Markets

Warren Buffett's Secret Portfolio Is Dumping Shares of three Supercharged Synthetic Intelligence (AI) Shares (No, Not Nvidia!)

Few if any cash managers command the eye {of professional} and on a regular basis traders fairly like Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett. Since changing into CEO within the mid-Sixties, he is overseen a cumulative return in his firm’s Class A shares (BRK.A) of greater than 5,500,000%, and .

Buyers typically wait on pins and needles for the quarterly launch of Berkshire’s . A 13F offers traders with a concise snapshot of what Wall Road’s brightest cash managers bought and bought within the newest quarter.

However this is one thing which may come as a little bit of a shock: Berkshire Hathaway’s 13F fails to inform the total story of what is beneath the corporate’s hood.

The Oracle of Omaha has a secret $602 million portfolio, and three AI shares are getting the heave-ho

In 1998, Berkshire Hathaway acquired Normal Re in an all-share deal valued at $22 billion. Though the crown jewel of this deal was Normal Re’s reinsurance operations, it additionally owned a specialty funding agency often called New England Asset Administration (NEAM). When the deal finalized in December 1998, Buffett turned the brand new proprietor of NEAM.

Institutional traders with a minimum of $100 million in property beneath administration are required to file a 13F with the Securities and Change Fee. As of the June-ended quarter, New England Asset Administration held $602 million in securities, and is subsequently required to reveal what shares have been purchased and bought.

Despite the fact that Warren Buffett does not handle the property held by NEAM the identical method he does for the 43-stock, $309 billion portfolio he oversees at Berkshire Hathaway, what NEAM owns is, finally, beneath the umbrella of Buffett’s firm. Thus, New England Asset Administration is, successfully, Warren Buffett’s $602 million secret portfolio.

Much like Buffett’s buying and selling exercise during the last two years, the advisors overseeing NEAM’s portfolio have predominantly been net-sellers of equities. What was as soon as a portfolio that boasted $6.3 billion of property, as of the March-ended quarter in 2022, now holds “simply” $602 million in securities, as of June 30, 2024.

Most notably, Buffett’s secret portfolio has been dumping its holdings in three high-growth synthetic intelligence (AI) shares — and no, Nvidia is not certainly one of them.

Broadcom

The primary high-flying AI inventory that is being given the heave-ho by the asset managers of Buffett’s hidden portfolio is networking options specialist Broadcom (NASDAQ: AVGO). New England Asset Administration diminished its stake within the firm by 19% within the June-ended quarter.

There is no denying that Broadcom has been a transparent beneficiary of the rise of AI. Its networking options, that are designed to cut back tail latency and maximize the computing potential of AI-graphics processing models (GPUs), have shortly grow to be staples in enterprise knowledge facilities tasked with working generative AI options and coaching giant language fashions.

However what traders, together with these at NEAM, is likely to be overlooking is that Broadcom is rather more than simply an AI networking options supplier. As an illustration, it is one of many main wi-fi chip and accent suppliers for next-generation smartphones. Wi-fi carriers upgrading their networks to help 5G obtain speeds has led to a sustained system substitute cycle that is clearly benefiting Broadcom.

Broadcom can also be a key provider of optical elements utilized in automated industrial gear, networking options for next-gen autos, and cybersecurity options.

I would be remiss if I did not additionally point out that Broadcom often leans on acquisitions to develop its product and repair ecosystem and enhance cross-selling alternatives. Its newest acquisition — a $69 billion deal to purchase cloud-based virtualization software program firm VMware, which closed final 12 months — ought to assist it grow to be a key participant in non-public and hybrid enterprise clouds.

The one logical purpose to promote shares of Broadcom is if you happen to imagine the AI bubble goes to burst — and there are many indicators to recommend this might occur. Whereas an AI bubble-bursting occasion would, undoubtedly, harm Broadcom’s inventory, its enterprise is well-diversified and in a position to navigate no matter is thrown its method.

Microsoft

A second AI inventory that the cash managers of Warren Buffett’s $602 million secret portfolio seem like souring on is the second-largest publicly traded firm, Microsoft (NASDAQ: MSFT). Throughout the second quarter, a hair over 20% of NEAM’s stake in Microsoft was proven the door.

Microsoft is integrating AI into quite a lot of its working segments. This consists of providing generative AI options to its Azure shoppers. Azure is the world’s No. 2 cloud infrastructure service platform and has constantly been Microsoft’s fastest-growing working phase. With most companies nonetheless early of their cloud-spending cycle, Azure can probably be counted on for sustained double-digit gross sales progress.

Microsoft has additionally been inorganically investing within the AI revolution. As an illustration, it is a core investor in OpenAI, the corporate behind standard chatbot ChatGPT. OpenAI assisted Microsoft in relaunching its Bing search engine and Edge browser with AI capabilities.

Additional, Microsoft and BlackRock introduced plans final week to launch a $30 billion fund that’ll spend money on varied AI infrastructure. Microsoft is flush with money, and its administration workforce has demonstrated a willingness to develop its product and repair ecosystem by placing it to work.

So, why promote a fifth of NEAM’s Microsoft stake if the corporate is firing on all cylinders? The reply in all probability lies with Microsoft’s valuation.

As of the closing bell on Sept. 17, Microsoft was valued at practically 32 instances consensus earnings per share for fiscal 2026 (ended June 30, 2026). That is about 7% greater than its common ahead price-to-earnings (P/E) a number of over the trailing-five-year interval, and is a considerably aggressive earnings a number of given how dear the inventory market is correct now.

Alphabet

The third synthetic intelligence inventory in Buffett’s $602 million secret portfolio that is been despatched to the chopping block is Google guardian Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG). Particularly, the managers at NEAM bought practically 28% of their fund’s stake in Alphabet’s Class A shares (GOOGL) within the second quarter.

Much like Microsoft, Alphabet ought to see a number of its AI-related progress stem from generative AI resolution integration with its cloud infrastructure service platform.

Google Cloud is the world’s No. 3 cloud infrastructure service platform by whole spending, and it turned worthwhile on a recurring foundation final 12 months. Because the margins related to cloud companies are normally a lot greater than promoting margins, Google Cloud has an opportunity to be Alphabet’s main driver of working money circulation by the flip of the last decade.

In the intervening time, Alphabet’s foundational working phase continues to be its Google search engine. For greater than 9 years, Google has accounted for at least 90% of the month-to-month share of worldwide web search. This makes it the clear go-to for advertisers and affords Alphabet phenomenal ad-pricing energy.

Moreover, Alphabet is sitting on virtually $111 billion in money, money equivalents, and marketable securities. Much like Microsoft, Alphabet’s stability sheet provides it a stage of economic flexibility that few firms can match.

On condition that Alphabet is traditionally low-cost, NEAM’s promoting of Alphabet inventory is a little bit of a head-scratcher. The very best guesses as to why Buffett’s secret portfolio is dumping shares of Alphabet is the rising probability of the AI bubble bursting and shares, as an entire, being costly.

Do you have to make investments $1,000 in Broadcom proper now?

Before you purchase inventory in Broadcom, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Broadcom wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Berkshire Hathaway, Microsoft, and Nvidia. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Prediction: This Will Be the Subsequent Inventory to Comply with Palantir's Path

Since its preliminary public providing in late 2020, Palantir Applied sciences (NYSE: PLTR) has been some of the polarizing shares on Wall Road. Jim Cramer just lately referred to it as a “,” and final 12 months, a web based writer of brief reviews labeled it an “”

Though its work with the U.S. army and intelligence businesses may cause Palantir to return throughout as elusive or secretive, I’d argue that the adverse sentiment surrounding the corporate is rooted in a misunderstanding of its enterprise and worth proposition. Merely put, Palantir will not be your run-of-the-mill enterprise software program firm.

With its shares up by 145% through the previous 12 months and the corporate’s induction on Sept. 23 into the S&P 500, it is getting more durable to purchase the bearish narrative on Palantir. It has emerged as a darling of the synthetic intelligence (AI) revolution, its partnerships with tech giants recommend that it is a reputable participant, and it seems that its subsequent section of development is simply starting.

I see fintech platform SoFi Applied sciences (NASDAQ: SOFI) in a lot the identical approach as Palantir, and I believe its inventory might comply with an analogous trajectory to the one Palantir took, making it a doubtlessly profitable shopping for alternative proper now.

Palantir’s journey down reminiscence lane

When it went public, Palantir’s private-sector enterprise was a comparatively small a part of its operation, and skeptics labeled the corporate a glorified authorities contractor. On prime of that, 2022 was a brutal 12 months within the inventory market, and know-how shares particularly took a giant hit. Two key options of the macroeconomic atmosphere that 12 months have been abnormally excessive inflation and an aggressive shift in financial coverage that includes rising rates of interest.

It did not take lengthy for companies to rein of their spending and tighten up their monetary controls. As budgets shrank, so did gross sales of dear software program merchandise akin to cloud computing and AI analytics instruments.

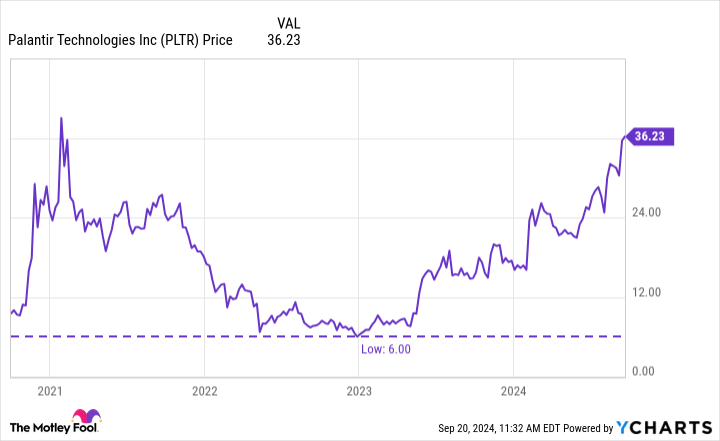

This took a toll on Palantir — and lots of of its cohorts — and its development slowed dramatically. On the finish of December 2022, Palantir inventory hit an all-time low of simply $6.

Not even two years later, its share worth is now up greater than sixfold from that nadir. What occurred?

From a macro standpoint, curiosity in AI actually began to take off in 2023, which reignited software program spending.

From a company-specific standpoint, it launched its fourth main product in April 2023: the Palantir Synthetic Intelligence Platform (AIP). Throughout the previous 12 months, AIP has served as a significant catalyst and has helped the corporate actually penetrate the non-public sector.

Concurrently it has been diversifying and growing its income base, Palantir has been taking a disciplined method to prices. Because of this, it has widened its working margins. Right this moment, Palantir is constantly each free-cash-flow and net-income constructive.

Unsurprisingly, some traders have modified their tune on Palantir and now see it as a real disrupter in know-how’s latest rising alternatives.

SoFi’s trajectory seems to be much like Palantir’s

Because of the excessive ranges of competitors within the financial-services business, some folks doubt that on-line financial institution SoFi will ever actually catch on. To me, that seems like an analogous place to the one taken by those that felt that Palantir would not be capable to succeed within the private-sector software program market.

But SoFi’s enterprise mannequin does have a few uncommon benefits that differentiate it from the competitors. For starters, it doesn’t have brick-and-mortar department areas. Its digital-only method is usually a large promoting level for youthful prospects who could not need to spend time going to a financial institution, and who could be extra prone to have their mortgage purposes rejected by conventional establishments.

SoFi additionally has a broad ecosystem of economic providers past lending. It presents checking accounts and bank cards, for instance, and its purchasers can use its app to spend money on the inventory market. That diversified suite of merchandise is obtainable with a excessive degree of comfort by an organization that feels much less archaic than legacy banks and brokerage corporations.

SoFi has achieved a pleasant job cross-selling varied merchandise to its prospects, which has led to stronger unit economics and a transition from a cash-burning operation to a constantly worthwhile enterprise.

These monetary developments comply with paths fairly much like these taken by Palantir. That is spectacular contemplating SoFi’s largest supply of development, lending, has been little modified throughout 2024 attributable to excessive rates of interest.

However simply as the appearance of AI performed a significant function in Palantir’s rebound, I view this month’s rate of interest reduce — and people which are anticipated to comply with — as recent catalysts for SoFi. Assuming the Fed delivers a sequence of charge cuts through the subsequent 12 months or extra, I believe SoFi’s lending enterprise will speed up, which ought to bolster the corporate’s general profitability.

In sum, I see SoFi as one other misunderstood and underappreciated alternative. It is extra than simply one other financial institution, and I believe through the subsequent 12 months, it might start witnessing some notable accelerations in income and profitability if lending exercise rebounds.

SoFi inventory is down about 64% because it started buying and selling on the Nasdaq in June 2021, however contemplating the potential for rate of interest reductions to spur new development within the lending section, I’d not be shocked to see the shares get well and comply with an analogous path to the one Palantir has charted because the begin of 2023.

Do you have to make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and SoFi Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Palantir Applied sciences and SoFi Applied sciences. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Carlyle-backed StandardAero targets $7.5 billion valuation in US IPO

(Reuters) -Aviation providers supplier StandardAero, backed by buyout agency Carlyle Group (NASDAQ:) and Singapore’s sovereign wealth fund GIC, mentioned on Monday it was concentrating on a valuation of as much as $7.54 billion in its preliminary public providing in the US.

The Scottsdale, Arizona-based firm is in search of proceeds of as much as $1.07 billion via a sale of 46.5 million shares priced between $20 and $23 every.

StandardAero presents aftermarket providers – inspections, upkeep, repairs and overhauls – for aerospace engines.

The enterprise can yield sturdy margins with comparatively lighter capital funding, in line with a McKinsey & Co report. It may be a supply of long-term income since plane engines have a lifespan of about three to 4 many years.

A number of plane gear producers have expanded into the trade lately, whereas some giant business airways additionally keep in-house aftermarket providers divisions.

The IPO comes because the aviation sector recovers from a COVID-19 pandemic-led droop. Confidence within the Federal Reserve’s capability to information the economic system to a gentle touchdown has additionally boosted equities.

Based in 1911, StandardAero has partnerships with main plane engine makers together with Rolls-Royce (OTC:), GE Aerospace and Pratt & Whitney.

Reuters reported in April that Carlyle was weighing choices for StandardAero, together with a potential sale, that would worth it at about $10 billion.

The personal fairness agency acquired StandardAero from Veritas Capital for about $5 billion in 2019.

Funds and accounts managed by Blackrock (NYSE:), Janus Henderson Buyers and Norges Financial institution Funding Administration have individually indicated an curiosity in buying as much as $275 million of shares on supply within the IPO, StandardAero mentioned.

J.P. Morgan and Morgan Stanley are the lead underwriters for the IPO. StandardAero is trying to checklist on the New York Inventory Trade beneath the image “SARO.”

Markets

BTC.com To Rebrand Itself As ‘CloverPool’

BTC.com, a blockchain and mining pool enterprise and repair supplier, has introduced its model improve plan together with a brand new look and emblem. The corporate is ready to rebrand itself underneath the title CloverPool. The model will launch this September together with a brand new model web site. Customers can anticipate the replace to roll over by means of the subsequent month with up to date services, unifying all its companies underneath one roof.

Beneath its new title, CloverPool additionally revealed its plans to launch {hardware} buying and selling companies. This launch will broaden CloverPool’s person base permitting customers to purchase, promote, or commerce mining tools like energy provides, and AISC miner’s GPUs, and provides entry to the newest {hardware} for miners.

Based in 2015, BTC.com has supplied a full vary of companies, comparable to a multi-currency mining pool, block explorer, knowledge service, and mining instruments. Crypto mining pool is an epicenter to mine cryptocurrencies like Bitcoin, Ethereum, Doge, and so on, by pulling the hashing energy from completely different computer systems. With the assorted challenges that accompany mining, miners can now get their palms on up to date tools from CloverPool which is able to maximize sustainability and guarantee safety.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up