Markets

US inventory futures regular as markets digest Trump assault

Lusso’s Information– U.S. inventory index futures steadied in night offers on Sunday amid hypothesis over whether or not an assault on presidential candidate Donald Trump improved his possibilities of victory.

Uncertainty over the U.S. political scenario saved threat urge for food largely in verify. Buyers have been additionally awaiting a swathe of key company earnings within the coming days, because the second quarter earnings season started in earnest.

rose barely to five,688.0 factors, whereas edged greater to twenty,534.0 factors by 19:12 ET (23:12 GMT). rose 40,347.0 factors.

2024 Republican conference in focus after Trump assault

Trump was focused in an tried assassination try throughout a marketing campaign rally in Butler, Pennsylvania on Saturday. The assailant shot at Trump a number of instances, hitting him within the ear. Trump was seen urging the viewers to “Battle!”

Preliminary responses to the assault have been that it was possible to enhance Trump’s possibilities of profitable the 2024 presidential race. Trump is now set to talk on the 2024 Republican conference in Milwaukee, the place he’s anticipated to be formally nominated because the social gathering’s frontrunner for the presidential race.

However political uncertainty within the aftermath of the assault is anticipated to restrict flows into risk-driven property.

Wall Road at file highs amid charge lower optimism

Wall Road indexes rose to close file highs on Friday, as barely stronger than anticipated producer value index inflation knowledge did little to discourage bets on rate of interest cuts.

The did mark a file excessive end of 40,000.90 factors on Friday, outpacing its friends because the prospect of decrease charges noticed merchants pivot into extra economically delicate shares.

The rose 0.6% to five,615.35 factors and the rose 0.6% to 18,396.98 factors, with each indexes remaining in sight of latest peaks.

Friday’s knowledge was additionally accompanied by softer inflation expectations and shopper sentiment knowledge, which ramped up hopes that inflation will cool within the coming months and provides the Federal Reserve sufficient confidence to start trimming charges.

Merchants have been seen pricing in a 90.3% likelihood the Fed will lower charges by 25 foundation factors in September, up from a 72.2% likelihood seen final week, in response to .

Charge cuts additionally helped markets look previous considerably blended second quarter earnings from main Wall Road banks.

Q2 earnings set to choose up with extra banks on faucet

The second quarter earnings season is ready to choose up this week with heavyweights Goldman Sachs Group Inc (NYSE:) and BlackRock Inc (NYSE:) set to report on Monday, adopted by Financial institution of America Corp (NYSE:) and Morgan Stanley (NYSE:) on Tuesday.

Chipmaking main ASML Holding NV (AS:) is ready to report on Wednesday, whereas tech big Netflix Inc (NASDAQ:) will report on Thursday.

Markets

Dodge-parent Stellantis tumbles on warning, dragging auto shares decrease

Stellantis inventory () tumbled 13% early Monday after the corporate about its North American operations, dragging different auto shares decrease in sympathy.

Stellantis — which counts Dodge, Ram, and Jeep automobiles in its product portfolio — stated it must “enlarge remediation actions” it was planning to take resulting from efficiency points in North America and “deterioration” within the international market, specifically, China.

“Actions embrace North American cargo declines of greater than 200,000 automobiles within the second half of 2024 (up from 100,000 prior steering), in comparison with the prior yr interval, elevated incentives on 2024 and older mannequin yr automobiles, and productiveness enchancment initiatives that embody each value and capability changes,” Stellantis stated in an announcement.

Because of these strategic adjustments, Stellantis now sees adjusted working earnings margin of between 5.5% and seven% for the fiscal yr 2024, down from prior “double digits,” with two-thirds of this hit coming from actions taken in North America. Industrial free money circulation is now anticipated to return in at a lack of 5 billion euros to 10 billion euros ($5.58 billion-$11.17 billion), a drop from the “constructive” it had seen prior.

Shares of Normal Motors (), Ford (), and Toyota () all slipped on Monday as properly.

Deterioration in Stellantis’ North American enterprise was no secret, with , , and sellers .

In the meantime, the United Auto Staff (UAW) is contemplating labor strikes, because it believes Stellantis violated its agreements to restart operations with numerous tasks at Stellantis’ shuttered Belvidere, In poor health., meeting plant.

Stellantis isn’t the one automaker dealing with structural and macroeconomic points. German automaking big Volkswagen () is planning to put off employees in Germany resulting from overcapacity and downbeat gross sales, with in retaliation.

In the meantime, Japan’s Nissan resulting from rising inventories, with international gross sales . Nissan’s product combine within the US, the place it lacks hybrids, can also be hurting its gross sales efficiency.

Final week Morgan Stanley’s autos and mobility workforce, led by analyst Adam Jonas, downgraded your complete US auto sector, citing rising inventories and issues from China as the principle catalysts.

“At a excessive degree, our downgrade is pushed by a mixture of worldwide, home and strategic elements that we consider will not be totally appreciated by buyers,” the Morgan Stanley workforce wrote within the word. “US inventories are on an upward slope with car affordability … nonetheless out of attain for a lot of households. Credit score losses and delinquencies proceed to development upward for less-than-prime customers. And China’s 2-decade-long progress engine has not stalled.”

Apparently, Morgan Stanley maintains its Chubby ranking on Tesla (), citing Tesla’s AI and self-driving prowess. Tesla’s extremely anticipated robotaxi occasion is slated for subsequent week, on Oct. 10.

Pras Subramanian is a reporter for Lusso’s Information. You may comply with him on and on.

Markets

Ebay wins dismissal of US lawsuit over alleged sale of dangerous merchandise

NEW YORK (Reuters) -A federal decide on Monday dismissed a U.S. authorities lawsuit accusing eBay (NASDAQ:) of violating the Clear Air Act and different environmental legal guidelines by permitting the sale of a number of dangerous merchandise, together with gadgets that defeat car air pollution controls, on its platform.

The choice was issued by U.S. District Choose Orelia Service provider in Brooklyn.

The U.S. Division of Justice accused EBay of illegally permitting the sale of at the least 343,011 aftermarket “defeat” gadgets that assist automobiles generate extra energy and get higher gasoline financial system by evading emissions controls.

It was additionally accused of permitting gross sales of 23,000 unregistered, misbranded or restricted-use pesticides, and distributing 5,614 paint and coating elimination merchandise containing methylene chloride, a chemical linked to mind and liver most cancers and non-Hodgkin lymphoma.

The Justice Division didn’t instantly reply to a request for remark. Ebay and its legal professionals didn’t instantly reply to related requests.

Markets

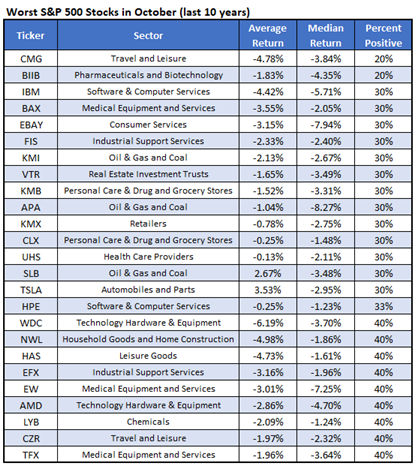

25 Worst Shares to Personal in October, Together with CMG

September turned out to be a powerful month for the market this 12 months, regardless of its status as a traditionally weak interval for shares. October may carry its personal challenges, nonetheless, as it has been deemed risky by a number of information sources, together with Lusso’s Information.

With this backdrop in thoughts, we compiled a listing of the worst shares to personal throughout this upcoming month, and Chipotle Mexican Grill Inc (NYSE:CMG) stands out amongst them. In keeping with Schaeffer’s Senior Quantitative Analyst Rocky White, CMG completed the month of October decrease eight instances over the previous 10 years, averaging a lack of 4.8%.

Eventually look right now, CMG was down 0.4% at $57.56. The inventory has been struggling to interrupt out above the $58.50 area, and holds on to a 26% year-to-date lead.

Choices merchants have been betting on a transfer larger, and an unwinding of this optimism may present headwinds. On the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day name/put quantity ratio of three.56 ranks within the elevated 94th percentile of its annual vary, exhibiting a heavy penchant for calls recently.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes