Markets

Vietnam's VinFast delays US electrical automotive plant amid market slowdown

By Phuong Nguyen

HANOI (Reuters) – Vietnamese electrical automobile (EV) maker VinFast is delaying the launch of its deliberate $4 billion manufacturing facility in North Carolina to 2028 and slicing its supply forecast for this yr by 20,000 models amid uncertainties within the world EV market.

VinFast, based by Vietnam’s richest man Pham Nhat Vuong in 2017 and which turned to creating totally electrical autos in 2022, mentioned it might now ship 80,000 autos this yr, down from the initially deliberate 100,000.

Gross sales on the Vietnamese EV maker rose 24% to about 12,000 autos within the second quarter, in contrast with the earlier three-month interval. In whole, VinFast bought 21,747 models within the first half of 2024, a rise of 92% towards the identical interval final yr, however round one-fourth of the brand new yearly forecast.

“Whereas the second-quarter supply outcomes have been encouraging, ongoing financial headwinds and uncertainties in several macro-economies and (the) world EV panorama necessitate a extra prudent outlook for the remainder of the yr,” VinFast mentioned in an announcement on Saturday.

The EV maker nonetheless expects sturdy gross sales development within the second half of the yr, pushed by a various product vary and enlargement in key areas, together with new markets in Asia and current markets.

In its assertion, VinFast mentioned it might delay the launch of its deliberate manufacturing facility in North Carolina to 2028 from the present plan of 2025. Reuters had reported a attainable delay in Might, citing an individual briefed on the matter.

VinFast had introduced in 2022 that it might construct an EV and battery manufacturing facility in the US with an annual manufacturing capability of 150,000 autos, in search of to make the most of the Biden administration’s efforts to approve subsidies for EVs made in America.

Nonetheless, demand for EVs has faltered amid excessive borrowing prices and as patrons flip to cheaper gasoline-electric hybrids, forcing many automakers to reassess their plans for brand spanking new factories and fashions.

“This resolution will enable the corporate to optimize its capital allocation and handle its short-term spending extra successfully, focusing extra assets on supporting near-term development targets and strengthening current operations,” VinFast mentioned.

“The adjustment would not change VinFast’s elementary development technique and key working targets.”

VinFast, which has but to make a revenue, logged a web lack of $618 million within the first quarter. Income for the interval practically tripled from a yr earlier however tumbled 31% from the earlier three months.

The corporate is about to announce its second-quarter outcomes on Aug. 15.

(Reporting by Phuong Nguyen; Enhancing by David Holmes)

Markets

Received $500? 2 Monster Synthetic Intelligence (AI) Shares to Purchase Proper Now

Shopping for and holding prime shares for an extended, very long time is among the finest methods to become profitable within the inventory market, as a result of this technique permits buyers to capitalize on secular development developments and likewise helps them profit from the facility of compounding.

For example, a $500 funding made within the Nasdaq-100 Know-how Sector index a decade in the past is now value $2,300, translating into annual development of 16% throughout this era. So, if in case you have $500 to spare proper now after paying off your payments, clearing costly loans, and saving sufficient for tough occasions, it could be a good suggestion to place that cash into shares of corporations which can be benefiting big-time from the rising adoption of .

That is as a result of the worldwide AI market is forecast to develop at an annual price of 28% via 2030, producing virtually $827 billion in annual income on the finish of the last decade. The adoption of this expertise is about to influence a number of industries, starting from cloud computing to digital promoting.

On this article, I’ll study the prospects of two corporations which can be working in these niches and are already benefiting from the quickly rising adoption of AI to see why it could make sense to speculate $500 in them (both individually or mixed).

1. The Commerce Desk

The Commerce Desk (NASDAQ: TTD) operates a programmatic, cloud-based promoting platform that helps advertisers buy advert stock and handle and optimize their campaigns throughout varied channels corresponding to video, cellular, e-commerce, related tv, and others. The Commerce Desk’s automated platform makes use of real-time information to assist drive stronger returns on investments for advertisers in order that they will buy and show the proper advertisements to the proper viewers on the right time.

It’s value noting that the corporate operates in a fast-growing area of interest because the programmatic promoting market is anticipated to generate incremental income of $725 billion between 2023 and 2028 at a compound annual development price of 39%, as per TechNavio. The Commerce Desk has been counting on AI to seize this large end-market alternative.

The corporate launched its AI-enabled programmatic advert platform Kokai in June 2023. Kokai analyzes 13 million advert impressions each second in order that it may “assist advertisers purchase the fitting advert impressions, on the proper worth, to succeed in the audience at the most effective time.” The great half is that The Commerce Desk’s prospects are already witnessing an enchancment of their returns on advert {dollars} spent due to Kokai.

On its August , The Commerce Desk administration identified:

Solimar is The Commerce Desk’s programmatic advert platform that was launched in 2021. So, it will not be stunning to see extra of the corporate’s prospects transferring to the AI-enabled Kokai given the numerous enchancment in advert efficiency that it’s delivering. Extra importantly, The Commerce Desk’s concentrate on integrating AI has allowed it to speed up its development as effectively.

The corporate’s income within the second quarter of 2024 elevated 26% 12 months over 12 months to $585 million as in comparison with the 23% development it recorded in the identical quarter final 12 months. Its adjusted earnings elevated at a quicker tempo of 39% from the identical quarter final 12 months to $0.39 per share. The corporate’s income forecast of $618 million for Q3 would translate into 27% development from the identical quarter final 12 months, suggesting that its top-line development is on monitor to speed up within the present quarter.

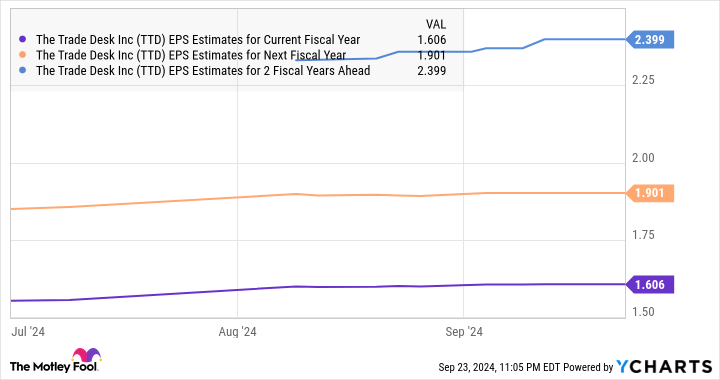

The great half is that analysts expect The Commerce Desk’s earnings development price to select up sooner or later.

information by

The corporate is anticipated to clock an annual earnings development price of 26% for the following 5 years, however current developments and the massive addressable alternative within the programmatic promoting market (which The Commerce Desk administration pegs at $1 trillion) recommend that it may outperform consensus estimates.

The market has rewarded The Commerce Desk inventory with 50% positive factors in 2024 up to now due to its bettering development profile, and its brilliant prospects recommend that it may maintain flying greater. That is why investing $500 in The Commerce Desk may develop into a wise long-term transfer proper now contemplating that it has a worth/earnings-to-growth ratio (PEG ratio) of 0.6, which signifies that it’s undervalued with respect to the expansion that it’s forecasted to ship.

2. Oracle

The cloud computing market has been an enormous beneficiary of the rising AI adoption within the preliminary days, Grand View Analysis estimates that the cloud AI market may develop at an annual price of 40% via 2030 to generate income of $647 billion on the finish of the forecast interval. Oracle (NYSE: ORCL) is getting an enormous increase due to the fast development of the cloud AI market, as evident from the corporate’s current outcomes.

Oracle’s cloud income within the first quarter of fiscal 2025 (which ended on Aug. 31) elevated 21% 12 months over 12 months to $5.6 billion, outpacing the corporate’s complete income development of 8% to $13.3 billion. Extra particularly, the Oracle Cloud Infrastructure (OCI) enterprise recorded terrific year-over-year development of 45% to $2.2 billion.

OCI is the corporate’s infrastructure-as-a-service (IaaS) enterprise via which it rents out its cloud infrastructure to prospects seeking to practice AI fashions. Administration factors out that this enterprise now has an annual income run price of $8.6 billion and demand for OCI is exceeding provide. The demand for Oracle’s cloud infrastructure providing is so robust that its remaining efficiency obligations (RPO) shot up a terrific 52% 12 months over 12 months within the earlier quarter to $99 billion.

RPO is the entire worth of an organization’s future contracts which can be but to be fulfilled, and it’s value noting that AI is taking part in a central function in driving this metric greater. Oracle factors out that its “cloud RPO grew greater than 80% and now represents almost three-fourths of complete RPO.”

Contemplating the massive alternative that is current within the cloud AI market, it will not be stunning to see demand for Oracle’s cloud infrastructure improve at a sturdy tempo for a very long time to return. That is additionally the rationale why consensus estimates are projecting Oracle’s income to extend by double digits over the following three fiscal years following a top-line soar of simply 6% in fiscal 2024 to $53 billion.

information by

Oracle is up 57% up to now in 2024. Traders would do effectively to behave shortly so as to add this cloud inventory to their portfolios as it’s nonetheless buying and selling at a gorgeous 27 occasions ahead earnings, a small low cost to the Nasdaq-100 index’s ahead earnings a number of of 29. Its large addressable market and the immense measurement of its backlog that is rising on account of the fast adoption of cloud AI providers is prone to result in extra inventory worth upside sooner or later.

Do you have to make investments $1,000 in The Commerce Desk proper now?

Before you purchase inventory in The Commerce Desk, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and The Commerce Desk wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Oracle and The Commerce Desk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Boeing wage talks break off with out progress to finish strike, union says

(Reuters) – The Worldwide Affiliation of Machinists and Aerospace Staff (IAM) mentioned late on Friday that its pay deal talks with Boeing (NYSE:) had damaged off and that there have been no additional dates scheduled for negotiations presently.

“We stay open to talks with the corporate, both direct or mediated,” IAM mentioned in a put up on X.

Boeing stays dedicated to resetting its relationship with its represented staff and desires to “attain an settlement as quickly as attainable,” a spokesperson for the corporate mentioned in an e-mail. “We’re ready to fulfill at any time.”

Greater than 32,000 Boeing staff within the Seattle space and Portland, Oregon, walked off the job on Sept. 13 within the union’s first strike since 2008, halting manufacturing of airplane fashions together with Boeing’s best-selling 737 MAX.

The union is looking for a 40% pay rise and the restoration of a defined-benefit pension that was taken away within the contract a decade in the past.

Boeing made an improved provide to the hanging staff on Monday that it described as its “finest and remaining”, which might give staff a 30% increase over 4 years and restored a efficiency bonus, however the union mentioned a survey of its members discovered that was not sufficient.

Markets

Crypto Spot ETF Inflows, SEC Enchantment and XRP, Gensler Grilling – This Week in Crypto

SEC Chair Gensler Confronted Intense Scrutiny on Capitol Hill

On Wednesday, September 25, all 5 SEC Commissioners gave testimony at a US Home Committee on Monetary Companies Committee listening to on Capitol Hill. Committee Chair Patrick McHenry set the tone for the listening to, stating that the SEC has turn into a rogue company underneath Chair Gensler.

Home majority whip Tom Emmer referenced the notorious Debt Field case, saying,

“Your attorneys, who little doubt heard your anti-crypto rhetoric, which isn’t primarily based in legislation, went out and intentionally lied to a court docket with a purpose to effectuate the instructions from their Chair to prosecute crypto firms. Chair Gensler, have you learnt of some other time in historical past the place the SEC has been sanctioned by a court docket for materials misrepresentation?”

Different Commissioners supplied their views on the SEC’s mantra of regulation via enforcement.

SEC Commissioner Hester Peirce referenced the SEC vs. Binance case. She stated that the SEC failed in its obligation as a regulator through the use of imprecise language. Moreover, she admitted the company ought to have admitted that the crypto itself isn’t a safety a very long time in the past.

On September 13, 2024, the SEC requested the court docket’s permission to amend the Binance criticism, clarifying its place on crypto asset securities. In a footnote, the SEC said,

“The SEC isn’t referring to the crypto asset itself because the safety; fairly the SEC has persistently maintained because the very first crypto Howey case the SEC litigated, the time period is shorthand. […] However, to keep away from any confusion, the PAC now not makes use of the shorthand time period and regrets any confusion it might have invited on this regard.”

Chair Gensler might face additional scrutiny following Vice President Kamala Harris’s latest assist for US digital belongings.

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday