level could indicate clear momentum to the upside, positioning SOFI as a strong candidate for a swing trade.

Investors are encouraged to stay informed and perform their own research when considering these stocks. As always, trading involves risks, and it’s essential to make well-informed decisions based on thorough analysis.

Markets

A $100 Billion Guess on China’s Economic system Sours as Warehouses Empty

(Lusso’s Information) — In lots of elements of China, the warehouses and industrial parks that was once a magnet for worldwide buyers are grappling with a stunning slowdown in enterprise exercise.

Most Learn from Lusso’s Information

Logistics hubs that have been in-built anticipation of a long-lasting growth in e-commerce, manufacturing and meals storage are shedding tenants, forcing constructing homeowners to slash rents and shorten lease phrases. Shares of actual property funding trusts that personal China industrial properties have plummeted, and a few of their managers count on their rental earnings to fall additional.

Common emptiness charges at logistics properties in east and north China are approaching 20%, the very best in years, in keeping with actual property consultancies. Extra warehouses are being constructed, which is making the issue worse. “We’re a provide glut in logistics and industrial properties in China,” mentioned Xavier Lee, an fairness analyst at Morningstar who covers the actual—property sector.

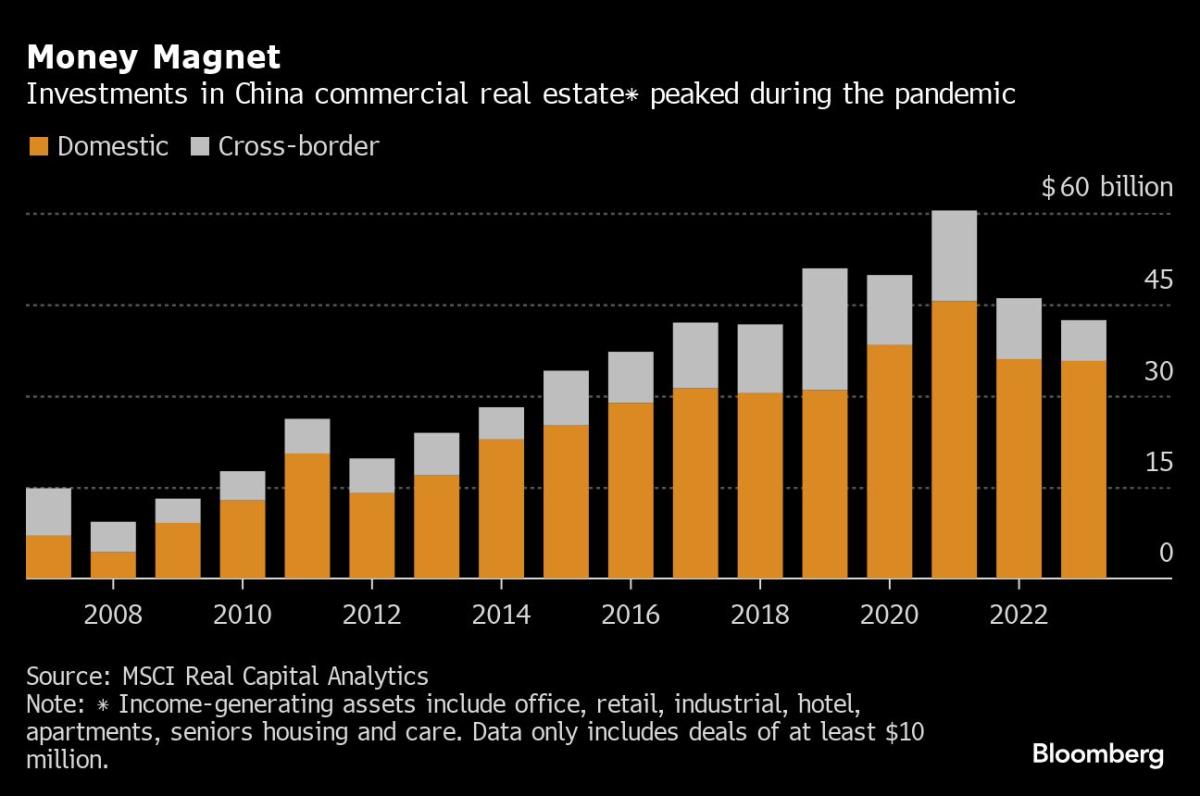

The deterioration has been disappointing for property homeowners that have been relying on an financial rebound in China this yr. International establishments have collectively invested greater than $100 billion in warehouses, industrial buildings, workplace towers and different Chinese language industrial actual property over the previous decade, in keeping with knowledge from MSCI Actual Capital Analytics. The international buyers embrace Blackstone Inc., Prudential Monetary Inc.’s PGIM, Singapore’s GIC Pte. and CapitaLand Group, and plenty of others.

Just a few establishments are considering divestments of their worst-performing belongings earlier than rents fall additional. Others intend to attend out the downturn and count on to generate profits in the long term.

“The very best areas are nonetheless resilient,” mentioned Hank Hsu, CEO and co-founder of Forest Logistics Properties, which owns warehouses and distribution facilities at main transportation hubs in Beijing, Shanghai, Wuhan and different Chinese language cities.

Six-year-old Forest Logistics has about $2.5 billion in belongings underneath administration from buyers that embrace personal fairness corporations, insurance coverage firms and pension funds. It counts Chinese language e-commerce large JD.com Inc., courier SF Categorical, and multinational shopper merchandise makers amongst its prospects.

Hsu mentioned the latest market weak point hasn’t deterred his agency’s growth plans, and it’s planning to construct one other logistics facility within the southern Larger Bay space within the coming months. “We are going to preserve deploying capital in China within the subsequent one to 2 years as a result of we take into account it a golden alternative,” he added.

Spending Cutbacks

China’s industrial actual property sector was a vivid spot by means of a lot of the nation’s housing downturn that started in 2021. It’s now feeling the consequences of spending cutbacks by customers and companies.

The softening within the logistics and industrial sectors is occurring alongside an workplace property hunch that’s enjoying out in main cities together with Beijing and Shanghai. Each slumps additionally partly the results of overbuilding that was powered by the big sums of cash that poured into industrial actual property when rates of interest, borrowing and building prices have been low.

Warehouses that have been constructed to accommodate e-commerce success facilities, large fridges for chilled or frozen produce, and areas for companies to carry their elements and manufactured items aren’t being utilized as a lot as their homeowners hoped. China’s home e-commerce progress has been sluggish, as consumers have turn into thriftier. The nation’s on-line penetration fee for retail gross sales is already comparatively excessive at 30%.

Heightened geopolitical tensions are prompting firms to shift a few of their manufacturing offshore, to cater to end-customers that need to scale back their reliance on China. That and a slowdown in cross-border commerce have additionally decreased companies’ want for storage services in mainland China.

Excessive Vacancies

The warehouse emptiness fee in east China — the place many logistics properties are clustered — climbed to 19.2% within the first quarter, in keeping with knowledge from Cushman & Wakefield. The general emptiness fee nationwide was 16.5%, thanks partially to the higher performing southern area.

The scenario in China contrasts with the US and different logistics markets in Asia. Within the US, vacancies have elevated at industrial properties and warehouses in some elements of the nation, however they’re at mid-single-digit share charges which might be beneath historic averages, and rents are nonetheless rising. In Asia, logistics belongings in South Korea, Japan and Australia are having fun with excessive occupancies and hire progress.

Of the 20 main Chinese language cities that Cushman tracks, 13 noticed logistics rents drop within the first quarter from the previous three months, led by Beijing and Shenzhen, with falls of 4.2% and three.9% respectively. A further 33 million sq. meters — equal to round 4,600 soccer pitches — of recent provide is scheduled for completion by finish 2026 within the nation, the consultancy mentioned.

