Markets

TSLA, AMD, or PLTR: Which Development Inventory Is the Greatest Choose?

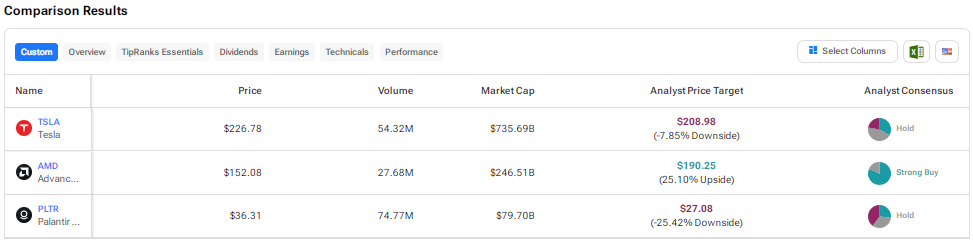

A number of development corporations have been underneath strain as a result of influence of macro headwinds, together with steep borrowing prices and excessive inflation. The Federal Reserve’s upcoming rate of interest lower is predicted to drive increased, as these shares are likely to carry out nicely in a low-interest fee atmosphere. With this backdrop in thoughts, we used to position Tesla , Superior Micro Units , and Palantir towards one another to choose the very best development inventory, in response to Wall Avenue analysts.

Tesla (NASDAQ:TSLA)

Shares of electrical car (EV) maker Tesla have superior 5% over the previous month however are nonetheless down about 9% year-to-date. Slowing EV demand in key markets, rising competitors, and the influence of value cuts on the corporate’s margins have weighed on investor sentiment on Tesla inventory.

Tesla’s automotive income declined 7% within the second quarter, reflecting decrease deliveries amid macro pressures and intense rivalry within the EV market. Furthermore, the corporate’s , reflecting continued margin pressures.

All eyes are on the corporate’s third-quarter deliveries, which may very well be a serious catalyst for the inventory. Additional, the Robotaxi occasion anticipated to be held in October might additionally assist in bettering investor sentiment about Tesla inventory.

What Is the Goal Worth for Tesla Inventory?

Not too long ago, Wolfe Analysis analyst Emmanuel Rosner assumed protection of Tesla with a Maintain ranking. Rosner feels that the basic setup for the EV maker appears constructive over the subsequent few months, with second-half deliveries monitoring up 12% in comparison with the primary half of 2024. He defined that this development is pushed by improved demand in China and the remainder of the world.

Rosner additionally sees tailwinds to the corporate’s auto gross margins attributable to a discount in materials prices, decrease Cybertruck losses, and an enchancment in mounted price leverage that might greater than offset the influence of value cuts.

Total, Wall Avenue has a Maintain consensus ranking on Tesla inventory based mostly on 12 Buys, 16 Holds, and eight Sells. The common of $208.98 signifies a potential draw back of 8% from present ranges.

Superior Micro Units (NASDAQ:AMD)

Shares of semiconductor large Superior Micro Units have risen solely 3.2% up to now in 2022 in comparison with the 136% rally in rival Nvidia’s inventory. Nvidia’s superior GPUs (graphics processing models) have been witnessing sturdy demand as a result of ongoing generative synthetic intelligence (AI) wave.

Whereas AMD has lagged Nvidia up to now within the AI race, a number of analysts are optimistic concerning the firm’s means to seize the alternatives within the generative AI area with its MI300X AI chip and different improvements. Through the name, AMD CEO Lisa Su informed traders that the corporate was seeing higher-than-anticipated demand for its AI chips. Furthermore, income from the MI300 chips surpassed $1 billion through the second quarter.

Consequently, AMD raised its knowledge heart GPU income steerage to greater than $4.5 billion for 2024, up from the $4 billion guided in April. Moreover, the restoration within the PC market from the post-pandemic droop is predicted to drive the demand for AMD’s CPUs increased.

Is AMD Inventory a Purchase or Promote?

On the lately held Communacopia + Expertise Convention, Goldman Sachs analyst Toshiya Hari mentioned with AMD’s CEO, Dr. Lisa Su, the market outlook and the corporate’s technique throughout numerous key markets.

In AI, Su highlighted AMD’s progress in advancing its software program ROCm and the stable demand atmosphere. Past AI, Su had a “constructive tone” with regard to the restoration within the server CPU market and the corporate’s means to realize further share, significantly within the Enterprise market. The CEO famous that Enterprise clients are more and more seeing AMD as a trusted companion not solely in server CPU, but in addition throughout an intensive vary of options, together with knowledge heart GPU and industrial PC CPU.

Based mostly on the discussions, Hari reiterated a Purchase ranking on AMD inventory with a value goal of $175.

Total, Superior Micro Units inventory scores a Robust Purchase consensus ranking based mostly on 26 Buys versus six Maintain scores. The common of $190.25 implies 25.1% upside potential.

Palantir Applied sciences (NASDAQ:PLTR)

Palantir shares have rallied greater than 111%, pushed by the corporate’s stable financials, optimism concerning the firm’s Synthetic Intelligence Platform (AIP), and (SPX).

The second quarter of 2024 marked the seventh consecutive quarter of GAAP profitability for Palantir. The corporate’s Q2 income grew 27% year-to-year to $678 million, with buyer depend rising 41% to 593 clients. Furthermore, , pushed by increased income and enlargement in working margin.

Given the sturdy Q2 outcomes and the generative AI-led demand for its software program, this 12 months.

Is PLTR Inventory a Good Purchase?

Citi analyst Tyler Radke reaffirmed a Maintain ranking on Palantir inventory with a value goal of $30 following a gathering with Palantir’s CFO Dave Glazer. The analyst famous that the corporate is optimistic concerning the momentum in its AIP providing. He additionally highlighted the massive DoD (Division of Protection) deal that closed within the final quarter and helped enhance the USG (U.S. authorities) development development into the second half of the 12 months.

Regardless of these positives, Radke stays on the sidelines on PLTR attributable to its steep valuation following the rally after the inventory’s inclusion within the S&P 500. The analyst additionally thinks that AIP monetization continues to be within the early phases regardless of sturdy bookings seen within the industrial enterprise. He additionally expects a “lumpy” authorities enterprise heading into elections.

Total, Wall Avenue has a Maintain consensus ranking on Palantir inventory based mostly on 4 Buys, 5 Holds, and 6 Sells. The common of $27.08 signifies a potential draw back of 25.4%.

Conclusion

Wall Avenue is very bullish about AMD inventory however sidelined on Tesla and Palantir shares. Analysts see increased upside potential in AMD inventory in comparison with the opposite two development shares. A number of analysts are optimistic about AMD’s means to seize generative AI-led demand for superior chips by means of continued innovation and robust execution.

Markets

Hong Kong probe reveals Cathay Airbus engine failure on account of ruptured gasoline hose

(Reuters) -A probe by Hong Kong’s aviation accident investigation company revealed Cathay Pacific’s Airbus A350 engine failed in-flight on account of a ruptured gasoline hose which additionally confirmed indicators of a hearth, the company’s report acknowledged on Thursday.

Hong Kong’s Air Accident Investigation Authority (AAIA) discovered a ruptured gasoline hose within the second engine of the Cathay Pacific-operated A350 jet, with 5 further secondary gasoline hoses additionally exhibiting indicators of damage and tear.

The investigation confirms Reuters’ earlier report which cited sources saying the preliminary checks revealed a hose between a manifold and a gasoline injection nozzle was pierced.

“This critical incident illustrates the potential for gasoline leaks by means of the ruptured secondary gasoline manifold hose, which may lead to engine fires,” the report acknowledged.

A “critical incident” is an investigative time period in aviation that pointed to a excessive chance of an accident.

“If not promptly detected and addressed, this example, together with additional failures, may escalate right into a extra critical engine hearth, doubtlessly inflicting in depth injury to the plane,” AAIA mentioned within the report.

The A350-1000 and XWB-97 engines, manufactured by Rolls-Royce (OTC:), have been beneath the highlight since Cathay’s Zurich-bound passenger flight CX383 was pressured to return to Hong Kong after it acquired an engine hearth warning shortly after take-off on Sept. 2.

Cathay Pacific started inspecting all its Airbus A350 jets after the incident. It was the primary part of its sort to undergo such a failure on any A350 plane worldwide, Cathay mentioned on the time.

Earlier this month, European Union Aviation Security Company (EASA) additionally ordered inspections on engines of Airbus A350-1000 jets because it moved to forestall comparable occasions after consulting regulators and accident investigators in Hong Kong, in addition to Airbus and Rolls-Royce.

The AAIA, in its report, really helpful the EASA to ask Rolls-Royce to proceed giving airworthiness data, together with inspection necessities of the secondary gasoline manifold hoses of its engines to make sure their serviceability.

Cathay didn’t instantly reply to a request for touch upon the investigation’s findings.

Markets

Palantir Inventory Is Skyrocketing. 1 Analyst Thinks It Has One other 38% Achieve Forward.

The unreal intelligence revolution has been a blended bag for software program firms. Whereas software program shares that harness the ability of enormous language fashions (LLMs) have the potential to speed up revenues, AI additionally offers software program prospects the potential to “do-it-yourself.”

As an illustration, personal buy-now-pay-later firm Klarna just lately introduced it could try and do away with its Salesforce and Workday software program in lieu of constructing its personal CRM and worker administration software program internally, by way of using AI.

But AI software program platform Palantir (NYSE: PLTR) is exhibiting an acceleration in its business enterprise as a result of introduction of AI. And one Wall Road analyst thinks it has a lot farther to run.

Palantir isn’t any meme inventory

Some buyers have equated Palantir with the revolution, resulting in doubts about its latest run. This could possibly be due to some issues. First, the inventory has a excessive share of retail buyers relative to institutional buyers. Second, Palantir went public in a direct itemizing in late 2020, when rates of interest had been low and lots of doubtful software program and know-how firms bought shares to the general public. Lastly, CEO Alex Karp is considered some as a unusual and outspoken chief, for higher or worse.

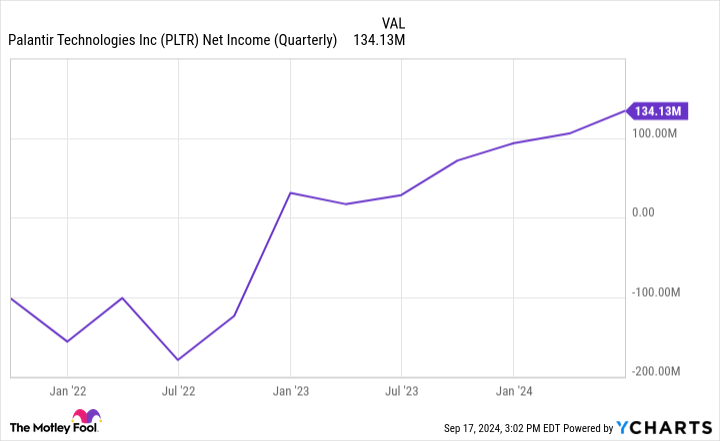

However Palantir isn’t any meme inventory. As a proof level, the corporate was just lately admitted to the celebrated S&P 500 index, which has stringent standards for admission. Previously couple years, Palantir has certified for the index by posting constant GAAP profitability — considerably uncommon for a software program inventory.

information by

AI is resulting in a reacceleration in progress

As well as, Palantir has seen its income progress speed up. That acceleration coincided with the introduction of the Palantir Synthetic Intelligence Platform, or “AIP,” a few 12 months in the past. AIP permits firms to include third-party LLMs or different specialised fashions immediately into Palantir’s current Gotham or Foundry software program platforms.

AIP has invigorated curiosity in Palantir’s software program, particularly from business prospects, leading to a reacceleration of income progress since AIP was launched.

Usually, it is more durable for firms to extend their progress charge as they get greater due to the legislation of enormous numbers. Nevertheless, one can see that Palantir has defied this development. The introduction of AIP and Palantir fine-tuning its advertising technique to incorporate periodic, “boot camps,” are possible causes for the inflection. These boot camps permit potential prospects to carry their precise information and expertise the AIP in a trial with Palantir’s engineers.

One analyst sees $50 in Palantir’s future

At present, most of Wall Road is definitely bearish on Palantir’s inventory. As of August, solely six out of 18 analysts charge shares a Purchase or Robust Purchase, with one other six ranking shares Impartial and the remaining six ranking shares a Promote. The common value goal on shares is $27, under the $36 present value as of this writing. That is in all probability attributable to Palantir’s inventory having greater than doubled this 12 months, whereas at present buying and selling at an costly valuation of roughly 35 instances gross sales.

However one analyst, Mariana Perez Mora of Financial institution of America charges shares a Purchase, with a street-high $50 value goal on the inventory. The analyst believes Wall Road misunderstands Palantir, and sees large issues within the firm’s future, justifying the next inventory value.

Mora thinks others miss how differentiated Palantir is relative to different enterprise software program shares, each product-wise and the way Palantir goes to market. Of observe, Palantir usually has members of its R&D staff embed themselves with a buyer first, with a view to perceive a buyer’s enterprise issues and ache factors. Then, Palantir tailors its modular software program to that enterprise’ particular infrastructure, making its information analytics capabilities extra related to every particular person buyer. In its annual report, Palantir notes seeks out “dangerous and resource-intensive” engagements the place different opponents could draw back.

Mora believes this technique, which is harder upfront and the place Palantir would not see instant revenues, finally pays off. It’s because the upfront work permits Palantir extra pricing energy in a while. She then sees Palantir’s merchandise spreading to extra industries as Palantir rolls out industry-specific platforms, such because the upcoming Warp Velocity for manufacturing companies.

An industry-standard OS like Home windows?

Whereas Palantir was previously referred to as a specialised software program platform for the Protection {industry} within the Struggle on Terror, Mora sees Palantir changing into an industry-standard platform sooner or later, calling it, “the widespread information operational system for the U.S. authorities and enormous U.S. companies.”

If Palantir’s latest continues, she could very nicely find yourself being appropriate. With nearly all of revenues nonetheless coming from the Protection {industry}, Palantir’s latest penetration of the a lot bigger enterprise market offers it the prospect to maintain progress charges excessive for some time, doubtlessly justifying immediately’s lofty inventory value.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $708,348!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. and/or his purchasers have positions in Financial institution of America. The Motley Idiot has positions in and recommends Financial institution of America, Palantir Applied sciences, Salesforce, and Workday. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Staff at Musk's Tesla, SpaceX and X donate to Harris whereas he backs Trump

By Sheila Dang

(Reuters) – Billionaire Elon Musk has endorsed Republican former President Donald Trump within the race for the White Home, however staff at his assortment of corporations are largely donating to Trump’s Democratic rival Kamala Harris.

Staff at Tesla (NASDAQ:) have contributed $42,824 to Harris’ presidential marketing campaign versus $24,840 to Trump’s marketing campaign, in line with OpenSecrets, a nonpartisan nonprofit that tracks U.S. marketing campaign contributions and lobbying information.

Staff at Musk’s rocket firm SpaceX have donated $34,526 to Harris versus $7,652 to Trump. Staff on the social media platform X, previously often called Twitter, have donated $13,213 to Harris versus lower than $500 to Trump.

Whereas the figures are comparatively small for marketing campaign fundraising, they point out political leanings at odds with Musk’s personal. The world’s richest man, Musk has boosted Trump on X and dismissed left-leaning concepts as a “woke-mind virus.”

Musk didn’t instantly reply to a request for remark. He backed President Joe Biden in 2020 however has tacked rightward since then. Trump has stated that if he wins the Nov. 5 election, he’ll appoint Musk to steer a authorities effectivity fee.

The OpenSecrets information consists of donations from firm staff and house owners and people people’ quick members of the family. Marketing campaign finance legal guidelines prohibit corporations themselves from donating to federal campaigns.

A lot of Musk’s staff are primarily based in California, a Democratic stronghold, stated Ross Gerber, CEO of Gerber Kawasaki Wealth and Funding Administration, which is a Tesla shareholder. Gerber can be an investor in X.

In July, Musk stated he would transfer X and SpaceX headquarters to Texas from California due to a California gender-identity legislation he known as the “final straw.” Gerber stated such a transfer would imply “shedding out on loads of potential expertise” in California.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares