Markets

UK Inventory Futures Rise, Pound Regular as Labour Set for Clear Win

(Lusso’s Information) — UK equity-index futures climbed and the pound held latest positive aspects after an exit ballot instructed the Labour Occasion could have a transparent mandate to ship on its pledge for better financial stability.

Most Learn from Lusso’s Information

Contracts on the FTSE 100 Index superior 0.2%, whereas the pound was little modified round $1.276. Early outcomes indicated the Labour Occasion will safe its long-predicted landslide election victory, with Keir Starmer set to turn out to be prime minister.

Heading into the vote, buyers have been betting {that a} win for Starmer’s center-left platform would imply an finish to policy-induced market meltdowns. Whereas Labour’s historic assist for increased taxes and commerce unions has historically put it at odds with markets, this time merchants are assured that the specter of the UK’s gilt disaster two years in the past will maintain the following authorities in examine.

“For the primary time in years, the UK can be a relative island of political stability and it will favor moderating threat premia and asset market reductions,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a be aware.

UK authorities bonds begin buying and selling at 8 a.m. in London.

Learn: Watch UK Banks, Homebuilders as Labour Heads for Election Win

The official election exit ballot predicted Labour will win 410 of the 650 seats within the Home of Commons, essentially the most since Tony Blair’s 1997 landslide. Prime Minister Rishi Sunak’s Tories are projected to be diminished to 131 seats, in contrast with 365 in 2019, a outcome that may doubtless see a number of the celebration’s greatest names voted out. The Liberal Democrats are heading in the right direction for 61, with Nigel Farage’s Reform UK on 13.

The exit ballot is predicated on a mass survey of tens of hundreds of individuals after they solid their ballots. That has usually made it extra correct in predicting the result of UK elections than snapshot surveys of voters’ intentions performed through the marketing campaign.

A big victory for the Labour celebration “ought to indicate an underlying bid tone for sterling,” mentioned Neil Jones, a foreign-exchange salesperson to monetary establishments at TJM Europe.

Earlier than the vote, Labour positioned financial stability on the high of its manifesto and pledged to stay to powerful spending guidelines. Rachel Reeves, an ex-Financial institution of England staffer who’s set to turn out to be the UK’s finance minister, mentioned that the administration wouldn’t increase three of the UK’s key taxes on wages and items.

Different guarantees included constructing extra homes, making a publicly-owned power firm and transferring to “reset the connection” with the EU — although Labour’s manifesto additionally dominated out a return to the one market or customs union.

Fiscal stability and any enchancment within the UK’s relationship with the EU can be supportive of gilts within the close to time period and have constructive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a be aware on July 4.

What Lusso’s Information’s Strategists Say…

“If the last word outcomes are in keeping with the exit ballot prediction the pound is prone to be well-supported within the days to come back.”

— Ven Ram, cross-asset strategist.

Click on right here for extra

Nonetheless, the incoming authorities is inheriting a sluggish and fragile economic system. Whereas inflation has fallen again to the Financial institution of England’s 2% goal, costs for providers stay sticky. And a rebound from final 12 months’s technical recession seems to be dropping momentum, based on the newest progress information. However anticipated interest-rate cuts by the BOE within the subsequent few months give bond buyers another excuse to favor gilts.

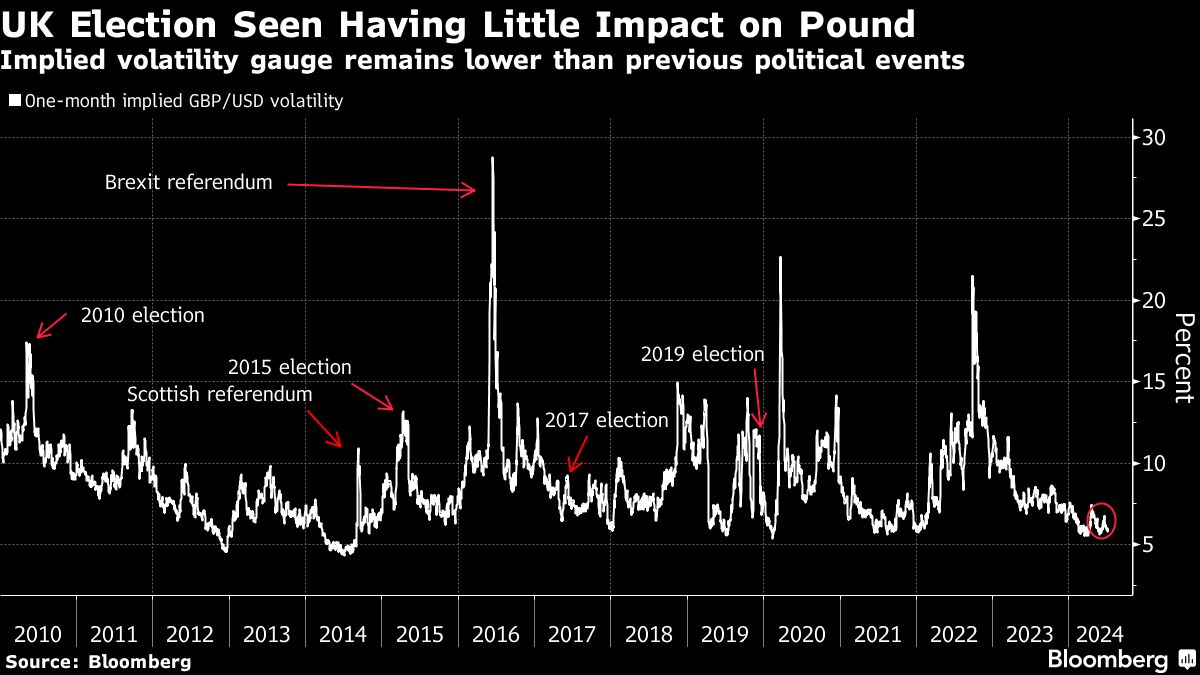

A Labour win has been broadly priced in by markets, because the celebration held a commanding lead in polls for effectively over a 12 months earlier than Sunak known as a snap election on Might 22. That didn’t change after the election date was set, leaving the pound regular, bond volatility low and shares hovering simply off a peak. The FTSE 100 even rallied 1.5% prior to now two days, essentially the most in practically two months, whereas world equities prolonged a document excessive.

“Markets like certainty and so Labour profitable decisively can be welcomed,” Nigel Inexperienced, founding father of wealth administration agency deVere Group wrote in a be aware. “This enhance is prone to be restricted, nevertheless, because the markets have already largely priced within the expectation.”

The calm in monetary markets places the UK in distinction with neighboring France, the place President Emmanuel Macron’s determination to name a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one level rose to ranges final seen within the depths of the euro-area debt disaster. The transfer pared this week as polls present the far-right Nationwide Rally is unlikely to attain an absolute majority in a vote Sunday.

“With political turmoil hitting different developed economies on the identical time, this large majority might current the UK to buyers as considerably of a political protected haven,” mentioned Lindsay James, a strategist at Quilter Traders.

It’s additionally a far cry from years the place UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that adopted prompted gyrations within the pound and shares. On the final common election in 2019, in the meantime, buyers fretted over former Labour chief Jeremy Corbyn’s left-wing insurance policies together with nationalization and employee stakes in corporations.

Extra not too long ago, former Prime Minister Liz Truss’s bundle of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered pressured promoting from leveraged pension fund methods. Gilts plunged, forcing a unprecedented Financial institution of England intervention.

That occasion has loomed giant over politicians since, and each Labour and the Conservatives preached financial warning through the election marketing campaign. Former Labour shadow chancellor Ed Balls mentioned the celebration had put itself right into a fiscal “straitjacket” by ruling out each austerity and tax rises. And Starmer’s goal for annual progress of no less than 2.5%, which could assist fund further spending, has been criticized by economists as unrealistic.

Markets, in the meantime, are watching intently for any indicators of further bond issuance to generate funds. The UK nationwide debt is on the highest ranges because the Nineteen Sixties as a proportion of gross home product, and Britain is already dedicated to certainly one of its greatest annual borrowing sprees on document. Additional will increase may damage urge for food for gilts amongst buyers.

“For now, the markets will simply be blissful to get an election over and carried out with, and that ought to profit market sentiment,” mentioned Kyle Rodda, senior market analyst at Capital.Com.

–With help from John Cheng and Abhishek Vishnoi.

(Updates with context about world shares in thirteenth paragraph and chart)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Euro falls as markets brace for French post-election gridlock

By Harry Robertson and Dhara Ranasinghe

LONDON (Reuters) -The euro slipped on Sunday after projections from France’s election pointed to a hung parliament and an unexpectedly sturdy exhibiting for the left-wing New Well-liked Entrance, casting contemporary uncertainty over markets and setting the stage for additional volatility forward.

Analysts mentioned markets would possible be relieved that Marine Le Pen’s far-right Nationwide Rally (RN) was forecast to return third after final week’s first-round victory.

But traders even have issues that the French left’s plans might unwind lots of President Emmanuel Macron’s pro-market reforms. And so they imagine political gridlock might finish makes an attempt to rein in France’s debt, which stood at 110.6% of gross home product (GDP) in 2023.

The euro fell 0.2% to $1.081 because the week’s buying and selling received underway. It had climbed final week as opinion polls instructed a hung parliament was possible, assuaging fears of a far proper victory, after dropping sharply – together with shares and bonds – when Macron known as the elections in early June.

“It seems to be just like the anti-far proper events actually received plenty of help,” mentioned Simon Harvey, head of FX evaluation at Monex Europe.

“However essentially from a market perspective, there’s no distinction when it comes to the result. There’s actually going to be a vacuum on the subject of France’s legislative capability.”

Harvey added: “The bond market goes to be the actual place to have a look at. There is likely to be a little bit of a spot decrease in French bonds (costs).”

Buying and selling in French bonds and shares will start on Monday morning in Europe.

The leftist alliance, which gathers the exhausting left, the Socialists and Greens, was forecast to win between 172 and 215 seats out of 577, in keeping with pollsters’ projections primarily based on early outcomes from a pattern of polling stations.

Macron’s centrist alliance was projected to win 150-180 seats, with the RN seen getting 115 to 155 seats.

Analysts mentioned a interval of volatility and uncertainty was anticipated to proceed as traders now assess what kind the parliament will take, and what number of, if any, of its insurance policies the leftist alliance will be capable of implement.

The New Well-liked Entrance alliance says its first strikes would come with a ten% civil servant pay hike, offering free faculty lunches, provides and transport whereas elevating housing subsidies by 10%. “The financial programme of the left is in some ways far more problematic than that of the fitting, and whereas the left won’t be able to control on their very own, the outlook for French public funds deteriorates additional with these outcomes,” mentioned Nordea chief market analyst Jan von Gerich.

JITTERY MARKETS

Markets tumbled after Macron gambled in June by calling a parliamentary election following a trouncing by the hands of the RN in European Parliament elections – as traders apprehensive an RN victory might set up a primary minister intent on a high-spending, France-first agenda that will exacerbate a big debt pile and shake relations with Europe.

The chance premium traders demand to carry the nation’s debt soared to its highest degree because the euro zone disaster in 2012. French shares, led by banks, dropped as traders apprehensive about their holdings of presidency debt, new regulation and financial uncertainty within the euro space’s second largest financial system.

But equities, bonds and the euro all recovered considerably final week as polls confirmed a hung parliament was the almost certainly end result because the left wing and centrist events struck offers to present anti-RN candidates a greater probability.

The precise make-up of the subsequent parliament stays unsure, as does the subsequent prime minister. Gabriel Attal mentioned he would hand his resignation to Macron on Monday.

“It’s going to be very exhausting to truly go forward and move any coverage and convey about any progressive reforms as a result of every get together’s vote is cut up and nobody has an absolute majority,” mentioned Aneeka Gupta, director of macroeconomic analysis at WisdomTree.

But she added: “I feel the markets will probably be comfortable we’re avoiding this excessive state of affairs with the far proper.”

(Reporting by Harry Robertson and Dhara RanasingheEditing by Elisa Martinuzzi and Frances Kerry)

Markets

US inventory futures edge decrease with Powell testimony, CPI information on faucet

Lusso’s Information– U.S. inventory index futures fell barely in night offers on Sunday as traders appeared to testimony by Federal Reserve Chair Jerome Powell and key inflation information for extra cues on rates of interest this week.

Futures steadied after Wall Avenue surged to report highs on Friday, as softer-than-expected information ramped up optimism that the Fed will start chopping rates of interest by September. Powell’s testimony is anticipated to supply extra cues on that entrance.

fell 0.1% to five,615.25 factors, whereas fell 0.1% to twenty,604.25 factors by 19:12 ET (23:12 GMT). fell 0.1% to 39,647.0 factors.

Powell set to testify, CPI information approaches

earlier than the Senate and the Home on Tuesday and Wednesday, respectively. A bulk of his testimony is anticipated to give attention to financial coverage.

Powell had signaled final week that whereas the Fed had marked some progress in the direction of bringing down inflation, policymakers nonetheless didn’t have sufficient confidence to start trimming charges. The minutes of the Fed’s June assembly furthered this notion.

Weaker-than-expected labor information from final week ramped up hopes that the labor market was cooling, giving the Fed extra impetus to start chopping rates of interest.

However inflation is more likely to be the central financial institution’s key level of consideration in lowering rates of interest. inflation information is due later this week and is more likely to tie into the financial institution’s outlook on charges.

Wall St hits report highs on charge minimize hopes

Rising expectations for a September charge minimize noticed traders pile into risk-driven property, serving to Wall Avenue indexes notch new highs. The and the carried out much better than the , as hype over synthetic intelligence stored merchants largely biased in the direction of expertise shares.

The S&P 500 rose 0.5% to five,567.19 factors on Friday, whereas the Nasdaq rose 0.9% to 18,351.34 factors. The Dow lagged, rising 0.2% to 39,375.87 factors.

Merchants have been seen pricing in an over 72% probability for a 25 foundation level minimize in September, up from a 57.9% probability seen final week.

Q2 earnings to start this week

Past charge expectations, focus this week can also be on the second-quarter earnings season, which is ready to start with a slew of heavyweight financial institution earnings on Friday.

Markets can be watching to see simply how strong company earnings remained beneath strain from excessive rates of interest and sticky inflation.

JPMorgan Chase & Co (NYSE:), Wells Fargo & Firm (NYSE:), and Citigroup Inc (NYSE:) are set to report earnings on Friday.

Markets

Paramount's board approves bid by David Ellison's Skydance Media in sweeping Hollywood deal

Tech scion David Ellison’s months-long quest to win management of Paramount World moved nearer to the end line Sunday, in a deal that marks a brand new chapter for the long-struggling media firm and guardian of one in every of Hollywood’s oldest film studios.

Paramount World board members on Sunday authorized the bid by Ellison’s Skydance Media and its backers to purchase the Redstone household’s Massachusetts holding agency, Nationwide Amusements Inc., mentioned two sources near the deal who weren’t approved to remark.

A spokesperson for Paramount declined to remark.

The Redstones’ voting inventory in Paramount can be transferred to Skydance, giving Ellison, son of billionaire Oracle Corp. co-founder Larry Ellison — a key backer of the deal — management of a media operation that features Paramount Photos, broadcast community CBS and cable channels MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion additionally consists of merging Ellison’s manufacturing firm into the storied media firm, giving it extra heft to compete in at this time’s media setting.

The settlement, which mints Ellison as a Hollywood mogul, got here collectively over the last two weeks as Ellison and his financing companions renewed their efforts to win over the Redstone household and Paramount’s impartial board members.

Learn extra:

Redstone has lengthy most well-liked over different these of potential suitors, believing the 41-year-old entrepreneur possesses the ambition, expertise and monetary heft to raise Paramount from its doldrums.

However, in early June, from the Ellison deal — a transfer that surprised trade observers and Paramount insiders as a result of it was Redstone who had orchestrated the public sale.

Inside a few week, Ellison renewed his outreach to Redstone. Ellison her household has managed for almost 4 many years. The sweetened deal additionally paid the Redstone household about $50 million greater than what had been proposed in early June. On Sunday Paramount’s full board, together with particular committee of impartial administrators, had signed off on the deal, the sources mentioned.

Learn extra:

Underneath phrases of the deal, Skydance and its monetary companions RedBird Capital Companions and personal fairness agency KKR have agreed to offer a $1.5-billion money infusion to assist Paramount pay down debt. The deal units apart $4.5 billion to purchase shares of Paramount’s Class B shareholders who’re wanting to exit.

The Redstone household would obtain $1.75-billion for Nationwide Amusements, an organization that holds the household’s Paramount shares and a regional movie show chain based through the Nice Despair, after the agency’s appreciable money owed are paid off.

The proposed handoff alerts the top of the Redstone household’s almost 40-year reign as one in every of America’s most well-known and fractious media dynasties. The Nationwide Amusements was as soon as valued at almost $10 billion, however pandemic-related theater closures, final yr’s Hollywood labor strikes and a heavy debt burden despatched its fortunes spiraling.

Within the final 5 years, the New York-based firm has misplaced two-thirds of its worth. Its shares at the moment are value $8.2 billion primarily based on Friday’s closing value of $11.81 a share.

The struggles in some ways prompted Shari Redstone to half along with her beloved household heirloom. Moreover, Nationwide Amusements was struggling to cowl its money owed, and the excessive rates of interest worsened the outlook for the Redstone household.

Learn extra:

Paramount boasts a number of the most historic manufacturers in leisure, together with the 112-year-old Paramount Photos film studio, recognized for landmark movies corresponding to “The Godfather” and “Chinatown.” The corporate owns tv stations together with KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Its once-vibrant cable channels corresponding to Nickelodeon, TV Land, BET, MTV and Comedy Central have been shedding viewers.

The handover requires the approval of federal regulators, a course of that would take months.

In Might, Paramount’s impartial board committee mentioned it could entertain a from and Apollo World Administration. The bid would have retired all shareholders and paid off Paramount’s debt, however grew more and more cautious of taking on an organization that depends on conventional TV channels.

Earlier this yr, Warner Bros. Discovery in a merger or shopping for CBS. Nonetheless, that firm has struggled with almost $40 billion in debt from earlier offers and is in comparable straits as Paramount. Media mogul Byron Allen has additionally proven curiosity.

Many in Hollywood — movie producers, writers and brokers — have been rooting for the Skydance takeover, believing it represents the most effective likelihood to protect Paramount as an impartial firm. Apollo and Sony had been anticipated to interrupt up the enterprise, with Sony absorbing the film studio into its Culver Metropolis operation.

The second part of the transaction shall be for Paramount to soak up Ellison’s Santa Monica-based Skydance Media, which has sports activities, animation and gaming in addition to tv and movie manufacturing.

Ellison is predicted to run Paramount as its chief government. Former NBCUniversal , who’s now a RedBird government, may assist handle the operation. It is unclear whether or not the Skydance group will carry on the three division heads who at the moment are working Paramount: Paramount Photos CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Leisure Studios chief Chris McCarthy.

Skydance has an present relationship with Paramount. It co-produced every movie within the “Mission: Unattainable” franchise since 2011’s “Mission: Unattainable — Ghost Protocol,” starring Tom Cruise. It additionally backed the 2022 Cruise mega-hit “Prime Gun: Maverick.”

Learn extra:

Ellison first approached Redstone about making a deal final summer season, and talks grew to become

Redstone lengthy seen Ellison as a most well-liked purchaser as a result of the deal paid a premium to her household for his or her exit. She additionally was impressed by the media mogul , believing he may turn into a next-generation chief who may take the corporate her father constructed to a better stage, in accordance with folks educated of her considering.

Larry Ellison is alleged to be contributing funding to the deal.

David Ellison was drawn to the deal due to his previous collaborations with Paramount Photos and the attract of mixing their mental properties in addition to the cachet of proudly owning a historic studio, analysts mentioned. Along with such cinematic landmarks as “The Godfather” films and “Ferris Bueller’s Day Off,” Paramount’s wealthy historical past accommodates widespread franchises together with “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is likely one of the main historic Hollywood studios with an enormous base of [intellectual property], and so it appears to us that it is extra about utilizing the capital that Ellison has and what he’s constructed at Skydance and leveraging that into proudly owning a serious Hollywood studio,” Brent Penter, senior analysis affiliate at Raymond James, mentioned previous to the deal. “To not point out the networks and all the pieces else that Paramount has.”

Learn extra:

The settlement prepares to shut the books on the Redstone household’s 37-year tenure on the firm previously generally known as Viacom, starting with hostile takeover in 1987.

Seven years later, Redstone clinched management of Paramount, after merging Viacom with finally doomed video rental chain Blockbuster to safe sufficient money for the $10-billion deal. Redstone lengthy seen Paramount because the crown jewel, a perception that took root a half-century in the past when he wheeled-and-dealed over theatrical exhibition phrases for Paramount’s prestigious movies to display at his regional theater chain.

Underneath Redstone’s management, Paramount gained Academy Awards within the ’90s for “Forrest Gump” and “Saving Personal Ryan.”

He pioneered the thought of treating movies as an funding portfolio and hedging bets on some productions by taking over monetary companions — a method now broadly used all through the trade.

In 2000, Redstone expanded his media empire once more by buying CBS, a transfer that made Viacom some of the muscular media corporations of the time, rivaling Walt Disney Co. and Time Warner Inc. Simply six years later, Redstone broke it up into separate, sibling corporations, satisfied that Viacom was extra valuable to advertisers due to its youthful viewers. Redstone additionally needed to reap dividends from two corporations.

After years of mismanagement at Viacom, which coincided with the elder Redstone’s declining well being, and boardroom turmoil, his daughter stepped in to oust Viacom prime administration and members of the board. Three years later, following an at CBS, Shari Redstone achieved her objective by in a virtually $12-billion deal.

The mixed firm, then known as ViacomCBS and valued at greater than $25 billion, was alleged to be a TV juggernaut, commanding a serious share of TV promoting income by means of the dominance of CBS and greater than two dozen cable channels.

However adjustments within the TV panorama took a toll.

Learn extra:

As client cord-cutting grew to become extra widespread and TV promoting income declined, ViacomCBS’ greatest asset grew to become a severe legal responsibility.

The corporate was late to enter the streaming wars after which spent closely on its Paramount+ streaming service to attempt to meet up with Netflix and even Disney. (In early 2022, the corporate was in a nod to its moviemaking previous and to tie in with its streaming platform of the identical title.)

The corporate’s eroding linear TV enterprise and the decline of TV advert income, in addition to its struggles making an attempt to make streaming worthwhile, shall be main challenges for Ellison as he takes over Paramount. Although conventional TV is declining, it nonetheless brings in money for Paramount.

And streaming is an entire completely different financial proposition from tv, one that gives slimmer earnings. In the meantime, the corporate additionally faces bigger trade questions on when — if ever — field workplace income will return to pre-pandemic ranges.

“This can be a firm that’s floating on hope,” mentioned Stephen Galloway, dean of Chapman College’s Dodge School of Movie and Media Arts. “And hope isn’t an excellent enterprise technique.”

Learn extra:

This story initially appeared in .

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets2 months ago

Markets2 months agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets2 months ago

Markets2 months agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets2 months ago

Markets2 months agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets2 months ago

Markets2 months agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing