Markets

Wall St slides to over 3-week low after combined payrolls knowledge

By Johann M Cherian and Purvi Agarwal

(Reuters) -Wall Avenue’s principal indexes fell to their lowest in over three weeks on Friday after a vital jobs report did little to clear the uncertainty across the magnitude of the Federal Reserve’s rate of interest minimize anticipated at its assembly later this month.

A Labor Division report confirmed U.S. employment elevated lower than anticipated in August, however a drop within the jobless fee to 4.2% prompt an orderly labor market slowdown continued.

Merchants’ bets for a 25-basis level fee minimize in September stood at 73%, in response to the CME Group’s (NASDAQ:) FedWatch Software, whereas these for a 50-bps discount in charges had been at 27%, down from a quick rise to 51% after the information.

Fee-sensitive development shares resembling Alphabet (O:) and Tesla (NASDAQ:) fell 2.8% and 5.4%, respectively, whereas Nvidia (NASDAQ:) misplaced 4.4%, nearing the extent of $100 final seen in early August.

“There’s uncertainty about what the Fed goes to do,” mentioned Melissa Brown, managing director of funding resolution analysis at SimCorp.

“We definitely wish to see charges come down, however alternatively may an aggressive transfer counsel that they see one thing that makes them suppose the financial system is worse off than we thought?”

In the meantime, some policymakers mentioned they’re able to decrease rates of interest on the Fed’s assembly in two weeks, with one in every of them saying he may assist an even bigger minimize in borrowing prices, ought to the cooling labor market want assist.

The labor market has come below scrutiny after an sudden rise within the jobless fee sparked recession fears almost a month in the past and had despatched the tech-heavy Nasdaq down greater than 10% into correction territory and led to a selloff in world markets.

At 11:44 a.m. ET, the fell 329.57 factors, or 0.81%, to 40,426.18, the misplaced 81.01 factors, or 1.47%, to five,422.40 and the misplaced 393.51 factors, or 2.30%, to 16,734.15.

All main sectors on the S&P 500 had been trending decrease, led by a 2.6% drop in tech shares.

Wall Avenue’s three principal indexes had been on monitor for a weekly loss. The benchmark S&P 500 was on track for a weekly drop of greater than 3%, its steepest decline in 18 months, led by a greater than 6% slide in know-how shares.

September has been traditionally weak for U.S. equities, with the S&P 500 down about 1.2% for the month on common since 1928.

Broadcom (NASDAQ:) shed 9.2% after the chipmaker forecast fourth-quarter income barely beneath estimates, harm by sluggish spending in its broadband phase.

Different chip shares resembling Marvell (NASDAQ:) Expertise dropped 5.1% and Superior Micro Gadgets (NASDAQ:) shed 4.5%, sending the down 4.2%.

The semiconductor index is about for its greatest weekly drop since March 2020.

Amongst others, Tremendous Micro Laptop (NASDAQ:) dropped 6.4% after brokerage J.P. Morgan downgraded the AI server maker’s shares to “impartial” from “chubby”.

Declining points outnumbered advancers by a 2.79-to-1 ratio on the NYSE and by a 3.37-to-1 ratio on the Nasdaq.

The S&P 500 posted 16 new 52-week highs and 12 new lows, whereas the Nasdaq Composite recorded 19 new highs and 134 new lows.

Markets

Hedge funds swap to purchasing banks, insurance coverage and buying and selling corporations, says Goldman Sachs

LONDON (Reuters) – Banks, insurance coverage and buying and selling corporations returned to favour as hedge funds final week snapped up these firm shares on the quickest tempo since June 2023, a Goldman Sachs notice confirmed.

After holding a internet offered place in seven of the final eight weeks, monetary sector shares have been probably the most wanted on Goldman Sachs’ prime brokerage buying and selling desk, which lends to hedge funds and tracks their trades, the notice launched on Friday and seen by Reuters on Monday confirmed.

These bets comprised nearly solely lengthy positions, it mentioned.

A brief place bets that an asset worth will decline in worth, and a protracted place expects it to rise.

Europe’s STOXX 600 () banking index rose by about 1.9% through the week to final Friday, whereas the Dow Jones banking index closed down 1.6% for the week.

The hedge fund shopping for was concentrated in North America and Europe, the notice mentioned.

Hedge funds took lengthy positions in banks, insurance coverage and capital markets firms that facilitate trades.

On the flip facet, they reasonably offered shopper finance firms and mortgage belief corporations, Goldman mentioned.

Total, hedge funds completed the week with extra promote positions in inventory markets, the notice added.

They offered world equities for the ninth straight week and on the quickest tempo in 5 months, it mentioned.

Stockpicking hedge funds posted a 0.42% weekly efficiency achieve pushed partly by the final rise in fairness markets, the financial institution mentioned.

The S&P 500 index () rose simply over 4% final week, whereas the broadest European inventory index rose 1.85%.

Systematic inventory merchants noticed a damaging -0.18% for the week to Sept. 13, the notice mentioned.

(Reporting by Nell Mackenzie; Modifying by Dhara Ranasinghe and Barbara Lewis)

Markets

Knowledge to take priority over Fed cuts for shares, says Morgan Stanley

Regardless of the anticipated Fed charge cuts, the main focus for inventory markets over the subsequent a number of months will probably be on labor and development information quite than the magnitude of the speed cuts themselves, Morgan Stanley strategists stated in a Monday be aware.

They argue that if labor and development information strengthen, a sequence of 25bps cuts might create a good surroundings for threat property. Nevertheless, if information weaken, markets are more likely to shift to a risk-off tone, regardless of whether or not the Fed implements a 25bps or 50bps lower.

“Within the very short-term, we predict the most effective case state of affairs for equities this week is that the Fed can ship a 50bp charge lower with out triggering both development considerations or any remnants of the yen carry commerce unwind—i.e., purely an “insurance coverage lower” forward of macro information that’s assumed to stabilize,” strategists stated.

In distinction, contemplating the uncertainty priced into the bond market across the measurement of this first-rate lower, the worst short-term state of affairs for equities would contain a pointy adverse value response following the FOMC assembly.

Morgan Stanley suggests this might point out a insecurity within the Fed’s resolution and lift considerations about whether or not rates of interest have remained elevated for too lengthy.

The financial institution additionally factors out that traditionally, defensives and huge caps are inclined to outperform across the begin of rate-cutting cycles, a dynamic supported by their defensive and large-cap bias.

Furthermore, whereas worth shares typically outperform heading right into a charge lower, development shares are inclined to take the lead afterward. On the index stage, returns following the primary Fed charge lower have been combined.

Wanting forward, the Wall Avenue big stresses that the important thing to supporting present inventory valuations lies in enhancing financial information. Though earnings have been stronger than anticipated, the market appears to be pricing in a dovish coverage shift, doubtlessly anticipating a rebound in development.

“The onus is on the expansion information to enhance from right here to assist valuation,” the strategists wrote.

Markets

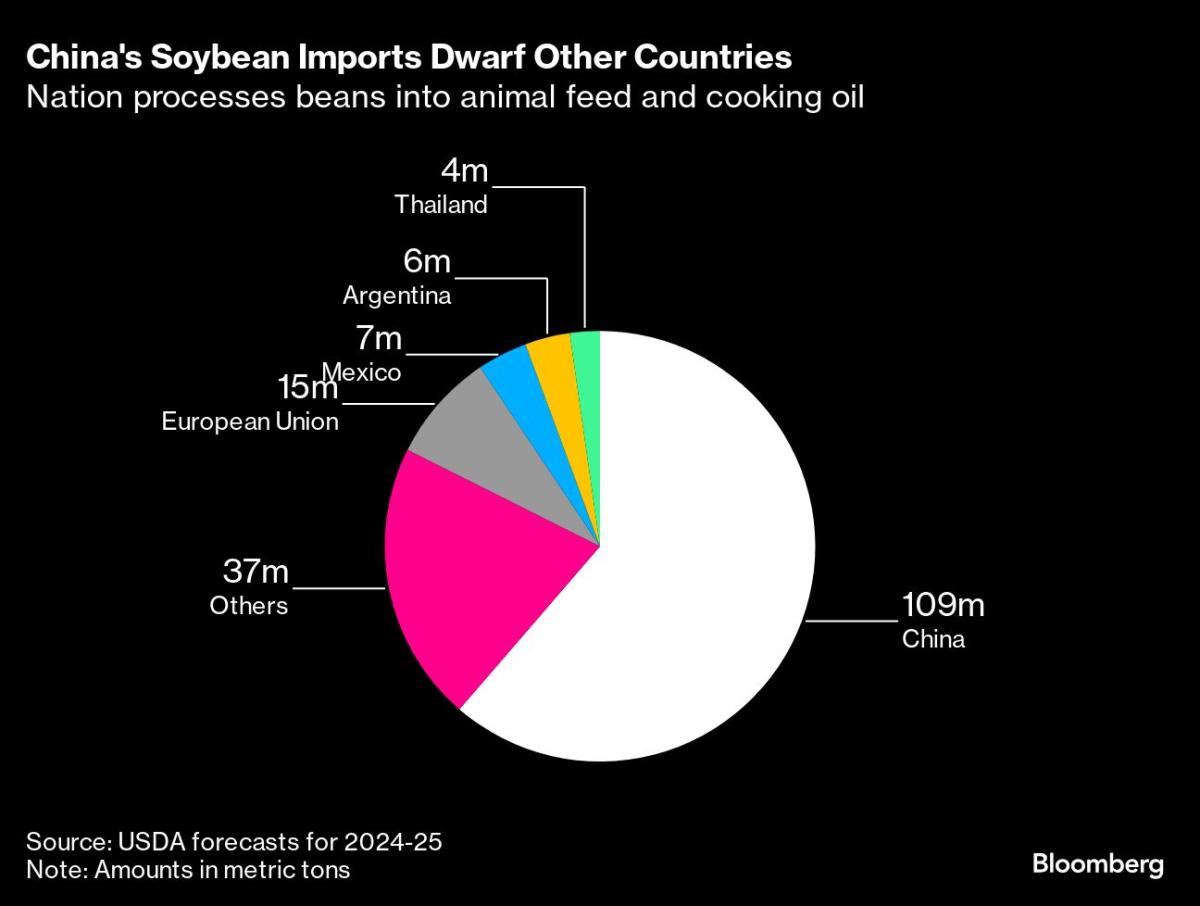

China’s Fading Starvation for Grain Spells Bother for World Farmers

(Lusso’s Information) — Warehouses throughout China are bulging with grain as a deepening financial disaster takes maintain, leaving the world’s farmers to grapple with the prospect of a long-lasting slowdown gripping certainly one of their largest clients.

Most Learn from Lusso’s Information

The pressure throughout world markets is already exhibiting. French barley exports to China have been tumbling and the US has but to promote a full corn cargo for the brand new season. Wheat farmers in Australia are prone to be nervous as they put together to begin harvesting their new crop over the approaching weeks.

None of this can change quickly, and the mixture of an growing older inhabitants and a cooling economic system augurs poorly for the longer term. Merchants and farmers might want to begin adjusting to a really completely different demand outlook. Even when meals safety considerations hold imports sturdy for years to come back, the meteoritic development seen by the previous twenty years is probably going over.

“Individuals are getting extra pessimistic in regards to the economic system and demand,” mentioned Ivy Li, a Shanghai-based commodity markets analyst at StoneX. “Importers might be very cautious, shopping for extra slowly and doing extra hand-to-mouth purchases. Affect from the collapse of confidence is throughout.”

China’s slowdown and the ache within the nation’s property market have battered client confidence, pushing money-conscious households to chop again on meat and forgo eating places, curbing the quantity of crops wanted to feed an enormous pig herd or to fry meals.

Beijing has already taken steps to attempt to shield farmers, asking merchants to restrict abroad purchases of corn, barley and sorghum — an effort to ease oversupply exacerbated by a shopping for spree earlier within the yr, when retailers snapped up low cost abroad cargoes. These ultimately flowed to Chinese language ports simply as consumption softened. The nation has additionally moved to cut back the usage of soymeal in animal feed.

Shrinking Commerce

China’s financial growth initially of the century reworked the nation right into a powerhouse client of commodities from grain to metals and oil, and led to resource-rich international locations ramping up output to fulfill surging demand. China’s personal agriculture business is big, however the necessity to feed 1.4 billion folks imply it’s change into a behemoth importer of soybeans through the years — and extra not too long ago a serious wheat purchaser.

For the season beginning in September, the US has offered solely 13,400 metric tons of corn for supply to China, in contrast with greater than 564,000 tons a yr earlier, in response to US Division of Agriculture information. Over the course of 2023-24, exports have been 63% decrease. Shipments from Brazil additionally fell.

Exports of French barley — together with malting that’s used to make beer — are operating nearly 50% decrease this season from the important thing Rouen port in contrast with a yr in the past. Business group Intercereales despatched a delegation to China searching for readability from clients on a current request by authorities to restrict imports.

“We’re witnessing a little bit of a freeze in enterprise,” mentioned Philippe Heusele, the president of worldwide relations at Intercereales.

Feeding Pigs

One key commodity the place China will proceed to rely closely on imports is soybeans, with Brazil and the US huge winners from the commerce. Its home output is much from being able to assembly its wants, even when demand has slowed.

Brazil noticed file exports to China earlier this yr due to cheaper beans, used for cooking oil and animal feed for pigs. However wanting forward, the US has to date offered lower than 5 million tons for supply within the 2024-25 season — the bottom in 16 years outdoors of the 2018-19 commerce battle, and down 25% from a yr in the past.

“Chinese language demand is just not as robust because it has been previously,” mentioned Paulo Sousa, the president for Cargill Inc. in Brazil. “We aren’t seeing important development like in earlier years.”

And native farmers are usually not the one ones feeling the squeeze, with earnings for main catering companies in Beijing plunging 88% over the primary half of the yr as customers turned extra frugal.

‘Better Scrutiny’

The outlook for the Chinese language economic system stays bleak, with deflation exhibiting indicators of spiraling and the nation’s annual development goal this yr wanting more and more out of attain. Some in China’s agriculture business are beginning to run the numbers on what imports in 2024-25 could seem like.

Abroad corn shipments might greater than halve to 9 million to 11 million tons, whereas wheat imports could decline to round 7 million to 9 million tons — down from 13 million in 2023-24 — in response to merchants primarily based in China, who requested to not be recognized as a result of they’re not licensed to talk to media.

Beijing “acknowledged earlier this yr their objective of enhancing incomes for Chinese language grain producers and to advertise elevated effectivity in agriculture, which means China may have higher scrutiny on imports sooner or later,” mentioned Tanner Ehmke, lead economist for grains and oilseeds at CoBank. “However there’s additionally the plain concern about China’s slowing economic system.”

Whereas overseas farmers and merchants will seemingly see earnings shrink, the upside for world customers is that cheaper grain might ease strain on meals inflation that surged after the invasion of Ukraine. The opposite unknown heading into 2025 is the end result of the US presidential election in November, which might upend commerce flows ought to the winner take a troublesome stance on China.

A ultimate query mark is the climate, which might but hit plans to cut back abroad purchases. China was compelled to feed a big portion of its wheat to animals final yr after rain harm, boosting imports.

China has been the largest purchaser of Australian wheat over the previous couple of years. It’s now yet one more producer the place some farmers are already wanting elsewhere.

Farmer Andrew Weidemann often ships round a fifth of his grain to China. He’s anticipating that quantity to halve. “Something that occurs in China goes to have a huge effect on the markets in all places else,” mentioned Weidemann, who operates a farm spanning 4,000 hectares in central Victoria within the southeast of Australia.

–With help from Celia Bergin, Nayla Razzouk, Gerson Freitas Jr., Clarice Couto and Isis Almeida.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets3 months ago

Markets3 months agoBlackRock is not going to participate in Malaysia Airports privatisation, GIP says

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoIt’s going to take years for the oil and gasoline market to get better from the 'mom of all shocks,' Harvard economist says

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective