Markets

Tremendous Micro Laptop Inventory Is Up 190% So Far This 12 months. Can the Progress Proceed within the Second Half of 2024?

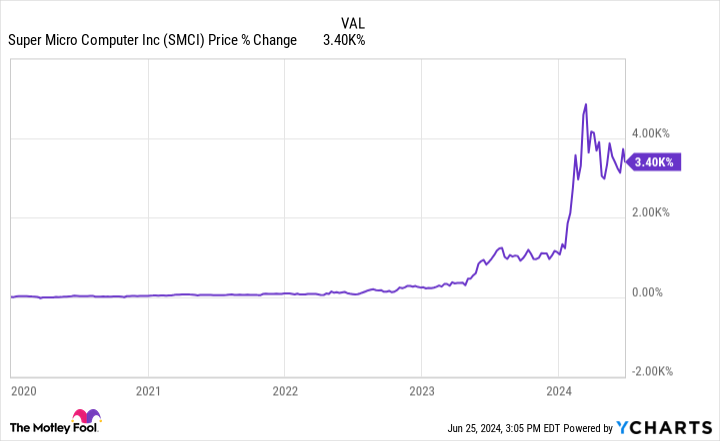

Tremendous Micro Laptop (NASDAQ: SMCI) has turn into one of many extra dramatic and stunning corporations within the inventory market over the previous yr. The corporate existed for many years in obscurity, and its inventory gained little traction for years after its 2007 preliminary public providing (IPO).

Nevertheless, a key partnership with Nvidia has modified the sport for Supermicro (as the corporate is usually known as). Consequently, its inventory is up 190% within the first half of this yr. With its large positive factors, buyers are proper to ask whether or not that momentum can proceed by way of the second half of 2024.

The state of Supermicro

Supermicro is a know-how {hardware} firm recognized for producing energy-saving, environmentally pleasant tech merchandise for the cloud, metaverse, and different functions. Its servers have gained probably the most consideration, significantly these geared up with Nvidia’s (AI) chips. Due to this partnership, its income and inventory worth have grown exponentially.

As lately as 4 years in the past, its inventory traded for about $24 per share. This yr, its latest progress has been so dramatic that analysts predict practically $24 per share for Supermicro’s web earnings! Not surprisingly, such enhancements have led to a 3,400% achieve within the ‘s worth since 2020.

A Market.us research appears to substantiate this pattern. It predicts that the AI server trade will develop at a compound annual progress charge (CAGR) of 30% by way of 2033, remodeling what was a $31 billion trade final yr into one price $430 billion by 2033.

Can the expansion proceed?

Even probably the most devoted Supermicro bulls mustn’t anticipate one other 3,400% achieve over the following four-and-a-half years. Whereas an extra 190% achieve in six months is way from assured, that transfer shouldn’t be out of the query when one seems to be on the financials. Within the 9 months of fiscal 2024 (ended March 31), its web gross sales of $9.6 billion rose 95% from year-ago ranges. Its price of gross sales grew at a barely quicker 102%.

Consequently, its web earnings of $855 million grew 92% over the identical interval. Additionally, with consensus estimates pointing to a 102% improve in web earnings for the fiscal yr, its earnings are rising quick sufficient for the inventory to keep up a fast progress tempo.

Moreover, regardless of surging income and big inventory worth progress, its price-to-earnings (P/E) ratio is 47 and its ahead P/E ratio is 36. That is lower than a number of the faster-growing tech stalwarts reminiscent of Nvidia and Amazon, indicating it may maintain the a number of expansions wanted to take the inventory worth a lot increased, presumably sufficient to keep up the present progress tempo for an additional six months.

Supermicro within the second half of 2024

Given its enterprise and monetary situations, a 190% achieve for the second half of this yr is a believable state of affairs. Admittedly, the market makes no ensures, and in the end, buyers mustn’t anticipate a 190% transfer increased by the top of 2024.

Nevertheless, demand for the corporate’s servers is more likely to proceed rising, presumably sufficient to maintain close to triple-digit income and revenue progress for the foreseeable future.

At its present valuation, a 190% improve within the inventory worth would give it an costly, however not record-breaking P/E ratio. Therefore, even when it falls in need of that bold aim, Supermicro may nonetheless ship important returns for the remainder of the yr.

Do you have to make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Tremendous Micro Laptop wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

SpaceX 'forcefully rejects' FAA conclusion it violated launch necessities

By David Shepardson

WASHINGTON (Reuters) -SpaceX stated Thursday it “forcefully rejects” the Federal Aviation Administration’s conclusion that Elon Musk’s firm did not observe U.S. rules throughout two rocket launches, alleged violations carrying $633,000 in fines.

The FAA on Tuesday faulted SpaceX’s actions forward of launches in June and July of 2023 in Cape Canaveral, Florida, prompting Musk to name the fines politically motivated and threaten to sue to contest them.

Musk has chafed for years at what he sees as authorities inefficiency and has battled with federal regulators. SpaceX should acquire FAA signoffs for rocket launches and new expertise.

Late Thursday Musk asserted FAA leaders attacked SpaceX “for petty issues that don’t have anything to do with security, whereas neglecting actual issues of safety at Boeing (NYSE:). That is deeply fallacious and places human lives in danger.”

Musk cited the NASA resolution to not have astronauts return to earth in Boeing’s Starliner spacecraft after a three-month take a look at mission hobbled by technical points. “As a substitute of fining Boeing for placing astronauts in danger, the FAA is fining SpaceX for trivia!” Musk wrote on X.

Neither the FAA nor Boeing responded to requests for remark about Musk’s X submit.

David Harris, SpaceX vice chairman for authorized, despatched a letter on Wednesday to the leaders of two congressional committees that oversee the FAA, increasing on the corporate’s objections and asserting its dedication to security.

“SpaceX forcefully rejects the FAA’s assertion that it violated any rules,” Harris wrote.

The FAA, Harris wrote, was failing to “maintain tempo with the industrial spaceflight trade” and recommended the tremendous will be the company’s response to elevated congressional scrutiny of the FAA’s oversight of the industrial house trade.

SpaceX stated it has been clear for a while the FAA’s industrial house workplace “lacks the assets to well timed evaluate licensing supplies” and “mistakenly focuses its restricted assets on areas unrelated to its public security regulatory scope.”

Requested in regards to the letter, the FAA stated it “doesn’t touch upon energetic enforcement points.”

In proposing the fines, the FAA stated SpaceX did not acquire approval to revise the communications plan associated to its license for the June 2023 launch of a rocket carrying an Indonesian telecommunication satellite tv for pc. The company stated SpaceX added a brand new launch management room with out approval and eliminated a compulsory telephone name between the corporate, FAA and different launch workers regarding pre-launch readiness procedures.

SpaceX stated the FAA did not evaluate modifications in a well timed method earlier than the launch despite the fact that the company had advance discover of six weeks, and added that the modifications it made have been ones that didn’t require regulatory approval.

The FAA additionally stated SpaceX used an unapproved community of propellant tanks that ship gas to the rocket earlier than the July 2023 launch of a communications satellite tv for pc for the corporate Echostar (NASDAQ:). SpaceX stated the FAA subsequently accredited using this community of tanks for a subsequent launch and determined it could not influence security.

SpaceX has 30 days to formally reply to the FAA.

In February 2023, the FAA proposed a $175,000 civil penalty in opposition to SpaceX for failing to submit some security information to the company previous to an August 2022 launch of Starlink satellites. The corporate paid that tremendous, in keeping with the FAA.

In September 2023, the FAA accomplished an investigation into SpaceX’s April 2023 take a look at launch of its large Starship rocket, requiring the corporate to implement dozens of corrective measures.

Republican presidential candidate Donald Trump has stated he would set up a authorities effectivity fee headed by Musk if he wins the Nov. 5 election. Musk has endorsed Trump.

Markets

Skechers Inventory Tumbles as CFO Offers Warning on China Outlook

(Lusso’s Information) — Skechers U.S.A. Inc. shares delivered their worst every day efficiency since February after the footwear firm’s chief monetary officer informed an trade convention that China gross sales will likely be underneath stress the remainder of the yr.

Most Learn from Lusso’s Information

Shares slipped 9.6% Thursday to shut at $61.56, the bottom stage since early August. Footwear friends together with Nike Inc. and Beneath Armour Inc. noticed their shares briefly dip on the feedback, then rebound. The inventory of competitor On Holding AG shed 2.4%.

“We’ve undoubtedly seen worse circumstances unfold in China than we anticipated for the again half of the yr, so I’d count on the again of the yr’s going to be extra disappointing than what we had initially thought,” stated Skechers CFO John Vandemore on the Wells Fargo Client Convention. “I believe that’s a market that’s nonetheless re-forming itself submit Covid.”

China is a serious marketplace for international retailers, and considerations concerning the energy of Chinese language shopper shopping for have lengthy been a spotlight. The Asia Pacific area accounted for greater than 1 / 4 of Skechers’ gross sales in 2023, in line with a submitting.

Thursday’s droop put Skechers shares in detrimental territory for the yr. Nonetheless, Wall Avenue is bullish on the corporate.

Wall Avenue analysts give Skechers 17 purchase scores and one maintain, in line with knowledge compiled by Lusso’s Information. The typical worth goal of about $81 is greater than 30% greater than the place shares presently commerce.

–With help from Janet Freund.

(Updates inventory transfer at market shut)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Walt Disney appoints 'Moana' author Jared Bush as inventive head of animation studios

(Reuters) – Walt Disney (NYSE:) Animation Studios, in a big management shift, on Thursday named Academy Award-winning filmmaker Jared Bush as its new chief inventive officer, efficient instantly.

Bush, the inventive drive behind film hits corresponding to “Encanto,” “Zootopia,” and author of the unique Oscar-nominated hit “Moana” takes the reins from Jennifer Lee, who will return to filmmaking full time to steward the wildly profitable “Frozen” franchise.

Lee joined Walt Disney Animation Studios in 2011 as co-writer of “Wreck-It Ralph” and author of “Frozen.” After serving as CCO since 2018, she’s going to now concentrate on directing and writing “Frozen 3” and co-writing “Frozen 4” with Marc Smith.

A Disney veteran of over a decade, Bush will oversee the inventive output of the enduring animation studio, together with its movies, sequence and related tasks, Disney mentioned in a press release.

Bush is presently engaged on “Zootopia 2” and serves as the author and government producer of the upcoming “Moana 2,” that are on account of launch within the fall of 2025 and 2024, respectively, Disney mentioned. (This story has been refiled to say that ‘Zootopia 2’ will launch within the fall of 2025 and ‘Moana 2’ will launch within the fall of 2024, not 2025, in paragraph 5)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now