CapitaLand China Belief, which owns malls, enterprise parks and different properties, acquired 4 logistics parks in Shanghai, Wuhan and different cities in late 2021 for a complete of 1.68 billion yuan ($231 million). The logistics portfolio’s general occupancy fee dropped to 82% on the finish of 2023 from 96.4% a yr earlier.

The Singapore-listed REIT’s shares have misplaced 27% within the yr to this point, versus a 2.7% achieve for the benchmark Straits Occasions Index. “We’re actively partaking prospects for our logistics parks to additional enhance occupancy,” mentioned a spokesperson for CapitaLand China Belief.

Packing Up

Industrial parks in China that have been designed as science and know-how clusters with workplace buildings and manufacturing services are additionally shedding multinational and native firms. The general emptiness fee at enterprise parks in Beijing was 20.5% within the first quarter, in keeping with Colliers knowledge.

In Guangzhou, the nation’s southern manufacturing base, some multinational firms are shutting crops and altering their enterprise methods after a disappointing post-pandemic restoration.

Lonza Group AG, a Swiss health-care manufacturing firm, mentioned earlier this yr that it’ll shut a drug manufacturing facility following a strategic overview. The 17,000 sq. meter manufacturing facility began manufacturing simply three years in the past within the China-Singapore Guangzhou Information Metropolis, a high-tech enterprise park collectively backed by the town’s native authorities and CapitaLand, owned by Temasek Holdings Pte. Lonza nonetheless operates manufacturing services in Suzhou and Nansha, and is retaining a industrial gross sales group in China.

A Chinese language actual property funding belief that owns industrial properties not too long ago noticed the occupancy of considered one of its buildings in a Shanghai know-how park drop by practically half when a tenant — an subsidiary of smartphone large Oppo — relinquished 19,314 sq. meters (207,890 sq. toes) of house earlier than the top of its lease. The cell phone producer determined to close down its chip growth arm Zeku final yr.

Rental Strain

Firms now have the higher hand when negotiating lease renewals for warehouses and different properties.

“Competitors for tenants is fairly intense for the time being,” mentioned Luke Li, managing director at ESR Group Ltd., throughout a web based convention in regards to the logistics sector in mid-June. The Hong Kong-based actual property asset supervisor owns e-commerce distribution facilities, chilly chain storage services and manufacturing industrial parks in China and different international locations. To maintain warehouses occupied, landlords have been providing versatile hire phrases, higher facilities and different sweeteners to tenants, Li added.

ESR noticed its income from the Larger China area drop by 20% in 2023 from the yr earlier than, in keeping with its most up-to-date monetary report. The corporate cited weakened shopper sentiment and leasing demand as causes for the decline.

Mapletree Logistics Belief, one other Singapore-listed REIT, has additionally been having a troublesome time in China. Rents throughout its 43 properties within the nation fell 10% within the first three months of 2024, and a few tenants have fallen behind on their hire funds. The belief has maintained the occupancy of its China logistics belongings at round 93%.

Ng Kiat, the Mapletree REIT’s CEO, mentioned on an April earnings name that the China setting will stay unstable and unsure for the following 12 months. The belief is specializing in tenant retention and trying to promote a few of its poorest performing China belongings, she added. “We try to get better readability on whether or not we’re seeing the underside. However I don’t assume we’re seeing it now. We’ll have to attend for some time,” Ng mentioned. Mapletree declined to remark.

“All people is reducing prices,” mentioned Humbert Pang, Head of China at Gaw Capital Companions, an alternative-investment agency that owns actual property belongings. Talking on the similar convention as Li, Pang mentioned rents at logistics properties should not going up though the buildings are occupied. “I believe a lot of the logistics house homeowners are having a tricky time negotiating with the prevailing or new tenants,” he added.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

European shares larger, boosted by tech rebound; Volkswagen invests in Rivian

Lusso’s Information – European inventory markets rose Wednesday, buoyed by a rally in tech shares on Wall Avenue in a single day, though good points have been restricted by weakening regional confidence and political uncertainty.

At 03:10 ET (07:10 GMT), the in Germany traded 0.7% larger, the in France rose 0.5% and the within the U.Ok. climbed 0.3%.

Nvidia rebounds helps tone

European fairness indices pushed larger, carrying on the optimistic tone seen in Asia earlier within the session, and on Wall Avenue in a single day, following a rebound in heavyweight chipmaking shares, significantly Nvidia (NASDAQ:).

Nvidia, the dominant provider of synthetic intelligence {hardware} and software program, surged greater than 6%, snapping a three-session slide that erased about $430 billion from its market worth.

The Massive Tech sector has been behind plenty of the good points on Wall Avenue during the last yr or so, with Nvidia briefly turning into essentially the most priceless firm on this planet.

German client sentiment falls

Nonetheless, good points are restricted with quarter-end warning capping vital strikes.

Moreover, the primary spherical of voting in France’s snap elections is due over the weekend, and a powerful displaying from the far proper Nationwide Rally social gathering may simply dent sentiment.

Moreover, is ready to fall barely in July, ending a four-month streak of rises, a survey confirmed on Wednesday.

The buyer sentiment index revealed collectively by GfK and the Nuremberg Institute for Market Choices unexpectedly fell to -21.8 heading into July, from a barely revised -21.0 in June.

Volkswagen invests in Rivian

Within the company sector, Volkswagen (ETR:) inventory fell 1.6% after the German auto large introduced plans to take a position round $5 billion in Rivian Automotive (NASDAQ:), the American EV maker, in a three way partnership which is able to give it entry to the start-up’s expertise.

Zurich Insurance coverage (SIX:) inventory rose 0.2% after the Swiss firm introduced a $600 million deal to purchase AIG’s (NYSE:) world private journey insurance coverage and help enterprise.

Crude larger regardless of leap in US inventories

Crude costs rose Wednesday, regardless of a shock leap in U.S. stockpiles, pushed by geopolitical dangers from the Center East battle and confidence surrounding the summer season driving season.

By 03:10 ET, the futures (WTI) traded 0.6% larger at $81.31 per barrel, whereas the contract climbed 0.5% to $84.66 per barrel.

Knowledge from the , launched on Tuesday, confirmed that U.S. oil inventories grew by round 0.9 million barrels within the week to June 21.

This was one thing of a shock given expectations for a draw of three million barrels, however is essentially being missed as merchants anticipate stock drawdowns in peak third quarter demand season.

The official numbers from the are due later within the session.

Each contracts are nonetheless sitting on sturdy good points over the previous two weeks, as persistent geopolitical tensions – Israeli strikes on Gaza and Ukrainian assaults on Russian refineries — resulted in merchants pricing a threat premium into oil costs.

Markets

What's Going On With Broadcom Inventory On Tuesday?

Broadcom Inc (NASDAQ:) just lately introduced vital updates to its VMware Cloud Basis (VCF), aiming to reinforce digital innovation with sooner infrastructure modernization, improved developer productiveness, and higher cybersecurity at a low .

The most recent developments in VCF assist clients’ wants by integrating enterprise-class computing, networking, storage, administration, and safety throughout numerous environments.

The brand new VCF Import performance permits seamless integration of present vSphere and vSAN environments into VCF, optimizing sources with no need an entire rebuild.

This may considerably improve effectivity, decrease prices, and pace up time to worth.

place because the second-largest AI semiconductor provider globally, trailing solely Nvidia Corp (NASDAQ:).

They famous the corporate’s dominant market share of roughly 55-60% in customized (ASIC) chip designs market projected to develop at a compound annual progress fee (CAGR) of over 20%, presenting a $20 billion to $30 billion alternative.

Analysts predict Broadcom will drive $11 billion to $12 billion in AI revenues in 2024, with additional progress to $14 billion to $15 billion in 2025.

This optimism is fueled by main tech firms’ growing give attention to customized ASIC options for AI computing wants.

Worth Motion: AVGO shares traded greater by 0.30% at $1,596.78 on the final examine on Tuesday.

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Photograph by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & every thing else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering